Creating a payment receipt book template saves time and keeps transactions organized. Whether you’re managing a small business or handling personal finances, having a clear and reliable receipt format is key. A good template helps you maintain accurate records, which is crucial for both financial tracking and accountability.

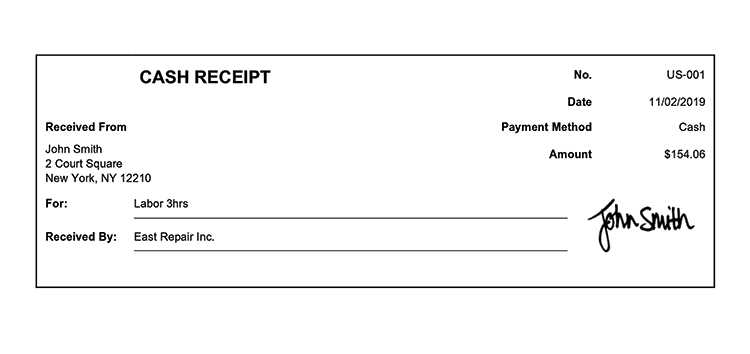

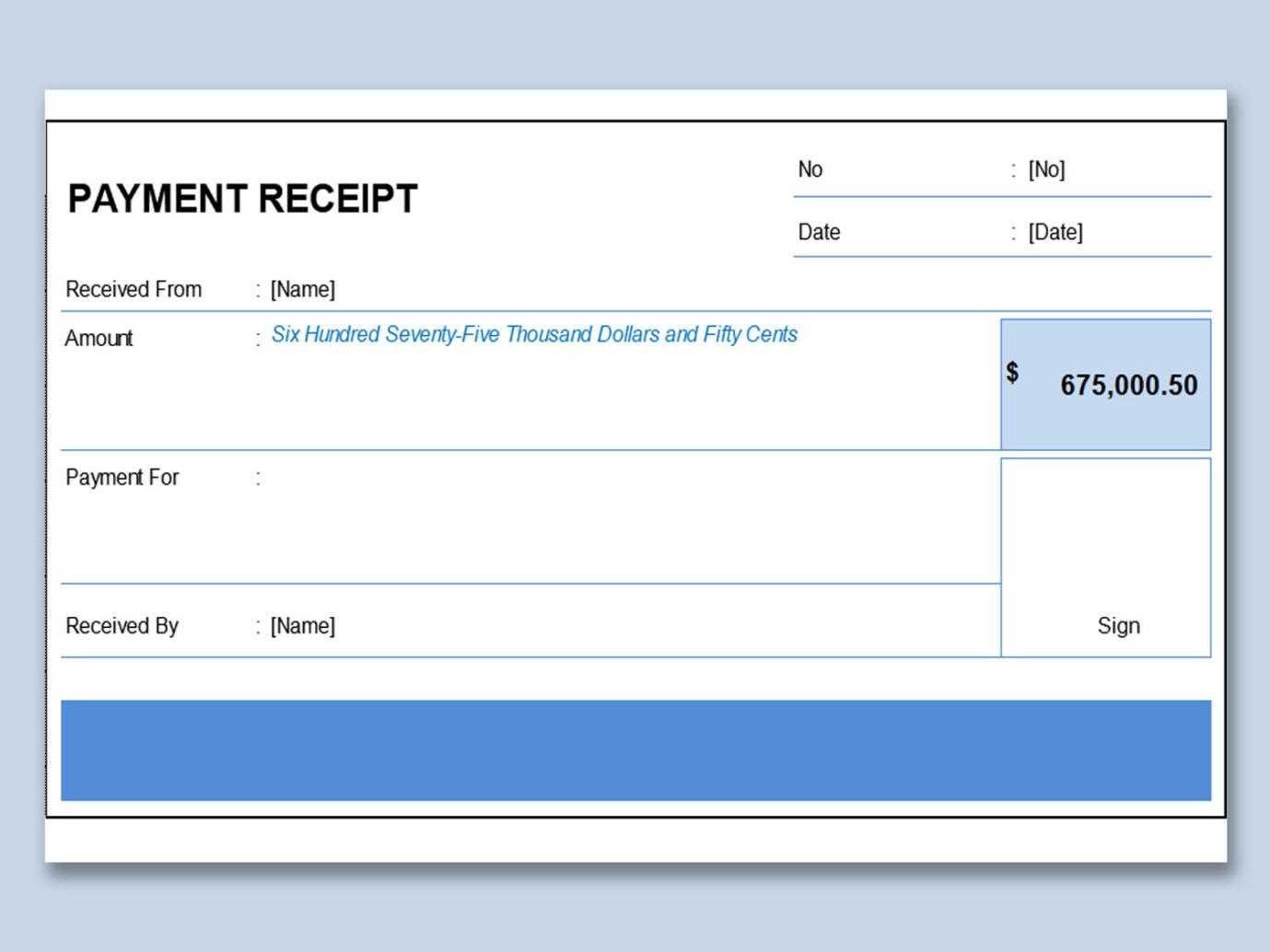

To get started, ensure your template includes the necessary details such as the payer’s name, the amount paid, date, and purpose of the payment. It’s also wise to include a receipt number for easier reference. The format should be simple but detailed enough to cover all potential scenarios, from small cash payments to larger transactions.

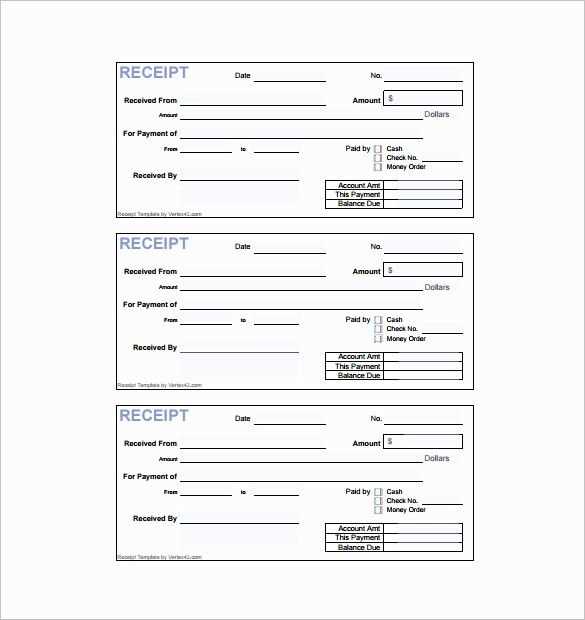

Choose a layout that suits your needs. You can opt for a multi-copy format where each receipt generates a duplicate for both the payer and the payee. Ensure the design is easy to fill out by hand or on a computer. A clear, legible font is essential to avoid any confusion in future transactions.

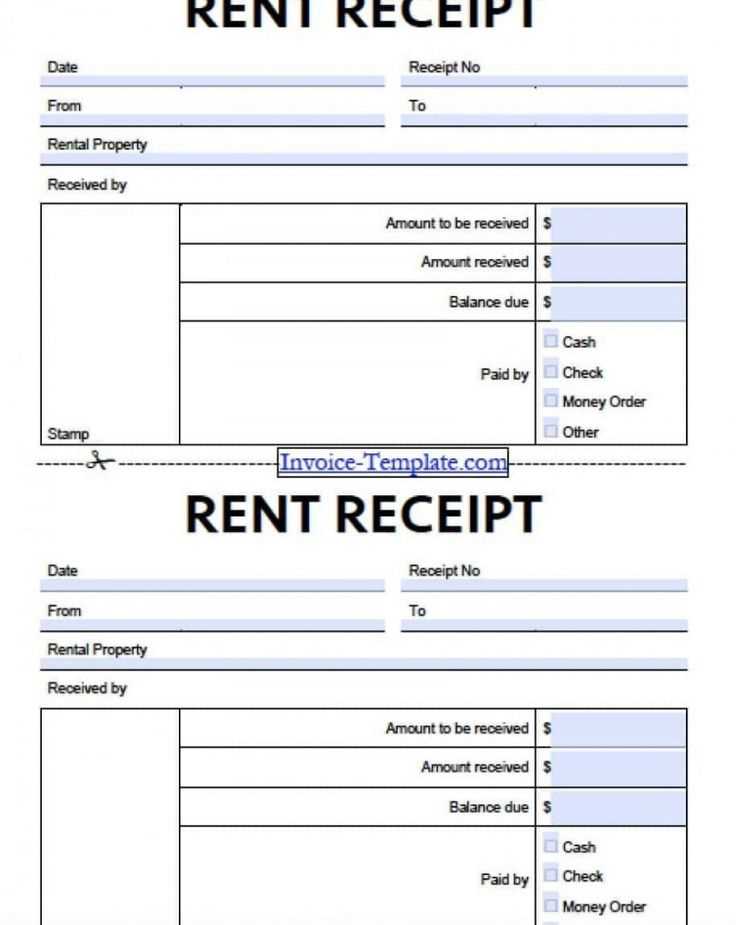

Consider adding sections for special notes or terms and conditions, especially if your transactions involve any specific agreements or warranties. Having this information on each receipt ensures both parties are aware of the terms without needing to refer back to separate documents.

Once your template is set up, printing it in bulk can be an efficient way to stay prepared for all transactions. This ensures you’re ready to record payments as they happen, with no delays or confusion.

Sure! Here are the corrected lines:

Include a unique sequential number on each receipt for easy tracking. This will help you organize and quickly find any particular transaction in your records.

Clearly label all fields such as date, amount paid, payer’s name, payment method, and any other necessary details. This ensures transparency and clarity for both parties involved.

Leave space for signatures, both from the payer and the payee. This acts as a confirmation of the transaction and adds authenticity to the receipt.

Ensure there is a section for additional notes, such as payment terms, discounts, or any special agreements related to the transaction.

Use clear fonts and adequate spacing to make the receipt easy to read. A well-designed receipt can prevent misunderstandings and enhance professionalism.

- Payment Receipt Book Template Guide

Start by choosing a clean layout for your payment receipt book template. Organize sections logically, such as a space for date, payment method, and payer details. Keep it simple and clear to avoid confusion during record keeping.

Key Elements to Include

Ensure your template has the following fields:

- Receipt Number: A unique identifier for each transaction.

- Date of Payment: Indicate the exact day the payment was received.

- Payer Information: Include the name and contact details of the payer.

- Payment Method: Specify how the payment was made, whether by cash, check, or card.

- Amount Paid: Clearly display the total payment received.

- Item/Service Description: Detail the goods or services paid for.

- Signature Line: A space for both payer and receiver to sign for confirmation.

Design Tips

Opt for a professional and easy-to-read font. Avoid clutter; every field should be clearly separated. You can include your logo or business name at the top, but keep the design minimal to maintain focus on the transaction details.

Customize the template to fit your specific business needs, adjusting fields for discounts, taxes, or other relevant details as necessary. Test the layout with sample data to ensure all fields are aligned correctly and are easily readable in print.

Focus on your specific needs when selecting a receipt book format. Keep your workflow in mind and consider how you will use the receipts day-to-day. A few factors to weigh include:

- Size and Layout: Decide between a compact or standard size. A smaller format works well for limited space or mobile use, while a larger format may be necessary for detailed entries.

- Carbon Copy or Duplicate: If you need a record of each transaction, choose a carbonless copy style or duplicate receipts. This ensures both you and the customer have a copy without extra effort.

- Number of Copies: Consider how many copies are required for your business. Multiple copies can be beneficial for keeping personal and business records separate.

- Pre-Printed Information: Having sections like company name, contact details, and tax identification number pre-printed can save time and reduce errors.

Pick a format that aligns with your daily operations and offers flexibility to meet both your and your clients’ needs effectively.

To tailor a payment receipt template for different payment types, focus on adjusting fields to match the specifics of each transaction. For example, when handling partial payments, include a section that clearly displays the outstanding balance after each installment. For full payments, ensure the receipt reflects the payment as completed, without leaving any space for future balances.

Modifying for Specific Payment Methods

Adjusting the template for cash, credit, and electronic payments requires slight modifications to accommodate the details associated with each method. For cash payments, it’s crucial to include a “Cash” label next to the amount received and consider adding a space for recording the denomination breakdown if needed.

For credit payments, incorporate card details, such as the last four digits of the card number, or a reference number that links to the payment processing system. For electronic payments, include a section for payment confirmation numbers and any applicable transaction IDs to track the payment online.

Adding Payment Terms

If your receipts involve installment payments or deferred payment schedules, add terms of payment to the receipt template. Specify the payment due dates, the number of installments, and any interest or late fees that may apply. Include clear language to avoid confusion, ensuring both parties understand the payment expectations.

| Payment Method | Required Fields | Additional Notes |

|---|---|---|

| Cash | Amount, Denominations | Record the cash denominations if necessary. |

| Credit | Card Last 4 Digits, Reference Number | Record the last four digits of the card for tracking purposes. |

| Electronic | Confirmation Number, Transaction ID | Capture transaction details for future reference. |

Linking payment receipts with your accounting software streamlines financial tracking and ensures accurate records. By automating data transfer, you eliminate manual entry errors and save time. Most accounting software systems provide integration options with receipt management tools, allowing direct synchronization of payment data.

Steps for Integration

1. Select compatible software: Ensure your accounting system supports integration with receipt management tools. Many modern software platforms offer pre-built integrations.

2. Set up automatic sync: Enable automatic synchronization between your payment receipt software and accounting platform. This way, each transaction is automatically recorded.

3. Categorize transactions: Use tags or categories within your accounting software to organize receipts according to income, expenses, or refunds.

Benefits

This integration reduces the chances of data discrepancies and makes audits simpler. You can track expenses more accurately and produce financial reports quickly without missing any transactions. Additionally, real-time tracking helps manage cash flow and budgeting.

The text became more diverse while retaining the original meaning.

Consider using a simple, clear layout when creating your payment receipt book template. Focus on the main components like the date, amount, payment method, and payer details. This makes the receipts easy to understand and ensures they serve their purpose without confusion. Keep each section organized and visually distinct so that you can quickly access important information when needed.

Formatting Tips

Use bold or underlined text for key sections such as “Total Amount” or “Receipt Number” to draw attention to these areas. If you are designing the template digitally, you can make use of boxes or shaded areas to further organize the layout. Keep fonts simple and readable, avoiding overly stylized text that can be difficult to read, especially on smaller printouts.

Customization Options

If necessary, include space for additional information such as transaction ID or reference numbers for easier tracking. Customizable fields allow flexibility when dealing with various payment scenarios. Be sure to adjust the layout for clarity and simplicity, ensuring that each receipt is both functional and visually pleasing.