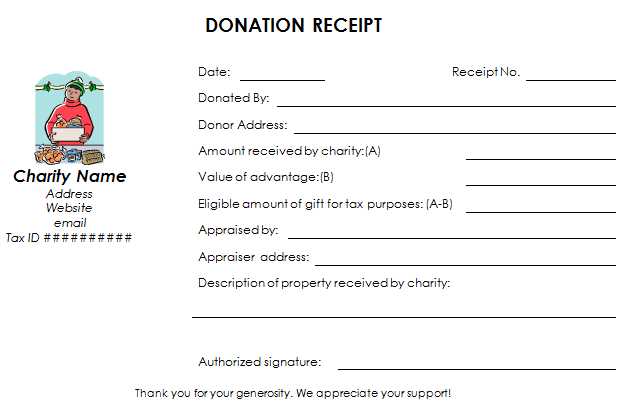

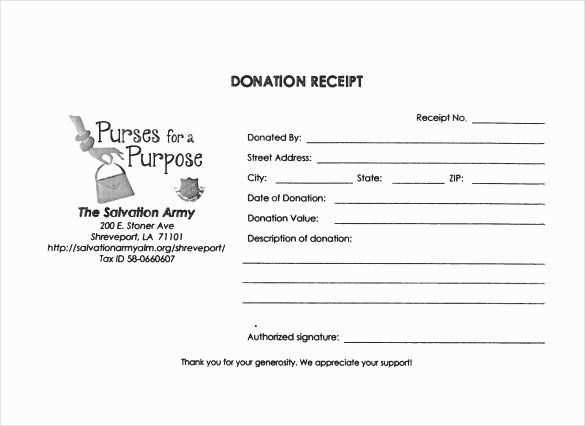

When creating a receipt for donations, focus on clarity and transparency. A template can streamline this process, making it easier for both the donor and the receiving organization to keep records accurate. Ensure that each receipt includes all necessary details: donor’s name, donation amount, date of contribution, and the purpose or cause the donation supports. This basic structure provides both parties with essential information.

In addition to standard details, be sure to include the organization’s name and tax-exempt status, if applicable. This ensures that donors can properly document their contributions for tax purposes. Including a unique receipt number helps with tracking donations and avoids confusion, especially when managing multiple transactions.

For maximum utility, keep the template simple but complete. Avoid overwhelming the donor with unnecessary information. Focus on what matters most, and make sure the format is easy to read and understand. By following these guidelines, your template will serve its purpose effectively, ensuring both transparency and convenience for everyone involved.

Here is the improved version based on your request:

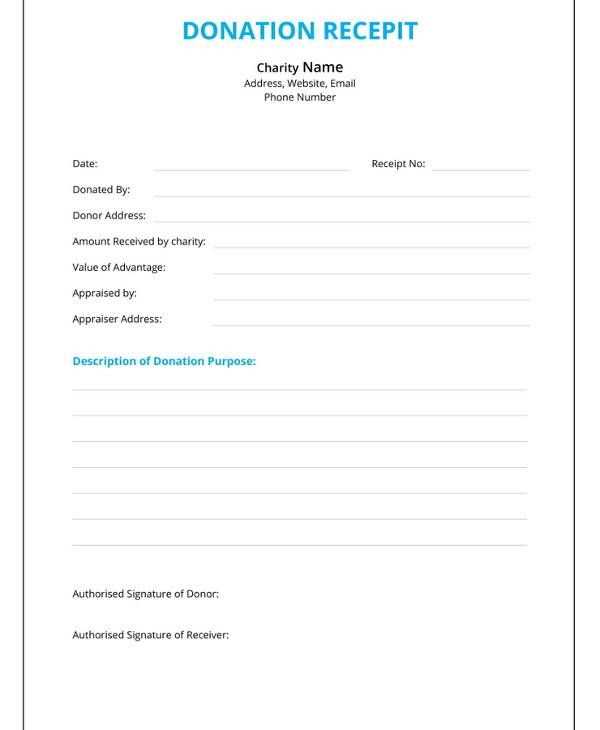

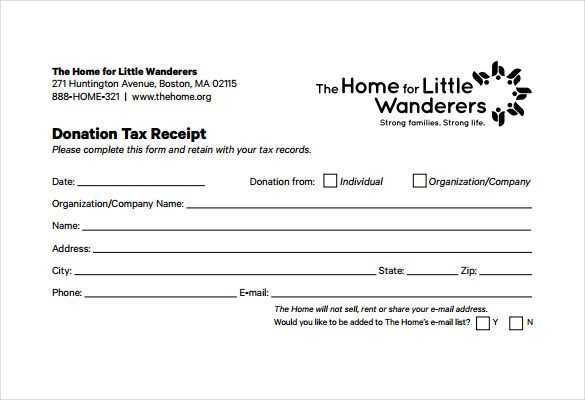

To create an effective template for a donation receipt, ensure it includes all necessary legal and financial details. A straightforward layout helps donors quickly understand the information. Clearly display the donation amount, date, and donor’s name, along with a thank-you note. If applicable, include any tax-related information, such as the tax-exempt status of the organization and a reference to the relevant tax code section.

Key Elements to Include

First, make sure to specify the donation’s value, whether it’s monetary or in-kind. For non-monetary donations, describe the items or services donated, and provide an estimated value. Add your organization’s name, contact details, and registration number for transparency. Include a statement that no goods or services were provided in exchange for the donation if that’s the case.

Tax Deduction Information

For donations that qualify for tax deductions, include a brief statement about the donor’s eligibility for a deduction and any relevant information needed for tax filing purposes. Avoid vague language–clarity on these points can prevent confusion and ensure compliance with tax laws.

Template Receipt Donation: Practical Insights

How to Create a Donation Receipt Template

Design your receipt template with a clear layout that includes essential details: the donor’s name, the donation amount or description, the organization’s name, and the date of the donation. Include a section confirming whether the donation was monetary or non-monetary, and if non-monetary, provide a brief description of the items donated. This structure will ensure transparency and clarity.

Legal Considerations for Issuing Receipts

Before issuing donation receipts, verify the legal requirements in your region. Certain jurisdictions require organizations to issue receipts for donations exceeding a specific threshold, while others mandate that the receipt includes the organization’s tax-exempt number. Ensure your template aligns with these rules to avoid compliance issues.

Best Practices in Managing Donation Receipts

Keep accurate records of all issued receipts, including electronic copies. Use software that tracks donations and automatically generates receipts. This helps streamline your process and ensures that you can quickly provide any necessary documentation for audits or donor inquiries. Regularly review your templates for accuracy and update them if there are any changes in tax laws or organizational details.