A well-structured customer receipt form provides clear documentation of a transaction. It simplifies record-keeping, ensures transparency, and helps customers track their purchases easily. A good template should include basic details such as the business name, the date of the transaction, itemized products or services, the amount paid, and payment method. Make sure the form is simple and organized, with space for all required information.

Key elements like the receipt number, customer contact details, and terms of the sale can be added to improve clarity and customer service. By keeping these details consistent across all transactions, you create a reliable system that can be referenced later if needed. This avoids confusion and minimizes errors in your records.

Use a template that’s easy to update and adapt to your business’s needs. Whether you’re dealing with physical receipts or digital versions, having a standardized format saves time and effort. A template also ensures compliance with tax and accounting regulations, which is important for legal purposes.

Finally, be sure your template is user-friendly. Clear fonts, well-organized sections, and space for a signature or any necessary disclaimers can go a long way in making the form practical for both customers and staff. This small detail helps in building a smooth, trustworthy transaction process.

Here’s the revised version:

Make sure the receipt includes the following key details: customer name, date of transaction, items purchased, total amount, payment method, and a unique transaction ID. This ensures both clarity and traceability for both the customer and the business.

Provide space for the business address and contact information, as well as a clear breakdown of any taxes or additional charges applied to the total. Transparency in this area helps avoid confusion and builds trust.

Keep the font readable, using no more than two types of font for the receipt, and ensure there’s adequate spacing between sections. A clean layout contributes to the overall user experience and ensures customers can quickly find the information they need.

Consider including a section for the customer’s signature, if relevant, to confirm the transaction details. This is particularly useful for high-value purchases or where a return policy is in place.

Ensure that the receipt is easy to store digitally, either through email or a QR code. This offers customers a convenient way to access the receipt at any time, especially for returns or warranty claims.

Customer Receipt Form Template

A well-designed receipt form should capture key transaction details clearly and professionally. A simple template helps ensure consistency and legal compliance while saving time during transactions.

How to Design a Simple Template for Your Business

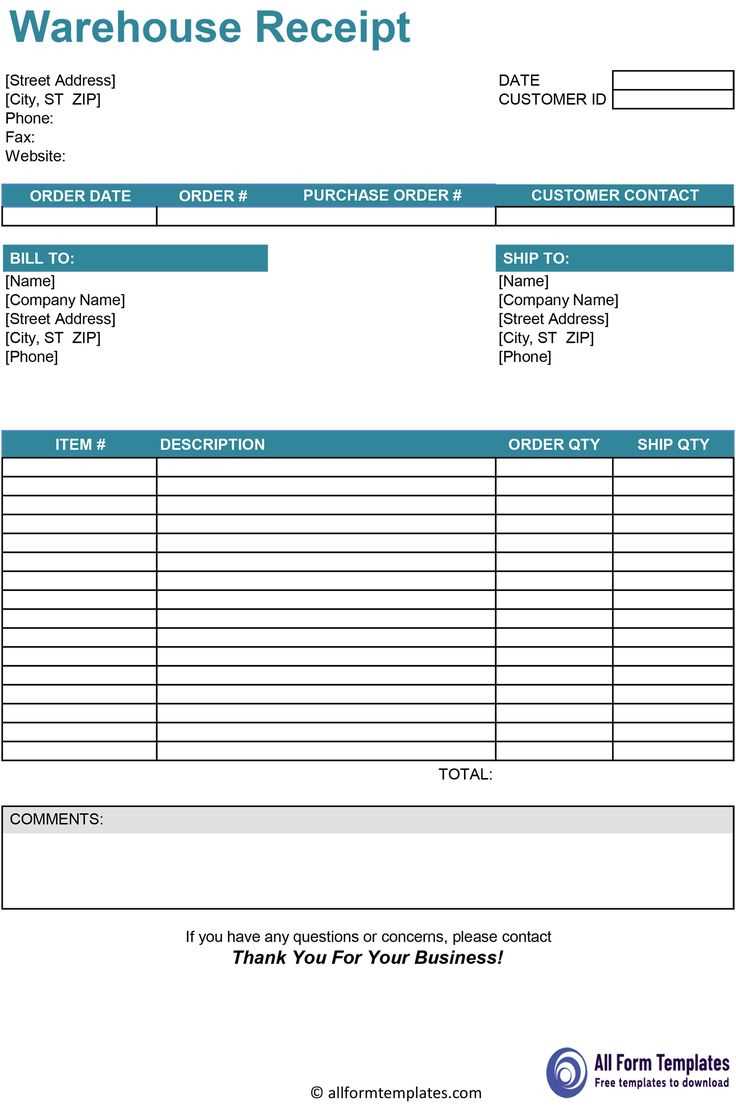

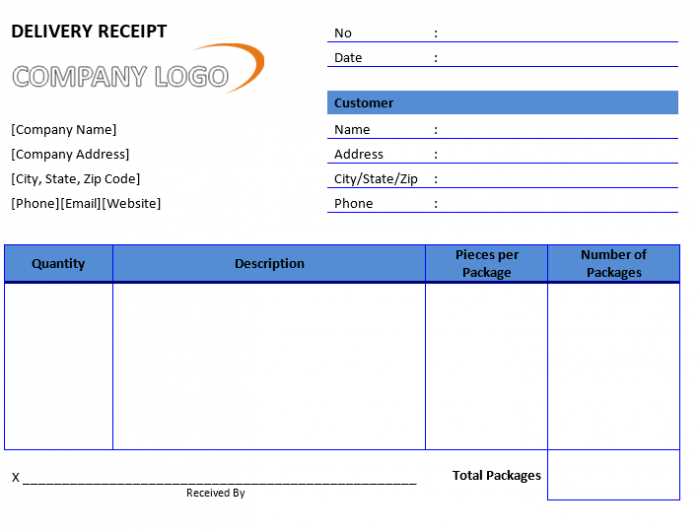

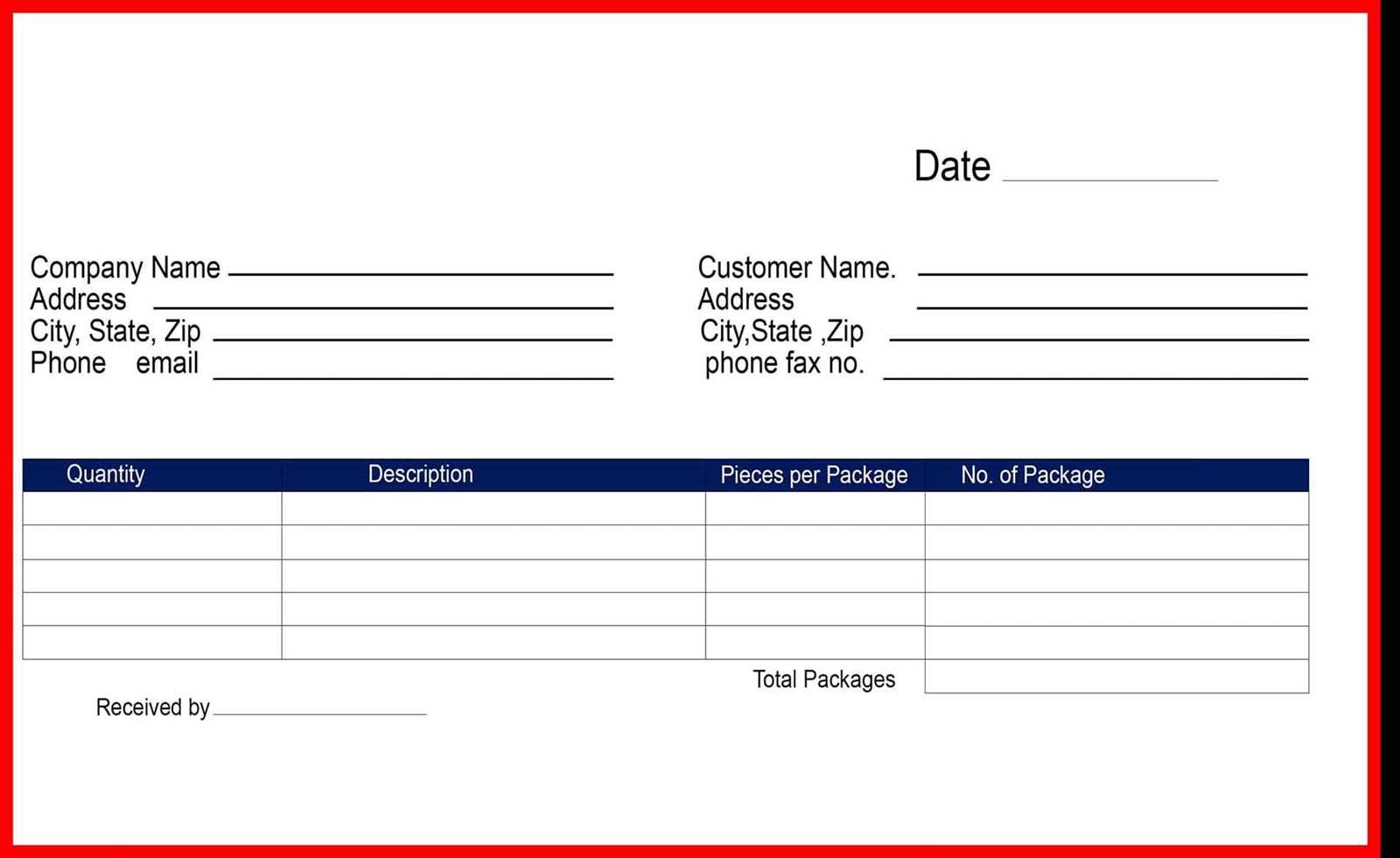

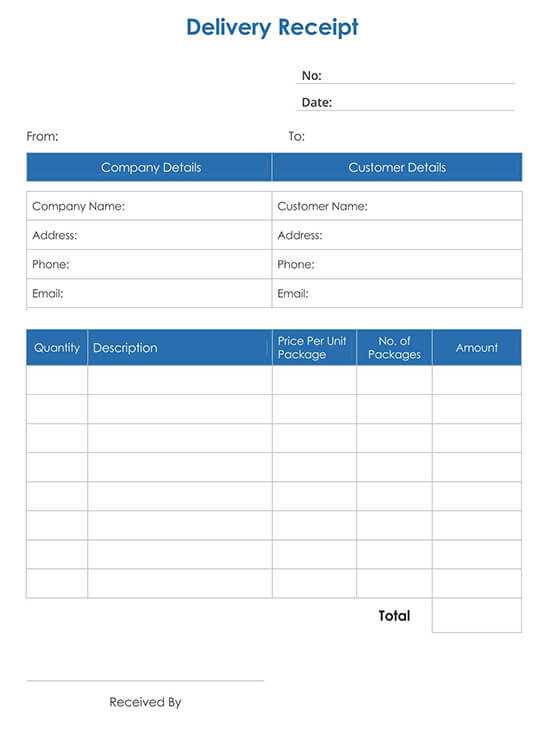

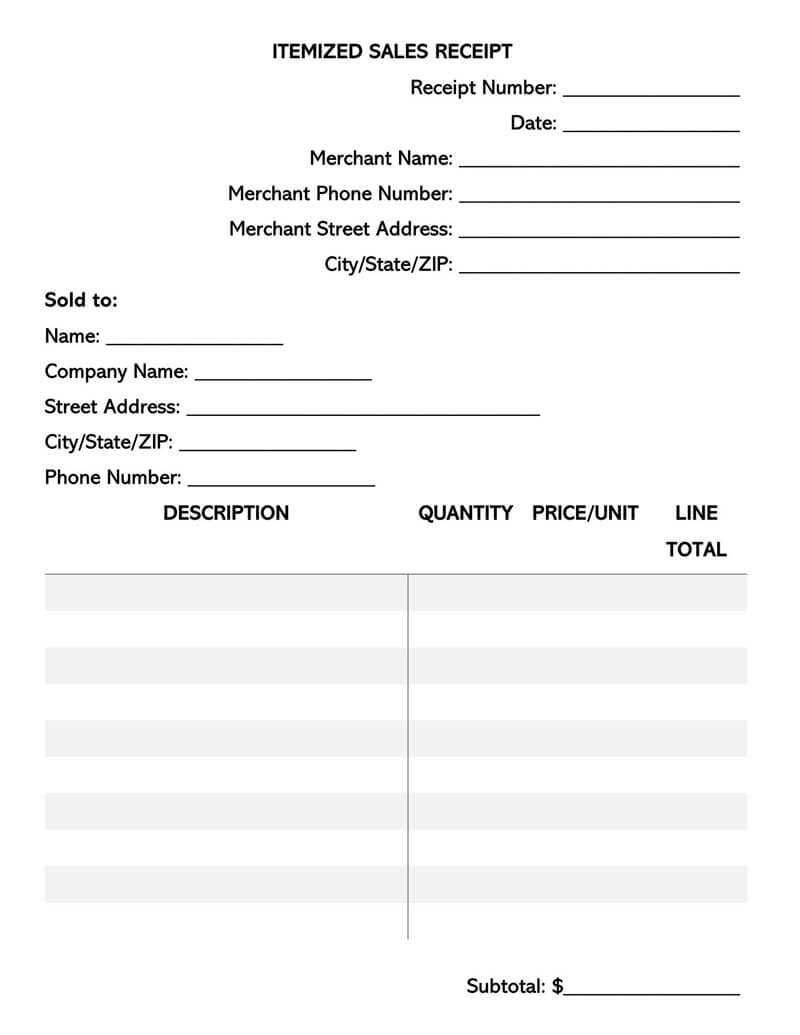

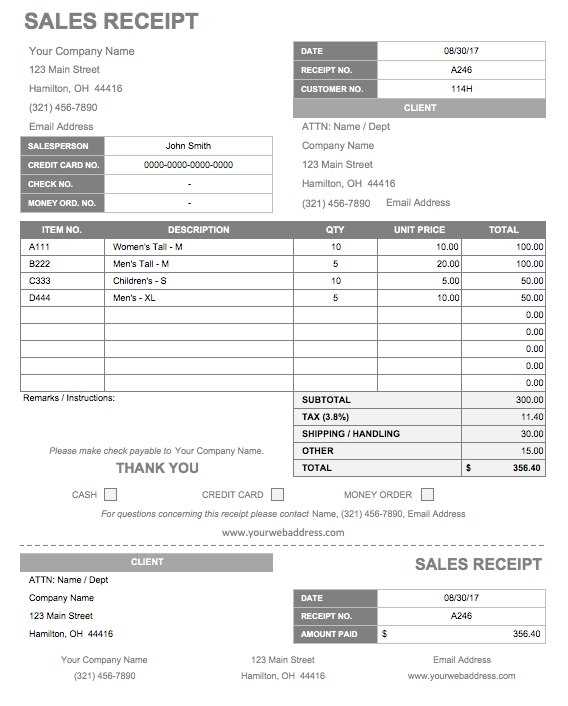

Your receipt template should include sections for basic business details, transaction data, and payment confirmation. Use a clean, legible font with enough spacing to make information easy to read. Start by including your business name, address, phone number, and email at the top of the receipt. Below this, add the date of the transaction and the receipt number for tracking purposes.

Key Elements Every Receipt Should Include

Make sure your template covers the following components:

- Itemized List: Each item or service purchased should be listed with the price, quantity, and total amount.

- Subtotal and Taxes: Clearly display the subtotal, tax amount, and total sum.

- Payment Method: Specify the payment method (cash, card, online, etc.). This helps avoid confusion later.

- Business Identification: Your business name, logo (optional), and contact details are necessary for identification.

By keeping these elements visible and organized, you reduce errors and make the receipt both functional and professional.

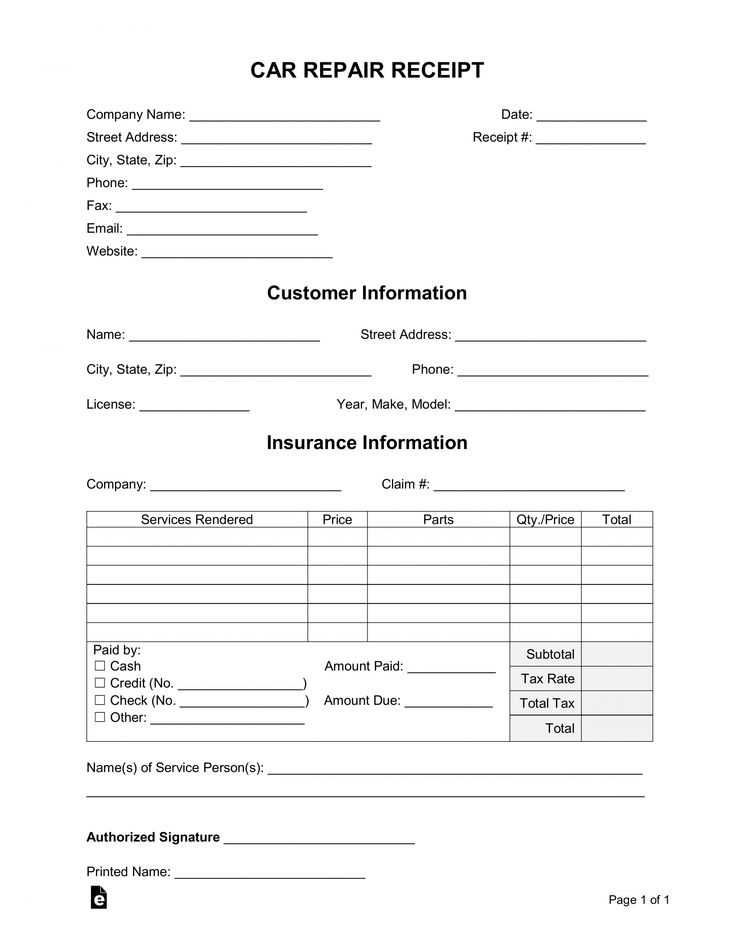

Customizing Templates for Different Payment Methods

If your business accepts multiple payment methods, customize the receipt to reflect the chosen option. For example, if the payment was made by credit card, include the last four digits of the card number and the approval code. For cash payments, note the amount tendered and the change given. With online payments, adding transaction IDs or payment processor details can offer transparency.