If you need a donation receipt letter, you’ve come to the right place. A well-written letter ensures transparency and allows donors to keep track of their contributions for tax purposes. Use this free template to create a professional and clear receipt that will leave a positive impression on your supporters.

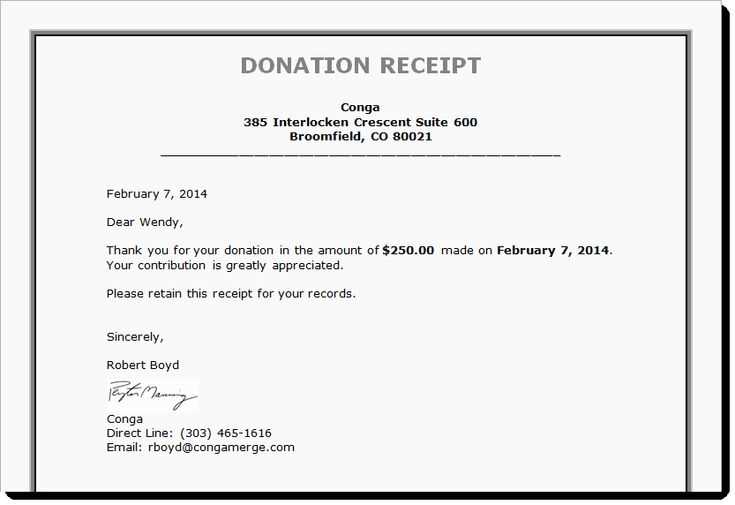

The template includes all necessary components: donor information, donation details, and your organization’s contact information. By filling in these fields, you can easily customize the letter to fit any type of donation. The date, amount, and specific purpose of the donation are also highlighted, making it straightforward for donors to use the receipt for tax deductions.

Don’t complicate the process; this template is designed to save you time while maintaining professionalism. Just plug in the details, print, and send! You can even adjust the language to reflect your organization’s tone and brand. A simple and clear donation receipt goes a long way in building trust and encouraging future donations.

Here are the corrected lines:

When crafting a donation receipt letter, clarity is key. Ensure you include the donation amount, donor details, and a thank you message. Here’s a streamlined approach for effective documentation:

Key Elements to Include:

- Donor’s Name – Always list the full name of the donor. Double-check spelling for accuracy.

- Donation Amount – Clearly state the total donation, and specify whether it is monetary or material.

- Date of Donation – Include the exact date the donation was made. This helps for tax purposes and tracking.

- Purpose of Donation – If applicable, mention how the funds will be used or the intended cause.

- Thank You Statement – A brief but sincere expression of gratitude goes a long way in maintaining good donor relations.

Example Template:

Here is a straightforward template that covers the necessary details:

[Organization Name] [Organization Address] [City, State, Zip Code] [Date] [Donor Name] [Donor Address] [City, State, Zip Code] Dear [Donor Name], Thank you for your generous donation of $[Donation Amount] on [Donation Date]. Your support helps us [mention purpose or use of funds]. We are truly grateful for your contribution and commitment to our cause. Sincerely, [Your Name] [Your Title] [Organization Name]

Modify this template according to your needs. It’s adaptable for various donation types and ensures all important information is included without overwhelming the donor.

- Donation Receipt Letter Template Free

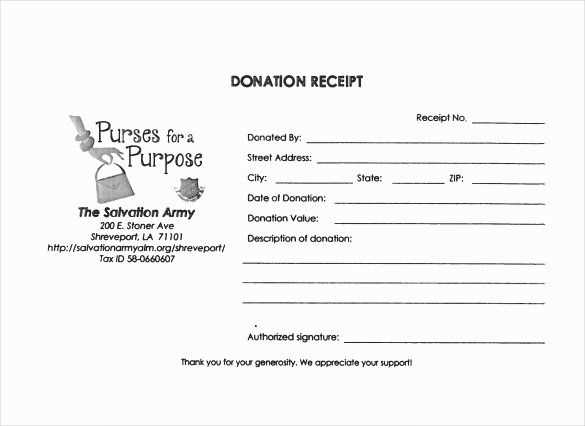

Ensure your donation receipt letter is clear and accurate. Start by including the donor’s name, donation amount, and date of contribution. Specify the type of donation–whether it’s cash, goods, or services. For monetary donations, make it clear if any goods or services were provided in exchange, which may affect tax deductions.

Here’s a basic structure to follow:

- Donor’s name and contact details

- Organization’s name and contact information

- Date of donation

- Amount donated (or item description if non-monetary)

- Statement confirming no goods or services were exchanged (if applicable)

- Tax ID number for your organization

- Thank you message for the donor’s support

By following this structure, you create a receipt that is straightforward and meets legal requirements, ensuring your donor receives proper documentation for their tax purposes.

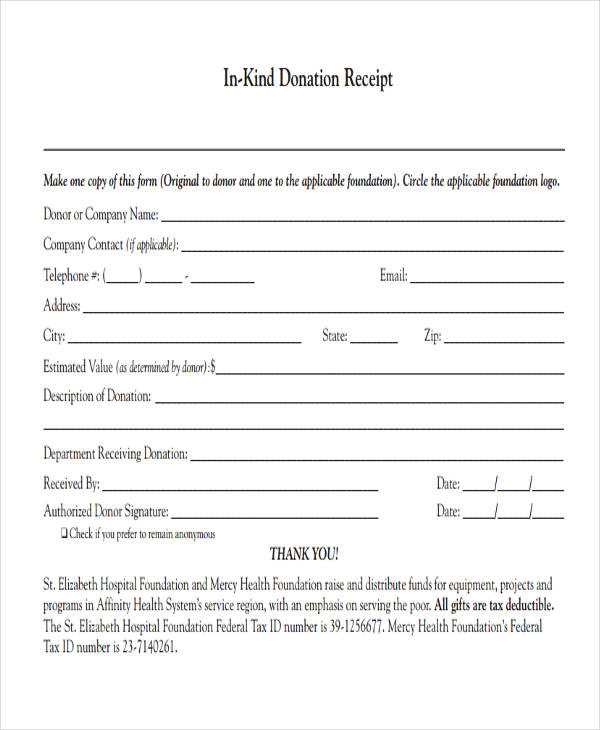

To create a donation receipt letter, include the following key details:

1. Donor Information

Start by listing the donor’s name, address, and contact details. This ensures the receipt is correctly attributed.

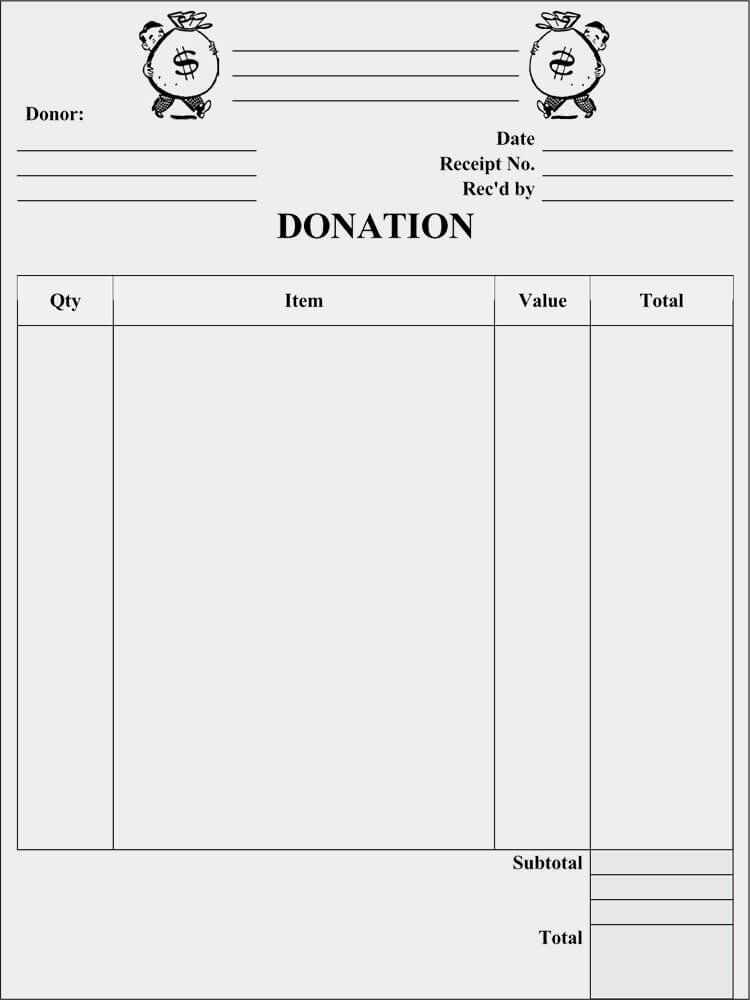

2. Donation Information

Include the date of the donation, the amount (if monetary), or a description of the donated items. For non-monetary donations, provide a detailed list of the items and their estimated value, if applicable.

3. Acknowledgment Statement

Include a statement that acknowledges the donation and expresses gratitude. A simple message like “Thank you for your generous support” works well.

4. Tax Information

For tax purposes, state that the donor did not receive anything of significant value in return for the donation. This is important for the donor’s tax deduction claims.

5. Organization Details

Provide the name of your organization, its address, and its tax-exempt status (if applicable). This helps establish the legitimacy of the donation.

6. Signature

End with a signature or the name of the person in charge of issuing the receipt. This adds credibility to the document.

| Section | Details |

|---|---|

| Donor Information | Name, address, and contact |

| Donation Information | Amount or item description |

| Acknowledgment | Thank you statement |

| Tax Information | Clarify no goods or services were provided |

| Organization Details | Name, address, tax-exempt status |

| Signature | Signature or name of authorized person |

By following these steps, your donation receipt will be clear, professional, and compliant with tax regulations.

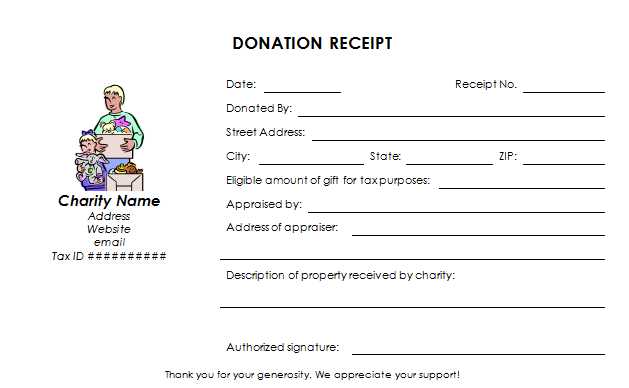

Include the donor’s full name and address at the top of the letter. This ensures accurate identification for both your organization and the donor’s tax records.

State the donation amount clearly. For monetary donations, list the exact amount given. For in-kind donations, describe the item(s) donated and their estimated value.

Provide the date the donation was received. This helps the donor track their giving for tax purposes.

Include a thank-you message that reflects gratitude for the donor’s generosity. Personalize it by mentioning how their contribution will support specific projects or goals within your organization.

Make sure to add your organization’s name, address, and tax-exempt status. This reinforces your legitimacy and helps the donor with tax deductions.

State that no goods or services were provided in exchange for the donation, or list any benefits if applicable. This is required for the IRS documentation for charitable contributions.

End with a warm sign-off, preferably from someone within your organization who has direct involvement with donations, such as the Executive Director or Development Officer.

Several platforms offer free donation acknowledgment templates. Websites like Template.net provide easily customizable formats for nonprofit organizations. These templates include the key details like donor names, donation amounts, and personalized messages. You can adjust them based on the type of donation and recipient preferences.

Microsoft Office Templates offers simple donation acknowledgment letters in Word format. These templates are designed for quick use and allow you to personalize content based on your needs.

Google Docs also has free templates that you can use directly in your browser. These templates are easy to edit, and you can save them in various formats for convenience.

Nonprofits and organizations can also explore platforms like Canva, which provide customizable letter templates with more design flexibility. These are ideal if you’re looking for a more visually appealing acknowledgment letter.

If you’re interested in an even simpler option, Fundraising Websites often offer free acknowledgment letter templates. These websites cater specifically to donors and fundraisers, so the templates are built with relevant details in mind.

Using these free resources will save you time and ensure that your donation acknowledgment letters are clear, professional, and customized to your needs.

Modification of “Receipt” to “Acknowledgment”

In the template, the word “Receipt” was replaced with “Acknowledgment” in certain sections to avoid repetition and maintain clarity. This change ensures that the letter remains formal and precise while conveying the same intent. Both terms serve the same purpose in the context of donation letters, but “Acknowledgment” can feel slightly more formal and aligned with legal or official documentation, which may be useful for certain organizations or donors.

By using “Acknowledgment,” the document can provide a more professional tone without altering the meaning. It also helps diversify the language within the letter, which is important for readability and flow. This small adjustment makes the letter feel more polished and reduces redundancy, improving the overall quality of communication with the donor.