To create a receipt template for your milk shop, focus on including the necessary transaction details such as product name, quantity, price, total amount, and date. A clear structure helps both customers and employees understand the purchase. Ensure the name of your shop and contact information are prominently displayed at the top for easy reference.

Product Information should be clearly listed, including the milk type or variant, along with the quantity purchased. This allows customers to review their purchase and helps in resolving any future discrepancies. Include any applicable discounts or promotions under the item description to provide full transparency.

Total Calculation should be straightforward. Clearly show the subtotal, tax, and final amount. Make sure to include a breakdown of the tax applied to ensure accuracy. This builds trust with customers and provides them with a complete record of their transaction.

Payment Methods should also be included if relevant. Indicate whether the payment was made in cash, card, or any other method. If the receipt is for a bulk purchase or subscription, ensure the terms are mentioned clearly to avoid confusion.

Template Receipt for Milk Shop: Practical Guide

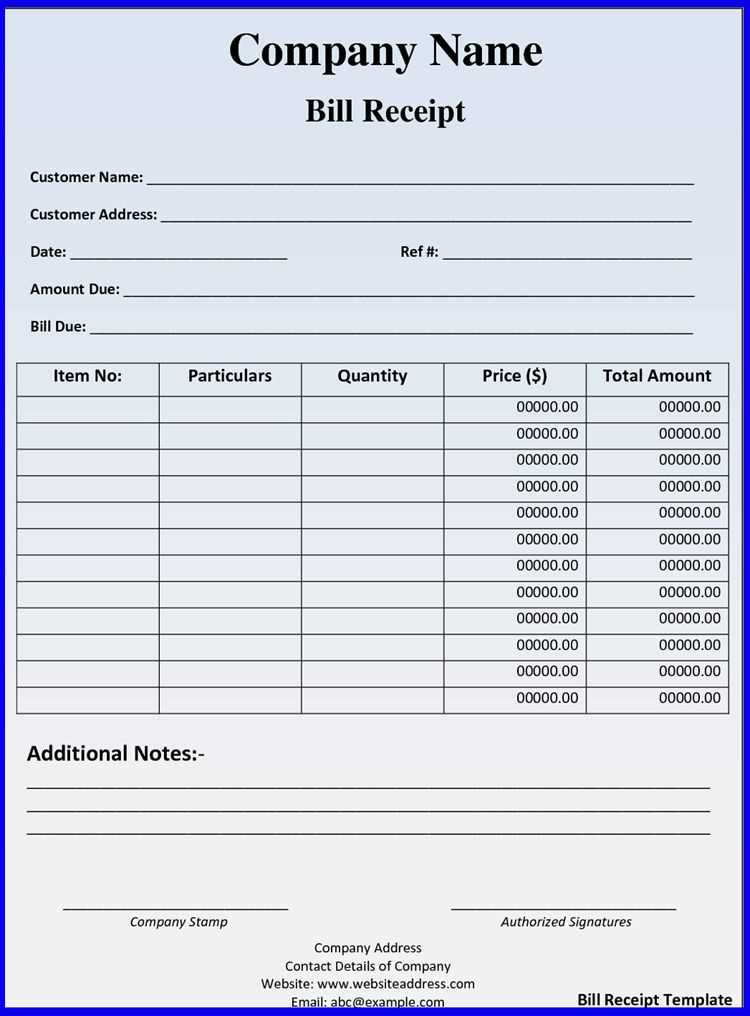

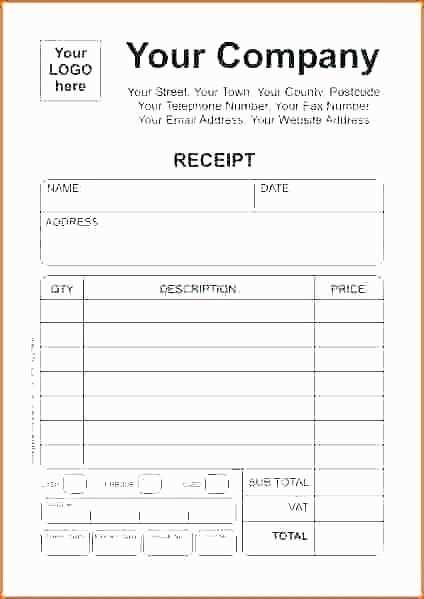

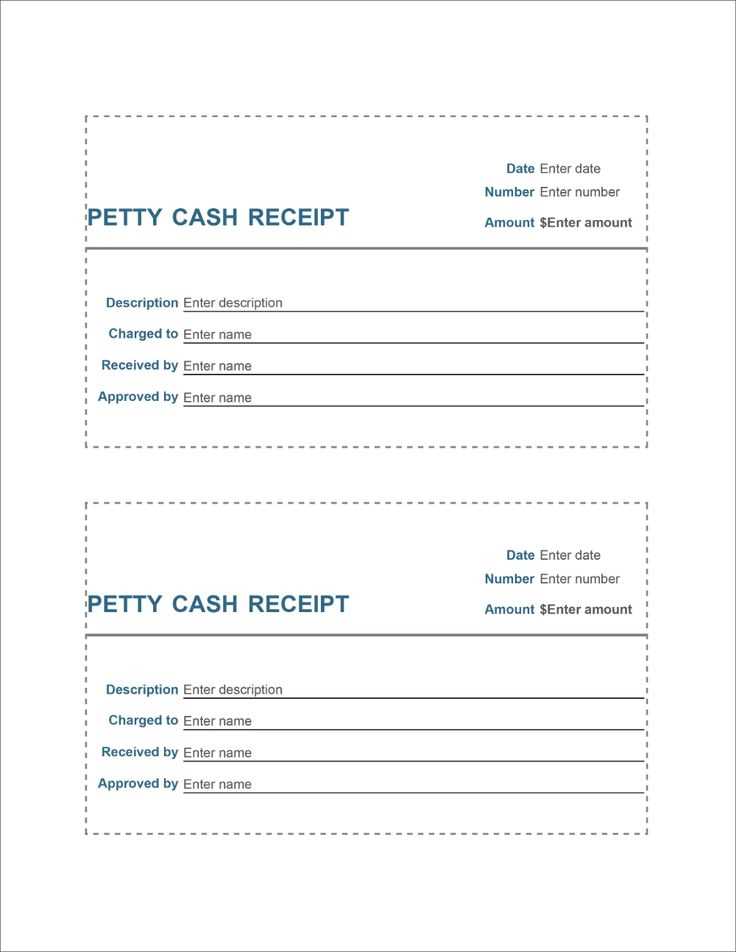

Start with a clean and simple design that clearly lists the product details, quantities, and prices. Use sections to break down the transaction: one for the items purchased, another for payment details, and a final one for the store’s contact information. For clarity, include the name of your milk shop, address, phone number, and tax identification number. Be sure to format the total price in a prominent way to avoid confusion.

Include columns for product description, unit price, quantity, and total price per item. The line item totals should add up to the overall total at the bottom of the receipt. If applicable, include a section for discounts, loyalty points, or any special offers. Ensure the tax breakdown is clear–state the tax rate and how much tax is being charged on the sale.

Incorporate a space for the date and time of the purchase. This is important for both record-keeping and any potential returns or inquiries. Make sure the receipt has a professional look by using a clean font and organizing the information logically, ensuring that the customer can quickly scan and understand the details of their purchase.

Provide a footer with store policies or a reminder about customer service contacts in case of any issues with the purchase. Finally, consider adding a thank-you note or reminder to visit again. The design should balance practicality with a friendly, welcoming tone.

Choosing the Right Information to Include in a Milk Shop Receipt

List the transaction details clearly. Always include the date and time of purchase. This helps customers track their purchases and ensures transparency. Provide the name of your shop and its contact details, including the address, phone number, and email, in case a follow-up is needed.

Include the product names and quantities. If possible, provide a clear description of the milk types or any other dairy products sold, especially if there are variations (like organic, low-fat, etc.). Customers appreciate knowing exactly what they are buying. Add the price of each item individually and the total cost at the bottom, including any applicable taxes or discounts.

For loyalty or promotional programs, add a line about rewards points or applicable discounts. This not only adds value to your receipt but also encourages repeat business.

Finally, always include your return policy. A brief note on how customers can return items or get refunds can prevent misunderstandings and build trust.

Designing a Simple and Clear Template for Easy Use

Focus on clarity and ease of navigation. Create sections that are easy to scan, with a logical flow. The template should reduce confusion and speed up tasks for the user. To achieve this, consider the following steps:

Use a Clean Layout

A cluttered design leads to confusion. Keep the layout clean with enough white space around elements. Make sure text is well-spaced, and elements are aligned properly. Avoid unnecessary decorative elements that can distract from the main content.

Prioritize Key Information

- Place the most important details in prominent positions.

- Use headings and subheadings to break down information logically.

- Minimize text and focus on key points using bullet lists or tables where possible.

Ensure the template is adaptable to various devices. It should maintain readability and functionality, whether accessed on a computer, tablet, or mobile phone.

Streamline Interaction

- Ensure buttons and forms are easily clickable and well-placed.

- Use simple language for instructions and labels.

- Provide immediate feedback after actions, such as form submissions or button clicks, to keep the user informed.

Test the design regularly. Gather feedback from actual users to identify areas that might cause frustration. Keep refining the template until it offers a smooth, intuitive experience.

Integrating Payment Methods and Tax Calculations into the Receipt

Ensure the receipt clearly reflects all payment methods used by the customer. Include a line that lists each payment option, such as cash, card, or mobile payment, and the amount applied for each. This helps track payments accurately and provides transparency for both the customer and the shop.

Tax calculations must be displayed with precision. Break down the tax rate applied and the total tax amount on the receipt. Include the tax percentage next to the subtotal, so it’s evident how the total price is derived. This is particularly important for complying with tax regulations and offering clear information to the customer.

For receipts involving multiple items, list the tax calculation for each product individually, followed by a summary of the total tax. This avoids confusion and ensures the customer sees how taxes were applied across their purchase.

Make sure that any discounts or promotions are clearly noted, as they can affect the final tax calculation. Adjust the tax amount accordingly to reflect the discount and provide an accurate total after discounts and taxes are applied.

Integrating these payment and tax details into the receipt provides both clarity and compliance, creating a transparent experience for the customer.