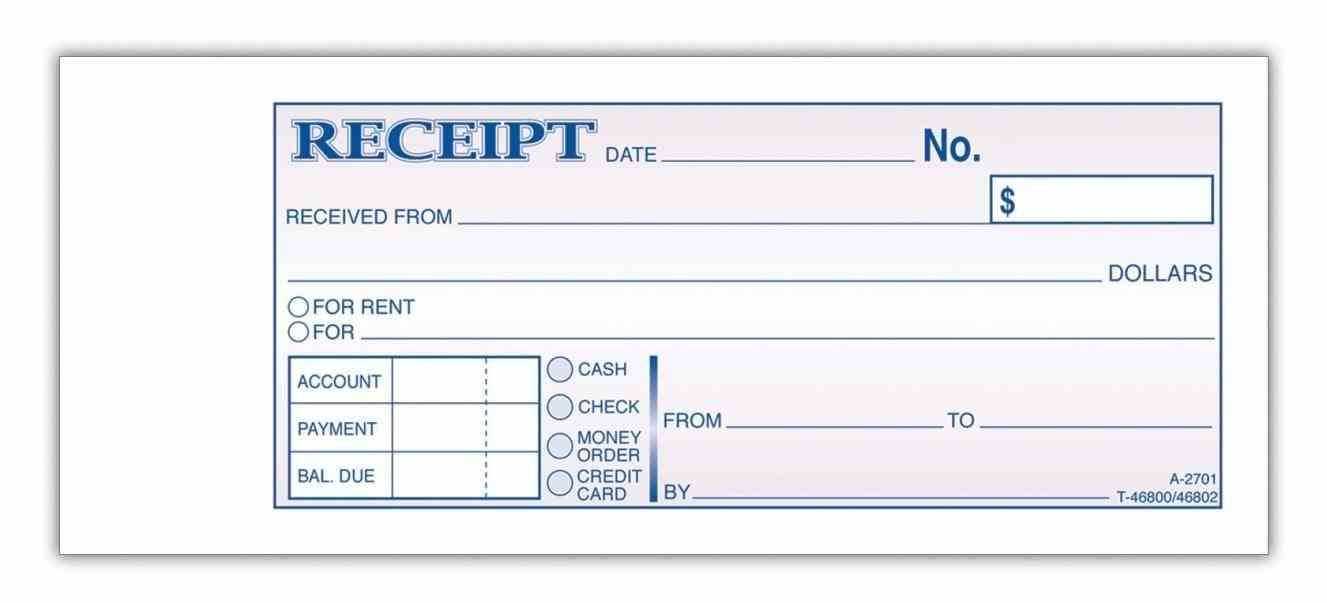

To streamline financial transactions and maintain accurate records, creating a reliable template for your cash receipt book is key. This template should be simple, yet detailed enough to capture all necessary information for each payment received. Start by including sections for the date, payer’s name, amount received, payment method, and a brief description of the transaction.

Ensure the format includes space for sequential numbering to track receipts easily. This helps prevent any confusion in the event of audits or discrepancies. A well-structured template not only ensures smooth operations but also reinforces transparency, making it easier to track payments and reconcile accounts.

Incorporating a section for signatures or initials from both the payer and the receiver can provide an additional layer of verification, ensuring that both parties are in agreement with the details recorded. This step can safeguard against disputes and improve the reliability of the receipts over time.

Here’s an improved version, minimizing word repetition while maintaining clarity and accuracy: A detailed plan for an article about “Template Cash Receipt Book”

Using a template for cash receipts provides a structured approach to record transactions clearly and efficiently. This document acts as a record for payments received, ensuring transparency in financial activities. It helps maintain an organized account of cash exchanges, reducing the likelihood of errors or misunderstandings.

Key Elements of a Cash Receipt Template

- Date: Clearly mark the date of each transaction to keep records timely.

- Receipt Number: Assign a unique number for easy reference and tracking.

- Amount Received: Indicate the exact amount received, ensuring accuracy.

- Payee Information: Include the name or details of the person making the payment.

- Payment Method: Note whether the payment was made by cash, cheque, or another method.

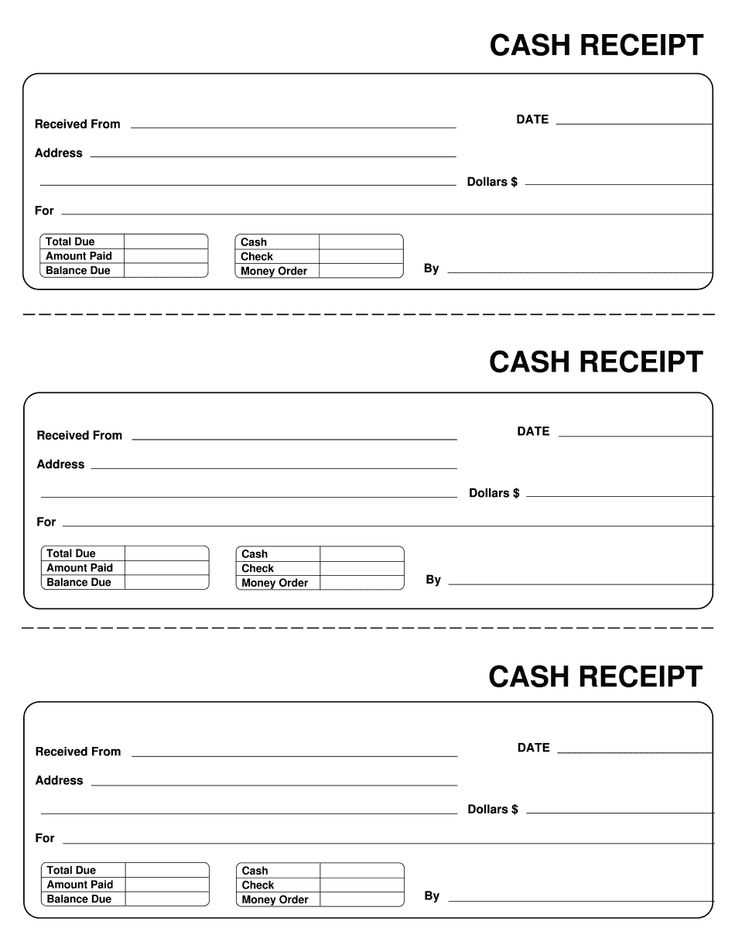

How to Use the Template Effectively

- Consistency: Always use the same format for each transaction to maintain uniformity in records.

- Cross-checking: Verify all data before completing the receipt to avoid errors.

- Digital vs. Paper: Digital templates offer the advantage of easier storage and retrieval, while paper templates can be kept on-site for immediate use.

- Security: For sensitive transactions, consider using secure templates that prevent unauthorized alterations.

Using a template for cash receipts not only organizes transactions but also enhances accuracy and trust in financial reporting.

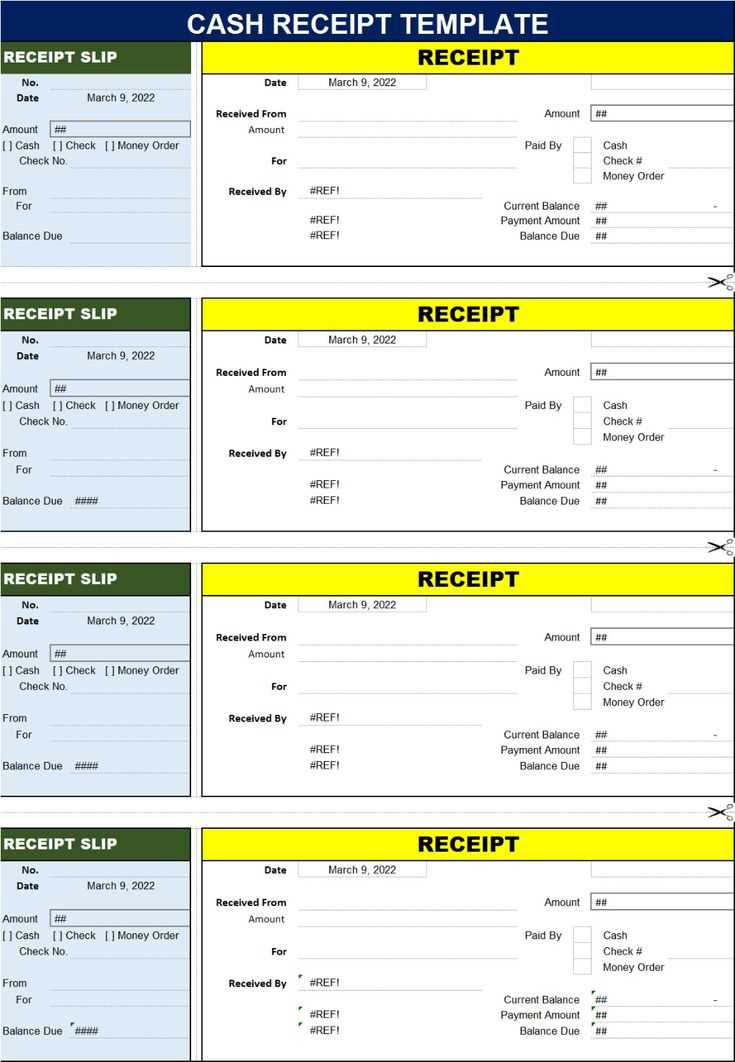

Creating a Custom Format for Your Receipt Book

Choose a layout that suits your business needs. Include a section for the receipt number, which helps track each transaction. Ensure there’s space for the date, client details, and the items or services sold, along with their prices. A clear breakdown prevents confusion and simplifies record-keeping.

Incorporate space for both the total amount and any applicable taxes. This ensures transparency and helps with financial reporting. For added customization, include your logo or business name at the top to make your receipts identifiable. Keep the design clean and professional, avoiding unnecessary details that might clutter the space.

Consider adding a signature line, allowing for client acknowledgment. This can be particularly useful for service-based businesses. Lastly, ensure the format is easy to replicate, whether you’re using a pre-printed book or a digital version. Customizing the receipt book ensures it meets both your operational needs and legal requirements.

Ensuring Legal Compliance and Record Accuracy

Maintain up-to-date records of all transactions in the receipt book, including date, amount, and purpose. These details ensure transparency and help meet legal requirements. Avoid gaps or missing information, as this can raise questions during audits.

Ensure that your receipt book follows local tax regulations. Depending on your location, specific requirements for format, content, and retention periods may apply. Check with local authorities or legal advisors to stay compliant.

Implement a clear system for issuing receipts. For example, assign unique serial numbers to each receipt, which simplifies tracking and cross-referencing records. This will help prevent fraud and errors, and streamline the auditing process.

Store receipt books in a secure place, ensuring that they are protected from tampering, loss, or unauthorized access. Periodically review your system to confirm that records are complete and accurate, and that any discrepancies are promptly addressed.

Best Practices for Managing and Storing Receipts

Keep receipts organized by categorizing them into clear sections, such as personal expenses, business costs, or tax-related items. This method helps you quickly access the right documents when needed.

Digitize Receipts

Scan or photograph each receipt to create a digital archive. Store these images in a cloud service with proper backup procedures to avoid losing important data. Digital copies are easy to search and access on the go.

Label and Date Receipts

Mark each receipt with a label that includes the date and type of purchase. This labeling system makes tracking and retrieval more straightforward. Be sure to date the physical receipt as well to avoid confusion.

Use software or apps that automatically categorize and store your receipts. Many tools integrate with accounting software, allowing for seamless management and real-time updates to your financial records.

Store physical receipts in a dedicated folder or binder. Use dividers to separate receipts by category, and avoid piling them loosely, which can lead to misplaced documents.

Review your receipts regularly to ensure they are up-to-date and properly stored. This prevents pile-ups and ensures that all records are available for auditing or tax purposes.