Creating a rent receipt spreadsheet helps simplify the tracking of rental payments. A well-organized template allows both landlords and tenants to easily reference payment history, providing clarity and transparency. By structuring your spreadsheet with key information like tenant name, payment date, amount paid, and balance, you’ll avoid confusion and ensure accurate records.

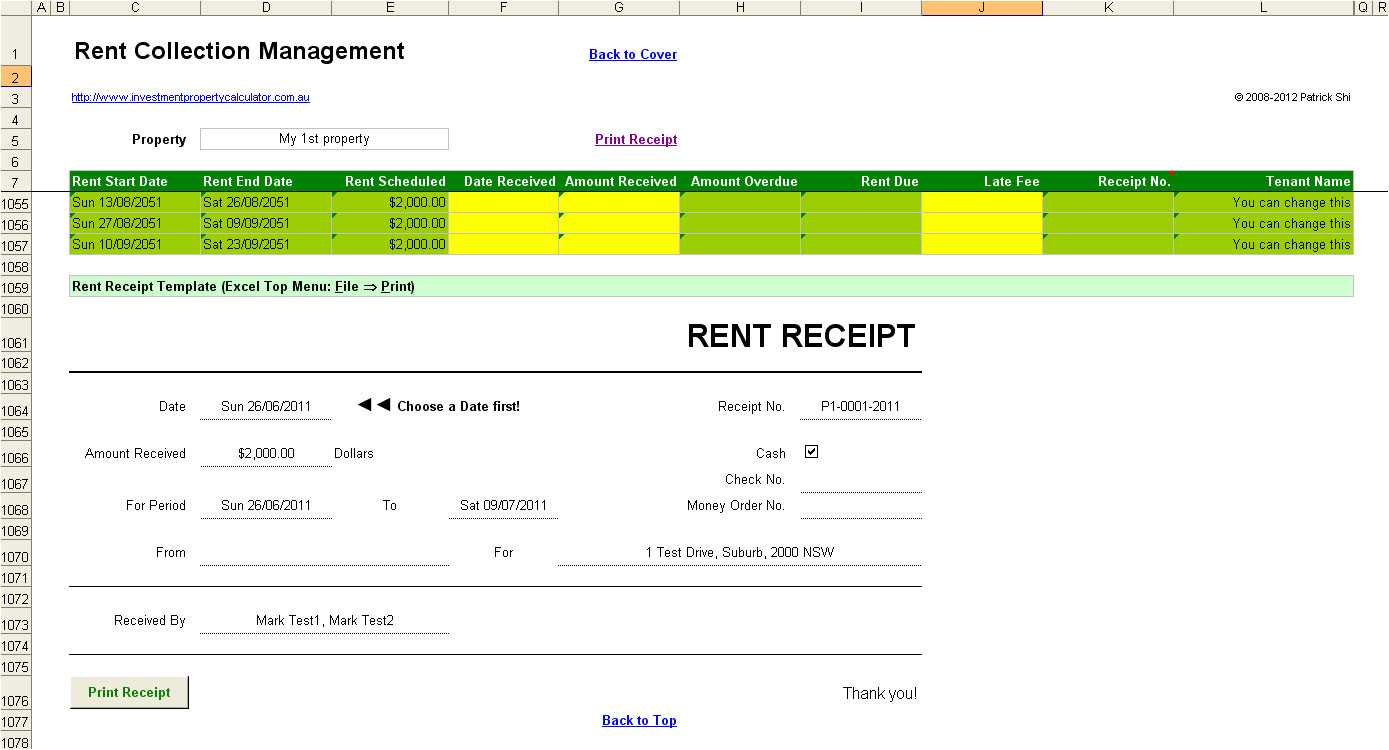

The template should include columns for the tenant’s name, rental period, payment date, payment method, and amount received. Adding a column for any notes, such as late fees or partial payments, can prevent future misunderstandings. For better organization, consider including a total section that calculates the overall income for a given period.

Save time by utilizing a pre-made template that can be customized to fit your specific needs. Choose one with formulas that automatically calculate totals and balances, reducing the chances of errors. This can be a real time-saver during tax season or when preparing year-end reports.

Here’s the updated version:

For a clear and accurate rent receipt, a spreadsheet template can simplify the process of tracking payments. Ensure each entry includes the tenant’s name, rental amount, date received, and payment method. If you want to further streamline the process, adding columns for the due date and any late fees can help you stay on top of payments. Keep formulas in place to automatically calculate totals and ensure accuracy.

Consider color-coding different sections to make the sheet visually clear and easy to read. Use a separate tab for each tenant to keep things organized, and always back up your data in a secure cloud storage to prevent loss.

For consistency, use a uniform date format and include a unique reference number for each receipt. This helps both you and your tenants keep track of payments efficiently.

- Rent Receipt Spreadsheet Template Guide

A rent receipt spreadsheet helps landlords track payments and keep records organized. Below is a guide on how to set up a functional and simple template that can be tailored to your needs.

Basic Structure of the Template

Start by setting up the following key columns in your spreadsheet:

- Tenant Name

- Payment Date

- Payment Amount

- Payment Method

- Property Address

- Month Covered

- Receipt Number (optional for tracking)

Each row represents a separate transaction. This format ensures that all important details are covered in one place.

Creating the Template in Excel or Google Sheets

Follow these steps to create a functional spreadsheet:

- Create a new spreadsheet in Excel or Google Sheets.

- Label the columns as listed above.

- Format the “Payment Date” column as a date field, and the “Payment Amount” column as currency for accurate tracking.

- If you want to automate some tasks, consider adding simple formulas to sum up payments or calculate outstanding balances.

- Use conditional formatting to highlight overdue payments or payments made after the due date.

Example Template Layout

| Tenant Name | Payment Date | Payment Amount | Payment Method | Property Address | Month Covered | Receipt Number |

|---|---|---|---|---|---|---|

| John Doe | 2025-02-01 | $1,200.00 | Bank Transfer | 123 Main St | February 2025 | 001 |

| Jane Smith | 2025-02-05 | $1,250.00 | Cheque | 456 Oak St | February 2025 | 002 |

Once set up, you can easily add new entries and maintain a clean record of all payments. The template is simple, but it allows you to track all key details efficiently.

In case you need more advanced features, you can include options like adding a due date column and calculating outstanding balances automatically using formulas.

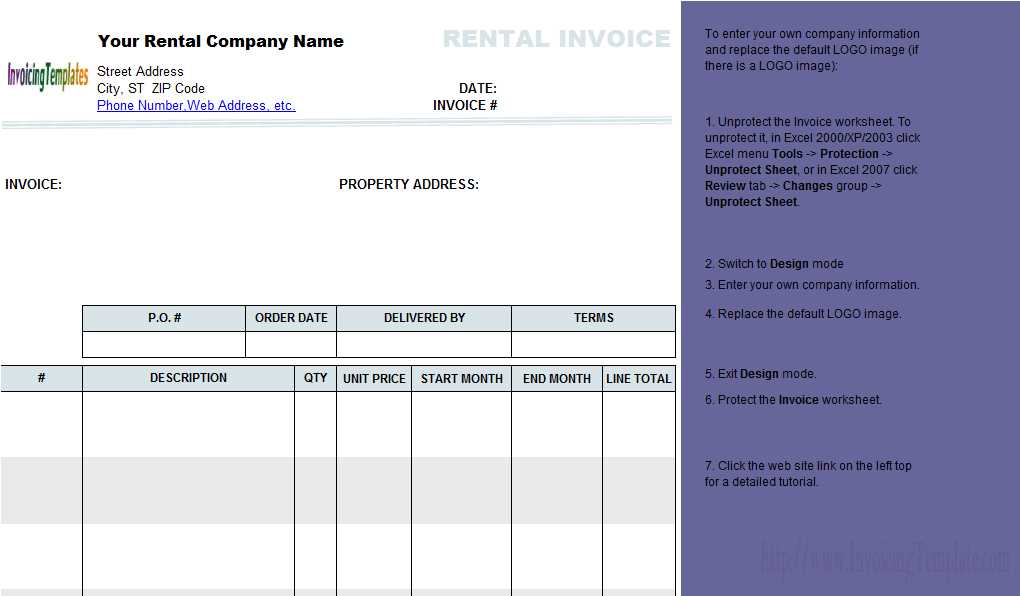

To create a custom rent receipt template in Excel, begin by organizing the key information you need to include: tenant name, rental property address, payment date, payment amount, and payment method. Once you have these details, you can design a simple and effective template for regular use.

Step 1: Set Up the Basic Layout

Create a new Excel file. In the first row, add headers for the following columns: Tenant Name, Property Address, Payment Date, Payment Amount, and Payment Method. Adjust the column widths to ensure all information fits neatly. You may also want to add rows for each rent payment you process.

Step 2: Add Formulas for Totals

If you plan to track payments over time, use Excel’s SUM function at the bottom of the Payment Amount column to calculate the total rent received for each month or year. This can be helpful for both you and the tenant to see payment summaries.

For consistency, use date formatting in the Payment Date column and currency formatting in the Payment Amount column. You can also add conditional formatting to highlight overdue payments or discrepancies.

Once your template is set up, you can save it and reuse it as needed. You can also customize it further by adding your logo, adjusting fonts, or incorporating any other necessary details specific to your rental agreements.

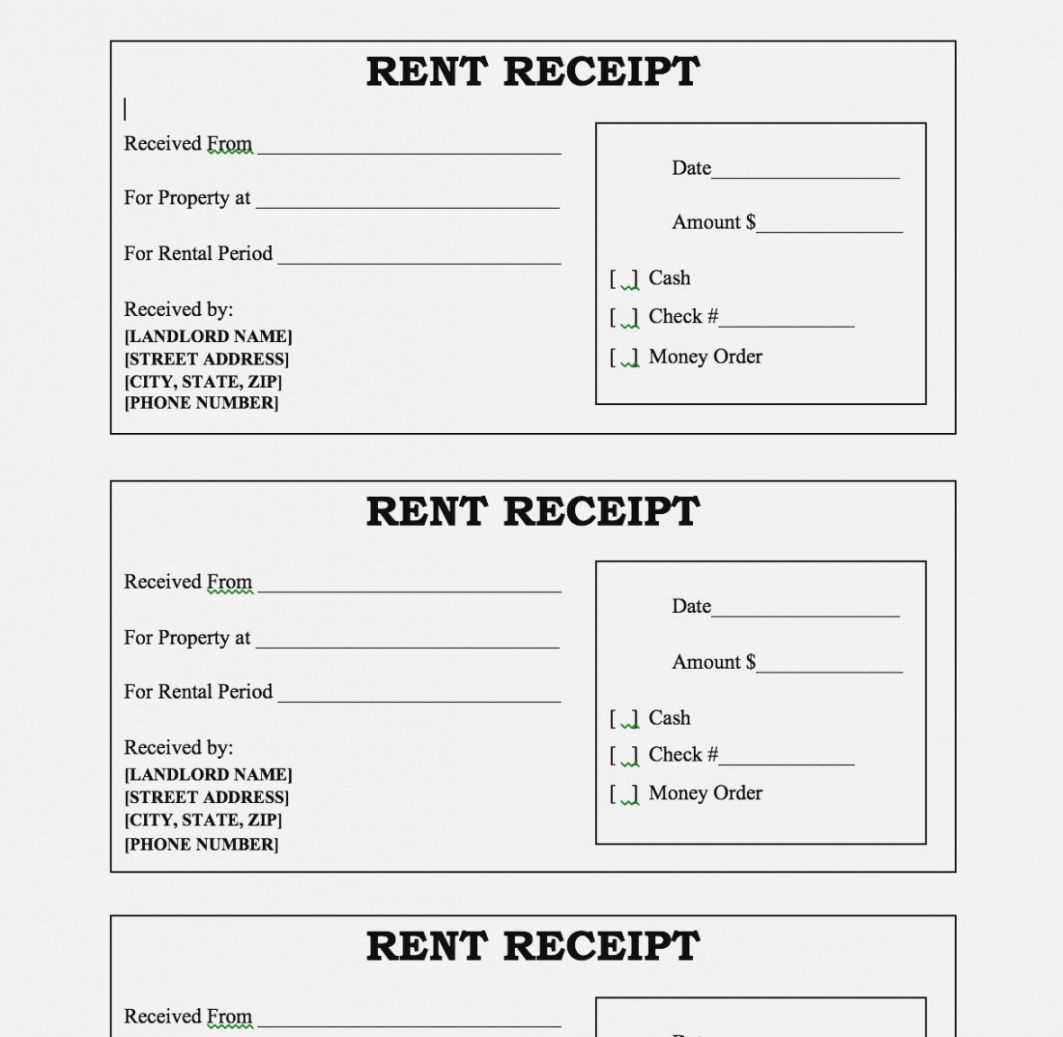

A well-structured rent receipt template helps maintain clarity and transparency for both landlords and tenants. Here’s what to include for accuracy and convenience:

- Tenant and Landlord Information: Clearly list the tenant’s name, address, and contact information, as well as the landlord’s details. This ensures the receipt is properly associated with the correct parties.

- Property Address: Specify the rental property’s full address to avoid confusion, especially if the landlord owns multiple properties.

- Payment Date: Include the exact date the rent was paid. This helps both parties track payments over time and can prevent disputes regarding late payments.

- Amount Paid: Clearly state the total rent amount paid for the given period. If there are additional charges (e.g., utilities, maintenance), list them separately for transparency.

- Payment Method: Indicate how the payment was made (e.g., check, bank transfer, cash). This can help confirm the transaction method in case of discrepancies.

- Rental Period: Specify the start and end date of the rental period covered by the payment. This provides context for the payment and helps avoid confusion about billing cycles.

- Receipt Number: Assign a unique number to each receipt. This allows for easy tracking of payments and serves as a reference in case of future disputes.

- Late Fees (if applicable): If the tenant was charged a late fee, it should be noted clearly on the receipt. This ensures both parties understand the additional cost involved.

- Signature (optional but recommended): A space for the landlord’s signature adds an extra layer of authenticity and accountability to the receipt.

- Additional Notes: If there are any special terms, concessions, or agreements between the landlord and tenant, include a section for this information to ensure transparency.

Formatting Tips

Make sure the receipt is easy to read with clear headings, appropriate spacing, and a logical layout. Organizing the details in a table format or bullet points can enhance clarity.

Use simple formulas to automate tracking. Start by setting up a column for payment dates and another for amounts. Then, in a separate column, calculate the remaining balance by subtracting the payment amount from the total rent due using a formula like: =Total_Rent - SUM(Payment_Amount).

Next, set up conditional formatting to highlight overdue payments. Create a rule that changes the background color for cells where the payment date is older than today and the balance is greater than zero. This instantly draws attention to missed payments.

If you’re using a monthly rent schedule, use the IF function to automatically flag payments that are due. For example, the formula =IF(TODAY()>=Due_Date, "Due", "Upcoming") can label payments as “Due” when the due date is passed, or “Upcoming” when the payment date is in the future.

For recurring payments, use the AutoFill feature to duplicate formulas across rows. This way, as you enter each month’s payment data, the calculations will automatically update without manual input.

Finally, set up a summary section at the top of your sheet that automatically pulls key data. Use functions like SUM to calculate the total amount collected and AVERAGE to track trends in payment consistency. This gives you a quick overview without searching through every entry.

Reducing Redundancy in Rent Receipt Templates

Streamline your rent receipt spreadsheet by focusing on essential data and removing unnecessary repetitions. Here’s how you can achieve this:

- Consolidate Payment Information: Instead of repeating details for every entry, group payments by tenant and period. This reduces space and prevents redundant entries.

- Use Dynamic Date Ranges: Specify rent periods (e.g., monthly, quarterly) once and update the template as needed. This eliminates multiple entries for each individual payment.

- Standardize Descriptions: Use predefined categories for services and charges (e.g., “Rent,” “Utilities,” “Late Fee”) to avoid writing out descriptions each time. This keeps the document clean and concise.

- Include Auto-Calculations: Set up formulas to automatically calculate totals, taxes, or late fees. This not only cuts down on manual work but also eliminates repetitive data entry.

By following these steps, you can significantly reduce redundancy and maintain clarity in your rent receipt spreadsheet.