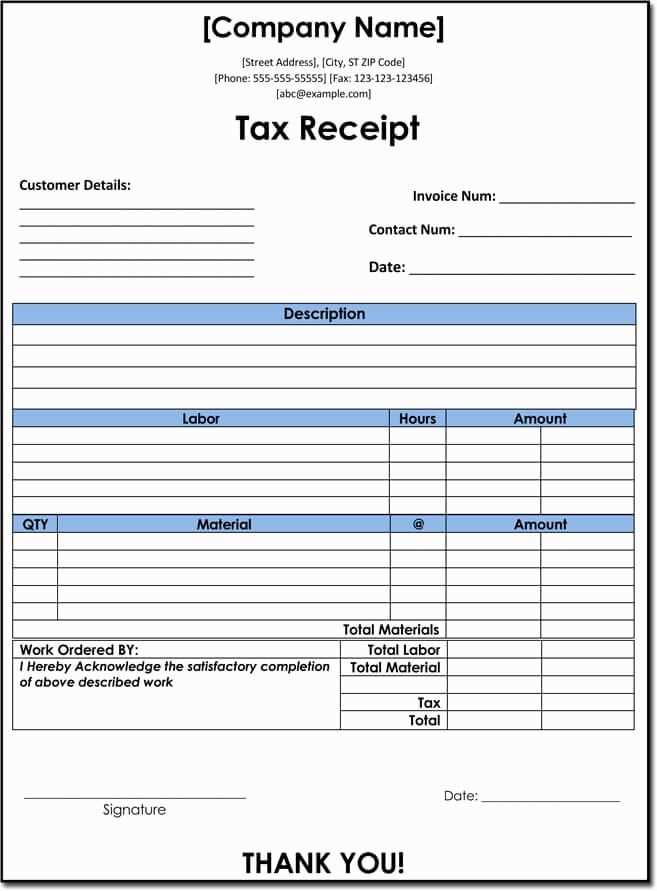

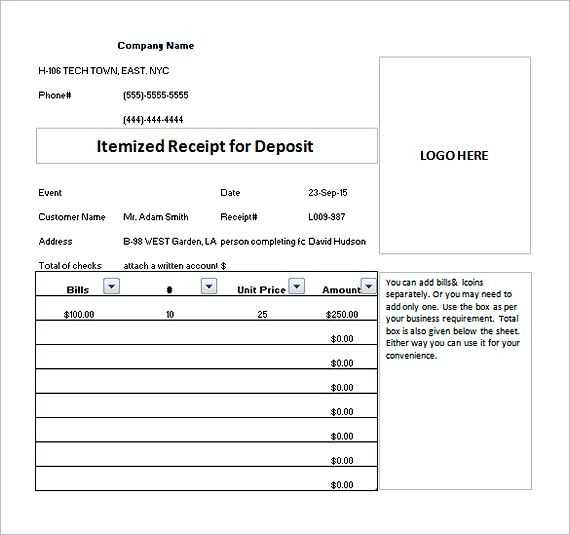

A well-structured restaurant itemized receipt template simplifies the transaction process for both customers and business owners. Clearly listing each item ordered, its price, and any applicable taxes or tips ensures transparency and avoids confusion. Customers can easily review their purchase, while restaurant managers can track sales and manage their finances with accuracy.

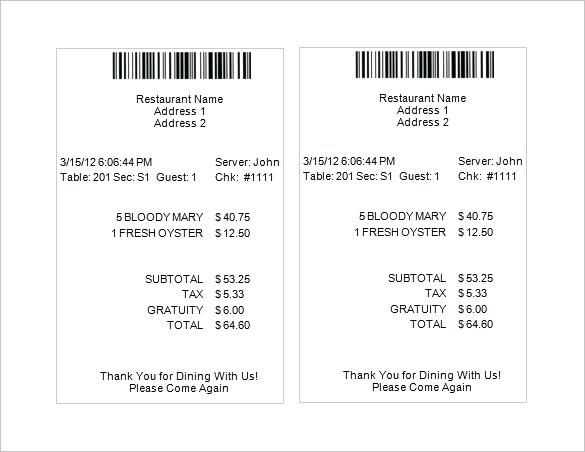

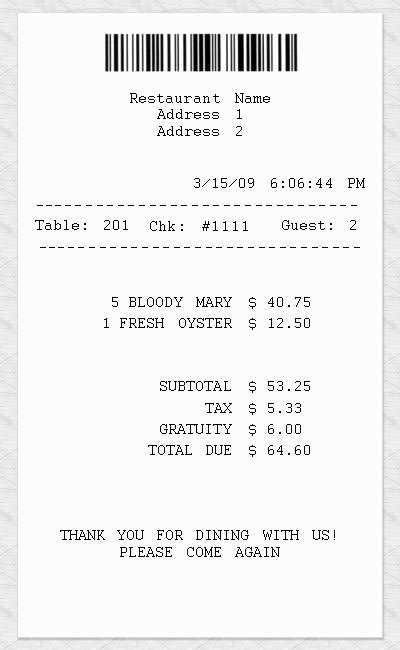

Each receipt should include item descriptions, quantity, unit price, and a total for each order. A breakdown of taxes and tips should also be visible, along with the final total amount paid. This format helps customers understand the pricing structure and gives them an itemized view of their spending.

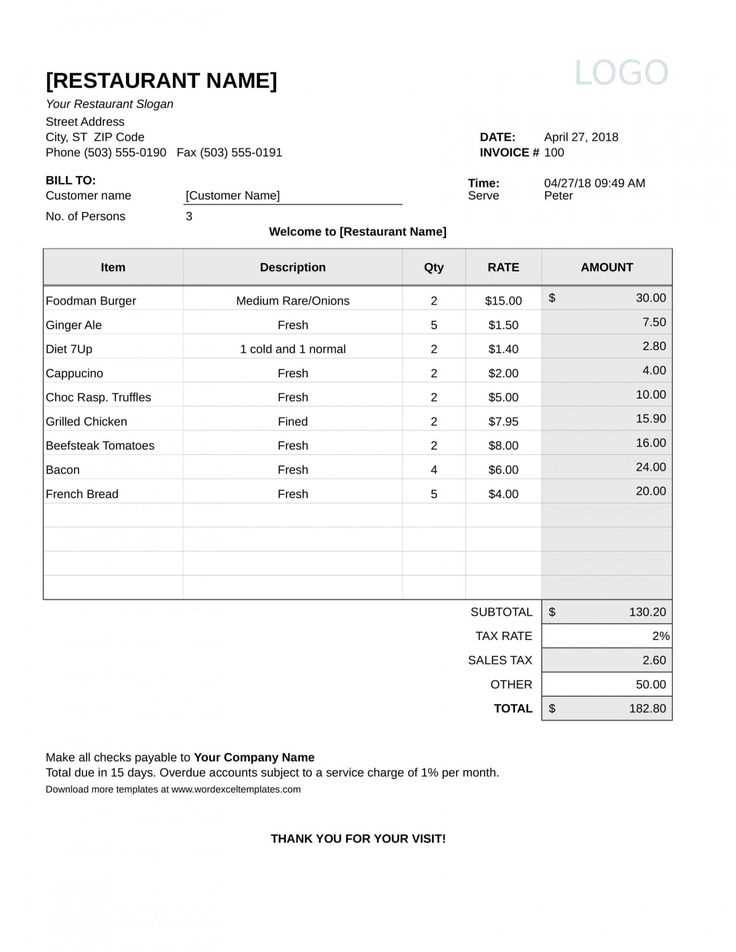

Additionally, incorporating the restaurant’s name, address, and contact information at the top enhances professionalism. Including payment methods and a section for customer feedback can further improve customer relations and provide valuable insights for business growth.

Here’s a detailed plan for an informational article on “Restaurant Itemized Receipt Template,” formatted in HTML. Each heading focuses on a specific aspect of the topic

To create a well-structured and user-friendly restaurant itemized receipt template, focus on breaking down each section clearly. Each item on the receipt should be listed with its price, and include any applicable taxes or tips. A template should allow flexibility for customization while maintaining clarity. The following outlines how to effectively organize the structure.

Header Section: Restaurant Details

Include the restaurant’s name, logo, and contact information at the top. This helps customers identify the receipt and easily reach out if needed. Providing the restaurant’s address and phone number makes it easy for customers to follow up on any questions related to their bill.

Itemization of Charges

The most crucial part of the receipt is itemizing all purchased items, with their individual prices. Each food or beverage item should be listed separately, including any modifiers or special requests made by the customer. For example, if an item was served with a substitution, it should be reflected in the pricing. A clear breakdown avoids confusion.

After listing the items, include the subtotal, taxes, and any service charges. Clearly label each to make sure the customer can easily follow the calculation of the final total. Offering a total before and after any tips can be helpful, especially for transparency in tipping policies.

Footer Section: Payment Details

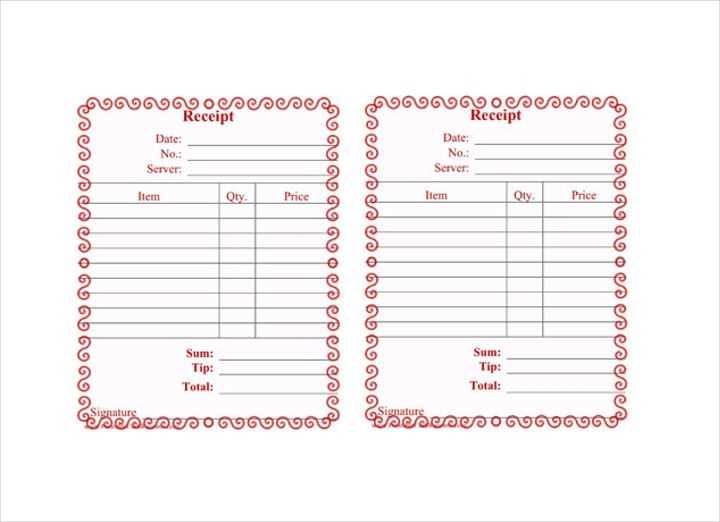

At the bottom of the receipt, provide a section for payment information. This includes the payment method (e.g., credit card, cash), the transaction ID, and any discounts applied. Also, offer a space to thank the customer for their visit to promote goodwill.

Consider adding a line for gratuity, especially in establishments where tips are expected but not automatically included. This will make the receipt comprehensive while maintaining transparency in how payments are processed.

How to Create a Clear Itemized Receipt

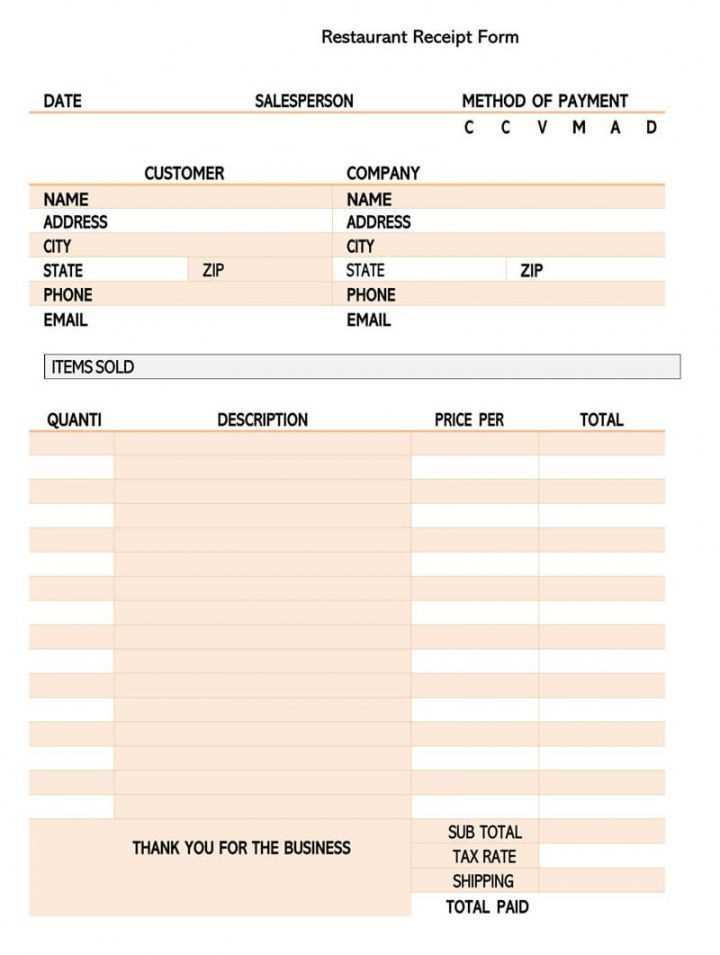

Begin by organizing the receipt into sections that customers can easily understand. Start with the restaurant name and contact information at the top. Include the date and time of the transaction, and if applicable, a unique receipt or order number for reference.

Next, list each item separately with its corresponding price. For accuracy, include details about modifications or special requests, such as extra toppings or ingredient changes. Keep the descriptions concise and clear. If items are grouped together (e.g., appetizers or drinks), ensure the total price for that group is shown distinctly.

After listing the items, calculate the subtotal and add tax. Be transparent about any service charges or additional fees, if applicable. Ensure the tax rate is clearly stated so customers know exactly what they are paying for. The final amount due should be clearly marked, with a breakdown showing subtotal, tax, service charge, and any discounts applied.

Finally, at the bottom of the receipt, include payment information, such as the method of payment (e.g., card or cash), and any tips left by the customer. Make sure to include a thank-you note or message of appreciation to leave a positive impression.

Customizing the Template for Your Restaurant’s Needs

Adjust the template’s layout to fit your restaurant’s branding and service style. Add your logo in a prominent position at the top of the receipt to make it easily recognizable. This small step will help reinforce your brand identity with every transaction.

Organize the Menu Items Clearly

Group menu items based on categories like appetizers, main courses, and desserts. Use bold text or a different font to highlight the section headers. This not only improves readability but also enhances the customer’s experience, especially when they need to review their order quickly.

Include Specific Payment Information

Ensure your receipt template includes detailed payment options, including cash, credit card, and any online payment methods. Clearly list the taxes and tips to prevent confusion. This transparency is key for customer satisfaction and can avoid potential misunderstandings later.

Customize the footer with personalized messages like “Thank you for visiting” or a loyalty program reminder. Keep it short and friendly–small touches like this go a long way in customer retention.

Legal Considerations for Restaurant Receipts

Ensure all receipts clearly itemize purchases and include required information to comply with local tax laws. It’s important to provide details such as the business name, address, and tax identification number.

- Clear Breakdown of Charges: List each item purchased, including any taxes or service charges. This transparency helps avoid misunderstandings and ensures customers can easily verify what they are paying for.

- Receipt Format Compliance: Some jurisdictions mandate specific formats for receipts, including a breakdown of the tax rate applied or a detailed description of the items purchased.

- Retention Period: Keep records of all issued receipts for a designated period as required by tax authorities. This ensures businesses can provide documentation if needed for audits or disputes.

- Tip Disclosure: If tips are included on the receipt, they must be clearly marked and distinguishable from other charges. Inform customers about the tipping policy to avoid confusion.

Failure to comply with these regulations can lead to penalties or issues with audits. Restaurants should stay informed about local legal requirements and adjust receipt practices as necessary to stay compliant.