Use an Excel expenses receipt template to easily track and manage your receipts. It saves time by organizing your expenses and offers a clear breakdown of every item you purchase. Start with columns for the date, vendor name, and amount spent, and add categories for better tracking. Make sure to include a column for payment method, which helps you keep a complete record for reimbursement or tax purposes.

A good template should allow you to easily filter expenses by category, date, or vendor. This makes it easier to identify where your money is going and identify any potential areas for cost savings. Consider adding formulas to automatically calculate totals and taxes, reducing the risk of errors in your calculations.

Keep your receipt templates simple but thorough. You don’t need to overcomplicate the process–just ensure you can quickly capture the necessary details and retrieve them when needed. This approach will not only save you time but also give you more control over your financial records.

How to Set Up a Basic Template

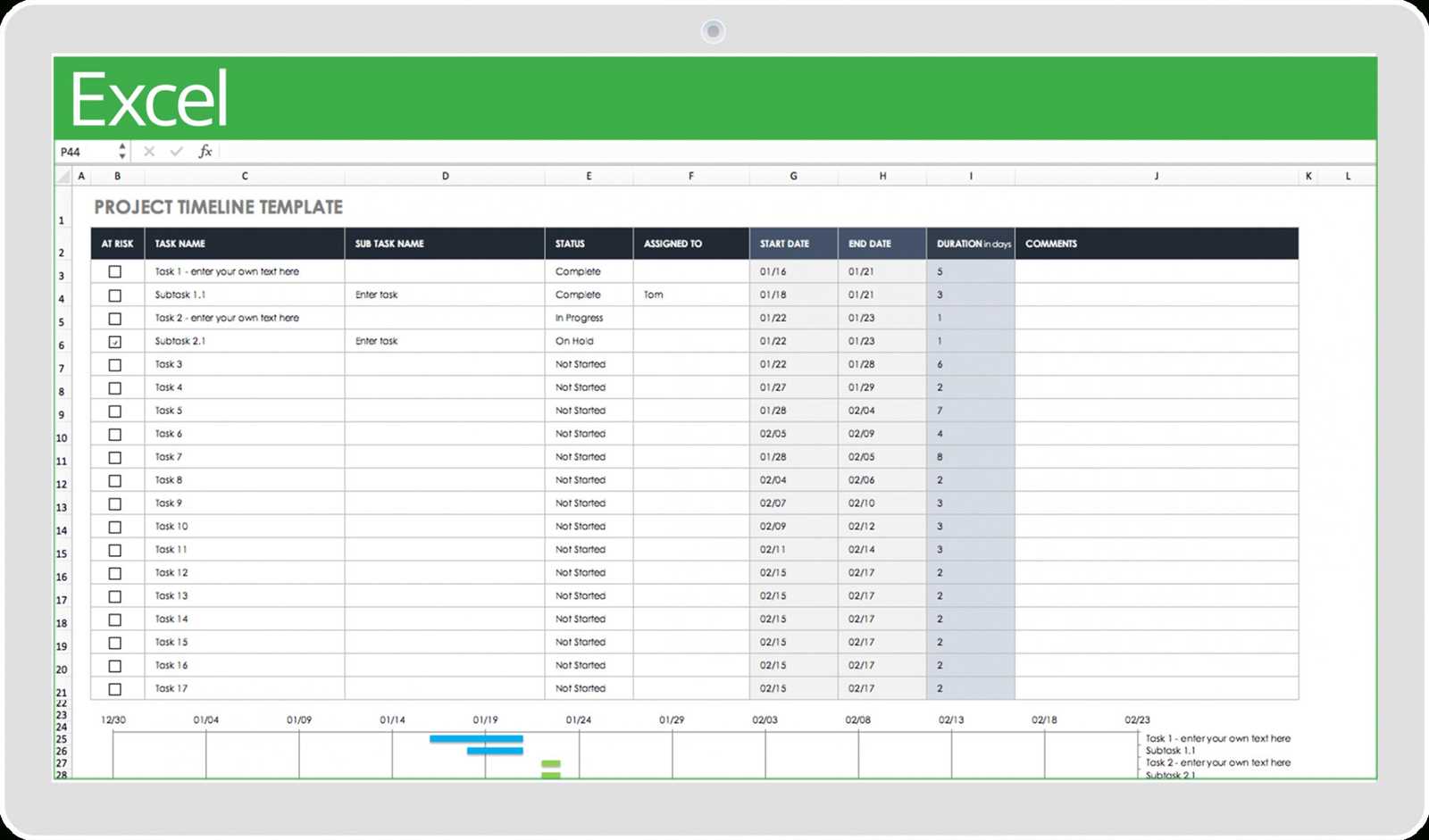

Create a simple Excel expenses receipt template by organizing the key sections: date, description, amount, and category. Use column headers like “Date”, “Item”, “Amount”, and “Category”. Start by formatting the columns to ensure readability–set column widths to match the expected content.

Step 1: Set Up Column Headers

Enter the following headers in the first row: “Date”, “Description”, “Amount”, and “Category”. Bold the headers and center them for clarity. These are the core categories for tracking expenses, making it easy to fill in data and analyze later.

Step 2: Format Data Cells

Format the “Amount” column to display currency. Right-click the column, select “Format Cells”, then choose “Currency” under the Number tab. This ensures that all amounts are consistent and easy to read. You can also use a simple date format for the “Date” column to keep things consistent.

Set data validation rules for the “Category” column, where you can create a drop-down list with common categories like “Travel”, “Meals”, and “Supplies”. This will standardize the entries and reduce input errors.

Finally, create a total row at the bottom of the “Amount” column using the SUM function to automatically calculate the total expenses. This setup will allow you to track and review expenses quickly and accurately.

Customizing for Specific Expense Categories

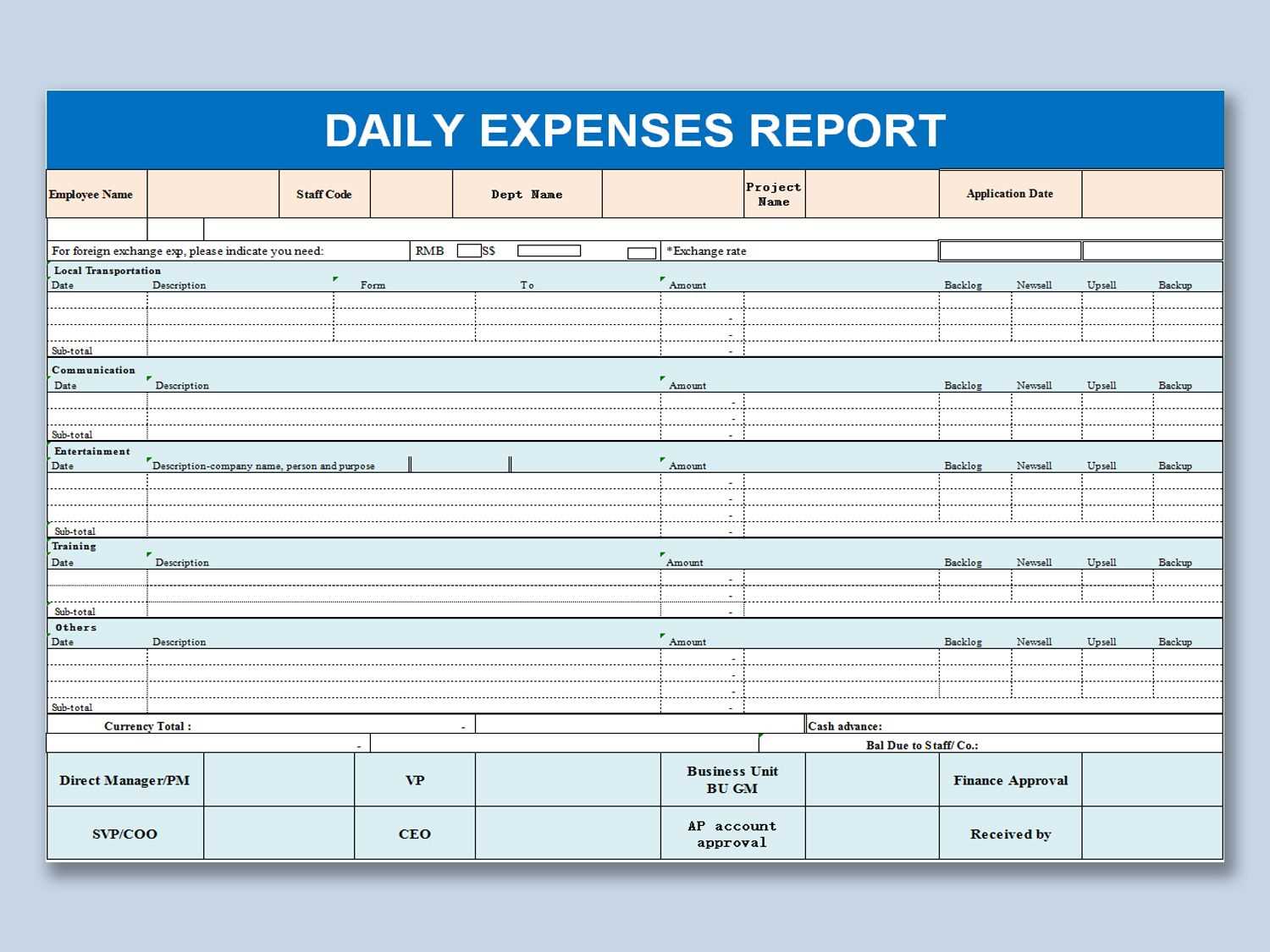

Adjust your Excel expenses receipt template by tailoring it to match the categories of expenses that are most relevant to your needs. Start by creating specific columns for each expense type, such as “Travel,” “Meals,” “Supplies,” or “Entertainment.” This ensures that each transaction is recorded under the correct heading, simplifying analysis and reporting.

Setting Up Category-Specific Columns

For each category, define clear labels and ensure they align with your budget categories. Use drop-down lists to standardize entries, making it easier to enter consistent data. This method helps reduce mistakes and speeds up data entry, particularly for recurring expenses.

Formatting for Quick Identification

Color-code categories to make the spreadsheet visually intuitive. For instance, highlight travel-related expenses in blue and meals in green. This visual distinction improves readability and allows you to spot trends or anomalies quickly. Conditional formatting can also be used to flag outliers or overspending in certain categories.

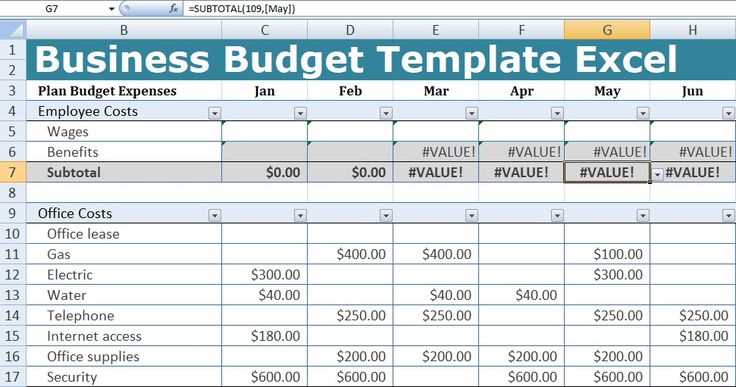

Using Formulas to Calculate Totals and Taxes

To calculate the total cost of your items, use the SUM formula. For example, if your item prices are in cells B2 to B6, enter =SUM(B2:B6) in the cell where you want the total. This will automatically add the prices together without needing to input each one manually.

Calculating Sales Tax

Once you have the total, apply a formula to calculate the tax. If your total is in cell B7 and the tax rate is 8%, use =B7*0.08 to calculate the tax amount. Excel will update this calculation automatically if you change the total.

Final Total with Tax

To find the grand total including tax, simply add the tax to the total. If the tax amount is in cell B8, use the formula =B7+B8 to get the final amount. Adjusting the item prices or tax rate will instantly update the grand total for you.