A charity donation receipt serves as an official record of a donor’s contribution. It’s a simple yet significant document that confirms the amount donated and can be used for tax purposes. If you’re a charity organization or an individual handling donations, having a well-structured receipt template is key to keeping records clear and accurate.

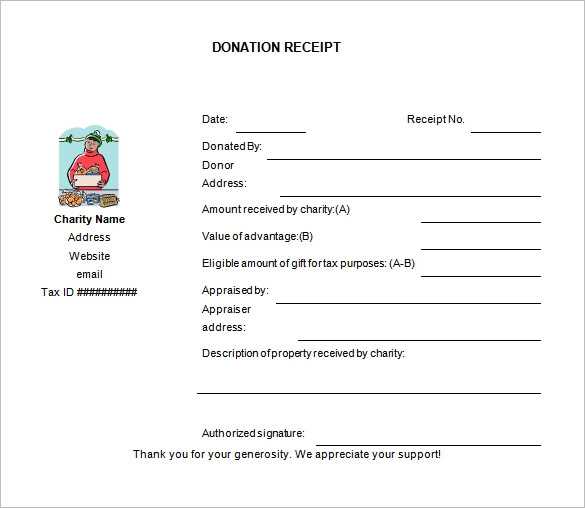

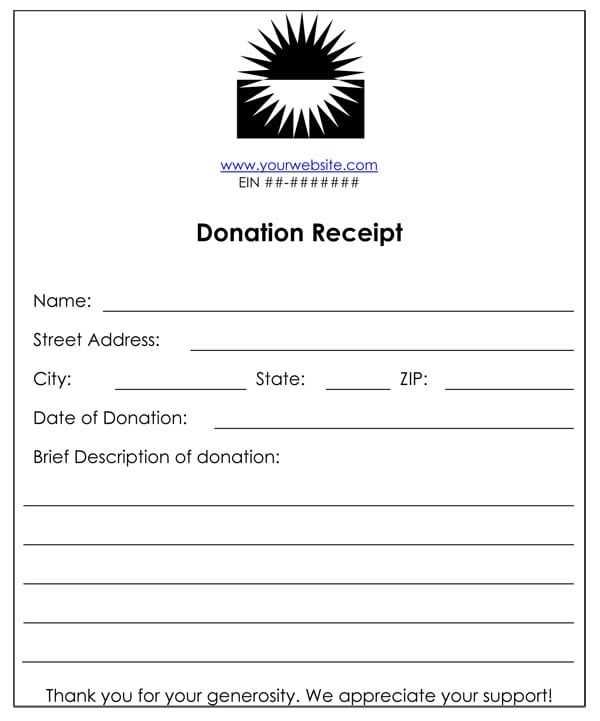

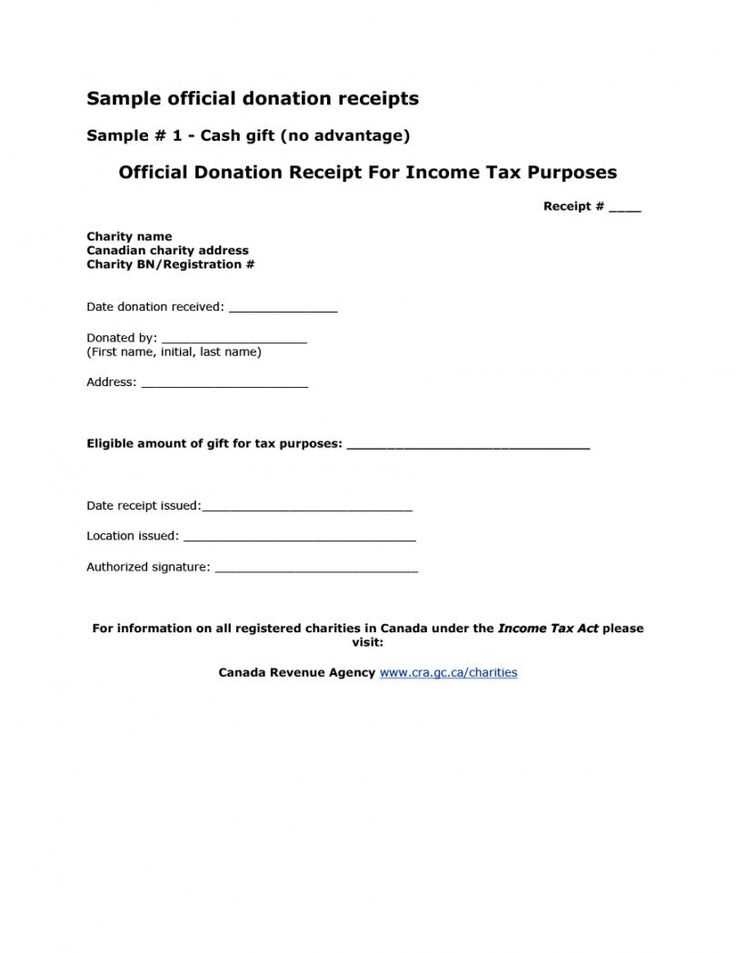

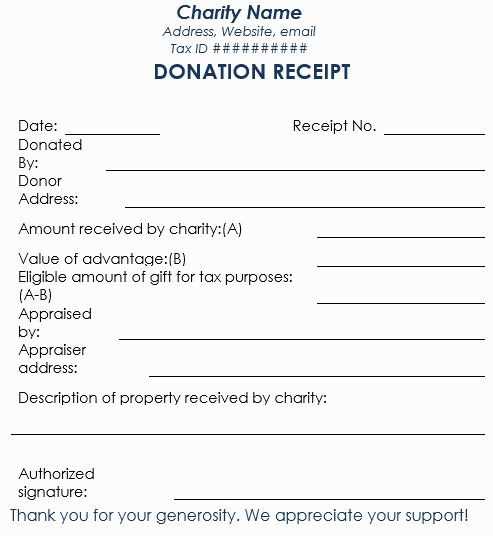

Each receipt should include the donor’s name, donation amount, and the date of the donation. Additionally, you should specify whether the donation was monetary or in-kind, and if applicable, the estimated value of any donated goods. This ensures transparency and helps with potential audits or tax claims.

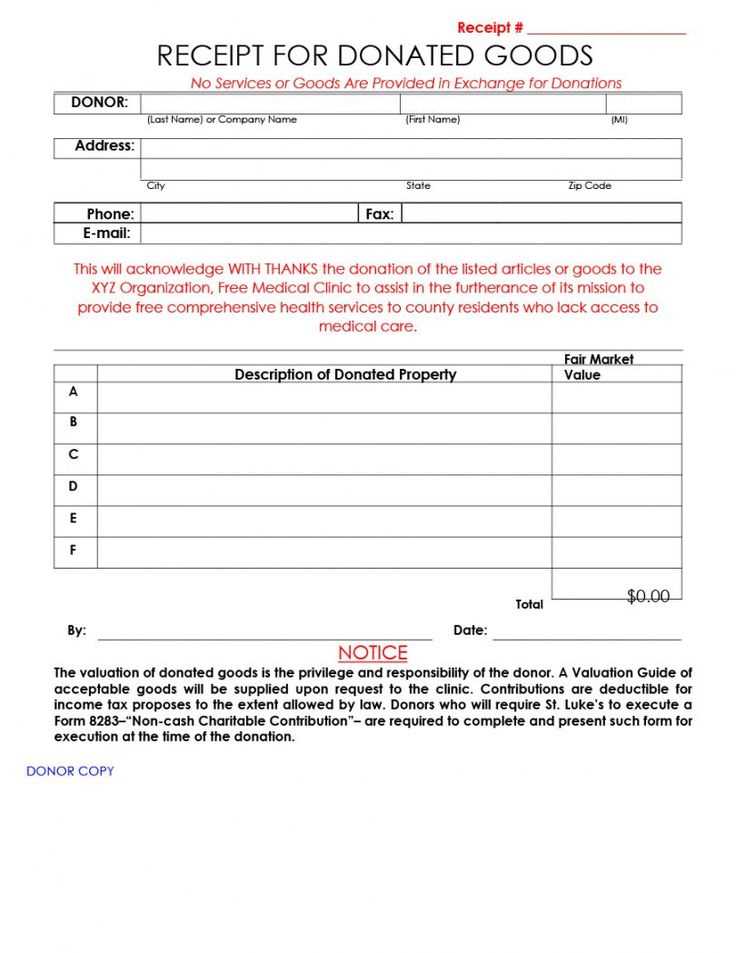

To streamline the process, consider creating a template that can be easily personalized for each donation. Include fields for the donor’s contact details, the organization’s contact information, and a statement confirming that no goods or services were provided in exchange for the donation. This simple format will save time and ensure consistency in all your records.

How to Create a Legally Compliant Receipt for Donations

Include the name and address of your organization at the top of the receipt. This helps the donor identify your organization for tax purposes.

State the date of the donation. This is crucial for the donor’s records and tax filings.

Clearly specify the amount of the donation. If the donation is non-monetary, provide a description of the item(s) donated, including their value if available.

Indicate whether any goods or services were provided in exchange for the donation. If there were, reduce the value of the donation accordingly. If no goods or services were exchanged, note that as well.

Include a statement that your organization is a registered charity and provide its tax identification number or relevant registration details.

For donations over a certain amount (depending on your jurisdiction), offer a specific receipt format that includes a disclaimer, ensuring compliance with local tax laws.

Ensure the language used in the receipt is clear and unambiguous, avoiding terms that could lead to confusion in financial reporting or tax filings.

Essential Information to Include in a Donation Receipt

Clearly state the donor’s name and address. This helps identify the individual or organization who made the donation. Ensure the donation date is included, as well as the receipt number for tracking purposes. If applicable, list the specific amount or description of the donation, especially for non-cash items, including their fair market value.

Include the charity’s name, address, and a brief statement confirming its tax-exempt status. This assures donors that their contribution qualifies for tax deductions. If the donation is monetary, specify whether it was a cash or non-cash donation, and note if any goods or services were provided in exchange for the donation.

Clarify the statement of no goods or services provided, if relevant, to confirm that the donor can claim the full value for tax deductions. If goods or services were provided, clearly state their fair value to ensure transparency.

Formatting and Customizing Your Receipt Template for Different Donors

To ensure your donation receipt resonates with different donors, tailor the design and information based on their contribution. For larger gifts, include detailed breakdowns of their donation–amount, date, and designation–along with any specific requests or notes from the donor. Smaller donations, on the other hand, can follow a more streamlined format but still maintain all necessary legal information.

Personalizing for Regular Donors

For repeat contributors, consider adding a personalized greeting and the donor’s history with your cause. A simple statement like “Thank you for your ongoing support since [year]” builds rapport and shows appreciation. You can also customize receipts by including acknowledgment of their cumulative impact over time.

One-time Donations

For one-time donors, focus on clarity and simplicity. Include the date of the donation, the total amount, and the specific program or campaign the funds are directed toward. These donors may not expect an in-depth history, so providing a straightforward summary with minimal design elements will be more effective.