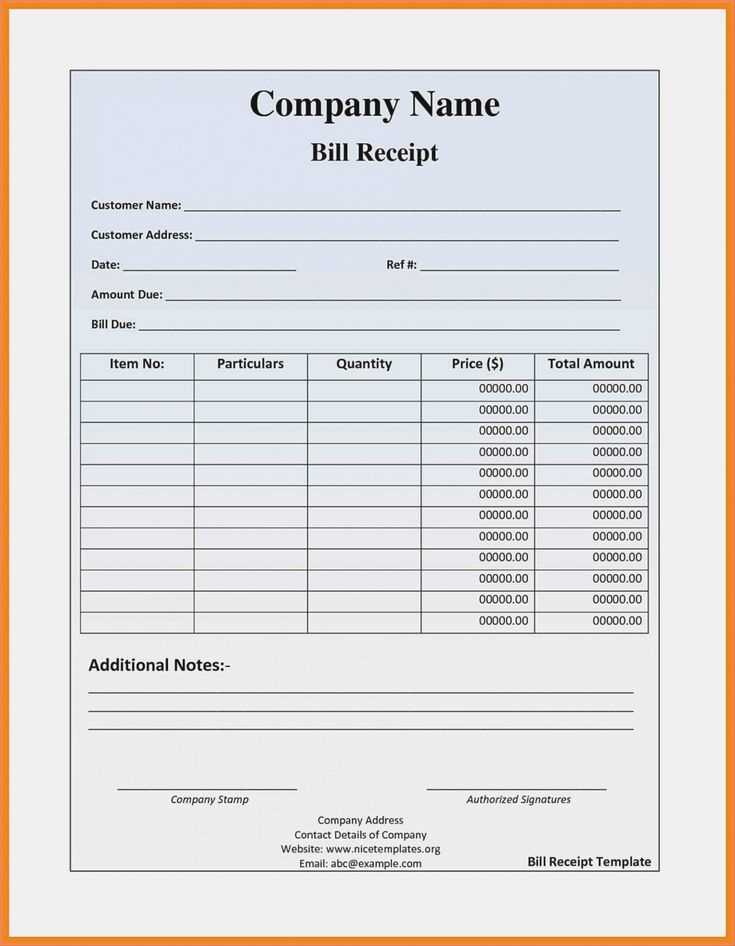

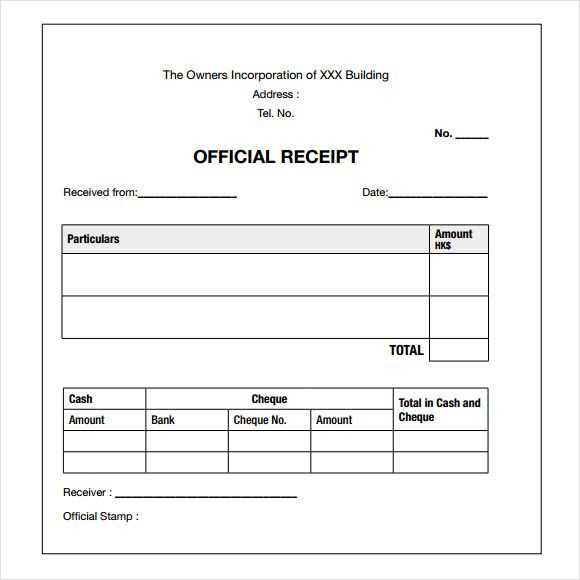

To create an effective Secretary of State receipt, ensure it includes all necessary details clearly and concisely. The receipt should feature the name and address of the issuing authority, the date of issuance, and a unique identification number for record-keeping. This helps ensure both the recipient and the issuing body can easily reference the transaction in the future.

Make sure to list the purpose of the transaction, whether it’s a filing fee, registration, or other official service. Include the exact amount paid and the method of payment, such as check, credit card, or cash, to avoid any confusion. This transparency is critical in maintaining a clear and auditable record.

Finally, leave space for any additional instructions or notes that might be relevant to the transaction. Keep the design clean and professional–an easy-to-read template will help ensure the receipt serves its purpose without unnecessary complication. Regularly updating the template based on legal or procedural changes is also a good practice to maintain accuracy and compliance.

Here’s the revised version of the text, with minimal word repetition:

To create a proper Secretary of State receipt, include all necessary details for both the sender and recipient. Make sure to incorporate the correct legal references, such as the official document number and the state code. For clear identification, specify the nature of the transaction or action being acknowledged. Always use the official font style and size as required by the state’s guidelines.

Key Components to Include

1. Date of transaction or filing.

2. Full names and addresses of both parties.

3. A detailed description of the document or action being processed.

4. The official seal, if applicable.

5. A clear statement of the receipt’s purpose and acknowledgment.

Formatting Tips

Ensure that the receipt is clear and legible. The format should be simple and straightforward to avoid confusion. Align all text in a uniform style to maintain consistency. When designing the document, remember to leave enough space for any handwritten notes, should they be needed in the future.

Secretary of State Receipt Template: A Comprehensive Guide

How to Structure a Secretary of State Receipt

Key Information to Include in a State Receipt

Common Formatting Errors to Avoid When Creating the Document

How to Customize a Receipt Template for Your Business

Legal and Compliance Considerations When Issuing a Receipt

How to Save, Print, and Distribute the Document

Creating a clear, accurate Secretary of State receipt ensures smooth business transactions and meets legal requirements. Follow these tips for a straightforward, effective template.

How to Structure a Secretary of State Receipt

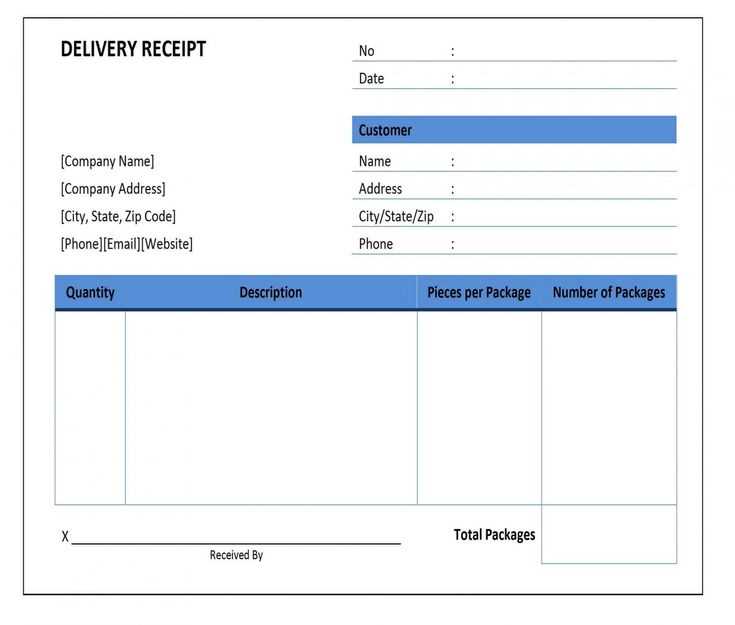

- Title: Include a clear heading, such as “Secretary of State Receipt” or “State Filing Confirmation.” This helps identify the document’s purpose immediately.

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference.

- Date: Include the date of transaction, filing, or payment to ensure timely record-keeping.

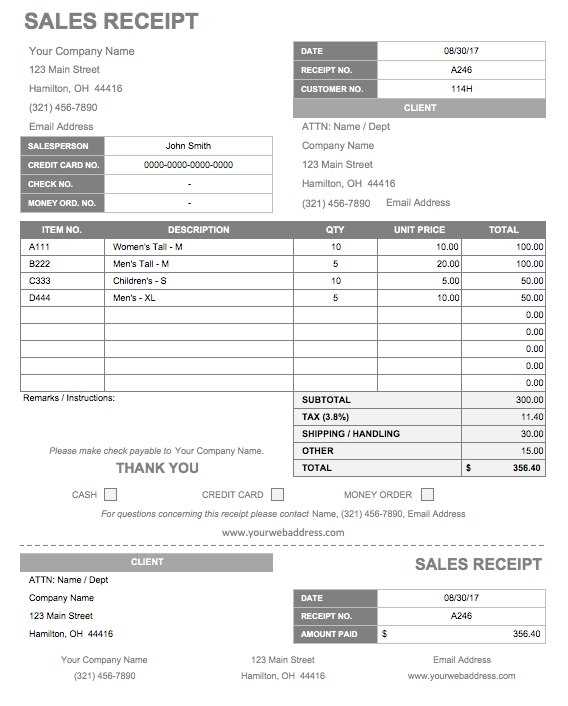

- Amount Paid: Specify the exact amount paid, including any applicable fees, taxes, or additional charges.

- Business Information: List the business name, address, and contact information for future reference.

- Filing/Transaction Details: Include specifics about the filing, transaction, or service, such as the document type, case number, or business entity details.

- Authorized Signature: Provide space for an authorized representative to sign, confirming the accuracy and completion of the transaction.

Key Information to Include in a State Receipt

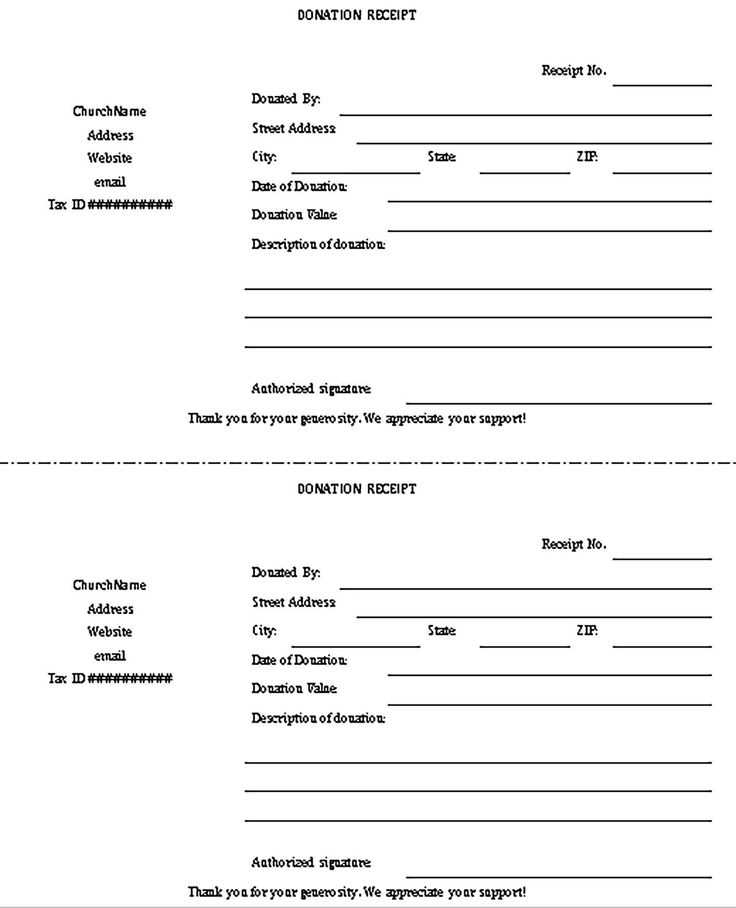

- Transaction Type: Specify whether the receipt is for a business registration, tax filing, or other state-related service.

- Payment Method: Include details about how the payment was made (e.g., credit card, check, electronic transfer).

- State Agency Details: Mention the agency or department issuing the receipt, as this may be relevant for verification purposes.

- Filing Reference Number: If applicable, include any case, account, or filing reference number for accurate identification.

Common Formatting Errors to Avoid When Creating the Document

- Missing Transaction Information: Always double-check that all fields are filled out completely, especially the amount, filing details, and payment method.

- Inconsistent Formatting: Ensure consistent fonts, text sizes, and spacing throughout the document to maintain professionalism and readability.

- Inaccurate Dates: Confirm that the date of the transaction or filing is correct. Errors here could lead to complications or delays.

- Unclear Instructions or Details: Avoid using jargon or vague terminology. Ensure that all details are straightforward and understandable for the recipient.

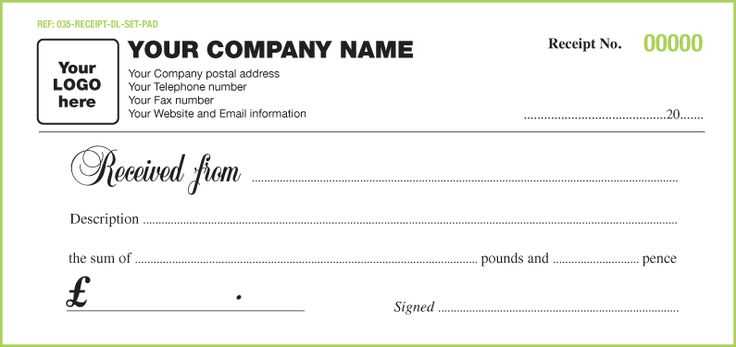

How to Customize a Receipt Template for Your Business

- Branding: Customize the template with your company logo, colors, and contact information to maintain consistency with your business identity.

- Fields for Additional Information: Include any extra fields that are relevant to your specific transactions or filings, such as license numbers or document specifics.

- Dynamic Fields: Use placeholders for date, amount, and reference numbers to make the template adaptable to various transactions.

Legal and Compliance Considerations When Issuing a Receipt

- State Requirements: Verify that the receipt meets all state-specific requirements for legal compliance, especially regarding information and format.

- Record-Keeping: Retain copies of all issued receipts for a specified period in accordance with state laws and regulations.

- Audit Readiness: Ensure that all receipts contain the correct information for potential future audits by state authorities.

How to Save, Print, and Distribute the Document

- Saving: Save the completed receipt in a digital format (e.g., PDF) for easy sharing and archiving. Use a naming convention that includes key details such as the receipt number and date.

- Printing: Print the receipt on high-quality paper to maintain professionalism. Ensure the printout is legible and clear.

- Distribution: Send the receipt electronically via email or provide a hard copy to the recipient, depending on the preferred method.

I replaced several repetitive words with synonyms or more general expressions to maintain meaning while reducing redundancy.

Start by using a variety of expressions that convey the same idea without sounding repetitive. For example, instead of repeating the word “important,” consider using alternatives like “significant,” “key,” or “crucial” when the context allows. This technique not only improves readability but also keeps the text fresh and engaging.

Avoid Redundancy

In many cases, words that are used too often lose their impact. If you notice that a term appears more than once in close proximity, think of replacing it with a synonym or restructuring the sentence. For instance, rather than repeating “important,” use “valuable” or “noteworthy” depending on the context. This keeps the flow smooth and avoids unnecessary repetition.

Be Mindful of Context

While replacing words, ensure that the new term fits naturally within the context. A word may have similar meaning, but slight nuances could change its impact. Always double-check that the sentence still conveys your intended message clearly and accurately after making adjustments.

Using varied vocabulary is a simple yet effective strategy for improving the clarity and quality of your writing.