To create a reliable monthly payment receipt, use a clear structure that includes specific details. Start by stating the amount paid, the payment method, and the date the transaction was completed. Include the payer’s and receiver’s information to avoid any confusion later on.

Clearly list the payment breakdown if applicable. This ensures transparency, especially for recurring charges or variable amounts. For example, include details such as subscription fees, discounts, taxes, or any other adjustments that were applied.

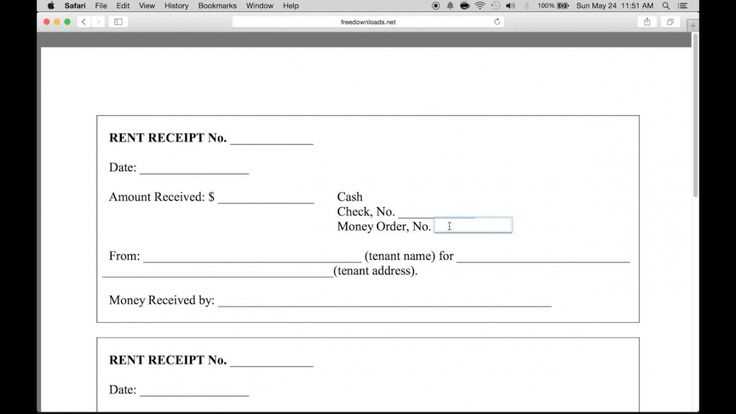

For easy tracking and reference, add a unique receipt number. This will help both parties identify and retrieve the receipt quickly. Make sure that the format of the receipt is consistent and easy to read for future use or audits.

Here’s the corrected version:

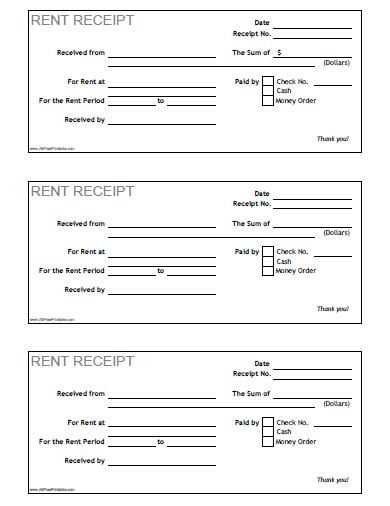

Make sure to clearly label each section of the payment receipt, including the amount, date, and recipient. Use a consistent format for numbers and dates to avoid confusion. Include both the amount in words and numbers, especially for larger sums. Place the recipient’s name and contact details at the top to ensure clarity. Always include a reference or invoice number to track payments easily.

Payment Amount: Write the total amount clearly, breaking it down if necessary (e.g., taxes, discounts). Always check for accuracy in the total.

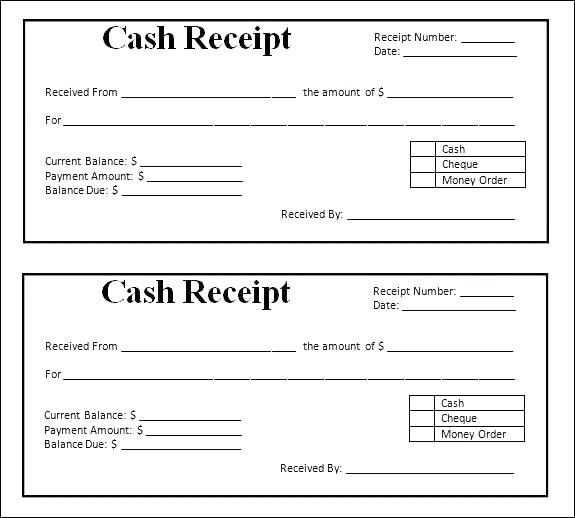

Payment Method: Specify whether the payment was made by credit card, bank transfer, check, or another method. This provides an easy reference in case of discrepancies.

Date of Payment: Clearly mark the date when the payment was made. This is especially important for recurring payments or subscription services.

Receipt Number: Assign each receipt a unique number for better tracking. This can help in keeping financial records organized.

- Monthly Payment Receipt Template

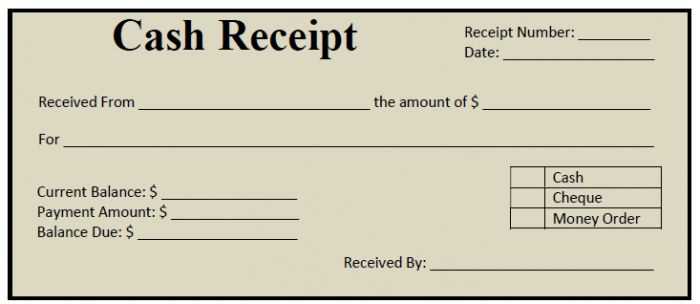

Design a clean and clear template for monthly payment receipts. Ensure it includes these key sections: the payer’s and payee’s details, the payment amount, the date of payment, the payment method, and any references or invoice numbers.

Required Fields

Begin with the payer’s name and contact information at the top. Include the payee’s name and address directly below. In the main body of the receipt, list the payment amount in both numbers and words. Ensure that the date is clearly marked along with the payment method, whether it’s cash, bank transfer, or another form. Add space for a reference number or invoice ID if applicable.

Design Recommendations

Keep the design simple, using clear fonts for easy reading. Use tables or bullet points for listing details, making the receipt look organized and professional. Add a signature line for confirmation at the bottom and make sure there’s a section for additional notes if needed.

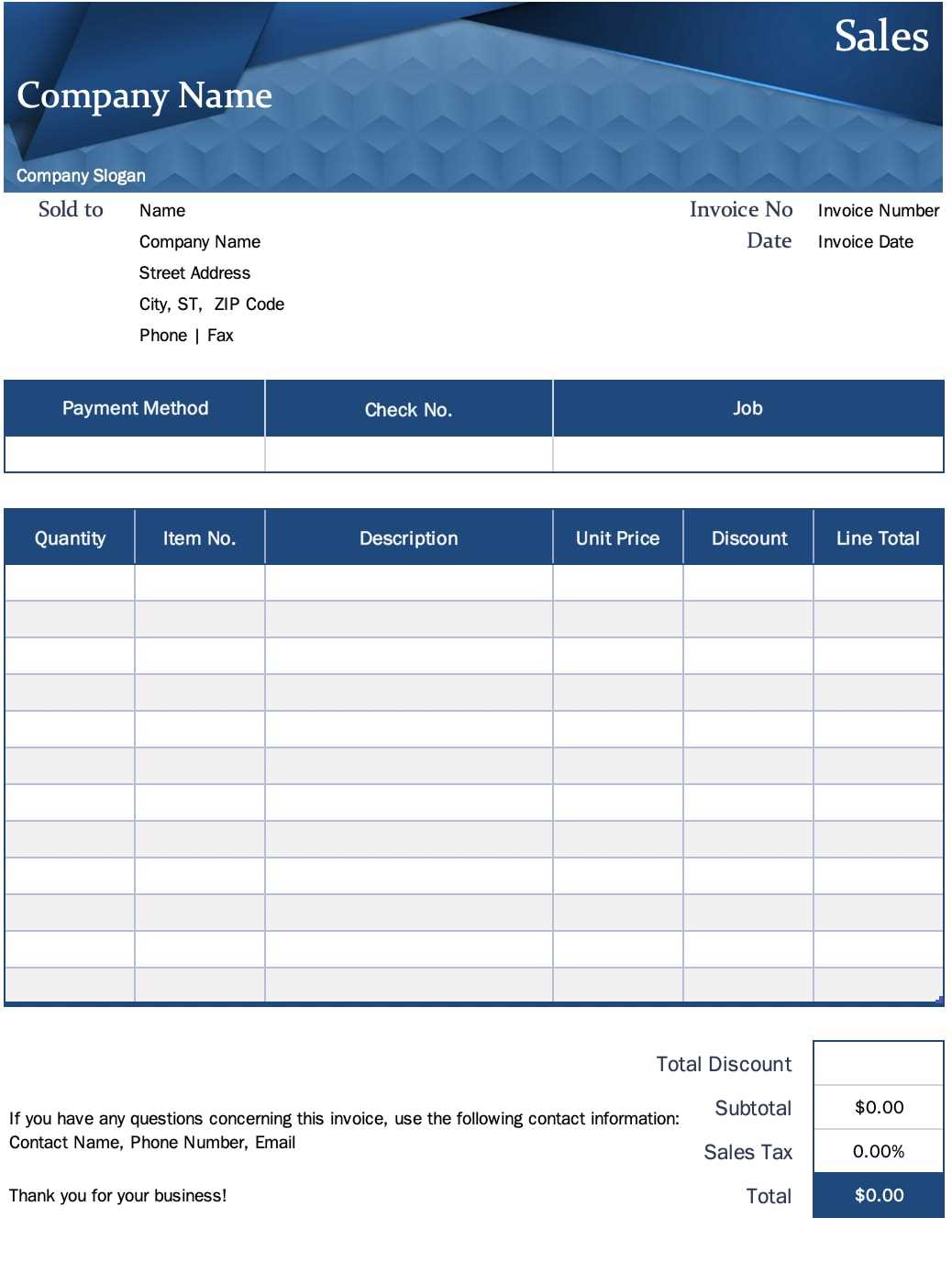

Focus on clarity and simplicity when designing a receipt template. Ensure that all necessary details are easy to locate at a glance. Start with a clean header that includes the business name, logo, and contact information. This will establish a professional identity for the receipt.

Next, include a space for the receipt number and date. This helps both you and your customers track transactions effectively. Make sure to use a bold font or slightly larger size for these key details to stand out.

Follow with a section for transaction specifics: items purchased or services rendered, their quantities, unit prices, and total amount. Align these details clearly, possibly in a table format, so they are easy to read and follow. Consider using alternating row colors to separate each item for a more organized look.

Don’t forget to include payment details–whether the transaction was made via cash, card, or other means. Adding a note for the method of payment can help both parties confirm the transaction type quickly.

Finally, wrap up with a thank-you message or a return/exchange policy, if relevant. Keep the tone friendly and polite, and provide any necessary instructions for customer follow-up, like contact information for support or next steps in case of issues.

To tailor your payment receipt template for different payment methods, focus on the details that are unique to each option. For cash payments, add a section for the amount received in cash and the change given. For card payments, include the card type (e.g., Visa, MasterCard), authorization code, and the last four digits of the card number. For bank transfers, provide the bank name, transaction reference, and transfer date.

Ensure the receipt shows the payment method clearly at the top or bottom of the document for easy identification. If payments are split between methods, create separate sections for each method, showing the subtotal for each one. This will help both the payer and the receiver track the transaction accurately.

For mobile wallet payments, include details like the wallet name (e.g., PayPal, Apple Pay), transaction ID, and the time of payment. Customizing each payment method section with the right fields allows for clear, accurate records and minimizes confusion for both parties.

Receipts serve as a direct proof of transactions and play a significant role in keeping accurate records for accounting and tax filing. Proper documentation ensures that all income and expenses are tracked for financial transparency and tax compliance.

- Store receipts in an organized manner–group them by month or category to simplify access during tax season.

- Use receipts as evidence of business-related expenses to claim deductions on your taxes. This reduces taxable income and lowers your overall tax liability.

- For audits, receipts are essential to verify claims made on your tax returns. Keep receipts for at least three to seven years, depending on your local tax laws.

- If you are self-employed, receipts are crucial for distinguishing between personal and business expenses, ensuring that only eligible expenses are deducted.

Without organized receipt management, errors in reporting income or expenses could lead to penalties or missed opportunities for tax deductions. Maintain an efficient system to prevent complications during tax season.

To create a structured monthly payment receipt, consider organizing the key details into clearly defined sections. This ensures transparency and makes it easier for both the payer and recipient to understand the transaction. Start by including basic payment information such as the payer’s name, the amount paid, and the due date.

Payment Breakdown

List the payment components clearly. If the payment covers multiple items or services, specify each item along with its individual cost. This provides a detailed record for future reference.

| Item/Service | Cost |

|---|---|

| Item 1 | $50 |

| Service 1 | $30 |

Payment Confirmation

Clearly state the payment method used, such as credit card, bank transfer, or check. If relevant, include transaction IDs or reference numbers. This serves as confirmation that the payment has been processed successfully.