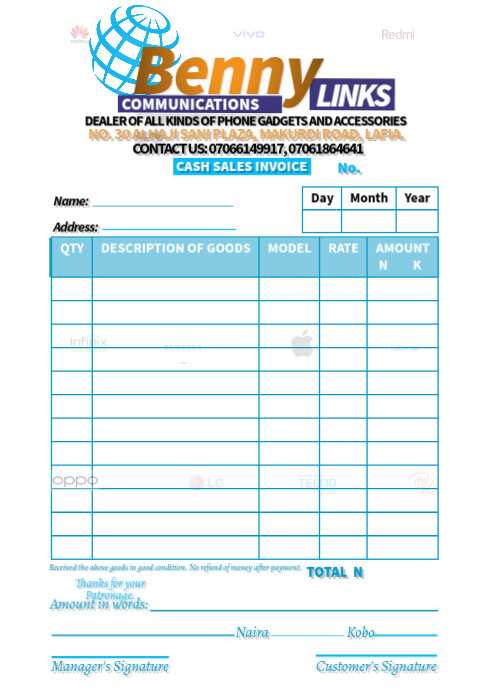

For a quick and professional solution to documenting sales transactions, using a customizable receipt template saves time and ensures consistency across your business. These templates streamline the process of generating receipts, whether printed or sent digitally. Customizable fields allow you to include specific business information, including logos, addresses, and itemized pricing details.

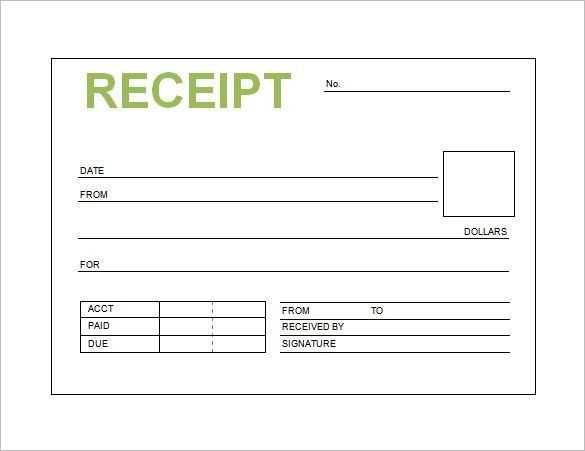

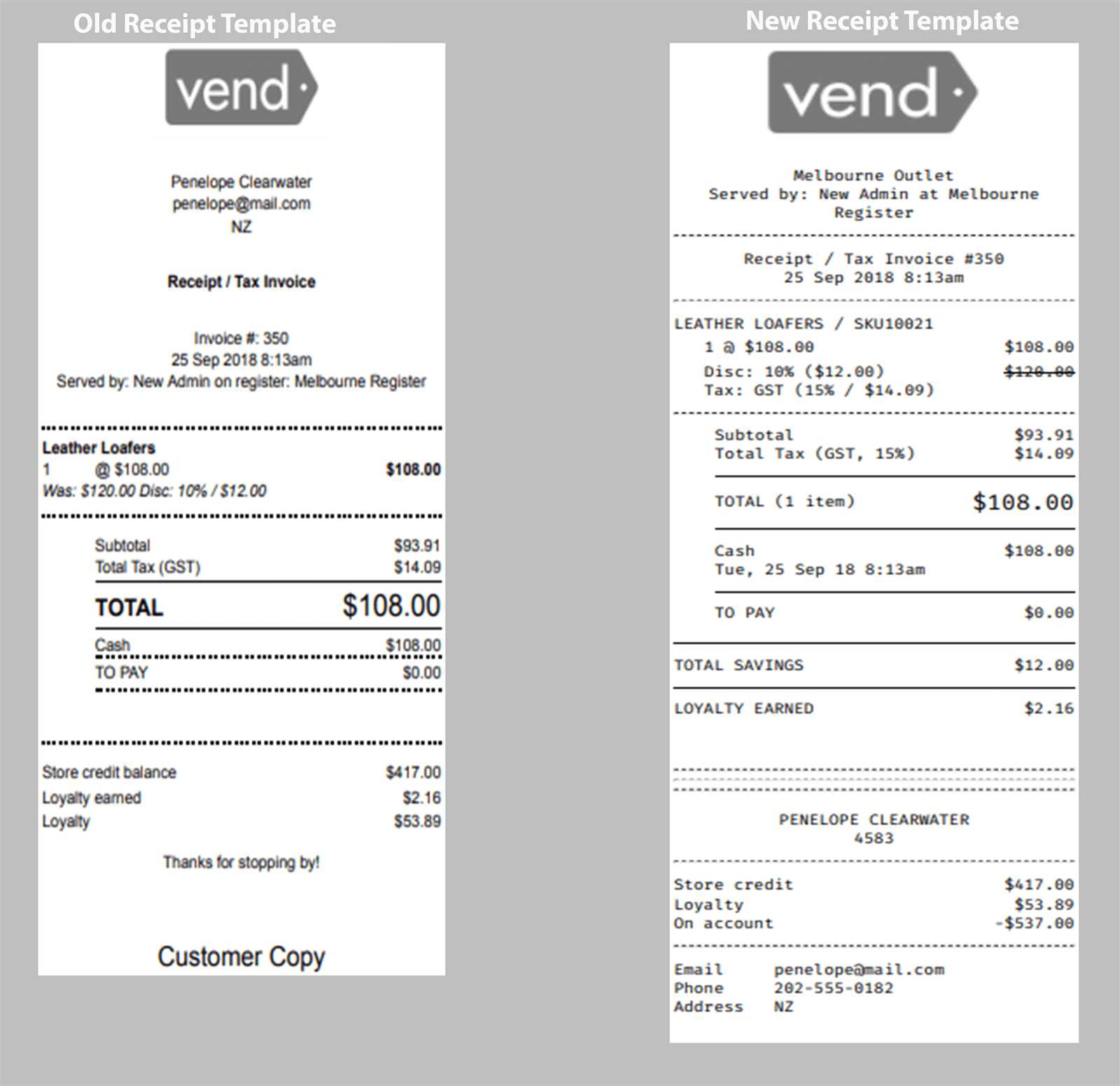

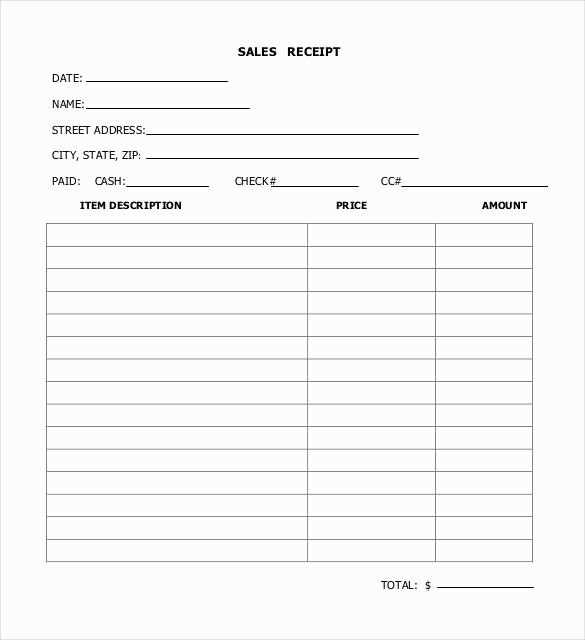

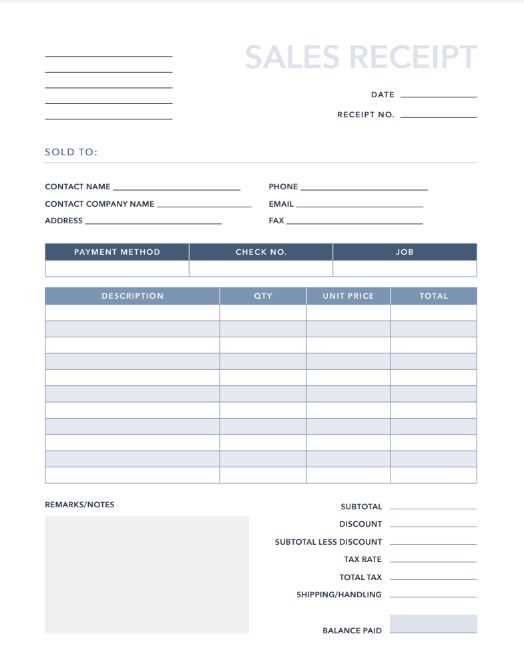

Choose a template that matches the scale of your operation. For smaller businesses, a simple format with essential transaction details such as item description, price, and total is sufficient. Larger businesses may require additional fields for tax breakdowns, payment methods, and loyalty rewards. Regardless of size, the goal is clarity and ease of use for both the business and the customer.

Keep your receipts clear and professional. This not only enhances your brand’s image but also minimizes confusion in case of returns or disputes. Having a standard template for every transaction improves accuracy and ensures that each customer receives the correct information. Customize your templates according to seasonal promotions or special offers for better alignment with business needs.

Here’s a detailed plan for an informational article on the topic “Retail Sales Receipt Templates” with three concise, practical subheadings in HTML format

When designing retail sales receipt templates, focus on clarity, functionality, and simplicity. A well-structured receipt is not just a legal requirement but also an important tool for customer communication. Below are the three key sections to cover in your article:

Choosing the Right Information to Include

The first step in creating a functional receipt template is deciding which details are necessary. At a minimum, include the store name, transaction date, items purchased, prices, taxes, and total amount. Adding contact information, payment method, and return policies helps ensure customers have all they need for future reference.

Design Layout and Structure

A clean layout enhances readability. Keep the text aligned properly and use easy-to-read fonts. Group related information, such as purchase details and totals, to guide the eye naturally from one section to the next. White space is crucial in preventing clutter and making the receipt easier to digest.

Customization and Branding Options

Personalize the receipt with your store’s logo, color scheme, and any additional branding elements. Customization helps reinforce brand identity and gives a professional touch. Consider offering digital options for customers to receive receipts via email or SMS, which reduces paper waste and enhances convenience.

Creating a Custom Template for Your Store

Choose the right layout for your sales receipt. Prioritize clarity, ensuring customers can easily identify important details like the product name, price, and total. A simple format works best, without clutter or unnecessary elements.

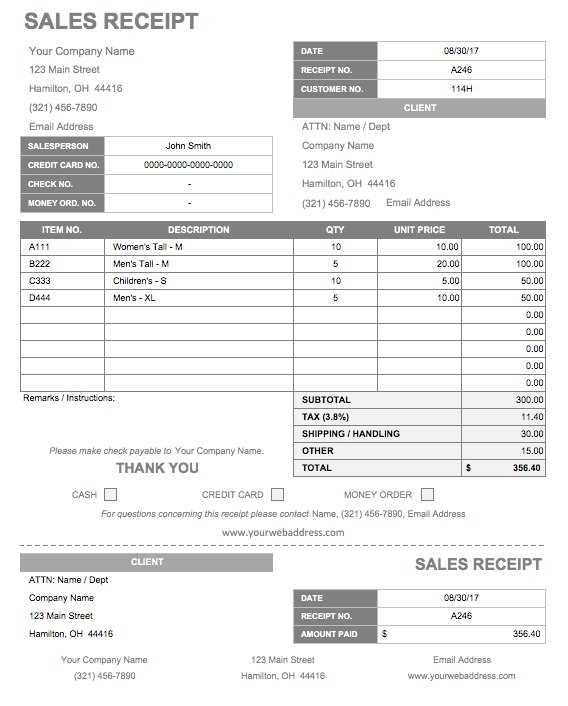

Include essential business details. Your store name, address, and contact info should be prominently displayed at the top. This builds trust and makes it easier for customers to reach you if needed.

Design a section for tax calculations. If applicable, break down taxes separately. This transparency reassures customers and complies with regulations in many regions.

- Product Details: List items clearly, including quantity, price, and any discounts applied.

- Subtotal: Ensure the subtotal is visible and correctly calculated.

- Taxes: If relevant, show the tax amount or percentage.

- Total: Make the total amount bold and easy to find.

Make your store’s branding visible but subtle. Use your logo and brand colors sparingly to maintain a professional look without overwhelming the customer. Consistency in branding increases recognition and adds a personal touch.

Choose legible fonts. Ensure the text is easy to read in various lighting conditions. Stick to standard fonts like Arial or Helvetica, and use larger sizes for the total and important information.

Consider adding a return policy or other important notices at the bottom. This offers transparency and helps avoid potential disputes later. Keep it concise and to the point.

- Return Policy: Include clear instructions on how returns or exchanges are handled.

- Contact Information: Provide multiple ways to contact your store (phone, email, etc.).

Finally, review the template regularly. As your store evolves or regulations change, update the design and information to keep it current. A receipt is not just a proof of purchase; it’s a reflection of your brand’s professionalism.

Integrating Payment Methods on Receipts

Include clear payment method details on receipts to avoid confusion. Start by listing the type of payment used, whether it’s credit, debit, mobile payment, or cash. For card payments, specify the last four digits of the card number for easy reference.

If multiple methods are used, break them down individually, showing the amount paid by each. This transparency simplifies record-keeping and makes it easier for customers to track their expenses. Also, mention if any discounts or promotions were applied to the total amount.

For digital payments, include any transaction IDs or confirmation codes. This adds an extra layer of verification, helping to resolve any potential issues with the payment. Keep the payment method section concise yet informative, ensuring it is easily readable by the customer.

Offer a summary of the total amount paid after all deductions. This will ensure customers can quickly spot discrepancies, if any, and gives them a clear overview of what they’ve paid and how.

Legal Requirements and Compliance for Receipts

Receipt templates must meet specific legal criteria to ensure compliance with local tax laws and consumer protection regulations. Always include the business name, address, and contact details on the receipt. Tax registration numbers or VAT identification must also be displayed where required by law.

In many jurisdictions, receipts must show the date of the transaction and a detailed breakdown of purchased items, including quantities and prices. This ensures transparency and supports accurate record-keeping for tax purposes. For electronic receipts, make sure they are accessible for future reference and include all required details.

For businesses offering returns or refunds, it’s crucial to specify the policy on the receipt, including timeframes and conditions. Ensure that the format of the receipt is clear and readable, avoiding any ambiguities that could lead to legal disputes.

Compliance also extends to specific industries, such as food service or retail, which may have additional requirements. For example, restaurants often need to list service charges separately, and retailers may need to include warranty information for certain products. Keep updated on local regulations to avoid fines or legal issues.