Need a quick and easy way to keep track of payments? Download free cash receipt templates that are ready for use and customizable to fit your needs. Whether you’re managing personal transactions or running a small business, these templates provide a simple solution for documenting cash payments.

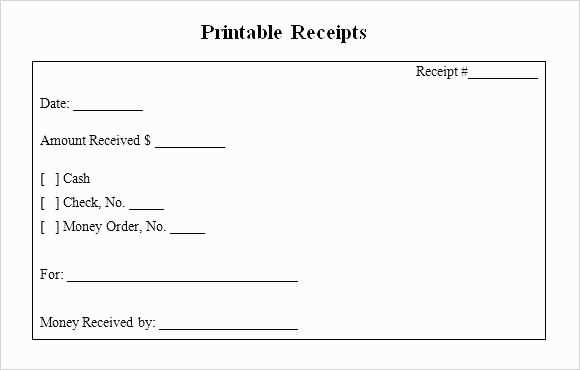

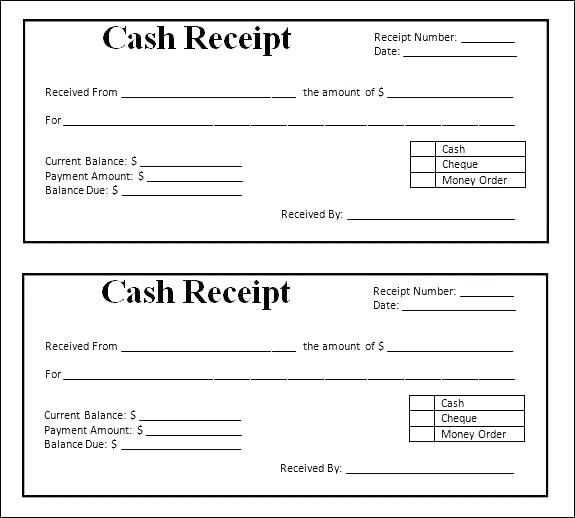

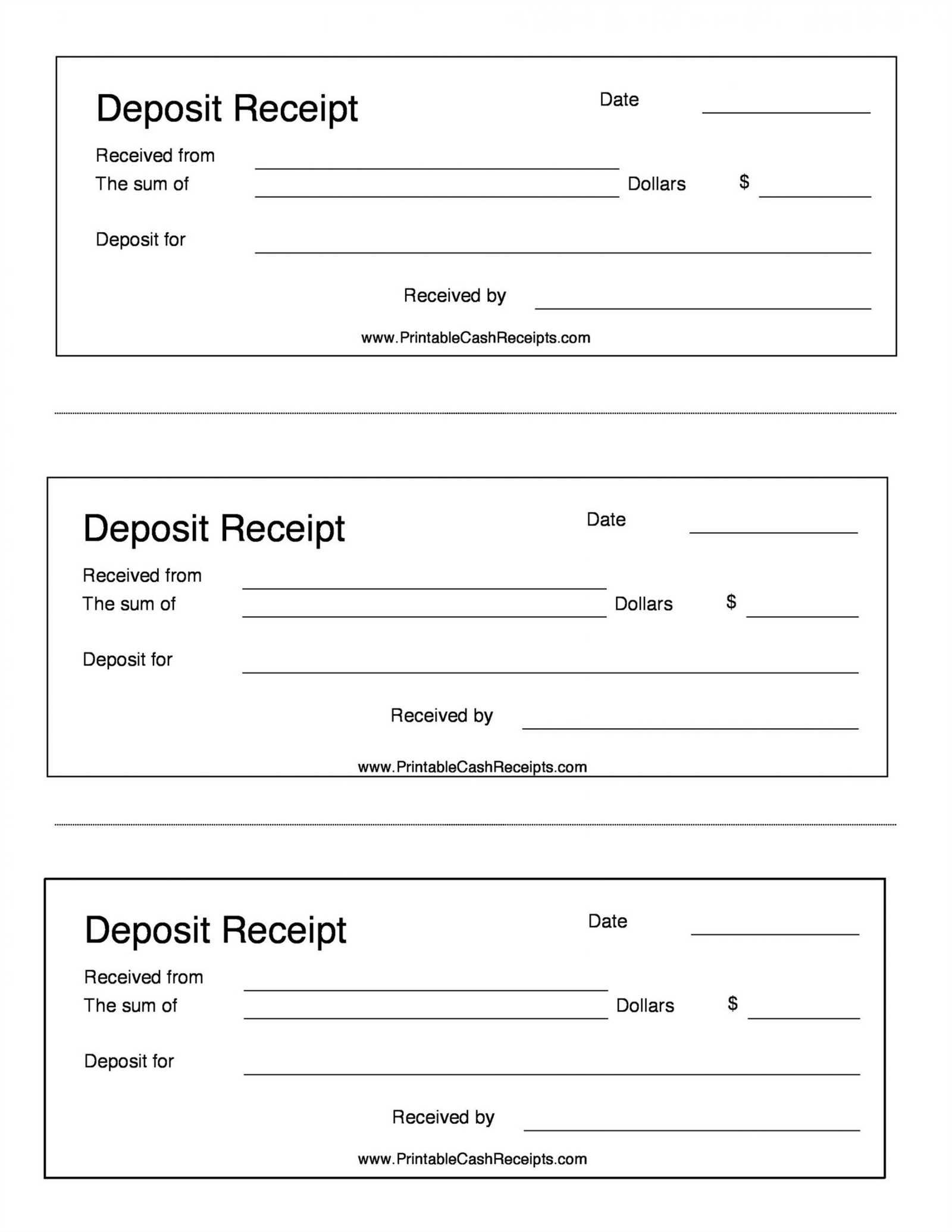

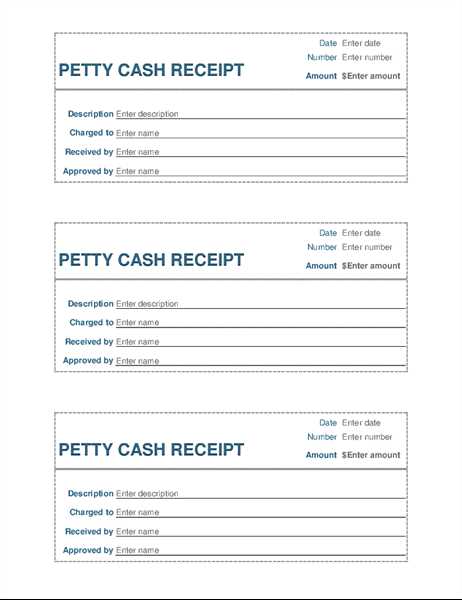

Choose from a variety of designs that suit different purposes–ranging from basic templates to more detailed versions with spaces for item descriptions, amounts, and signatures. These templates are formatted for easy printing, saving you time and hassle. Fill them out manually or use them digitally to streamline your processes.

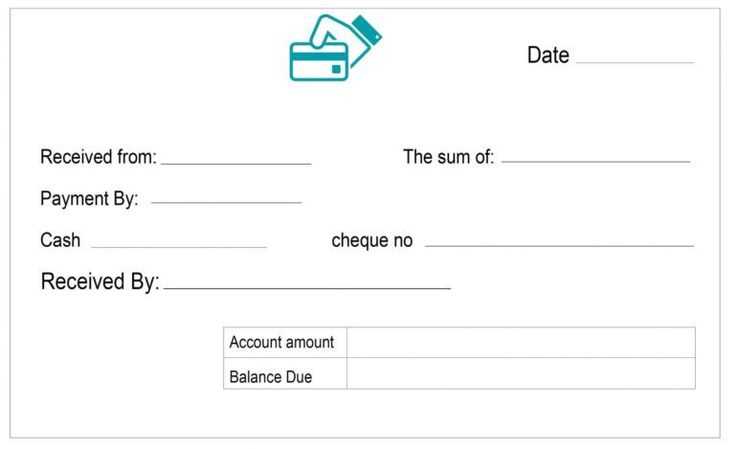

Each template includes essential fields like date, amount, payer information, and payment method, ensuring you have all the details for record-keeping. Customize them with your business name, logo, or specific notes to personalize the receipts. By using these free templates, you can maintain accurate financial records without any added costs.

Here are the corrected lines:

First, make sure your template includes a clear and concise header, such as “Cash Receipt” or “Payment Receipt.” This allows both parties to easily identify the document’s purpose. The receipt should display the date of the transaction, the amount paid, and the payment method (e.g., cash, check, credit card). Make sure to include the name of the payer and the recipient for clarity.

Ensure the template includes an area for an optional note or description, especially if the payment is for a specific service or product. This adds more context to the transaction. Always place space for both parties to sign at the bottom to verify the transaction. It’s also a good idea to add a unique receipt number for record-keeping and future reference.

Lastly, adjust the layout to be easy to read, using standard fonts and adequate spacing. Avoid clutter, as a clean design helps in quick understanding and better organization.

- Free Printable Cash Receipt Templates

If you’re looking for an easy way to manage your cash transactions, a printable receipt template can save you time and effort. These templates allow you to quickly create receipts, ensuring that both the buyer and seller have a clear record of the payment.

Where to Find Free Templates

- Many websites offer free printable cash receipt templates that you can customize. Popular platforms include:

- Look for formats in Word, PDF, or Excel to make editing easier.

Key Features to Look For

- Editable fields for date, amount, payer details, and purpose of payment.

- Clear and concise layout with sections for both the payer and payee information.

- Customizable design to match your branding or personal style.

With these templates, you can generate receipts instantly, ensuring your financial records stay organized. Whether you’re handling small transactions or larger sales, a receipt is a simple way to provide proof of payment and maintain transparency.

Find a cash receipt template from a reliable website offering free downloads. Most sites provide a variety of formats, including Word, Excel, and PDF. Select the one that best fits your needs, depending on whether you prefer to fill it out digitally or print it for manual completion.

Once downloaded, open the file in the appropriate software. For Word or Excel templates, you’ll be able to modify text fields easily. Add or remove details like the recipient’s name, amount, date, and purpose of the transaction. Customize fonts, colors, and layout to match your preferences or business branding.

If the template is in PDF format, use a PDF editor to add or change the necessary fields. Many free online PDF editors offer simple tools to modify text boxes and checkboxes. Some may even allow you to save the modified document for future use.

Ensure the receipt includes all necessary details, such as a unique receipt number, the method of payment, and a signature line if required. Double-check the template for any blank fields that might need to be filled in manually later. Save the final version and keep it on hand for future use.

After customization, save the template in a format that’s easy to access and reuse. For businesses, it’s a good idea to keep several templates handy, with minor adjustments for different transaction types. This way, you’ll always have a prepared document ready for any cash exchange.

The choice between PDF and Word for printing cash receipts depends on the specific needs of your business. Both formats offer distinct advantages, but the decision comes down to ease of use, formatting control, and distribution preferences.

Why PDF is a Better Option

PDF is the most reliable format for cash receipts, especially if you want to maintain consistent formatting across different devices and platforms. Unlike Word, PDFs preserve fonts, images, and layout exactly as intended, regardless of the user’s system or software. PDFs also allow for easy sharing and printing without worrying about changes in alignment or page breaks.

When to Use Word Documents

Word documents offer flexibility if you need to edit receipts frequently or customize them with variable data. It’s a good choice if you want to create receipts with dynamic content like customer names or amounts that may change frequently. However, the layout may not remain consistent when opened on different devices unless the document is converted to PDF before printing.

| Feature | Word | |

|---|---|---|

| Consistency of Layout | High | Can vary depending on system |

| Editing Flexibility | Low | High |

| File Size | Small to Medium | Medium |

| Ease of Sharing | Very Easy | Can be tricky for non-Word users |

| Printing | Reliable | May require adjustments |

If you’re aiming for professional and error-free printing, PDF is the superior choice. However, if customization and frequent updates are needed, Word may be more suitable–just remember to convert to PDF for a more stable final output.

Ensure all fields are filled out correctly. A common mistake is leaving fields incomplete or vague, especially the date, transaction details, and payment method. A receipt with missing information can lead to confusion or disputes later.

1. Forgetting to Customize Templates

Using a generic receipt template without tailoring it to your business can create issues. Add your company name, logo, address, and contact details. Personalizing the template enhances professionalism and helps customers recognize your business.

2. Ignoring Consistency

Consistency in design and formatting across all receipts is vital. Keep font choices, colors, and layout the same throughout. This makes your receipts look polished and reinforces brand identity.

3. Incorrect Tax Calculation

Ensure your tax rates are accurate. Many receipt templates allow you to input tax percentages, but these need to be updated if tax laws change. An error in tax calculation can lead to financial discrepancies and legal issues.

4. Not Including a Unique Identifier

Each receipt should have a unique serial number. Skipping this step can create problems for record-keeping and make it harder to track transactions. Adding a receipt number is a simple way to maintain order and clarity.

5. Using Low-Quality Template Sources

Download templates from reliable sources. Using poorly designed or unreliable templates can lead to technical issues, incorrect formatting, or even security risks. Always choose templates from trusted websites to ensure accuracy and safety.

6. Forgetting to Update Templates Regularly

Over time, your business or tax rates may change. Make sure your receipt template reflects the latest updates. An outdated template can lead to errors or omissions that could cause problems with your bookkeeping.

7. Not Testing Before Use

Test the receipt template by filling it out with mock data. This will help you spot any layout or functionality issues before you start using it for actual transactions.

Each Line Now Avoids Redundant Repetition and Retains Its Meaning

When designing a cash receipt template, precision is key. Every line of text should be clear, concise, and free from unnecessary repetition. Start with a straightforward header indicating the transaction type, followed by the essential details: date, amount, and payment method. Eliminate any redundant phrases or filler words that don’t add value to the receipt.

Clarity in Information

Each section should clearly separate key information. For example, list the itemized products or services and their costs in individual lines. Avoid repeating terms like “item,” “cost,” or “quantity” unless absolutely necessary for clarity. Using simple yet specific terms ensures the document remains professional and easy to read.

Accurate Totals and Confirmation

At the bottom, the total amount should be clearly visible. The line for the payment method should also follow without duplication, providing confirmation of the transaction type (e.g., credit card, cash). This method reduces confusion and ensures the recipient can quickly verify the details without re-reading the document.