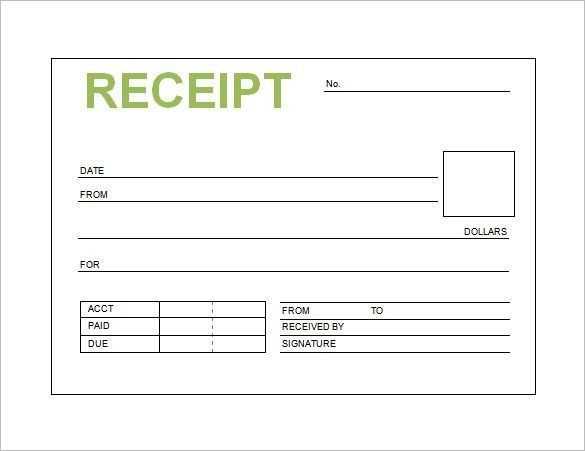

Creating a department store receipt that looks professional and meets legal requirements is straightforward once you know the key elements to include. Start by listing the store’s name, address, and contact information at the top. This ensures customers have easy access to any necessary details after their purchase.

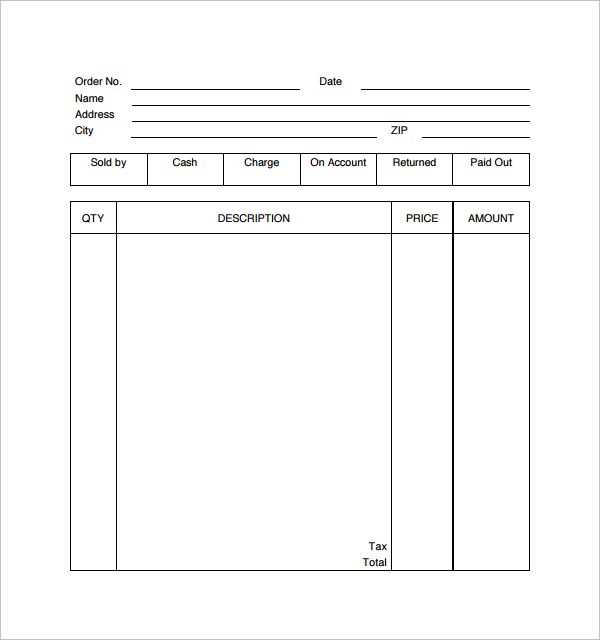

Include the transaction date and time. This helps both the customer and store staff keep track of the purchase. A unique receipt number is also critical for identification, especially in case of returns or exchanges. Itemized listings with descriptions, prices, and quantities allow for clear understanding of what was purchased.

The total amount, including taxes and any discounts, should be clearly stated at the bottom of the receipt. Make sure the payment method is noted, whether it’s cash, card, or any other form of payment. You can also provide a section for customer feedback or future promotions to engage your audience and encourage loyalty.

Here’s a detailed plan for an informational article on the topic “Department Store Receipt Template” with practical, focused subheadings:htmlEditDepartment Store Receipt Template: A Comprehensive Guide

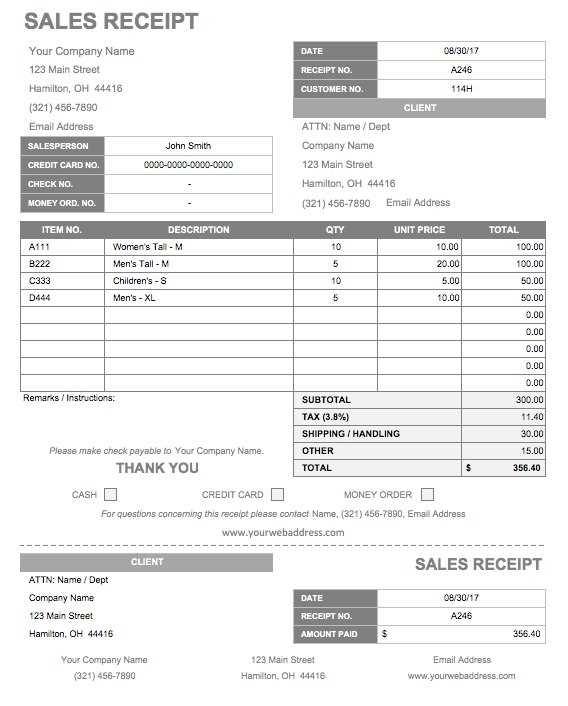

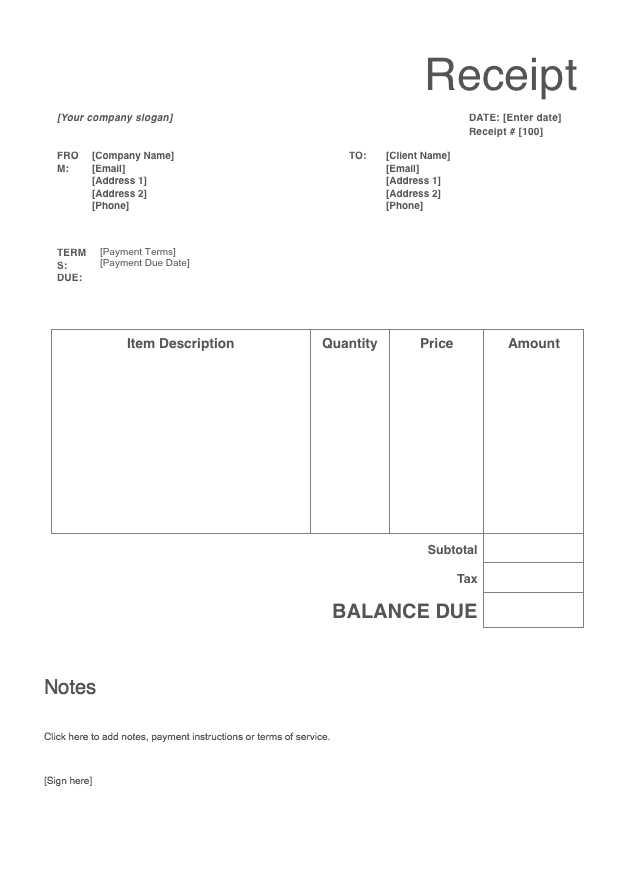

Begin with a clear layout for the receipt. Place the department store’s logo at the top for immediate recognition. Use a simple, clean font for readability. Include the store name, address, phone number, and website underneath the logo for easy access to contact information.

Incorporate a transaction date and time right after the store details. This helps customers track their purchase and serves as a reference for returns or inquiries. Ensure the font size is appropriate so it stands out without cluttering the layout.

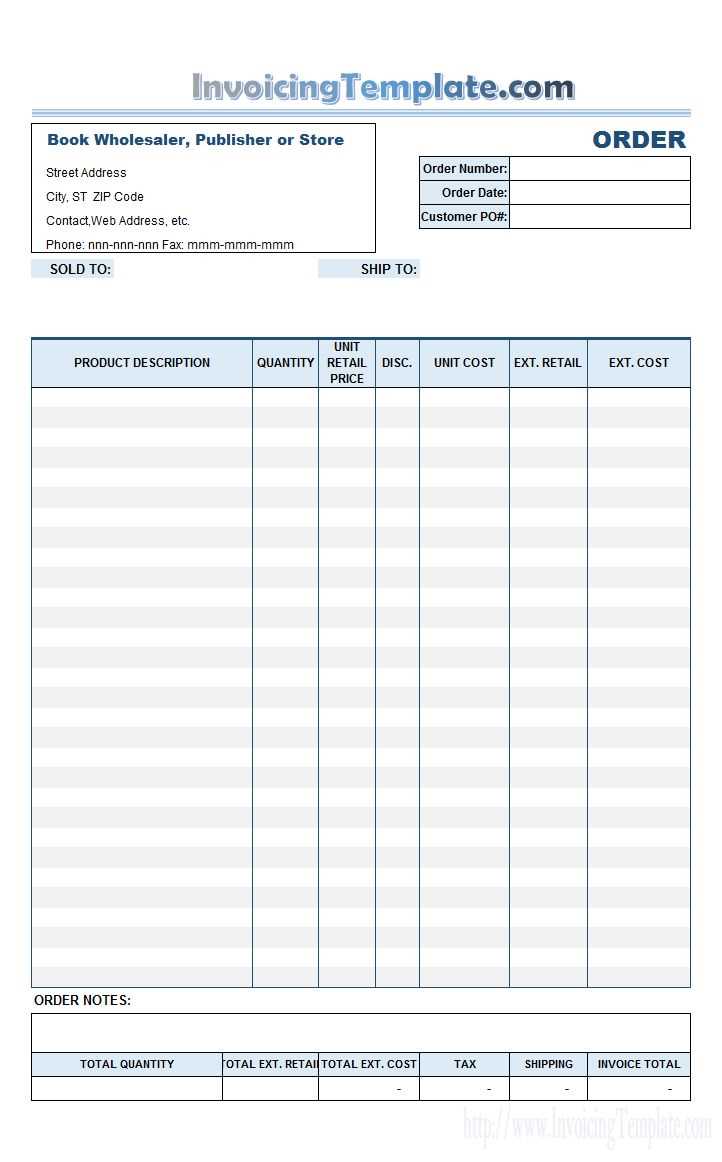

List purchased items in a table format with clear headings such as “Item”, “Quantity”, “Price”, and “Total”. Provide a breakdown of each item for transparency, making it easy for customers to review their purchases at a glance. Add any applicable taxes separately to avoid confusion.

After itemization, clearly display the total amount due, including taxes, fees, and discounts applied. Ensure that the subtotal, tax, and final total amounts are well defined and visually distinct from other information on the receipt.

Include a section for payment method details. Mention whether the transaction was completed with cash, credit, debit, or other forms of payment. This provides clarity for customers and adds an extra layer of accountability for both parties.

If the receipt includes any special promotions, loyalty points, or store credits, make sure to highlight this information. A short line at the bottom of the receipt, summarizing loyalty program benefits or upcoming sales, can enhance customer retention.

Lastly, add a footer with a brief return policy, and any necessary legal disclaimers. Make this information easy to read but concise, as customers may refer to it when needed. The footer should not overwhelm the rest of the content but still remain accessible for reference.

Key Elements of a Receipt Template

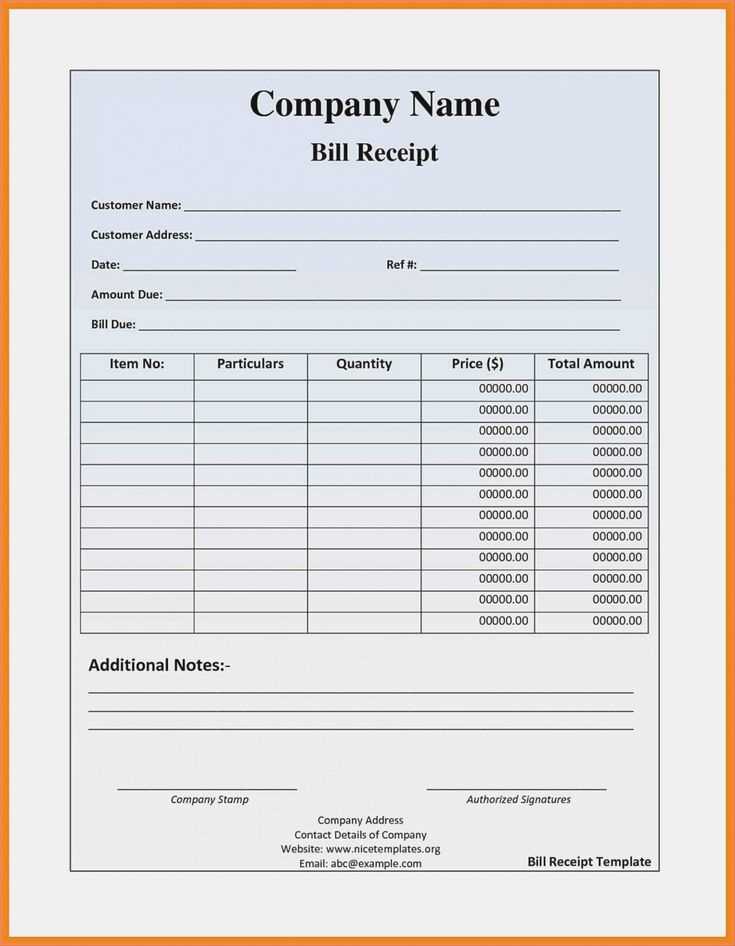

Each receipt template should clearly display certain details to ensure transparency and provide necessary information to both the customer and the business. Start with the store’s name, contact information, and location. This establishes the origin of the transaction and provides a reference point for future inquiries.

Transaction Details

Include the date and time of purchase, along with a unique receipt or transaction number. These are critical for tracking purchases and resolving any potential issues with returns or refunds. The items purchased must be listed with their prices, quantity, and total cost. Make sure to include any applicable taxes or discounts as separate line items, with a clear breakdown of the final total.

Payment Information

Clearly display the payment method used, whether it’s cash, credit, or another form of payment. If applicable, show the last four digits of the credit card or transaction reference for traceability. Don’t forget to mention any loyalty points or rewards that may have been applied during the transaction.

Designing a User-Friendly Template for Customers

Ensure clarity by using a simple, clean layout. Prioritize readability with a clear font choice, such as sans-serif, and ensure that the font size is large enough for easy reading.

- Organize the information logically: product details, total cost, and store contact should be easy to locate.

- Use bold for headings and key data points, such as total price and tax, so they stand out.

- Keep a consistent structure across receipts for recognition and ease of use.

Provide sufficient white space around the text to avoid a cluttered appearance. This makes the receipt easier to scan quickly, especially in busy shopping environments.

- Break the data into sections: store information, itemized purchases, and payment methods.

- Include a short summary at the bottom for quick reference, like payment confirmation or loyalty points earned.

Consider incorporating symbols or icons for quicker visual identification, such as a shopping cart for items or a percentage sign for discounts. Ensure the design is visually balanced and doesn’t overwhelm the customer.

Legal Considerations and Tax Information

Ensure that your department store receipt includes all required information by law, such as the business’s name, address, and tax identification number. This helps protect your business from potential legal disputes and ensures transparency with customers.

For tax purposes, receipts must clearly show the total purchase amount, any taxes applied, and the breakdown of items sold. Depending on your location, you may need to specify the sales tax rate and the amount of tax paid on each item. Double-check local tax laws to stay compliant.

Store owners must keep copies of receipts for auditing purposes. In many regions, tax authorities require businesses to maintain transaction records for several years. These documents can be crucial if you face an audit or need to prove compliance with tax laws.

If your business operates internationally, be aware of varying tax regulations in different countries. Some countries have Value-Added Tax (VAT), while others may use different systems. Make sure receipts reflect the correct tax system applied in your region.

Failure to comply with legal and tax requirements can lead to fines or penalties, so it’s critical to stay up-to-date with local tax laws and ensure that all necessary details are included on receipts. Regularly review your receipt templates and adjust them as needed to reflect any changes in the law.