Creating a clear and straightforward honorarium gift receipt template is a great way to ensure transparency and formality when gifting or receiving honoraria. This document serves as a record of the transaction and helps both parties maintain accurate financial records. To ensure smooth handling, include specific details such as the giver’s name, recipient’s name, amount, purpose, and date of the gift.

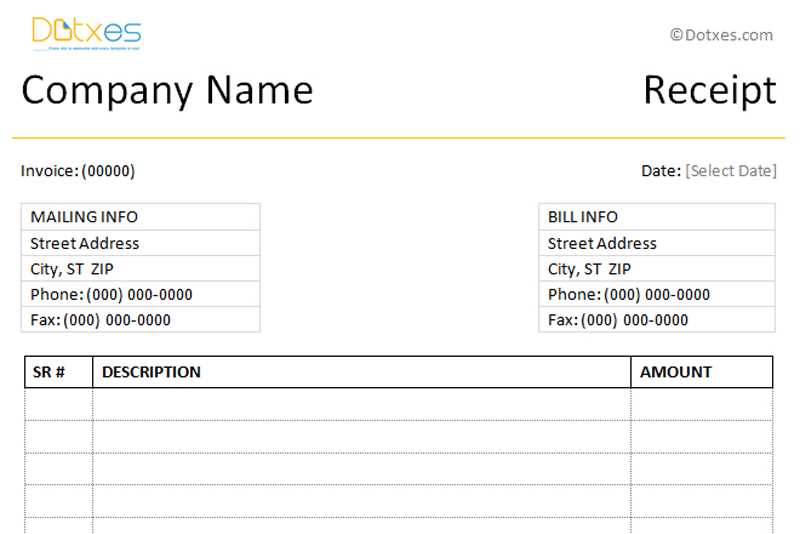

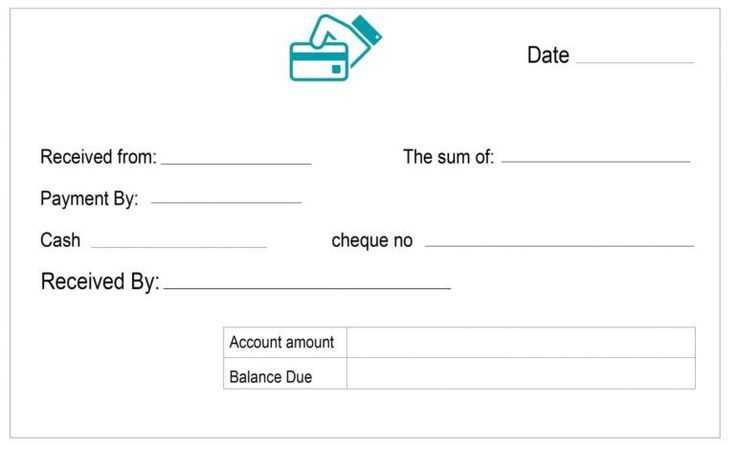

Start with the basics: Your template should begin with the date the honorarium is given, followed by the full name and contact information of both the giver and the recipient. This sets the foundation for the document and ensures that all relevant parties are clearly identified.

Include a detailed description of the gift: The amount or value of the honorarium, along with any relevant context or conditions of the gift, should be clearly outlined. This helps to avoid misunderstandings and ensures that both parties are on the same page regarding the nature of the transaction.

Finally, sign the document: A signature from both the giver and recipient formalizes the agreement. This simple step reinforces the authenticity of the transaction and creates a paper trail that can be referenced later if needed.

Here’s the revised version:

To create a clear and professional honorarium gift receipt, include the following key details:

Recipient Information

Start by noting the recipient’s full name and contact information. This provides transparency and ensures proper documentation.

Details of the Gift

Specify the nature of the gift, its value, and any related conditions. For example, describe the gift as a monetary amount, gift card, or service. Clearly state the amount or value associated with it.

Finally, include the date of the transaction and the signature of the giver. This validates the receipt and ensures both parties have a clear understanding of the exchange.

- Honorarium Gift Receipt Template

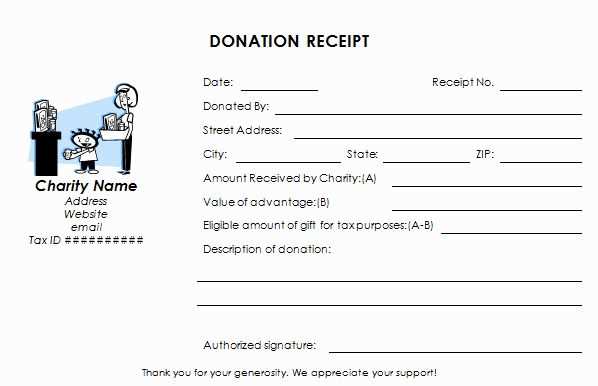

When creating an honorarium gift receipt template, make sure to include specific details that will help the recipient and the giver maintain clear records for tax and personal purposes. Below is a guide to structuring an effective template.

Key Elements

- Recipient’s Name: Clearly state the full name of the person receiving the honorarium.

- Donor’s Information: Include the name and contact details of the donor, especially if the recipient needs to report it for tax purposes.

- Gift Description: Briefly describe the honorarium gift provided, including the amount or nature of the item, if relevant.

- Date of Gift: Specify the date when the honorarium was received.

- Signature: Provide space for both the donor and recipient to sign, confirming the transaction.

Additional Recommendations

- Tax Considerations: If applicable, mention whether the gift is taxable, and remind the recipient to consult with a tax professional for further advice.

- Thank You Message: Adding a personal note of thanks to the recipient adds a warm touch and maintains positive relations.

- Receipt Number: Assigning a unique receipt number can help with tracking and future reference.

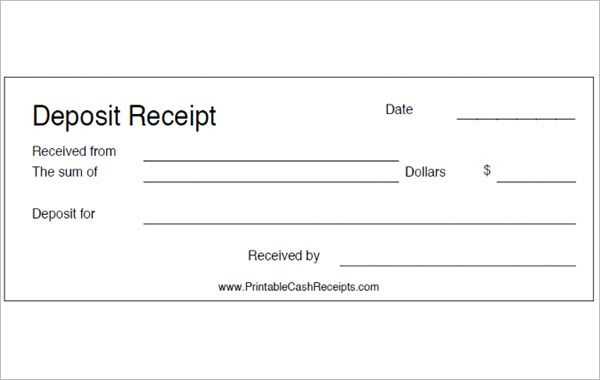

Begin by clearly identifying the parties involved. Start with the recipient’s name and address, followed by the payer’s information. Include the date the honorarium was received for accuracy.

Key Information to Include

List the amount received, both numerically and in words. This eliminates any potential confusion. Specify the reason for the payment, such as “honorarium for guest speaking” or “honorarium for consulting services.” It’s crucial to clarify the purpose of the honorarium to maintain transparency.

Final Touches

End the receipt with the recipient’s signature and a note stating that the payment is being acknowledged. This finalizes the document as a formal acknowledgment of the transaction. Always keep a copy of the receipt for your records.

Ensure the gift receipt complies with local tax regulations. Honorarium gifts can be taxable if they exceed certain thresholds, so clarify if the amount needs to be reported as income. The receipt should include the donor’s details, including their name, address, and the amount or value of the gift. Proper documentation is necessary to avoid potential tax penalties for both the donor and recipient.

Tax Reporting Requirements

Verify whether the honorarium is considered taxable by the tax authorities. In many cases, gifts exceeding a specified amount must be declared. Both the recipient and donor might need to report the gift on their respective tax filings. Check with local regulations to determine the reporting obligations for both parties.

Gift vs. Compensation

Differentiate between a genuine gift and compensation for services. If the gift is tied to services rendered, it may not qualify as a gift and could be taxed as income. Clear documentation specifying that the gift is unrelated to any work or service helps to avoid misclassification.

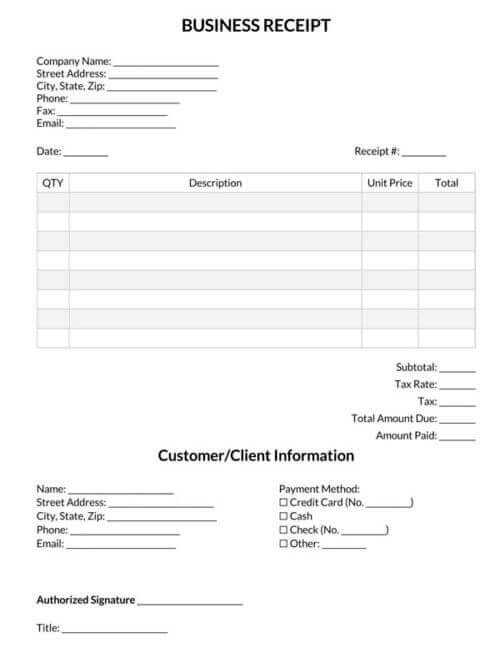

To create a personalized honorarium gift receipt template, focus on key elements that convey a sense of appreciation and professionalism. Begin with a well-structured header that includes the recipient’s name and the event’s details, ensuring clarity. Customizing the body of the receipt allows you to make the donation feel meaningful and specific.

Consider adding fields for the amount, purpose of the honorarium, and any special instructions. This not only helps in clarity but also adds a personal touch. If the honorarium is a part of a larger event, include the date, location, and event type, making it clear where and why the gift was given.

| Field | Personalization Option |

|---|---|

| Recipient’s Name | Insert the recipient’s full name or preferred title |

| Amount | Choose to specify the exact amount in words or numbers |

| Purpose of Gift | Customize to reflect the event or contribution being honored |

| Date | Include the specific date of the honorarium or event |

| Location | Personalize with the venue or location of the event |

Tailor the language in your template to match the formality or informality of the event. A more formal occasion might require professional language, while an informal setting can be relaxed. Lastly, a thank-you note at the bottom of the receipt leaves a warm touch, reinforcing gratitude.

Honorarium Gift Receipt Template

Ensure your honorarium gift receipt contains the following key details to maintain clarity and professionalism:

- Recipient’s Information: Name, address, and contact details.

- Amount Received: Clearly state the honorarium amount, including any applicable taxes or deductions.

- Purpose of Gift: A brief description of the event or reason for the honorarium.

- Date of Receipt: Specify the exact date the honorarium was given or received.

- Donor’s Information: Name and contact details of the person or organization providing the gift.

Example Template

Use the following template for your receipt:

- Recipient: [Recipient Name], [Address]

- Amount: $[Amount]

- Purpose: Honorarium for speaking at [Event Name]

- Donor: [Donor Name/Organization]

- Date: [Date of Receipt]

Ensure that all sections are filled out clearly to avoid confusion and ensure both parties have accurate records.