To create a simple donation receipt, focus on clear, straightforward details. Make sure to include the donor’s name, the amount donated, the date of donation, and your organization’s name. This basic information will be enough for the donor’s tax records and ensures everything is documented properly. You can also add a thank-you note to make the receipt feel personal and appreciated.

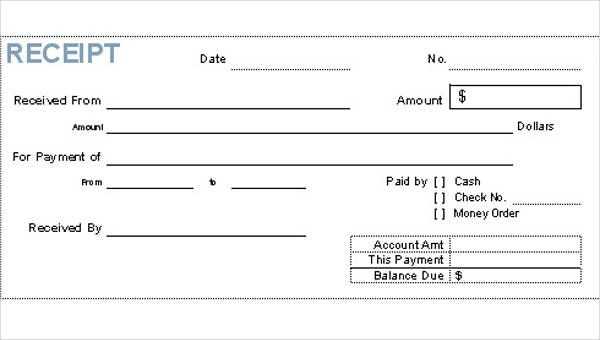

Use a clean layout that makes the information easy to read. This helps your donors quickly locate what they need. A simple format, such as a table with clear headers like “Donor,” “Amount,” and “Date,” works well. Acknowledging the donation with a brief sentence like, “Thank you for your generous support!”, adds a nice touch.

Ensure you include a statement confirming that no goods or services were provided in exchange for the donation, as this is necessary for tax purposes. A phrase like “No goods or services were provided in exchange for this donation.” will suffice.

Here’s the improved version with minimal repetition:

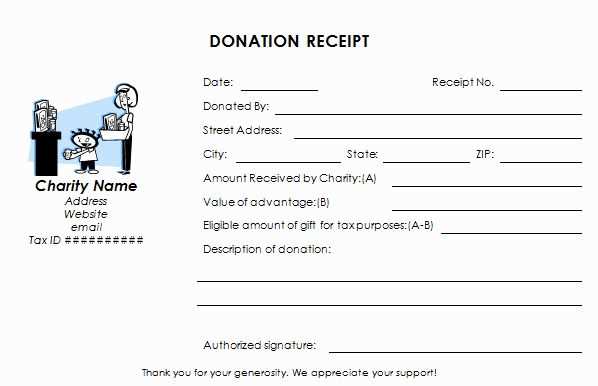

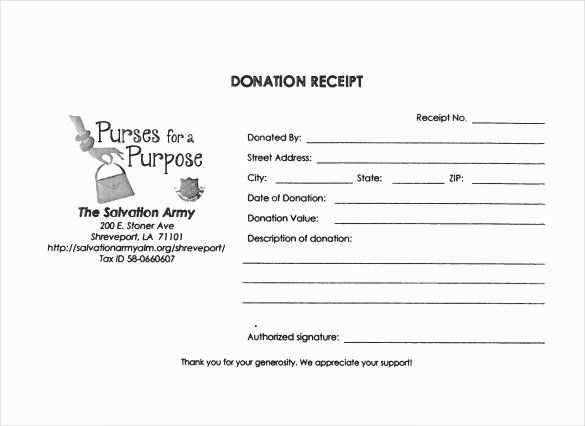

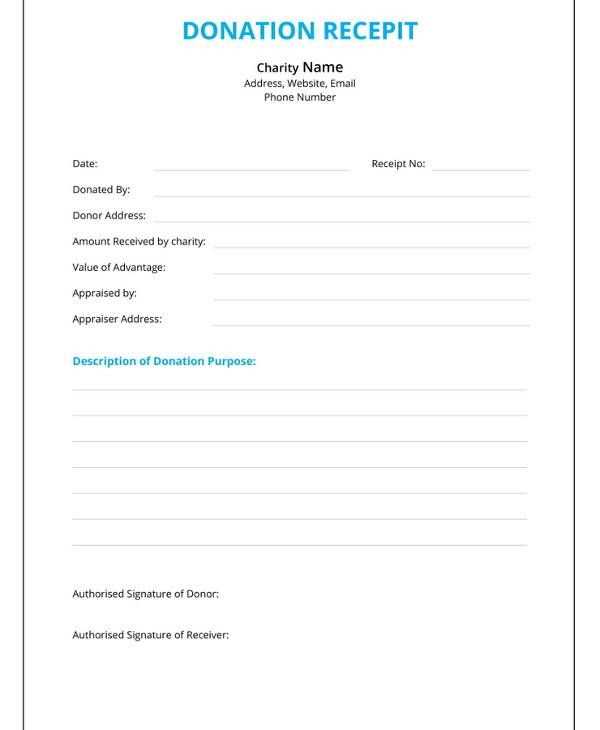

To streamline your donation receipt, ensure all key details are covered concisely. Start with the donor’s name and donation amount. Make sure to include the date of donation and your organization’s name and tax ID number.

Basic Structure

Each receipt should contain:

- Donor’s name

- Donation amount (in both words and figures)

- Donation date

- Your organization’s details (address and tax ID number)

Additional Information

If applicable, note whether the donation was in cash, check, or in-kind. If the donation was a gift of goods or services, specify the description and value of the item.

Keep the tone polite, professional, and clear. Ensure there’s no ambiguity in how the donation is recorded. This version reduces redundancy and improves clarity, ensuring donors know exactly what they’ve contributed and what they can claim for tax purposes.

- Simple Donation Receipt Template

A simple donation receipt should include key details that confirm the donation for both the donor and the recipient. Keep the format straightforward and easy to understand, with a focus on accuracy. Below is a template you can customize for your needs.

Template Structure

The receipt should contain the following components:

- Organization Name and Contact Info: Include the legal name of your organization and any relevant contact information (address, phone number, email).

- Donation Date: Clearly specify the date the donation was received.

- Donor Information: Include the donor’s name and address, if possible.

- Donation Amount or Description: Clearly state the value of the donation, whether it is a cash amount or an item description with estimated value.

- Tax-Exempt Status: If applicable, include a statement confirming the organization’s tax-exempt status (e.g., 501(c)(3) in the U.S.).

- Statement of No Goods or Services Provided: If no goods or services were provided in exchange for the donation, include a simple statement such as “No goods or services were provided in exchange for this donation.”

- Signature: Add space for the signature of a representative from your organization who can confirm the donation receipt.

Example Template

Here is a sample format for reference:

[Organization Name] [Organization Address] [Phone Number] [Email Address] Date: [Date of Donation] Received from: [Donor Name] Address: [Donor Address] Donation Amount/Description: [Amount or Description of Donation] This donation is tax-deductible. No goods or services were provided in exchange for this donation. Signature: _________________________ [Name of Representative] [Title]

Make sure to adjust the template based on your specific needs and local tax laws.

Begin by including the name of your organization and its contact details at the top of the receipt. This ensures the donor knows where the donation is coming from and how to reach out if needed.

Next, provide the date of the donation. This is key for both your records and the donor’s tax filing purposes. Make sure the date is accurate and easy to spot.

Include the donor’s name and address. This helps to confirm who made the donation and provides necessary information for acknowledgment and tax documentation.

Clearly state the amount donated. If applicable, mention the currency to avoid confusion, especially if dealing with international donors.

If the donation was for a specific purpose (e.g., a project or campaign), note it on the receipt. This helps both parties keep track of how the funds are allocated.

If the donation was made in kind (goods or services), specify what was donated, along with an estimated value if possible. This helps in providing transparency and ensures accurate reporting for tax purposes.

End with a thank-you message. A simple “Thank you for your generous donation!” adds a personal touch and encourages future support.

Finally, include a disclaimer stating that the receipt does not serve as a statement of the donor’s fair market value, especially if the donation was in kind. This will clarify your organization’s position on the valuation of non-cash donations.

To ensure a donation receipt serves its purpose, include the following key details:

1. Donor Information

List the full name of the donor and their contact details. This helps for verification and provides transparency in case of any inquiries or audits.

2. Date of Donation

Clearly indicate the date the donation was made. This is crucial for tax deduction purposes and record-keeping.

3. Donation Amount or Description of Donated Items

For cash donations, state the exact amount donated. For in-kind donations, describe the items given along with their estimated value, if applicable.

4. Nonprofit’s Information

Include the name, address, and tax ID number (EIN) of the nonprofit organization to ensure the receipt is recognized for tax purposes.

5. Statement of No Goods or Services Provided

If the donation was fully charitable, include a statement confirming that the donor did not receive any goods or services in return for their donation. This is necessary for tax deduction eligibility.

6. Receipt Number

Assign a unique receipt number to each donation for easier tracking and record-keeping. This helps both the donor and nonprofit maintain organized records.

7. Signature of Authorized Person

Include the signature or name of the authorized representative of the nonprofit who issued the receipt. This validates the authenticity of the receipt.

Example Donation Receipt Table

| Detail | Description |

|---|---|

| Donor Name | John Doe |

| Date of Donation | January 15, 2025 |

| Donation Amount | $100 |

| Nonprofit Info | ABC Charity, EIN: 123456789 |

| Goods or Services | No goods or services provided |

| Receipt Number | 001234 |

| Authorized Signature | Jane Smith |

Canva offers an easy-to-use platform with a variety of free templates for designing donation receipts. With customizable fields for donor information, donation amount, and organization details, it’s a quick solution to create professional-looking receipts.

Google Docs

Google Docs is another free tool for creating donation receipts. You can use a pre-made template or build one from scratch. The integration with Google Drive makes sharing and storing documents easy. Plus, it’s compatible with other Google tools like Sheets, which could be useful for tracking donations.

Microsoft Word

If you have access to Microsoft Office, Word provides simple receipt templates. These templates are straightforward and can be customized to suit your needs, including adding donation dates, donor information, and tax-exempt status.

Free online platforms like Canva, Google Docs, and Microsoft Word help simplify the design process without requiring any design skills or expensive software. These tools also make it easier to store and distribute donation receipts efficiently.

Charitable organizations must follow specific legal guidelines when issuing donation receipts. The receipt should include the donor’s name, donation amount, and the date of the donation. For donations exceeding a certain threshold, the receipt must also include a statement confirming whether any goods or services were provided in exchange for the donation, and if so, the fair market value of those items.

Ensure that the organization’s tax-exempt status is clearly indicated on the receipt, along with its registration number if applicable. This is crucial for donors to claim tax deductions. Donors should receive receipts promptly, typically within a reasonable timeframe after their contribution.

In some jurisdictions, if the organization receives donations over a set amount, an official tax receipt with a unique serial number may be required for tax reporting. Always check with local regulations for any specific requirements in your area.

To personalize donation receipts effectively, tailor the content based on the type of contribution. Start by adjusting the donation amount fields and specifying whether it’s a monetary gift, item donation, or volunteer hours.

Monetary Donations

- Include the exact amount donated and the payment method (e.g., cash, credit card, bank transfer).

- Provide a clear statement of whether the donation is tax-deductible and include relevant tax-exempt information if applicable.

- Consider adding a personal thank-you message that reflects the specific impact of the donation.

Non-Monetary Donations

- List the donated items with descriptions and estimated values if necessary.

- If the donor contributed goods or services, specify how these will be used within the organization or cause.

- Include any applicable tax-deduction notes if the donation qualifies.

Volunteer Time

- Document the number of hours volunteered and the specific duties performed, if relevant.

- Thank volunteers for their time and highlight how their contributions help the organization.

- If applicable, mention how the volunteer hours contribute to any matching donation programs or tax benefits.

Send receipts within 24 hours of receiving a donation. This ensures donors have the necessary documentation for tax purposes right away.

- Include clear details: Donor’s name, donation amount, date, and organization’s tax ID number.

- Use an easy-to-read format: Avoid dense text and make sure the information is clear and accessible.

- Personalize the message: Address the donor by name and thank them for their contribution to create a stronger connection.

- Provide transparency: If the donation is tax-deductible, explicitly state the amount that qualifies and explain the tax status.

- Include instructions for further questions: Offer contact information if the donor needs clarification or additional information.

- Keep records: Maintain a copy of the receipt for your own accounting and tax reporting purposes.

Consistency in your process will help ensure that donors feel valued and can easily use receipts when needed.

Receipt Structure for Donations

Clearly list the donation amount and currency at the top of the receipt. Specify whether it’s a one-time or recurring donation. Include the donor’s name, address, and contact details if necessary. For accurate record-keeping, add the organization’s name, address, and tax identification number (TIN) if applicable.

Provide a concise description of the donation purpose or campaign. Mention any specific project or initiative the funds support, if relevant. Ensure the date and time of the donation are easy to find for quick reference.

Don’t forget to add a thank-you note. A simple acknowledgment can make a donor feel appreciated. Include instructions for obtaining a copy of the receipt for tax purposes, if required.