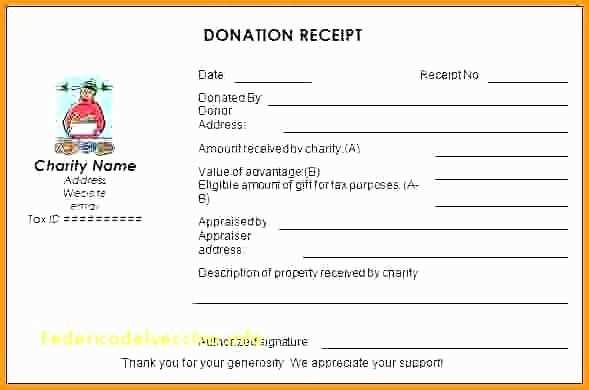

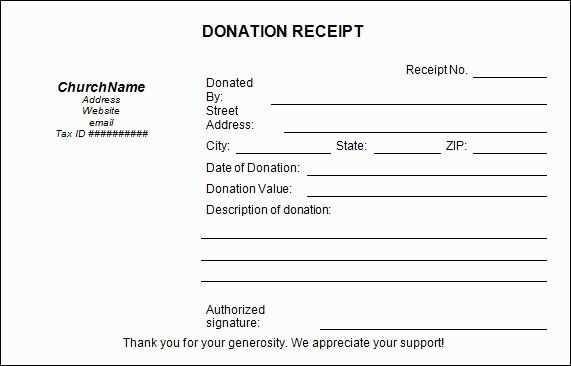

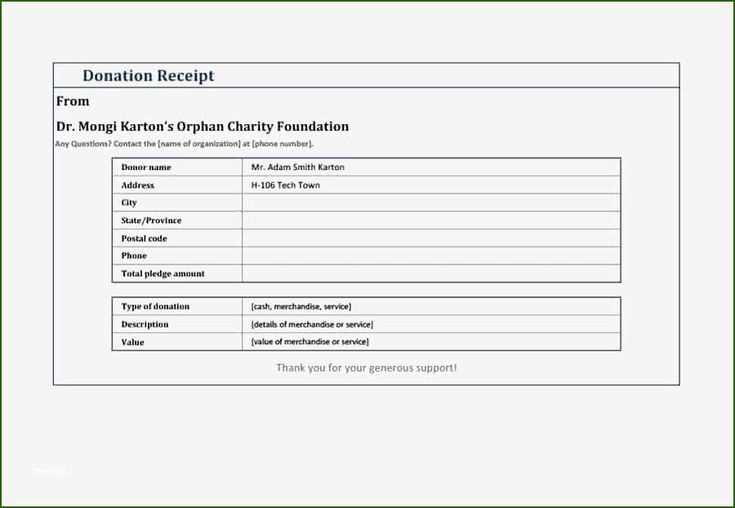

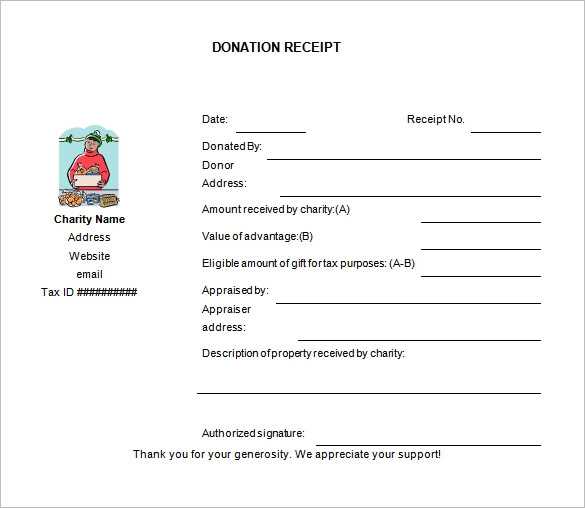

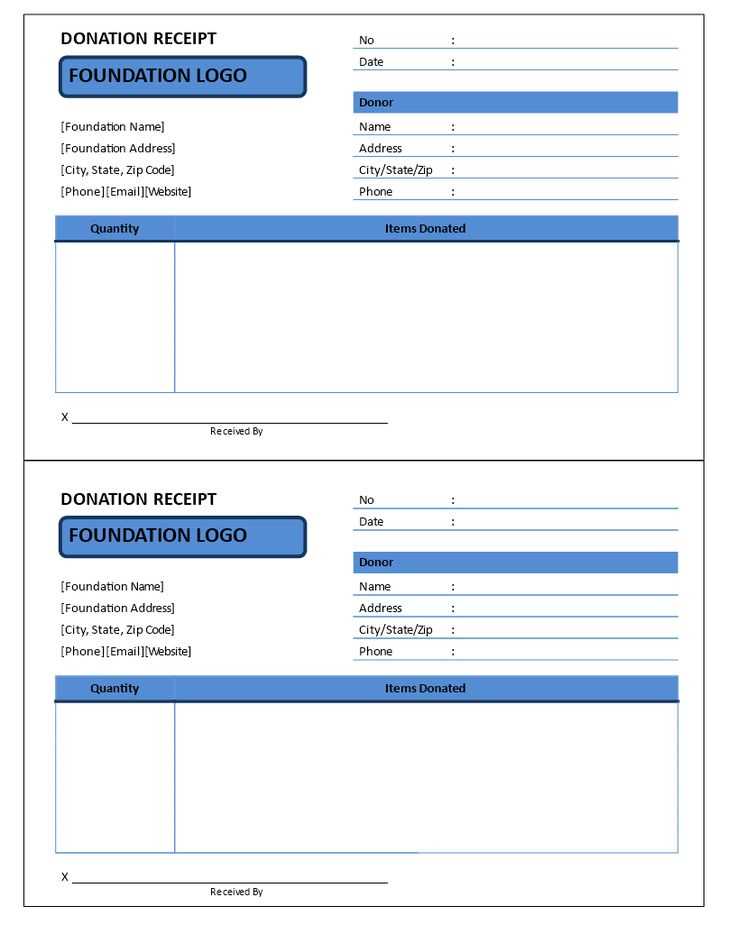

If you are looking to create a donation receipt for your UK-based charity or organization, use a clear and simple template to ensure that all required information is included. The receipt should outline the donor’s details, the donation amount, the charity’s information, and the date of the donation. This helps maintain transparency and serves as a confirmation for the donor’s tax records.

A donation receipt must include the donor’s name, the charity’s registration number, the amount donated, and a statement clarifying whether the donation is eligible for Gift Aid. Including a thank you note or acknowledgment can also add a personal touch. A well-structured receipt not only helps with compliance but also strengthens your relationship with the donor by showing appreciation.

For a fully functional receipt template, make sure to provide the donor with clear instructions on how to claim any potential tax relief, including Gift Aid, if applicable. Customize the template based on the size and type of the donation, and ensure that it aligns with UK charity law and HMRC guidelines.

Here is the revised version:

Ensure your donation receipt includes all key details to comply with UK tax rules. Start with the name and charity number of the organization. Clearly mention the donor’s name, address, and the date of donation. Include a specific statement confirming whether the donation was eligible for Gift Aid, if applicable. If the donation is monetary, specify the amount. For non-cash gifts, describe the item donated along with its estimated value.

Next, add a statement confirming that no goods or services were provided in exchange for the donation. This is necessary for tax purposes. Finally, close with the signature of an authorized representative from the charity to validate the receipt.

- Donation Receipt Template UK

For organizations and donors alike, a donation receipt is crucial for record-keeping and tax purposes. In the UK, receipts must contain specific information to comply with charity regulations and HMRC guidelines.

- Organization Details: Include the name, registered charity number (if applicable), and address of the charity or organization.

- Donor Information: List the name and address of the donor. If the donation is made anonymously, this section can be omitted.

- Donation Date: Clearly mention the date when the donation was made.

- Donation Amount: Specify the amount of money or a description of the donated goods. If the donation is in kind, provide an estimate of the value.

- Gift Aid Declaration (if applicable): If the donor has agreed to Gift Aid, include a statement confirming this. Make sure to specify the total value of donations for which Gift Aid can be claimed.

- Receipt Number: Assign a unique receipt number for tracking purposes.

Ensure that the format is clear and professional, making it easy for both parties to reference the transaction for tax deductions or personal records.

To ensure your donation receipt meets legal standards in the UK, include key details that confirm the transaction and comply with charity regulations. Start with the donor’s full name, address, and the date of the donation. Specify the amount or description of the gift, and clearly state if the donation was monetary or in-kind.

If applicable, note the charity’s name, registration number, and contact information. This is especially important for gifts over £100 or for donors requesting tax relief, as HMRC may require specific records. Include a declaration about Gift Aid if the donor has opted for it, ensuring you comply with the rules on this tax relief scheme.

For non-cash donations, describe the items donated and their approximate value. If there are any conditions attached to the gift, such as a specific use for the donation, make sure to mention this as well. Keep the tone formal but clear, and avoid unnecessary language that could create confusion.

Finally, make sure the receipt is signed by an authorised person from the charity or organisation receiving the donation. This confirms its authenticity and fulfils the legal requirements for record-keeping under UK charity law.

To claim tax relief on donations in the UK, the receipt must include specific details to ensure validity. These details help both the donor and the charity comply with HMRC requirements for Gift Aid and other tax relief programs.

1. Charity’s Name and Address

The charity’s full legal name and registered office address must be clearly stated on the receipt. This ensures the donor can easily identify the organization, which is essential for tax purposes.

2. Date and Amount of Donation

Clearly mention the date the donation was made and the exact amount donated. If the donation was in kind (goods or services), describe what was donated instead of a monetary value.

3. Gift Aid Declaration

If the donor has opted to include their donation under Gift Aid, include a statement confirming this. It should specify that the donor is a taxpayer and agrees to Gift Aid being claimed on their donation. A typical phrase might be: “I am a taxpayer and wish to donate under Gift Aid.” You must also state that the donor understands Gift Aid may be reclaimed by the charity from HMRC.

4. Unique Transaction Reference or Donation Number

To maintain clear records, include a unique reference or donation number associated with the transaction. This is helpful for both the charity and the donor when verifying donations for tax records.

5. Charity’s Registration Number

The charity’s registration number with the Charity Commission for England and Wales (or equivalent in Scotland or Northern Ireland) must appear. This confirms the charity’s legal status and eligibility for Gift Aid claims.

6. Donor’s Details (Optional for Anonymity)

If the donor is willing to provide their name, address, and contact details, these can be included. This helps in case the charity needs to send updates or provide further documentation for tax purposes. However, donors can choose to remain anonymous if they prefer.

7. Clear Statement of No Goods or Services Provided (if applicable)

If the donation was purely monetary and no goods or services were exchanged (such as in the case of a simple donation), include a statement confirming that. This is important for Gift Aid claims, as only genuine donations qualify for tax relief.

| Information | Why It’s Needed |

|---|---|

| Charity Name & Address | Identification of the charity for tax purposes |

| Date & Amount of Donation | Verification of donation for tax claims |

| Gift Aid Declaration | To claim Gift Aid from HMRC |

| Unique Transaction Reference | Clear record of the donation for both parties |

| Charity Registration Number | Confirm the charity’s eligibility for Gift Aid |

| Donor’s Details (optional) | Facilitate communication for future claims |

| No Goods or Services Provided | Eligibility for claiming Gift Aid |

By ensuring all of these details are included, both the charity and donor can be confident that the donation is eligible for tax relief under UK law.

Adjust your donation receipt template to match the specific requirements of different charity types to ensure clarity and compliance. For example, if your charity is a registered charity with HMRC, include your charity’s registration number and VAT details. This is crucial for donors who may wish to claim tax relief on their donations.

For small charities or community-based organizations, keep the template simple yet personal. You can include a thank-you message that reflects your charity’s mission and the direct impact of the donation. This adds a personal touch, showing donors the difference their contribution makes.

If your charity runs a campaign or specific project, customize the receipt to mention the project or initiative the donation supports. Donors appreciate knowing where their funds are directed, especially for time-sensitive or goal-oriented campaigns.

Religious organizations, for example, might want to include a note about the religious or community impact of the donation, alongside any applicable tax relief statements. Customizing the message helps reinforce the connection between the donor’s contribution and the charity’s values.

For larger charities with diverse funding sources, it may be helpful to include a breakdown of donation types on the receipt (e.g., one-time vs. recurring donations). This transparency can help donors better understand their giving patterns and facilitate easier record-keeping for tax purposes.

In any case, the key is to match the tone and details of your template to the needs of the charity while making sure all required information is included for transparency and legal purposes.

Reduce Word Repetition While Maintaining Meaning

Keep your writing clear and concise by eliminating unnecessary word repetition. Focus on using synonyms or restructuring sentences to avoid redundancy. Here are a few tips for doing this effectively:

- Use varied vocabulary. Replace repetitive words with synonyms that still fit the context.

- Restructure sentences. Change the order of your thoughts to keep the content fresh.

- Remove fillers. Eliminate unnecessary words or phrases that don’t add value.

- Be specific. Instead of repeating general terms, be precise in your description or action.

Examples of Sentence Restructuring

- Instead of saying “The donation receipt is issued when a donation is made,” try “A receipt is issued upon donation.”

- Instead of “The charity received a generous donation, and the donation was greatly appreciated,” say “The charity appreciated the generous donation.”

By following these steps, you can avoid redundancy while keeping your message clear and precise.