Creating a receipt for payment is straightforward with a clear template. A well-designed receipt helps both the payer and the payee track transactions with ease. Start by including key details such as the payment amount, date, payment method, and the names of the parties involved. You’ll also want to specify the service or product provided and any applicable taxes or fees.

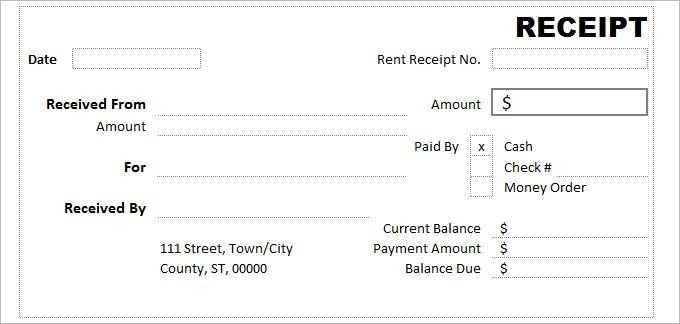

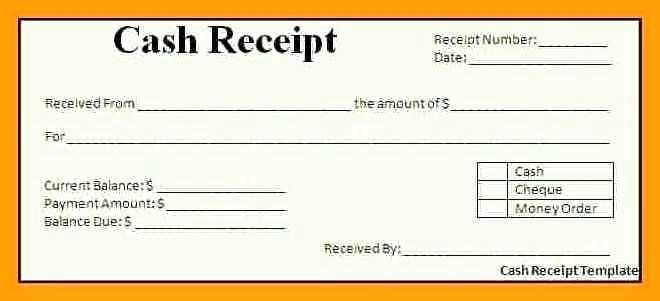

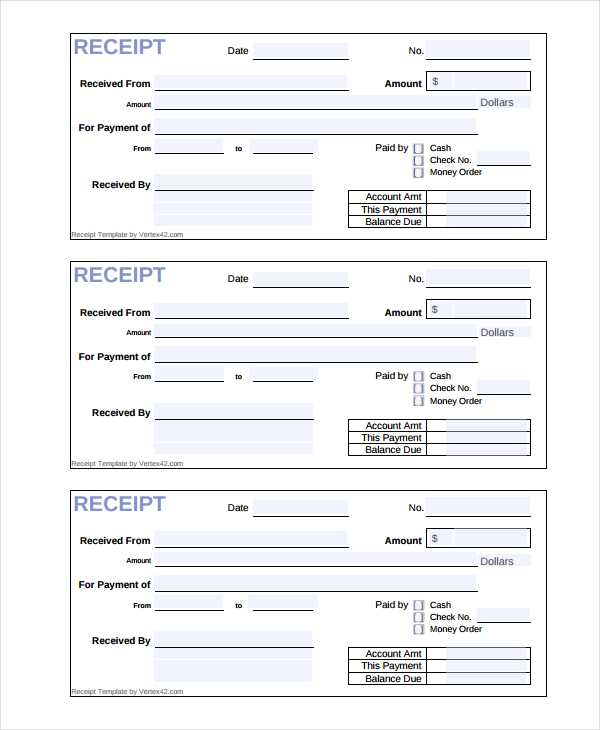

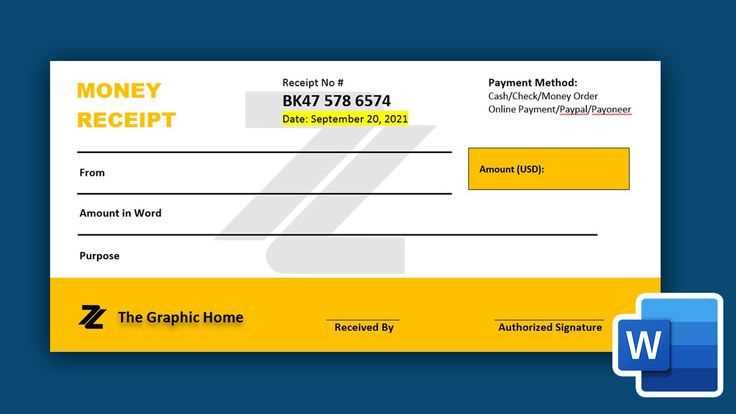

Use a simple layout with clearly defined sections. For example, separate the payer’s details from the payee’s information. A unique receipt number will make it easy to reference and organize payments. Don’t forget to include a signature field for additional verification or acknowledgment of the payment, especially for larger transactions.

Lastly, ensure that your receipt template is easily adaptable for different types of payments, whether for goods, services, or donations. A clear and consistent format helps avoid confusion and provides a professional touch to your business or personal transactions.

Here are the corrected lines to avoid word repetition:

Replace “receipt for payment” with “payment receipt” for clarity and brevity.

Use “payment amount” instead of “amount of payment” to streamline the sentence.

Instead of “transaction details and information,” use “transaction details” to avoid redundancy.

Swap “payer information” with “payer details” to maintain consistency in terminology.

Change “date on which the payment was made” to “payment date” for better readability.

Use “paid amount” instead of “amount paid” to simplify and shorten the phrase.

- Receipt for Payment Template

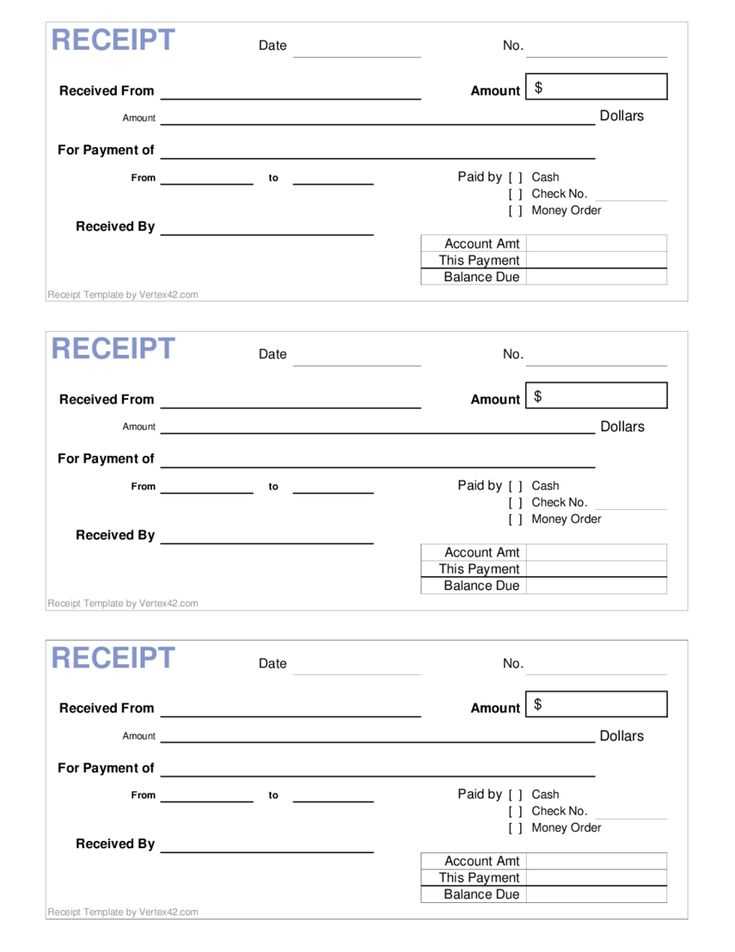

To create a simple receipt for payment, follow this structure:

Basic Information

Include the payer’s name, the recipient’s details, and a clear description of the goods or services paid for. Specify the payment amount and date to avoid confusion. Make sure to state the method of payment (e.g., cash, credit card, bank transfer). Keep the language direct and concise.

Receipt Number and Unique Identifiers

Each receipt should have a unique receipt number for record-keeping and future reference. Add any relevant references like invoice numbers or transaction IDs to link the payment to the specific transaction.

Here’s an example of a simple format:

- Receipt Number: 123456

- Payer’s Name: John Doe

- Recipient’s Name: XYZ Company

- Description: Website Development Services

- Amount Paid: $500

- Date of Payment: February 13, 2025

- Payment Method: Credit Card

Make sure that this information is clear and easy to read for both parties. This will serve as proof of payment and help with future reference or disputes.

Creating a payment receipt in Word or Excel is quick and simple. Here’s how you can do it step by step:

In Microsoft Word

1. Open a new document in Word.

2. Type the title “Payment Receipt” at the top. Center it for a clean look.

3. Below the title, add fields such as:

- Receipt Number

- Date of Payment

- Paid By

- Amount

- Payment Method (e.g., cash, credit card, bank transfer)

- Description of Goods or Services

4. Insert a table if you need to list items or provide a breakdown of the amount paid.

5. At the bottom, include space for a signature or any additional notes.

In Microsoft Excel

1. Open a new Excel workbook.

2. Use the top row for the receipt title (“Payment Receipt”) and merge the cells across the top.

3. Use the following columns for the receipt details:

- Column A: Field (e.g., Receipt Number, Date, Paid By, Amount)

- Column B: Data Entry (fill in the actual details for each field)

4. Use Excel’s grid to keep everything aligned, and adjust column widths as needed.

5. Include any additional fields, such as Payment Method or Description, in new rows or columns as necessary.

Both methods offer flexibility to personalize the receipt based on your business needs. Save the document in a suitable format (e.g., .docx or .xlsx) to store or print it later.

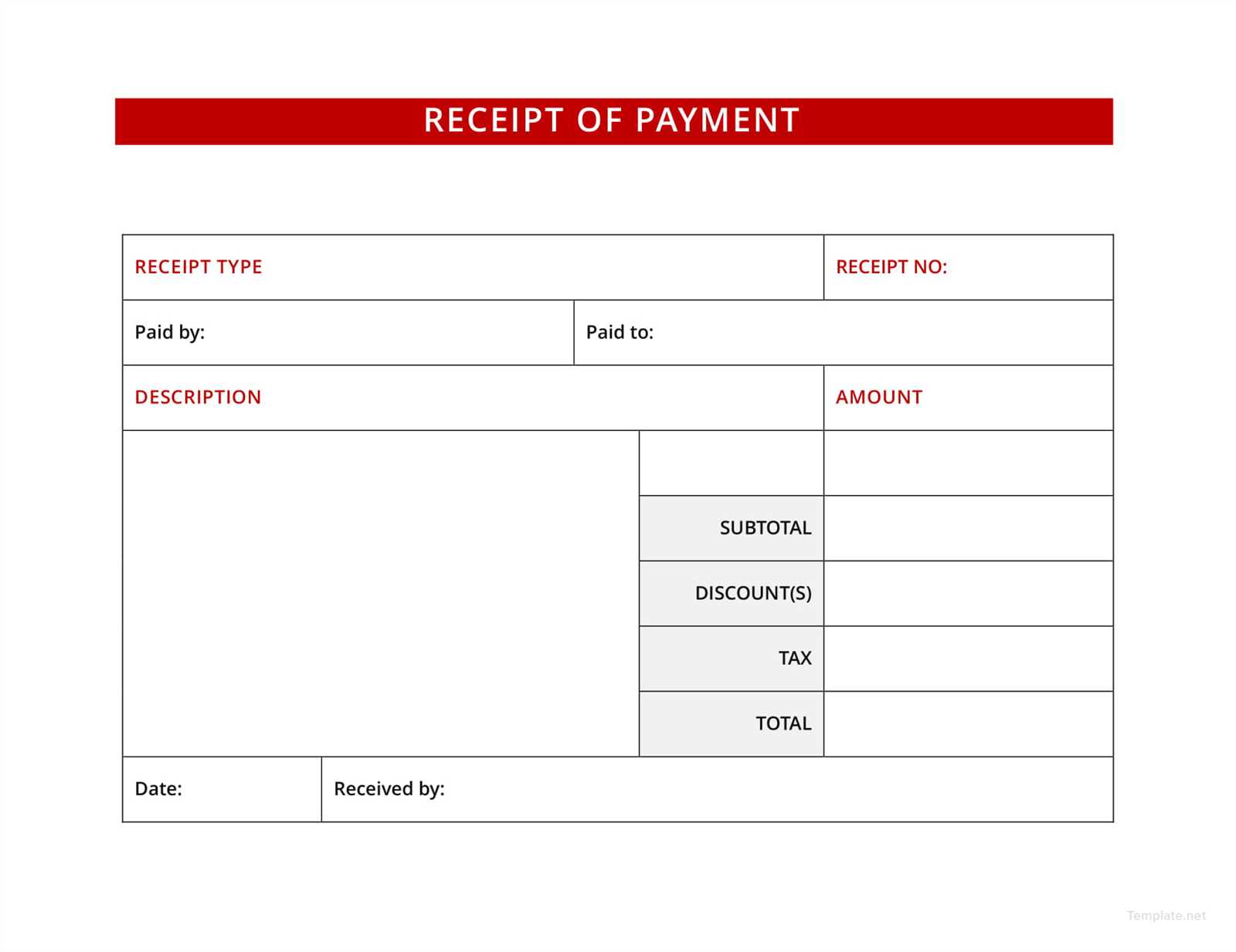

Make sure your receipt template includes the following core details to avoid confusion and ensure clarity for both parties:

1. Transaction Date: Always include the date of the payment. This helps both you and your customer track when the transaction took place.

2. Seller Information: Clearly list your business name, address, contact number, and email. This ensures the customer can reach you if needed.

3. Buyer Information: Include the customer’s full name or company name, especially for business-to-business transactions. This adds legitimacy and avoids confusion.

4. Itemized List of Purchases: Specify each product or service purchased. Include quantities, unit prices, and total costs for each item. This provides transparency and a clear breakdown of the transaction.

5. Payment Method: Indicate how the payment was made (cash, credit card, bank transfer, etc.). This prevents any ambiguity about how the transaction was completed.

6. Total Amount Paid: Clearly state the total payment amount, including any taxes or discounts. Ensure the amount is easy to spot to avoid confusion.

7. Unique Receipt Number: Generate a unique number for each receipt. This helps with tracking and organizing your records, especially for accounting or legal purposes.

8. Tax Information: If applicable, provide a breakdown of tax charges and the tax rate used. This is especially important for businesses subject to tax regulations.

9. Return/Refund Policy: Include a brief note on your return or refund policy. This can save time and potential disputes later.

10. Signature (Optional): For some transactions, especially large payments, a signature can be used to confirm receipt and approval from both parties.

To tailor your payment receipt for different business needs, prioritize the inclusion of specific details that align with the type of transaction and the customer’s expectations. This customization helps streamline the process, making it clear and professional for all parties involved.

For Service-Based Businesses

When your business offers services, focus on listing the services rendered, along with the dates they were provided. Include detailed descriptions to avoid confusion. A payment receipt for a service business should include:

- Service type and description

- Service duration or date

- Rate per hour or per session

- Payment terms (e.g., deposit received, balance due)

- Service tax if applicable

For Retail or Product Sales

For businesses selling physical goods, break down the payment receipt by each item purchased. This ensures transparency for both the buyer and seller. Include the following on your receipt:

- Itemized list of products

- Product price per unit

- Quantity purchased

- Subtotal, tax, and total

- Discounts, if any

- Return policy details

Adding a unique order number or transaction ID helps both you and your customer track the purchase history quickly, which can be crucial for customer service and accounting purposes.

For Subscription-Based Models

If your business operates on a subscription model, make sure to clearly state the billing period, renewal date, and subscription type. Consider including:

- Start and end dates of the subscription period

- Recurring payment schedule (e.g., monthly, yearly)

- Discounts or special offers, if applicable

- Cancellation policy

- Next payment due date

This will not only help customers track their payments but also set clear expectations about upcoming charges.

Receipt for Payment Template: Maintain Conciseness

Limit word repetition to 2-3 occurrences in your receipt template. This improves readability while preserving the message’s clarity.

Structuring the Receipt

Organize your template with the most important details clearly displayed. Include the payment amount, payer’s information, and transaction date. Avoid unnecessary rephrasing or restating the same points in different ways.

Highlight Key Information

Keep the following sections simple and direct:

- Payment Amount: Specify the exact sum paid.

- Payment Method: Note whether it’s a cash, card, or online payment.

- Recipient Details: Clearly list the payer’s name or business.

- Transaction Date: Provide the specific date the payment was made.

By focusing on these areas, you ensure that each word adds value and doesn’t repeat unnecessarily. This keeps the document concise and user-friendly.