Start using a free cash receipts journal template to streamline your accounting process. This template helps you track incoming cash transactions efficiently, ensuring that every entry is accurate and organized. You can easily customize it to fit your business needs, reducing the risk of errors and saving time.

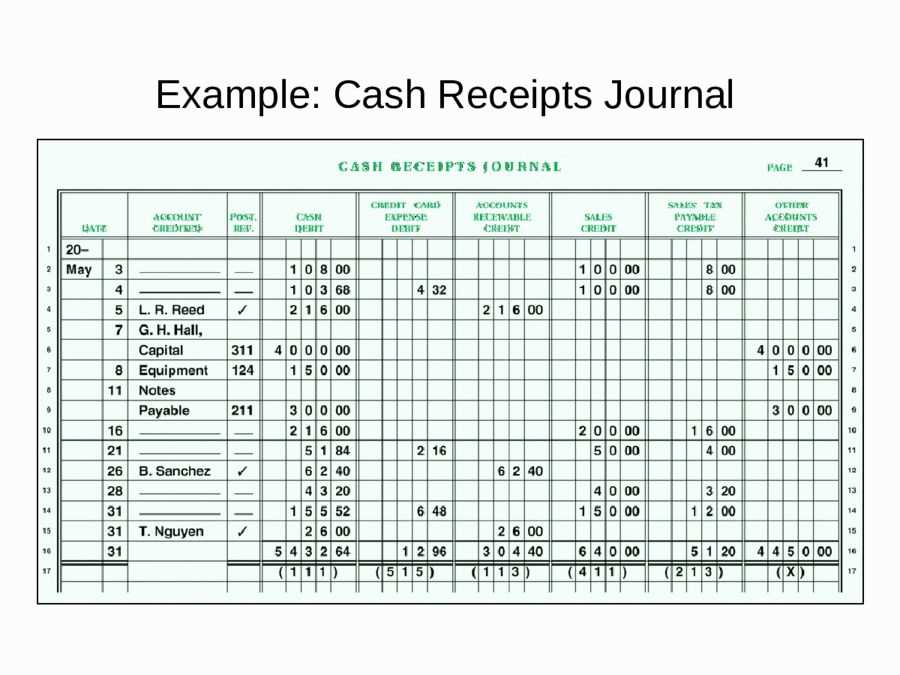

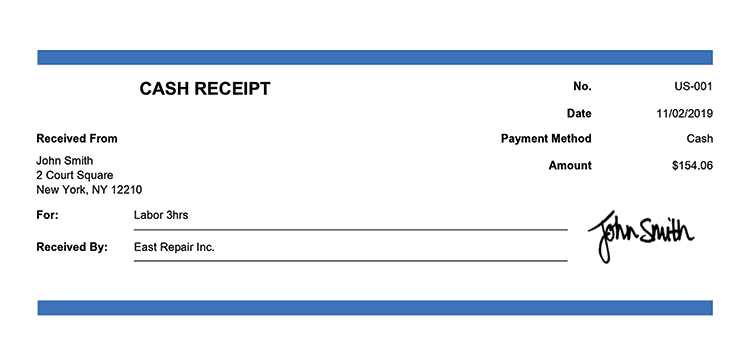

By incorporating a cash receipts journal, you can quickly document all cash payments received, from customers or other sources. The layout typically includes columns for the date, transaction description, amount received, and payment method. Having a clear record of all transactions allows for better financial tracking and reporting.

Use this template to maintain consistent records of cash flow, making it easier to reconcile bank statements and prepare financial reports. With a well-organized journal, you can avoid missing important details and stay on top of your finances without unnecessary complexity.

Here is the revised version with minimal repetition:

To set up a cash receipts journal template efficiently, focus on organizing key elements to ensure clarity and ease of tracking financial transactions. Begin with these key components:

- Date: Record the exact date for each transaction.

- Source: Identify the origin of the payment, such as customer or source type.

- Amount: List the total payment received.

- Payment Method: Specify whether the payment was made via cash, check, or electronic transfer.

- Description: Include a brief note on the transaction, such as invoice number or reason for payment.

- Account: Assign the received funds to the appropriate account or category.

This structure enables quick updates and easy reconciliation. Regularly review and adjust the template to accommodate any changes in business operations. To maintain accuracy, ensure each entry is clear and consistently formatted, with no unnecessary details. Consider using spreadsheet software for easy customization and automatic calculations.

- Cash Receipts Journal Template Free

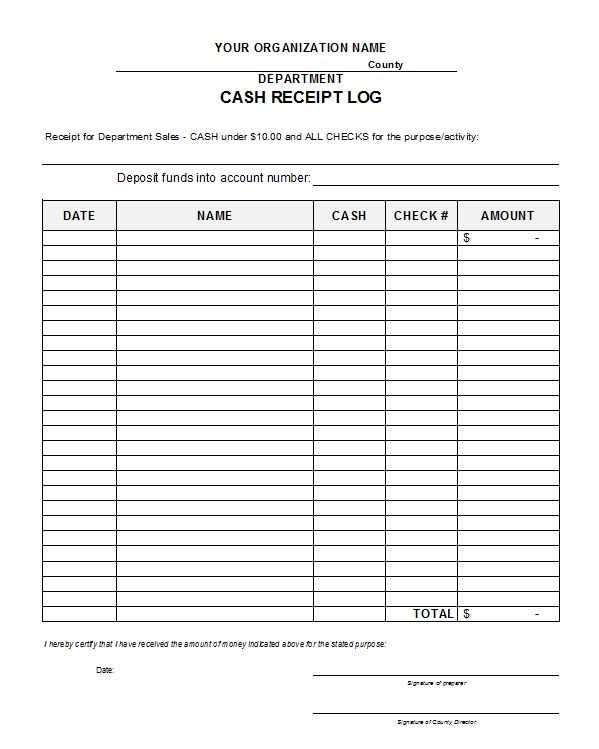

When setting up a cash receipts journal, it’s key to keep records clear and organized. A simple, free template can help you streamline this process and track your cash inflows accurately. Most templates are divided into specific columns such as the date, source of funds, account impacted, and amount received. This format helps maintain transparency in your financial records and saves time during reconciliation.

Look for a template that includes a section for notes or descriptions. This can be helpful to quickly reference transactions without needing to open additional files. Ensure that it also aligns with your business or personal finance tracking needs by adding categories or sections as required.

Many online platforms offer free templates in various formats, including Excel and Google Sheets. These are easily customizable, allowing you to adapt them to your specific requirements. Some even provide built-in calculations for balances and totals, reducing manual error and providing instant insights into your finances.

Consider a version with a summary or report section for quick overviews of total receipts in a given period. This feature saves time when you need to analyze cash flow or prepare reports. Use the template consistently to ensure you capture all transactions without missing any details, keeping your records up-to-date and organized.

Modify the default columns of the template to align with your business processes. Adjust the titles and formats for each column, including customer details, payment types, and transaction descriptions, ensuring they reflect the exact data you need to track.

Adjust Column Titles and Order

Switch generic column headers to ones that match your business operations. For example, replace “Account” with “Client Name” and “Payment Method” with “Transaction Type”. This helps in easily identifying relevant transaction details at a glance.

Example Customized Journal Template

| Date | Invoice Number | Client Name | Product/Service | Amount | Transaction Type | Status |

|---|---|---|---|---|---|---|

| 02/13/2025 | INV-001 | John Doe | Consulting | $300 | Credit Card | Completed |

| 02/14/2025 | INV-002 | Jane Smith | Design Services | $400 | Bank Transfer | Pending |

Review and modify the template as your business grows. Add or remove columns to match any new requirements or processes. This adaptability makes it easy to keep track of your receipts and manage financial data efficiently.

Set clear categories for your entries. Customize the template to reflect your business’s specific needs, such as separating cash receipts by type (sales, refunds, or deposits) for better tracking. This step will make it easier to monitor different streams of income and categorize them accurately for future reporting.

Keep Your Entries Consistent

Stick to a consistent format when entering data. This reduces errors and simplifies future data reconciliation. For example, always use the same date format and double-check your figures before entering them. This ensures clarity when reviewing your records later on.

Leverage the Template’s Built-In Features

Most free journal templates come with pre-set columns for important data such as date, description, and amount. Make sure to take full advantage of these built-in features. If your template includes a running total column, use it to track the cash flow automatically, minimizing manual calculations.

Regularly back up your journal. Even though it’s a template, storing it digitally makes it easier to retrieve when needed. Ensure that you back up your records at regular intervals to avoid data loss. Consider storing your journal in cloud storage for easy access and sharing with your accountant.

A free cash receipts journal template should have the ability to track important details, such as date, amount, payer, and payment method. These fields should be simple to fill in and clearly labeled for easy reference.

Clear Categorization

The template should allow for easy categorization of receipts, whether by transaction type or by income source. Having separate columns for each category will make it easier to review and analyze records.

Automatic Totals Calculation

Ensure the template has a feature that automatically calculates totals. This reduces the chance of human error and saves time when reviewing the journal for reporting purposes.

The template should be easily customizable. Whether you need to add more fields or adjust the layout, flexibility is important for accommodating different transaction needs.

To create an effective cash receipts journal template, focus on organizing all incoming cash transactions clearly. Start with columns for the date, receipt number, payer’s name, description, amount received, and payment method. This setup will help you keep track of cash flow and simplify financial record-keeping.

Columns to Include

Date: Record the date of the transaction for accurate tracking.

Receipt Number: Assign a unique number for each transaction to maintain order.

Payer’s Name: Write down the name of the person or organization making the payment.

Description: Include a brief explanation of the reason for the payment.

Amount Received: Document the exact amount of cash received in numeric form.

Payment Method: Note the method (cash, check, or bank transfer) used for the transaction.

Template Usage Tips

Always double-check the amounts recorded in the receipts journal. When handling multiple transactions, keep the template consistent to avoid errors. Regular updates help maintain clear, accurate financial records for audits or reporting purposes.