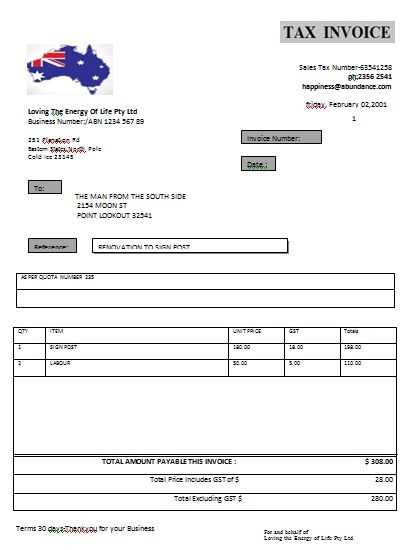

To create a tax invoice receipt in Australia, ensure it complies with the Australian Taxation Office (ATO) guidelines. The template should clearly display the seller’s details, including the business name, ABN (Australian Business Number), and contact information. It must also include the buyer’s details, a description of the goods or services, and the total amount paid. Ensure the document specifies whether GST (Goods and Services Tax) is included or excluded.

The invoice number must be unique, and the date of issue should be accurately noted. For transparency, it’s important to break down the cost, showing the GST amount if applicable. Make sure to include a clear payment method and terms, so the buyer understands when and how to settle the invoice.

Always double-check that the tax invoice contains all mandatory information, as this will ensure compliance with Australian tax laws and provide a reliable record for both parties involved. Keep the template simple, clear, and professional to facilitate smooth transactions and avoid any potential misunderstandings.

Tax Invoice Receipt Template Australia

To create a tax invoice receipt for use in Australia, ensure it meets the requirements outlined in the ATO guidelines. The key elements that must be included are:

- Seller’s name or business name and ABN (Australian Business Number)

- Invoice number for tracking purposes

- Date of issue

- Description of the goods or services provided

- Quantity or volume of the goods or services

- Price per item or service

- Total amount payable (including GST, if applicable)

GST and Taxable Amounts

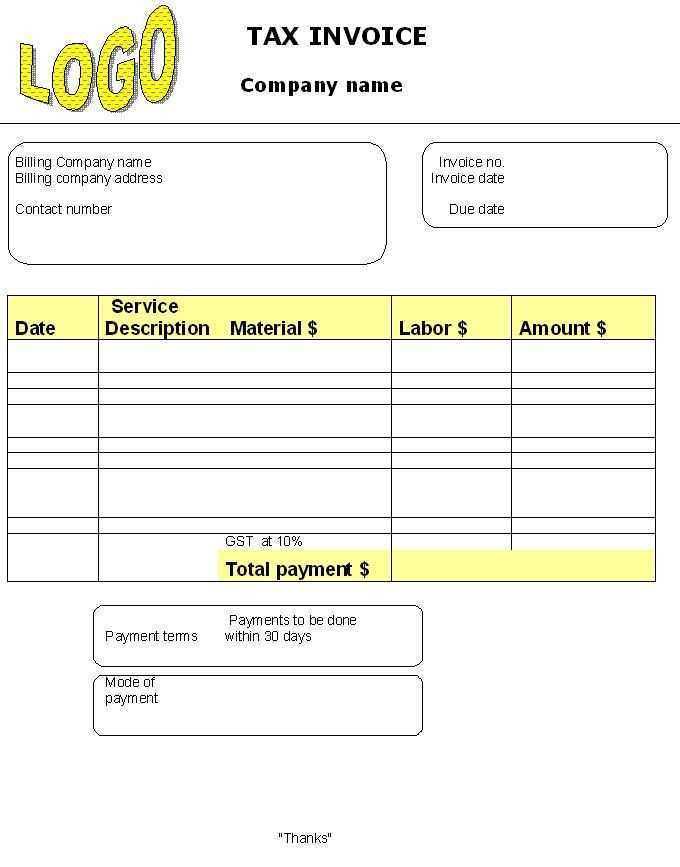

If the business is registered for GST, make sure the tax amount is clearly identified. This includes stating the total amount of GST included in the price. For example, you can indicate “GST included” or list it separately in the invoice details. If no GST is applicable, note that the invoice is GST-free or exempt where relevant.

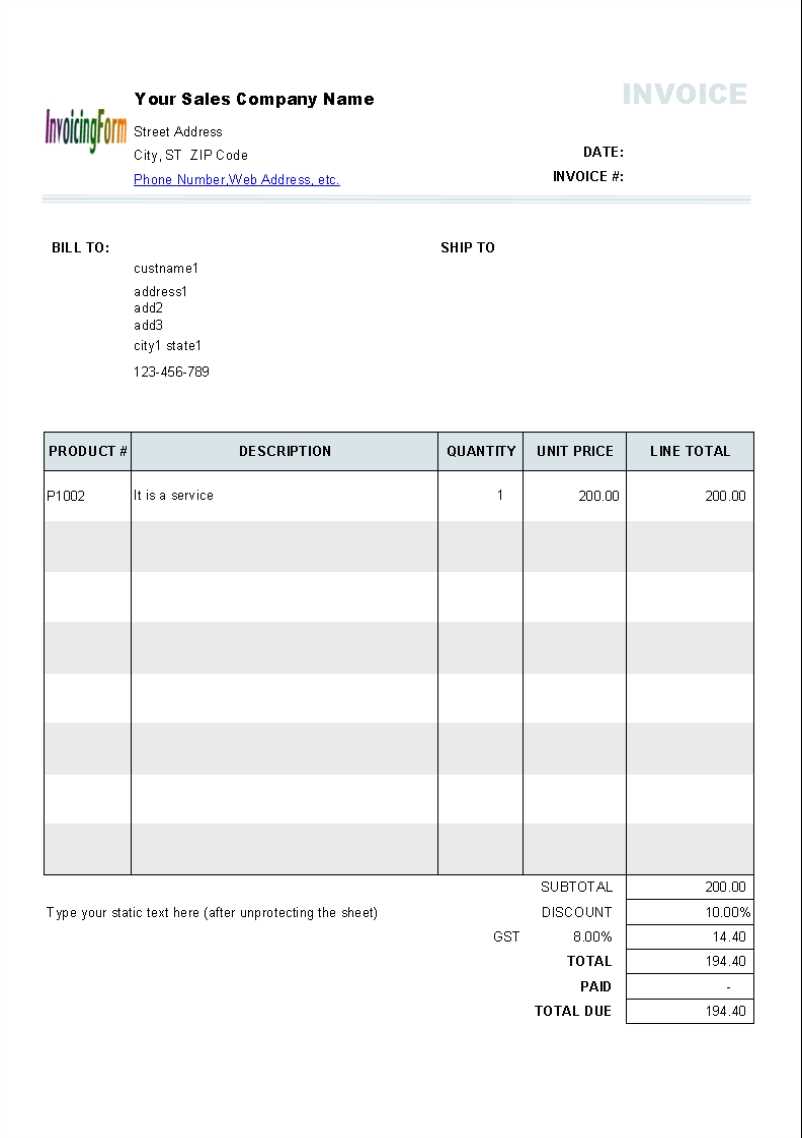

Designing the Template

When designing the template, ensure it is easy to read and structured. Start with a header that includes the business details. Follow with a section detailing the products/services, then the pricing. Conclude with the total amount, tax, and payment terms. Clear, logical flow will enhance clarity and ensure compliance.

How to Structure Key Elements in a Tax Invoice

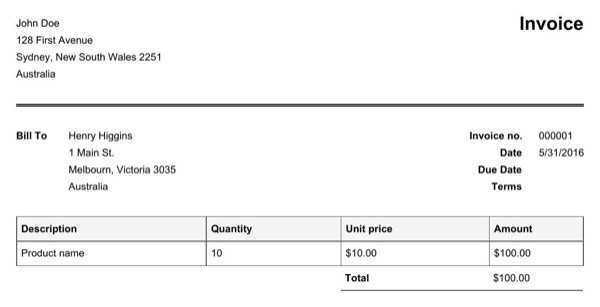

Place the date of issue at the top of the invoice. This is a crucial reference point for both the buyer and the seller. Include the invoice number immediately below the date. Each invoice should have a unique, sequential number for easy tracking and compliance with tax laws.

Seller and Buyer Details

Clearly list the seller’s name, business name, and contact details, including the ABN (Australian Business Number). Similarly, provide the buyer’s name or business name and their contact information. If applicable, include the buyer’s ABN for easier identification of business transactions.

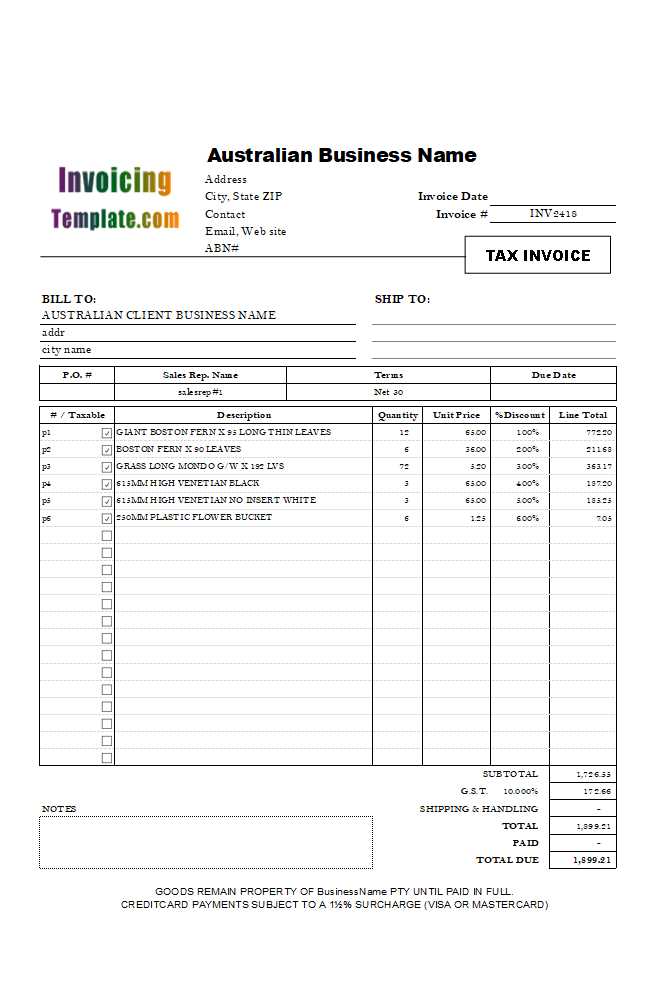

Itemized List of Goods or Services

Include a breakdown of each product or service provided. For each line, state the quantity, description, and the unit price. Ensure there’s clarity in the product or service description to avoid disputes later. If there are discounts or promotional offers, make sure to specify them.

Tax Information: Clearly indicate the GST amount for each line item, if applicable. The total GST should be added at the bottom of the invoice to show the total tax charged.

Terms of Payment should be listed next. Include the due date for payment and any penalties for late payments. It’s helpful to specify payment methods that are accepted, such as bank transfers, credit cards, or PayPal.

Customizing Your Template for Different Business Types

Adjust your tax invoice template to reflect the specific needs of your business type. For example, if you operate in a service-based industry, focus on adding detailed descriptions of the services provided, including hourly rates or project milestones. This ensures transparency and helps clients understand the value they’re receiving.

For Retail Businesses

Retail businesses should include product codes, quantities, and unit prices in their invoices. It’s helpful to group similar items together and display discounts or promotions clearly. Adding a section for sales tax and shipping charges is also common in retail invoices, ensuring customers can see the total cost breakdown.

For Contractors or Freelancers

Freelancers and contractors benefit from including a clear timeline of work completed and any additional expenses incurred during the project. A payment schedule with milestones or a due date for the full balance can help manage cash flow and set expectations for both parties.

Legal Considerations for Tax Invoices in Australia

Ensure your tax invoice complies with the Australian Taxation Office (ATO) requirements to avoid penalties and disputes. A valid tax invoice must include specific details to be considered legally binding.

- Supplier’s Information: The supplier’s name and Australian Business Number (ABN) must be present on the invoice. Without this, the invoice may not be recognized for GST claims.

- Invoice Date: The date the invoice is issued must be clearly stated. This is crucial for determining the timing of GST obligations.

- GST Breakdown: If your business is registered for GST, the amount of GST charged must be separately displayed on the invoice. This allows the buyer to claim GST credits.

- Description of Goods or Services: Provide a clear description of the goods or services supplied, along with their quantity and price. This ensures transparency in transactions.

- Invoice Number: Each invoice must have a unique identifier. This helps in record-keeping and auditing processes.

Failure to include the necessary details may result in the invoice being deemed invalid for GST purposes. Keep accurate records and issue correct invoices to comply with ATO regulations.