To streamline the process of tracking partial payments, using a cash receipt template can save time and prevent confusion. This document serves as a record that both parties–buyer and seller–agree on the amount paid and the outstanding balance. A simple, clear template ensures all necessary details are included, making future references easy and reliable.

Start by including the date of the payment, the amount paid, and a breakdown of the remaining balance. Specify the terms of payment–whether the remaining balance is due immediately or on a later date. The template should also include both the payer’s information and the receiver’s details for clarity and transparency.

Once completed, both parties should sign and keep a copy of the receipt. This can prevent misunderstandings and provide proof of transaction in case of disputes. By consistently using this template, you ensure a smooth, organized payment process for both buyers and sellers alike.

Here are the corrected lines:

Ensure the payment terms are clearly outlined. Specify the amount received, the balance remaining, and the method of payment. For partial payments, include the total amount due and clearly state the payment breakdown. Avoid ambiguity by separating the full amount from the paid amount, highlighting the remaining balance. Ensure the customer’s name, contact details, and reference number are included to prevent confusion. Verify the payment date and ensure it matches the transaction record. These details are vital for accurate recordkeeping and future reference.

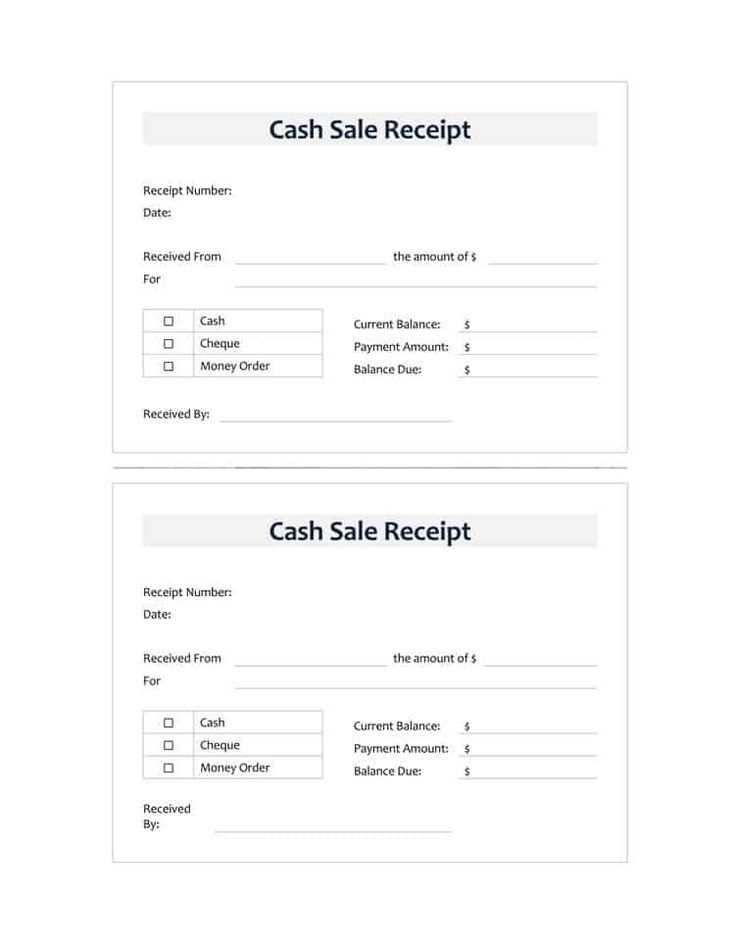

- Cash Receipt for Partial Payment Template

Use a clear and concise cash receipt template to confirm partial payments for transactions. This template ensures both parties have a record of the amount received and the remaining balance. Start by including the following information:

Key Details to Include

- Date of Payment: Record the exact date when the partial payment is made.

- Amount Received: Clearly specify the amount paid at the time of the transaction.

- Remaining Balance: Indicate the outstanding balance due after the partial payment.

- Payment Method: Specify how the payment was made (e.g., cash, check, card).

- Customer Information: Include the name and contact details of the customer making the payment.

- Receipt Number: Assign a unique receipt number to help identify the transaction for future reference.

Additional Tips

Make sure the template is easy to read. Use a straightforward format, listing each component clearly. You may also consider including a space for both the buyer and seller to sign, acknowledging the partial payment. This step adds extra security and confirms that both parties agree to the terms outlined.

To create a receipt for partial payments, ensure that the document reflects all relevant transaction details. Begin by stating the total amount owed, followed by the amount paid in the partial payment. This provides clarity for both the payer and the recipient, ensuring the record is accurate for future reference.

Key Information to Include

Each receipt should include the following elements:

- Full name of the payer and recipient

- Date of payment

- Total amount due

- Amount paid in partial payment

- Remaining balance

- Description of the item or service paid for

Example Receipt Template

| Field | Details |

|---|---|

| Payer’s Name | [Payer Name] |

| Recipient’s Name | [Recipient Name] |

| Date of Payment | [Date] |

| Total Amount Due | [Amount Due] |

| Amount Paid | [Partial Payment] |

| Remaining Balance | [Remaining Balance] |

| Description | [Description of Goods/Services] |

Finish the receipt with a note indicating the method of payment, such as cash, check, or card, for full transparency. Be sure to keep a copy for both the payer and recipient to track the payment history accurately.

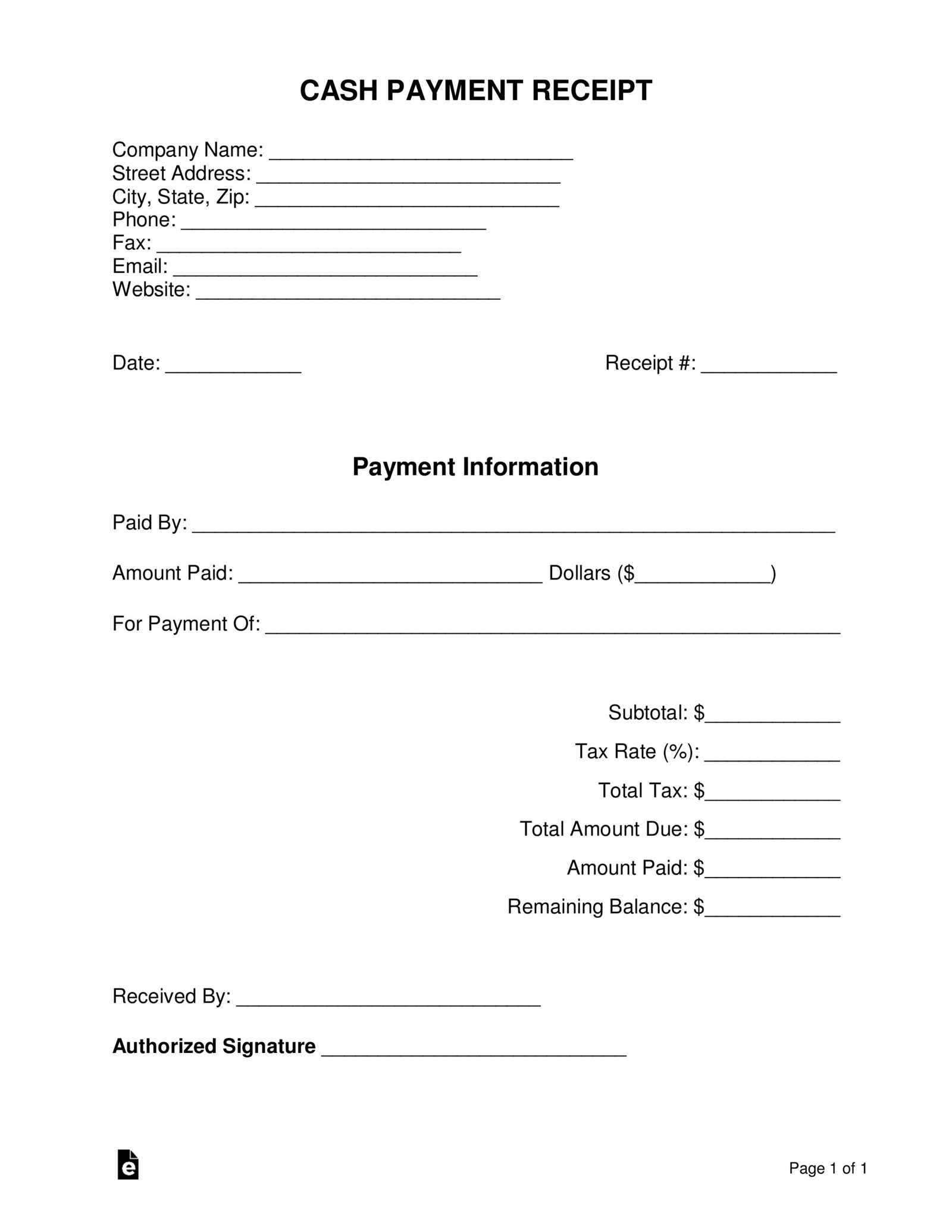

Each payment receipt should clearly display the transaction details. Include the full name or business name of both the payer and the payee. The date of the transaction is necessary for reference, as well as the payment amount. Ensure that the payment method (e.g., cash, credit card, or bank transfer) is stated, along with any transaction or reference number associated with the payment.

Payment Details

Specify the amount paid, including the currency type. If the payment was partial, mention the total amount due and indicate how much has been paid so far. If applicable, state the remaining balance or any terms related to future payments.

Additional Information

If the payment is for a specific product or service, include a brief description of the item or service and its corresponding cost. Providing this context helps clarify the purpose of the transaction. Also, add a section for any discounts or taxes applied, ensuring transparency in the total amount.

Ensure the receipt includes accurate payment details. Double-check that the amount received, date, and payment method are clearly stated. Errors here can cause confusion for both the payer and the recipient.

Don’t forget to include a unique receipt number. This helps track and reference payments, especially when handling multiple transactions. Missing receipt numbers can complicate future queries or disputes.

Avoid ambiguous language in the receipt description. Be clear about the purpose of the payment–whether it’s a deposit, final payment, or partial payment. Lack of clarity can lead to misunderstandings about the payment’s intent.

Failing to provide the payer’s information or details can create issues for both parties. Always include the name and contact information of the person making the payment, as well as the recipient’s details.

Do not neglect to sign the receipt. A signature provides legitimacy and shows that the transaction has been officially acknowledged. It’s a simple yet crucial step to avoid doubts about the payment’s authenticity.

Ensure that your cash receipt for partial payment includes the following key details:

- Date: Specify the exact date of payment to maintain clarity.

- Amount Paid: Clearly state the partial payment amount received.

- Outstanding Balance: Indicate the remaining balance after the partial payment.

- Payment Method: Note the method used for the partial payment (e.g., cash, credit card, bank transfer).

- Invoice Number: Include the reference number for the transaction or the related invoice.

- Signature: Obtain a signature from the person making the payment to verify the transaction.

Using this template will help keep your financial records organized and easily traceable.