Use a clear and concise template to document all transactions for professional services rendered. A receipt not only provides a record for clients but also ensures smooth accounting and tax reporting. This template should be simple and direct, listing all relevant details like service description, date, payment amount, and the service provider’s contact information.

Start with basic client and service information. Include fields for the client’s name, address, and phone number, alongside the service provided. Be specific in describing the work performed to avoid confusion. Include the total cost and the method of payment (e.g., cash, check, or credit card).

Don’t forget to include terms of payment. State the payment due date and any late fees or additional charges that apply. Make the payment instructions clear, so clients know how and where to submit their payment.

Finally, provide space for additional notes. This section allows both the service provider and the client to include any extra details, whether it’s a reminder for future services or a thank-you note. Keep it professional, but friendly, to reinforce positive relationships with clients.

Sure! Here’s the revised version with reduced repetition:

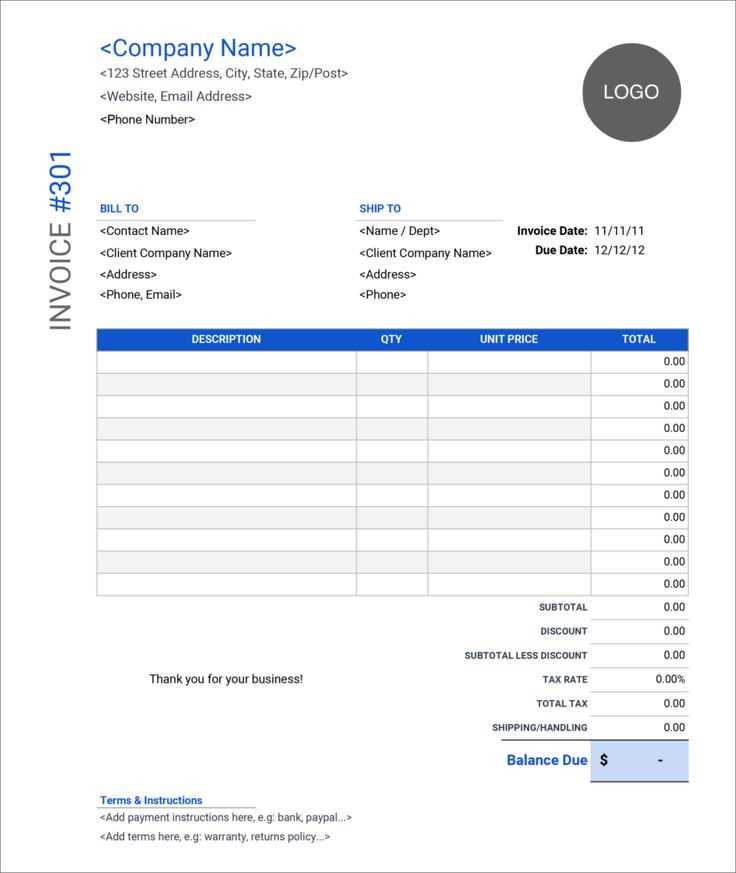

Design your professional services receipt template with clarity and precision. Begin by clearly stating the service provided, including detailed descriptions and quantities. This avoids ambiguity and ensures both parties are aligned on expectations. Ensure the pricing is straightforward, listing each service or product separately with associated costs. Be transparent about taxes and any additional fees, outlining them to prevent confusion.

Include a section for payment terms, specifying due dates and acceptable payment methods. This helps set clear financial expectations and reduces the likelihood of disputes. Provide space for both the service provider’s and client’s contact details, ensuring all parties can easily communicate in case of questions or adjustments. Finally, ensure the layout is clean, with consistent fonts and aligned sections to enhance readability and professionalism.

Here’s a detailed plan for an informational article titled Professional Services Receipt Template, structured with practical subtopics:

Begin by focusing on key sections that a professional services receipt should include to maintain clarity and compliance. Use clear headings and labels to organize the content effectively.

1. Basic Information

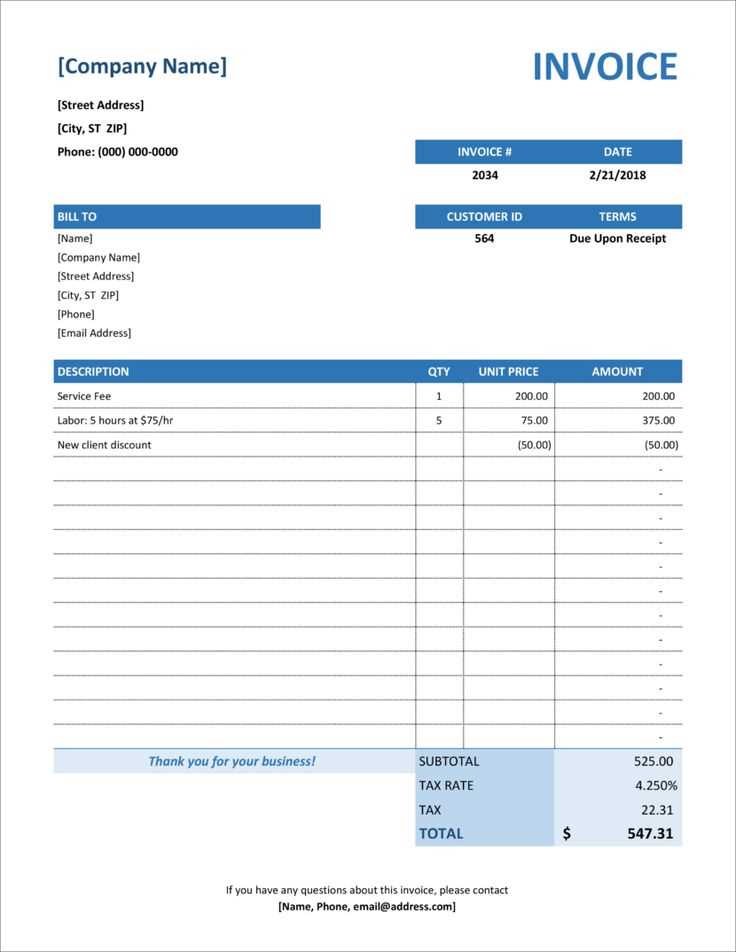

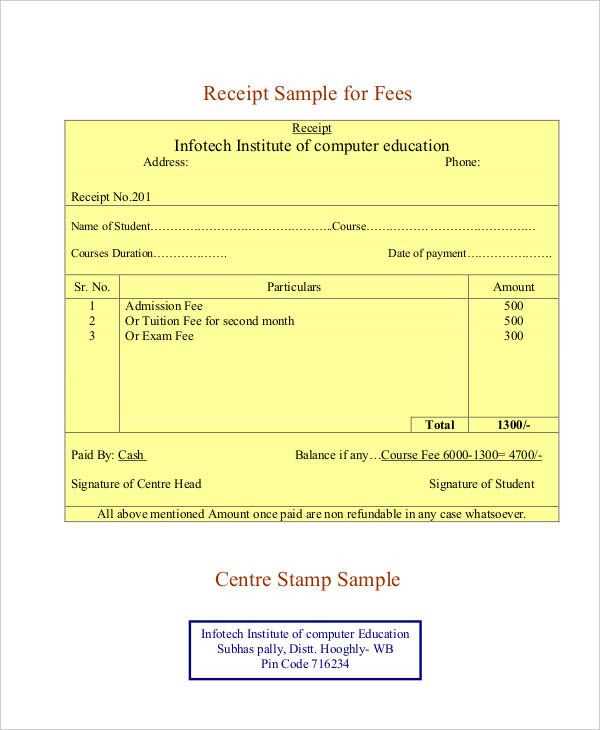

The receipt should start with basic details such as the service provider’s name, contact information, and business address. Similarly, include the client’s information for easy identification. Be sure to specify the service date and receipt number to track the transaction.

2. Description of Services Provided

List each service rendered in detail, including quantities and rates. This ensures the client understands exactly what they are being charged for. Include any specific details such as the duration or scope of the services. Use a simple table format to present this data clearly.

| Service | Description | Rate | Total |

|---|---|---|---|

| Consultation | One-hour consultation session | $100/hr | $100 |

| Report Creation | Detailed analysis report | $200 | $200 |

Ensure that each line item reflects the exact cost to avoid confusion later. If any discounts, taxes, or additional charges apply, these should be added as separate rows in the table for transparency.

3. Payment Details

Indicate the total amount due, including a breakdown of any taxes or discounts. Specify the payment method (e.g., credit card, bank transfer) and include relevant transaction details for future reference. Providing a due date helps the client understand the payment timeline.

4. Terms and Conditions

End the receipt by summarizing any important terms. For example, include refund policies, late payment fees, and warranties, if applicable. This section sets clear expectations and helps avoid disputes.

By following this structure, the receipt will not only serve as a proof of transaction but also as a professional document that enhances the service provider’s credibility.

- Key Service Details to Include in a Receipt

Always include the service provider’s name and contact details at the top of the receipt. This ensures customers know who performed the service and how to reach them if needed.

Next, list the date when the service was rendered. This is critical for tracking and reference purposes.

Clearly describe the service provided. This should be a brief, but precise, summary so both parties can confirm what was delivered.

Include the cost for the service. Break down the pricing if multiple items or services are involved. This helps avoid confusion and ensures transparency.

Indicate any taxes applied, if relevant. Specify the rate and amount, as this is a requirement for many businesses and customers alike.

Always provide the total amount due or paid, ensuring it is easy for the customer to see the final charge.

If applicable, note any discounts or special offers that were applied. This ensures customers know they received a deal and encourages repeat business.

Lastly, add a section for payment method and transaction reference. Include details such as credit card numbers (partially masked), bank transfer references, or cash payments, depending on the method used.

Use a clean, easy-to-read font like Arial or Helvetica. Avoid using too many different fonts, as it can make the receipt look cluttered.

Ensure the company name, logo, and contact details are clearly visible at the top. This gives the receipt a professional and consistent look.

- Keep the text aligned: Align important details like dates, amounts, and descriptions in a neat grid. It helps the customer quickly find key information.

- Use bold and italics sparingly: Highlight key elements like totals and taxes, but avoid overusing these styles to prevent the receipt from looking chaotic.

- Use white space effectively: Don’t overcrowd the receipt. Leave enough space between sections for easy reading. This helps to guide the eye and improves overall legibility.

- Include a clear breakdown: List individual items or services with their corresponding prices. This transparency builds trust and prevents confusion.

Make sure the total amount is prominent, ideally at the bottom or right-hand side of the receipt, and formatted in a larger or bolder font.

Use subtle lines or borders to separate different sections, such as item details, tax, and total amounts. This adds structure without overwhelming the design.

Ensure the receipt has a clean footer with any necessary legal disclaimers or return policies, aligned to the bottom to keep the main details clear and prominent.

Lastly, always keep the colors simple. Stick to a neutral background with dark text for maximum readability. A minimalist design ensures professionalism and clarity.

Ensure your professional services receipt meets all legal requirements to avoid disputes and potential penalties. A receipt must contain specific details mandated by law in many jurisdictions. These details vary, but typically include the following:

- Clear Description of Services: Each receipt should specify the services provided, including dates and a detailed description of the work done. Avoid vague terms like “consulting services” and provide specifics where possible.

- Accurate Payment Information: State the exact amount paid, including any applicable taxes, fees, or discounts. This ensures transparency and helps with tax reporting.

- Service Provider’s Details: Include the name, address, and business registration number (if applicable) of the service provider. This is critical for verification and to meet regulatory obligations.

- Client’s Information: In certain cases, especially in B2B transactions, it may be required to include the client’s name and address on the receipt. This helps with record-keeping and ensures accountability.

- Date of Transaction: Specify the exact date when the payment was made or services were completed. This serves as an official record of the transaction.

For tax purposes, some regions require receipts to include additional data like tax identification numbers or VAT registration numbers. Always verify the local laws that apply to your industry and region. Failure to comply with legal receipt standards can result in fines or complications during audits.

Let me know if you need any further adjustments!

To finalize your professional services receipt, focus on clarity and accuracy. Specify the service provided, the date of completion, and the agreed-upon payment amount. Make sure to include payment terms and accepted methods for transparency. Avoid ambiguity by listing any taxes or additional fees separately, ensuring the total sum is clear.

Structure of a Professional Services Receipt

At a minimum, a receipt should contain:

- Service provider’s name and contact details

- Client’s name and contact details

- Detailed description of the service

- Total amount charged

- Payment method and date received

- Any applicable taxes or fees

- Receipt number for tracking purposes

Additional Recommendations

If applicable, include a note that confirms the completion of the service or any follow-up steps. Keep your records organized to avoid confusion in case of a dispute or refund request. A simple, straightforward receipt can help maintain professionalism and clarity with your clients.