If you’re looking to generate a donation receipt for your Google donation, use a template that ensures all necessary details are included. A well-structured receipt helps the donor track their contribution and ensures that your organization remains compliant with tax regulations.

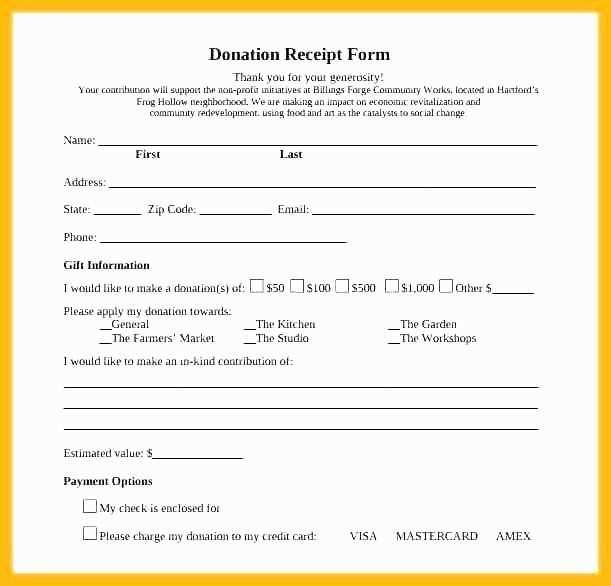

The template should cover the donor’s name, the amount donated, the date of the donation, and the method of donation (whether it was online or another form). Including your nonprofit’s name and contact details on the receipt is also essential, as it adds legitimacy and makes it easier for donors to reach out for further inquiries.

Make sure to state whether any goods or services were provided in exchange for the donation. If no goods or services were exchanged, this should be clearly indicated to comply with IRS rules. For transparency, add a thank-you note or acknowledgment of the donor’s generosity–a small gesture that enhances the experience for your supporters.

Here are the corrected lines with minimal repetition:

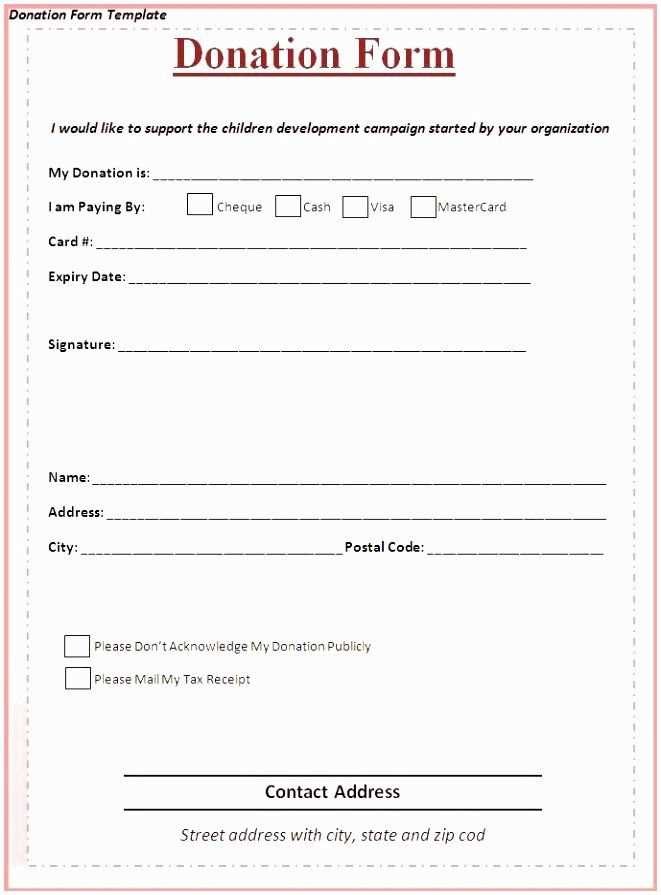

To create a clean and clear Google donation receipt template, focus on the essentials: donor name, amount, date, and the purpose of the donation. Avoid unnecessary text. Use simple formatting with clear headings like “Donation Date”, “Amount Donated”, and “Charity Name”. This helps ensure clarity and makes the document easy to understand at a glance.

Instead of using long paragraphs, break the information into small, digestible parts. For example, separate donor details and donation information into distinct sections. Each section should contain only the necessary details, ensuring the template remains user-friendly without redundant information.

Consider including a section for “Acknowledgment Number” for future reference. This can be automatically generated to maintain consistency and minimize errors. This small addition can make managing donations easier for both the organization and the donor.

Lastly, add a footer with the organization’s contact information and a brief note stating that the donation is tax-deductible. Keep it concise to avoid clutter.

- Google Donation Receipt Template Guide

To create a donation receipt using the Google Donation Receipt Template, follow these steps:

- Access the template: Open Google Docs and search for a donation receipt template or visit the Google Sheets template gallery for a receipt option.

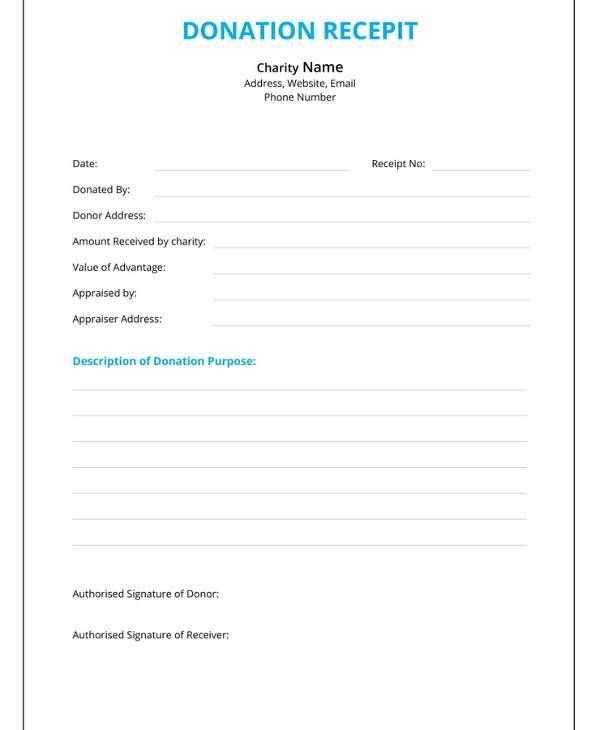

- Customize donor details: Include the donor’s full name, address, and email. Ensure the fields are up-to-date with the correct information.

- Specify the donation amount: Clearly state the donation amount, currency, and any notes regarding restrictions or designated use of the donation.

- Include the organization’s details: Insert the name, address, and tax identification number of your nonprofit organization to verify the receipt’s authenticity.

- Add a donation date: Make sure to note the exact date the donation was made, which is important for tax filing purposes.

- Tax information: If applicable, include a statement indicating that no goods or services were exchanged for the donation, which qualifies for tax deduction.

- Sign the receipt: Ensure a signature or digital sign-off from an authorized person within your organization, adding validity to the document.

Once customized, review the template for accuracy and completeness. After confirming the information is correct, you can send the donation receipt to the donor via email or print it for physical delivery.

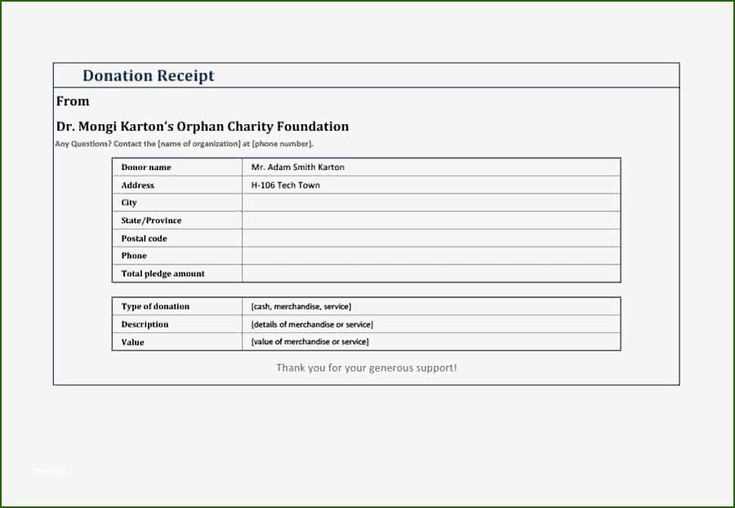

Customize your Google receipt template by editing key fields to match your nonprofit’s needs. Start with adjusting the header information. Include your nonprofit’s name, logo, and contact details to make the receipt official and personalized.

Next, update the donation section. Replace the default placeholders with specific information, such as donor’s name, donation amount, and donation date. You can add a brief description or purpose of the donation if needed.

Ensure that your nonprofit’s tax-exempt status is clearly mentioned. Include a statement about the receipt being valid for tax purposes. This can be a simple line such as: “Your donation is tax-deductible to the fullest extent allowed by law.”

Lastly, include your nonprofit’s EIN (Employer Identification Number) to give donors the necessary information for tax filing.

| Field | Recommended Customization |

|---|---|

| Header | Nonprofit name, logo, and contact info |

| Donation Details | Donor’s name, amount, date, and donation purpose |

| Tax Information | Tax-exempt status and EIN |

Review all information for accuracy before sending the receipt to ensure donors have the correct details for their records.

Ensure your donation receipt includes the donor’s name and address to confirm their identity. Specify the donation date and the amount or description of the donated item. For non-monetary gifts, provide a detailed description of the items received. Always include a statement that the donation was made without any goods or services exchanged in return, except for any token gifts that might have been provided. This assures the donor of the tax-deductible nature of their contribution.

If applicable, mention your organization’s tax-exempt status and include the IRS identification number to support the donor’s claims on their tax filings. A unique receipt number can help both the donor and the organization track donations easily for record-keeping and auditing purposes. Finally, provide a contact for any questions regarding the receipt or donation process.

To send and track donation receipts using Google templates, begin by creating a custom template in Google Docs or Sheets. This allows you to format your receipts according to your needs while maintaining consistency.

Create a Template

- Open Google Docs or Sheets and start with a blank document or sheet.

- Design the layout for your receipt, including sections for donor details, donation amount, and date.

- Add any necessary fields that will change for each donation (such as name, amount, or date) by inserting placeholders or using Google Sheets formulas.

- Save the document as a template so you can reuse it for future receipts.

Send and Track Receipts

- Once your template is set up, fill in the details for each donation.

- Use Google Sheets’ mail merge feature to automatically populate the template and send the receipt via email to each donor.

- To track receipts, create a log in a separate sheet where you record each sent receipt’s status, including sent date and confirmation of receipt.

- For more advanced tracking, use Google Forms or add a tracking column in your spreadsheet to log responses from donors acknowledging receipt of the donation confirmation.

Optimizing Repetitive Phrases in Google Donation Receipt

Remove unnecessary repetitions of “Google” and “Donation Receipt” in the text, ensuring their use only in appropriate contexts. For example, in the receipt header, you may include the word “Google” for clarity, but avoid repeating it unnecessarily in the description section. Keep the phrasing clear and concise without redundant references, focusing on maintaining a smooth flow. You may replace some instances of “Donation Receipt” with alternative terms like “receipt” or “donation acknowledgment” if the context allows it. This method reduces clutter while keeping the information clear and accurate.