Make your donation process easier with a clear and concise clothing donation receipt template. This document provides a record of your contribution, which is useful for both the donor and the organization receiving the items. Whether you’re donating to a charity or a local cause, a well-organized receipt ensures that both parties have the necessary information for tax purposes and future reference.

Include essential details such as the donor’s name, the date of the donation, and the type and condition of the clothing. Be specific when listing the items–this helps avoid confusion and makes the receipt more useful for documentation. You can also add the organization’s contact information and any other relevant notes that help identify the donation.

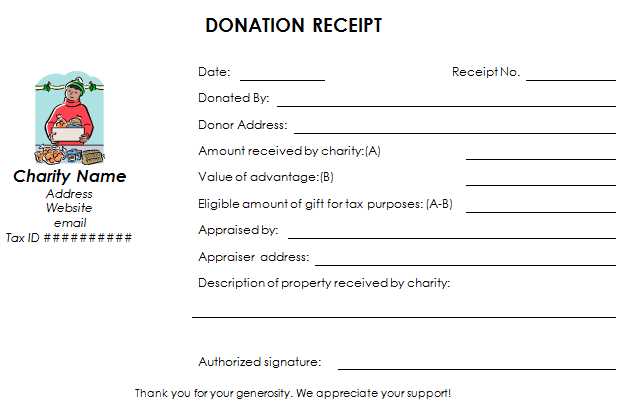

For tax purposes, make sure to provide an estimated value for the donated items. Many organizations offer a general guide to help determine the fair market value of second-hand clothing. Use this as a reference to make the donation receipt more accurate and reliable for potential deductions.

Clothing Donation Receipt Template Guide

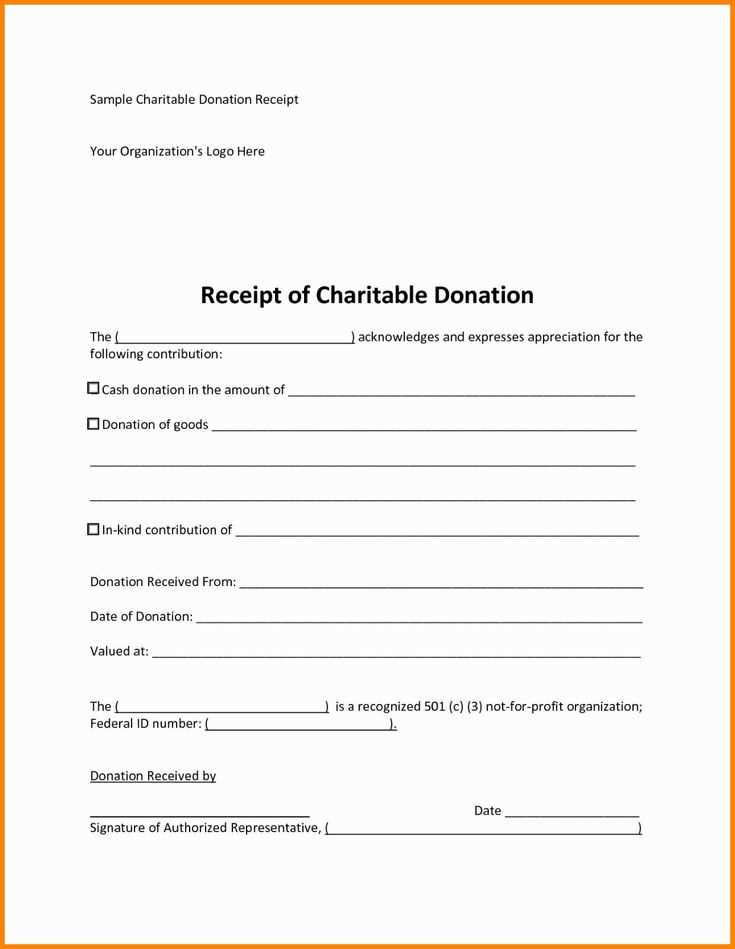

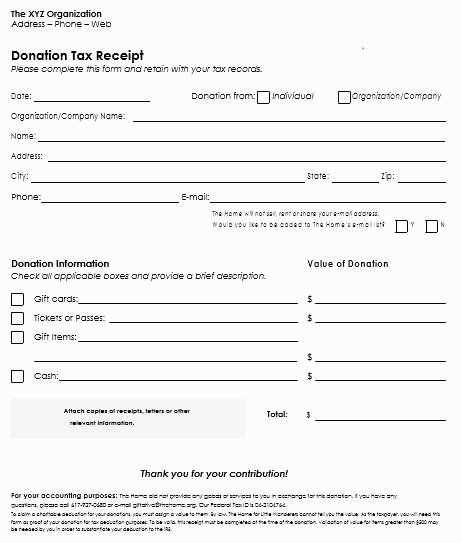

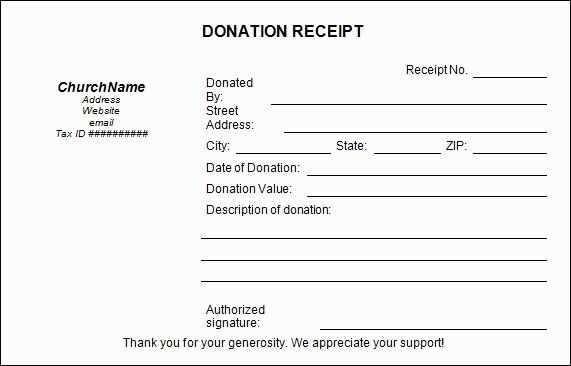

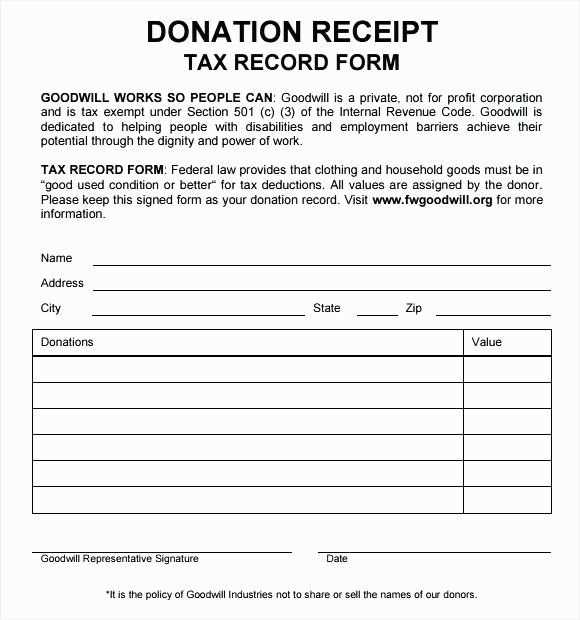

A donation receipt should clearly state the details of the items given and be formatted in a way that makes record-keeping easy. Use a template that includes the donor’s name, address, date, and an itemized list of the clothing donated. Ensure the total value of the donation is estimated accurately to help the donor with tax deductions.

Key Elements to Include

Include the donor’s full name, address, and contact information. List each clothing item, along with its estimated value. If possible, note the condition of the items (e.g., new, gently used, worn). Acknowledge that the donation is tax-deductible by including a statement like: “No goods or services were exchanged for this donation.” Include the organization’s name, address, and tax ID number for verification purposes.

Formatting Tips

Keep the template simple and easy to read. Organize the list of donated items in a table format, with columns for quantity, description, condition, and estimated value. Leave space for both the donor and the organization’s authorized representative to sign, confirming the donation details. Double-check that the donation receipt has a clear date and is signed by a responsible party from the organization.

How to Create a Simple Donation Receipt

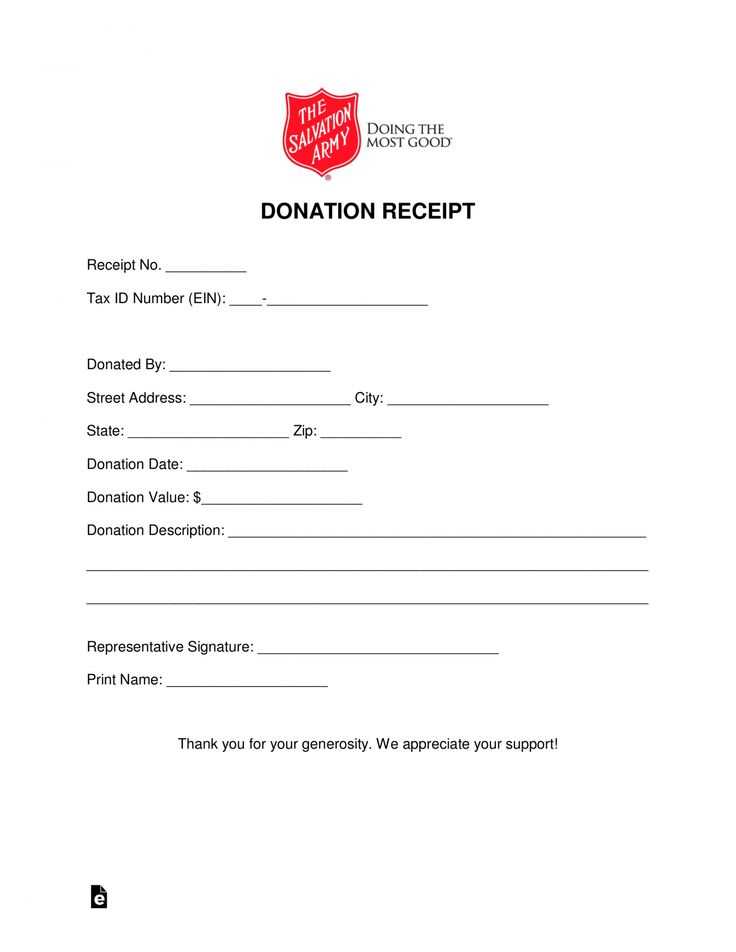

Begin by including the name of your organization at the top of the receipt, along with its contact information. This helps recipients easily identify the source of the donation.

Include the date of the donation. This is important for both the donor’s tax purposes and record-keeping.

Detail the Donated Items

For clothing donations, list each item donated along with a brief description (e.g., “three pairs of jeans” or “one winter coat”). It’s useful to include an estimated value of the items donated. If necessary, note that the donor is responsible for valuing the items.

Provide a Statement of No Goods or Services Received

State clearly that the donor received no goods or services in exchange for their donation. This is a required element for donations to be eligible for tax deductions.

Finally, thank the donor for their contribution, which strengthens the relationship and encourages future donations.

Key Details to Include in a Receipt

Include the donor’s name and contact information. This confirms who made the donation and allows for follow-up if needed.

Provide a detailed description of the donated items. Be specific about the type, condition, and quantity. This ensures clarity and supports tax purposes.

Include the donation date. It verifies the exact time of the donation and helps track tax-deductible contributions accurately.

Indicate whether any goods or services were provided in exchange for the donation. If applicable, note their value. This is important for tax purposes and transparency.

State the organization’s name, address, and tax-exempt status. This shows the recipient is a qualified nonprofit and helps ensure the donation qualifies for tax deductions.

Include a statement that the donation was voluntary and without compensation. This reinforces that the contribution was given freely and not in exchange for anything.

Include an acknowledgment of the donor’s generosity. A simple thank-you note adds a personal touch and strengthens the relationship with the donor.

Common Mistakes to Avoid When Issuing Receipts

Ensure the receipt clearly states the donation date. Omitting this detail can lead to confusion and cause issues for tax deductions.

1. Incorrect Donation Value

- Don’t overestimate or underestimate the value of the donated items. Use a reasonable market value based on the condition and type of items.

- Be clear and specific about item descriptions. Avoid vague terms like “clothing” or “miscellaneous.” List items individually or group them by category.

2. Missing Donor Information

- Always include the donor’s full name and address. Without this, the receipt may not be valid for tax purposes.

- Make sure the donor’s information is spelled correctly to avoid errors during record-keeping.

3. Failing to Include Your Organization’s Details

- Ensure your charity’s name, address, and contact details are listed clearly. Without this, the receipt cannot be verified.

- Include your organization’s tax ID number, especially if the receipt is intended for tax deduction purposes.

4. No Statement of No Goods or Services Provided

- If the donation was purely for charitable purposes and no goods or services were exchanged, include a statement confirming this. This is essential for tax reporting.

5. Incorrect Formatting or Unclear Structure

- Avoid a cluttered or confusing receipt. Make sure it’s easy to read and all important details are clearly highlighted.

- Use a consistent layout for all donation receipts to streamline record-keeping and ensure consistency.