For landlords and property managers, a rent tax receipt serves as a formal document proving that rent payments have been made. This template is a must-have for both parties, ensuring clear and organized records. A well-crafted receipt not only offers security but also helps in tax preparation by tracking income and expenses.

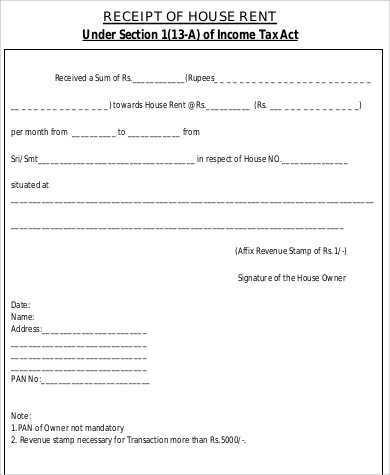

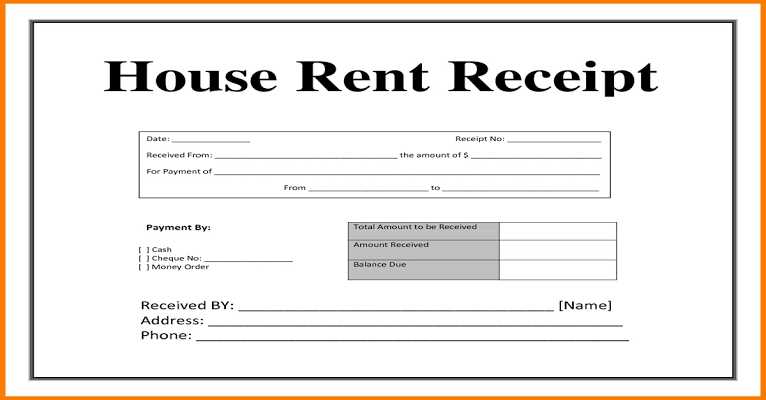

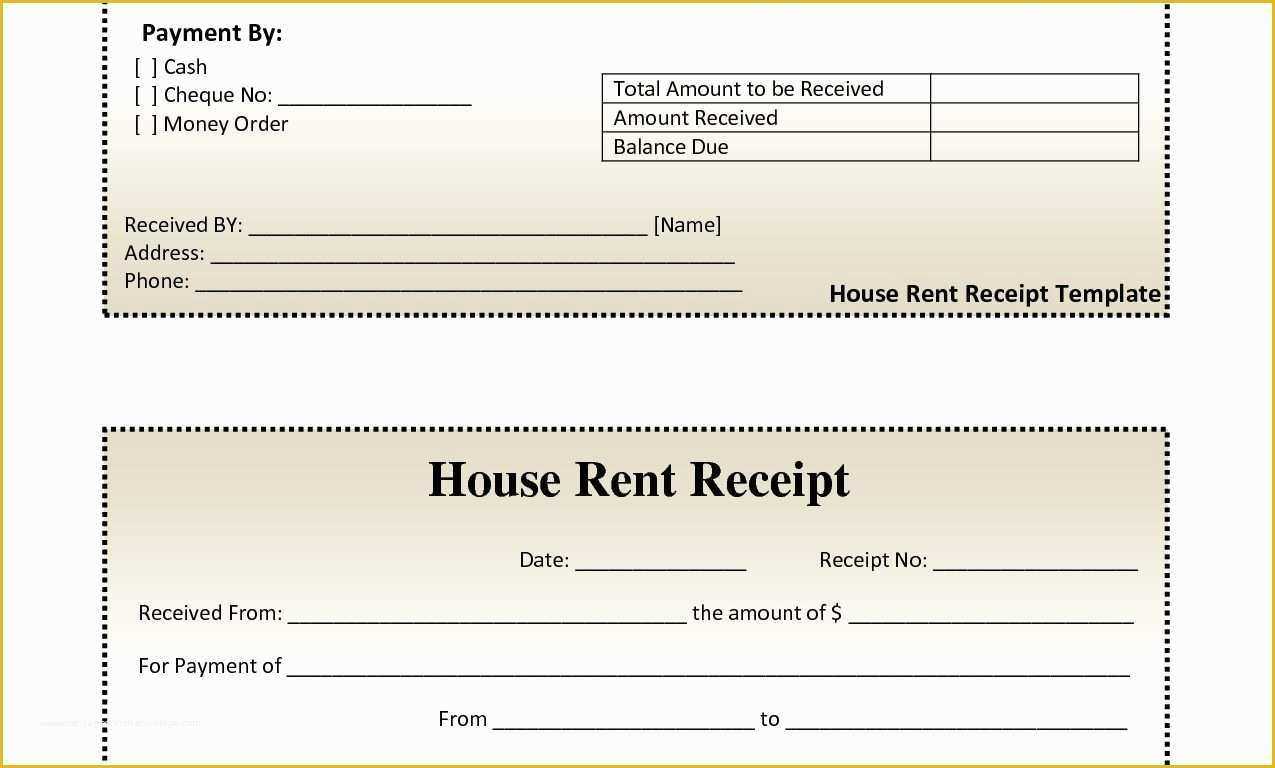

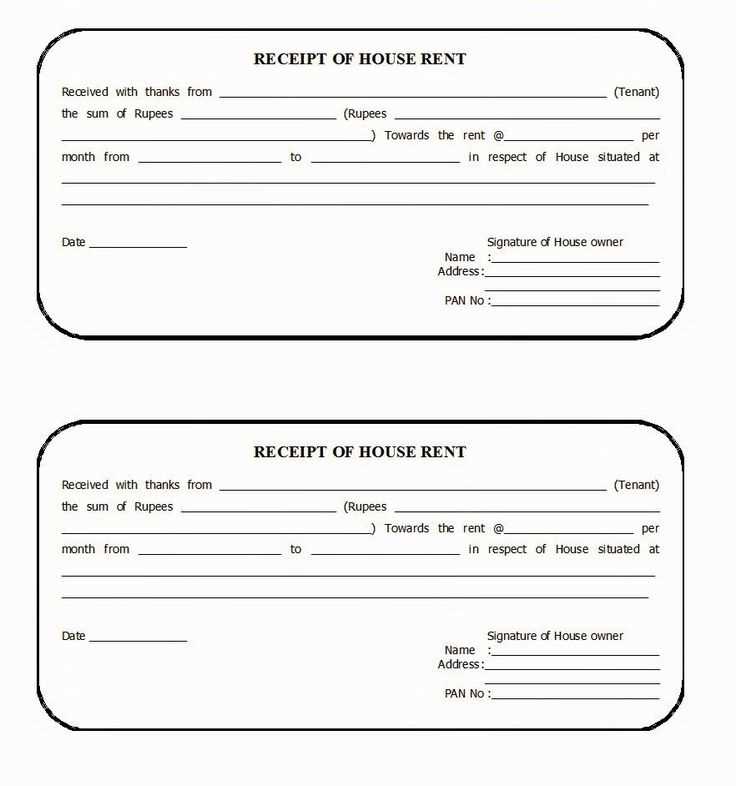

To create an effective rent tax receipt, it should include key details such as the tenant’s name, the property address, the rent amount, payment method, and the payment period. Ensure the date of payment is included, and specify whether the payment was for a partial or full period. You may also want to include any notes about deposits or adjustments made to the payment.

It’s best to provide this receipt in a format that is easy to store and reference. Using a digital template can streamline the process and keep your records neat. A well-designed receipt will prevent confusion and provide both the landlord and tenant with the necessary documentation for financial purposes.

Here’s the revised version with word repetitions minimized: Here’s a detailed HTML outline for an informational article on the topic “Rent Tax Receipt Template” with three practical and specific headings:htmlEdit

To create a tax receipt for rent payments, include key information that confirms the transaction. The document must state the landlord’s full name, the tenant’s name, the address of the rental property, and a description of the payment. Specify the amount paid, the payment date, and the payment method. Ensure the document is signed and dated by the landlord or property manager to make it legally binding.

What Should a Rent Tax Receipt Include?

Each rent tax receipt must clearly list the following details:

- Landlord’s Name and Address: Make sure the name and contact details of the landlord are included.

- Tenant’s Information: Include the tenant’s full name, ensuring that the recipient of the payment is identified correctly.

- Rental Property Address: Clearly state the address of the rented property to avoid confusion.

- Amount Paid: Specify the rent amount paid in both numerical and written format.

- Payment Date: Include the date when the rent was paid.

- Payment Method: Note the payment method (e.g., cash, cheque, bank transfer).

- Signature: The landlord must sign and date the receipt.

Why Is a Rent Tax Receipt Important?

A rent tax receipt serves as proof of payment for both the landlord and tenant. For the tenant, it may be required for tax deductions or as evidence of regular payments. For the landlord, it verifies that the rent was received and can be used to maintain accurate records for tax purposes. Keep copies of all receipts for future reference or audits.

Key Information to Include in a Rent Tax Receipt

Include the tenant’s full name and the address of the rented property at the top of the receipt. This helps identify both parties and the rental property involved.

Specify the rental period covered by the payment. Clearly state the start and end dates of the lease period, so it’s easy to verify which months or days the payment pertains to.

Payment Amount and Date

List the total rent amount paid, including any additional charges such as utilities or late fees. Also, mention the date when the payment was received. This ensures transparency and provides clear proof for tax purposes.

Landlord Information

Include the landlord’s name or business name, along with their contact information. If applicable, mention the landlord’s tax identification number for added accuracy.

For both the tenant and landlord, the receipt should include a clear statement that the transaction has been completed, and the payment has been accepted in full. This will be valuable when it comes time to file taxes or resolve any future disputes.

Common Mistakes to Avoid When Issuing Rent Receipts

Always include the correct payment date. Mistakes in dates, such as entering the wrong month or year, create confusion for both parties. Always double-check the date of payment and ensure it’s accurate on the receipt.

Specify the exact amount received. Avoid vague statements like “partial payment” unless you provide an exact figure. Clearly state the amount paid, as this helps prevent any misunderstandings or disputes later on.

Clearly outline the rental period covered. Ensure that you list the period for which the rent was paid (e.g., “Rent for June 2025”). Leaving this out can lead to confusion about the scope of payment, especially in cases where tenants pay for multiple months at once.

Provide a unique receipt number. Assigning a unique number to each receipt helps you keep track of payments. Avoid reusing numbers across different tenants or months, as this could cause issues in your accounting and documentation.

Include both tenant and landlord details. Make sure to list the full name and contact information of both parties involved. Missing this information can make it difficult to confirm the validity of the receipt or track disputes effectively.

Avoid generic terms like ‘rent paid.’ Instead of simply saying “rent paid,” use specific language like “payment for the month of [month/year].” This level of detail helps clarify what the payment was for, especially if the tenant pays for utilities or other fees along with rent.

Be careful with the payment method notation. Whether the payment is made by check, bank transfer, or cash, ensure the method is listed clearly on the receipt. Inaccurate details regarding the payment method could complicate future reference or verification.

In this version, the term “Rent Tax Receipt” is used just enough to maintain clarity, while avoiding excessive repetition.

To ensure clarity without overusing the term “Rent Tax Receipt,” consider the following practices:

- Introduce the phrase early on, then replace it with “receipt” or “document” for the remainder of the section.

- Use clear and descriptive language when referring to the receipt, ensuring that readers understand its purpose without needing constant repetition of the full term.

- In sections where the document’s function or context is clear, omit the term entirely and focus on the action or information it provides.

- For greater flow, use phrases like “proof of payment” or “tax document” in place of “Rent Tax Receipt” in applicable contexts.

These small adjustments maintain the document’s clarity and prevent redundancy, enhancing the reading experience while preserving the necessary legal context.