If you’re looking to streamline your accounting or business transactions, using the right receipt template can save you time and effort. A well-designed template helps ensure that all the necessary details are captured accurately, leaving no room for confusion. This is particularly important for UK-based businesses, where specific information is legally required to comply with tax regulations.

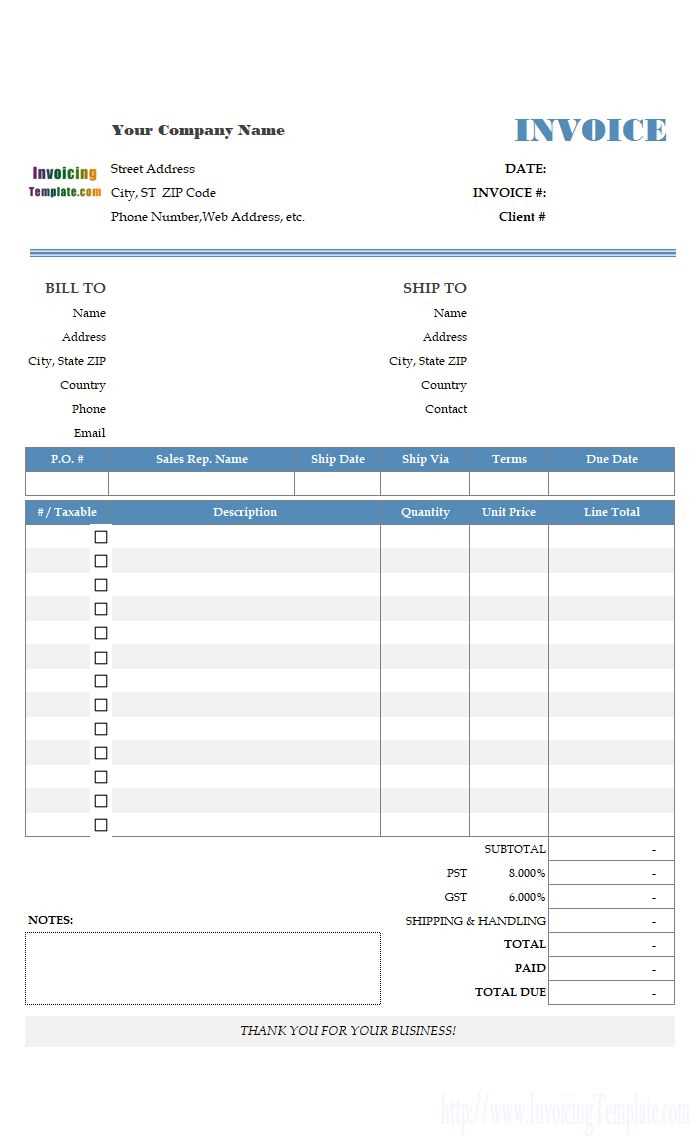

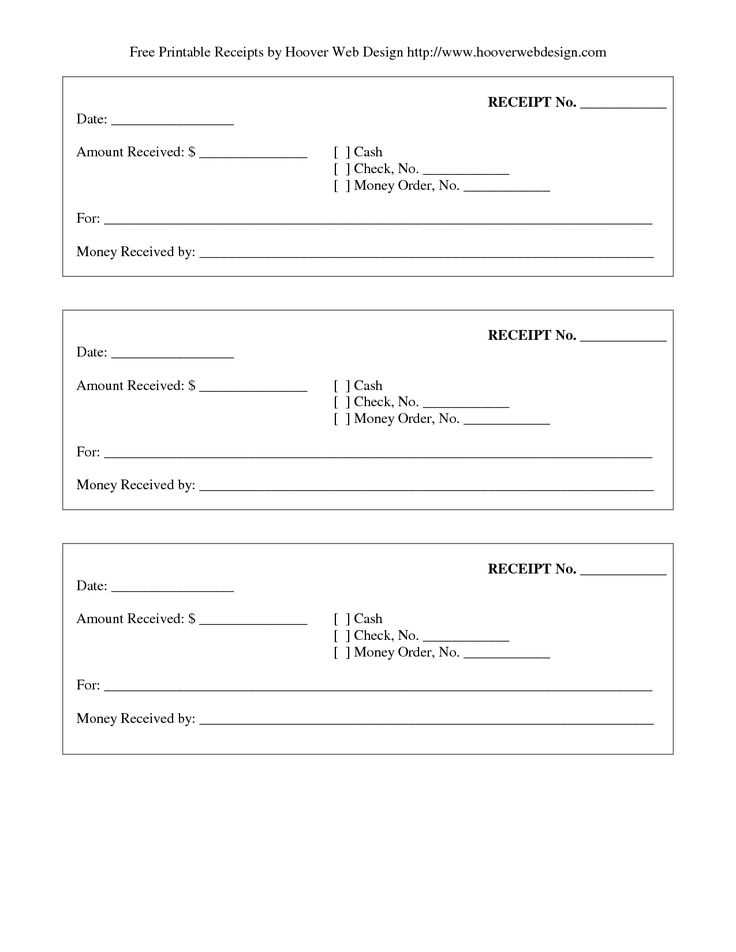

Using a pre-made receipt template tailored to UK standards can simplify this process. Make sure to include key elements such as the business name, address, VAT number (if applicable), and a clear breakdown of the products or services purchased. Additionally, a template that auto-generates the date and unique receipt number will save you from manual entry and reduce the risk of mistakes.

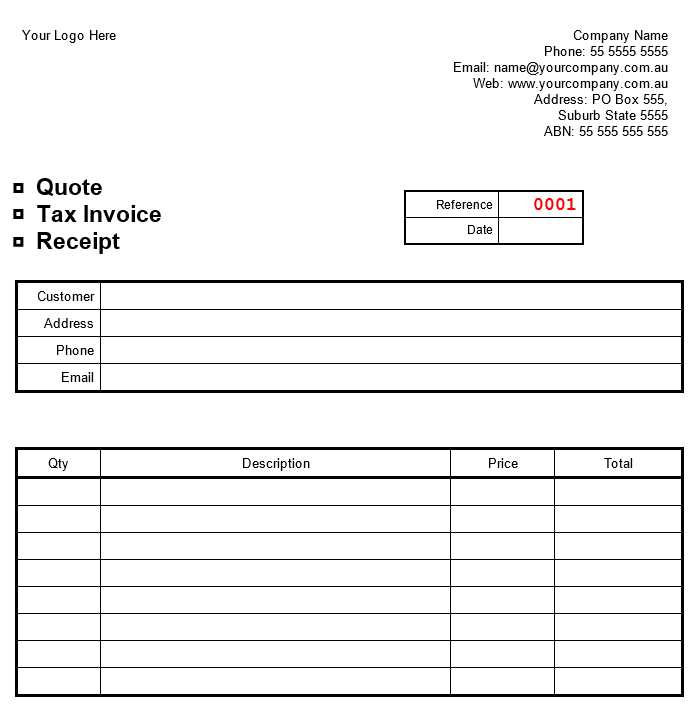

Don’t forget to choose a template that’s easy to customise, allowing you to add your branding and specific payment details. Customisation not only enhances professionalism but also gives your receipts a personal touch. Whether you’re running a small business or freelancing, having a reliable and consistent receipt system can make invoicing more efficient and help you maintain clear records for tax purposes.

Receipt Templates UK

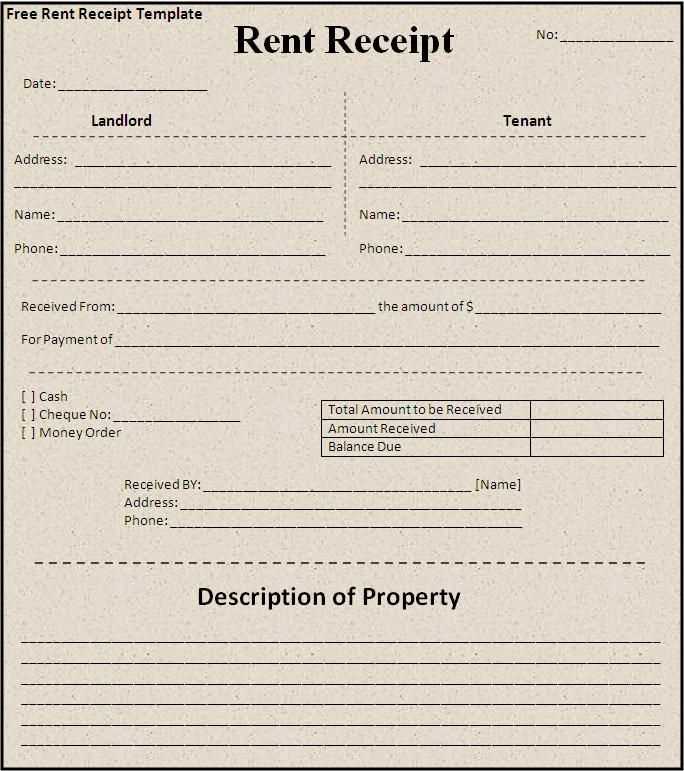

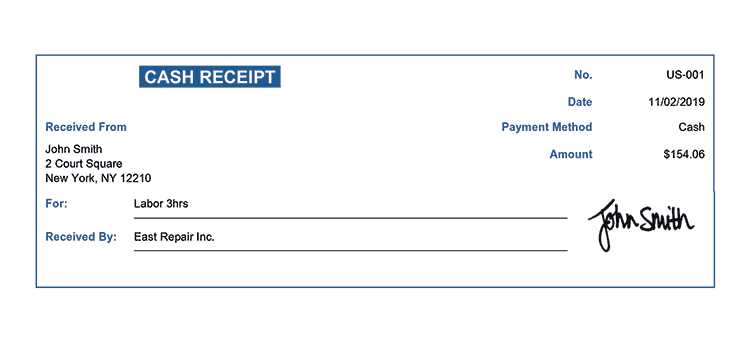

To create a proper receipt in the UK, start with a template that covers all required details. Make sure it includes the business name, contact information, and the VAT number if applicable. The total amount paid, item description, and date should always be present. Templates tailored for UK businesses often include fields for transaction type and payment method, which helps keep records organized and compliant with tax regulations.

If you’re unsure about how to structure a receipt, consider using pre-made templates that you can fill out easily. Many online platforms offer downloadable formats, such as Word or PDF, that meet UK standards. These templates often come with built-in sections for customer names and addresses, as well as fields for applying discounts or taxes, making it easier to handle different types of transactions.

For businesses that need to generate receipts regularly, using an automated tool or software could save time and reduce errors. Some tools allow you to customize templates to match your branding, including adding logos, custom colour schemes, or specific wording. Additionally, make sure that your template is flexible enough to handle both cash and card payments.

Be mindful of the specific requirements set out by HMRC. Including correct details like VAT rates is important for tax reporting. Also, remember that if you’re running a business and issuing receipts, keeping a copy for your records is necessary for accounting purposes and may be required during tax audits.

How to Choose the Right Receipt Template for Your Business in the UK

To pick the right receipt template for your business, first assess the specific details you need to include. Make sure the template allows you to add essential information such as your business name, address, contact details, and VAT number if applicable. Check if the template supports including item descriptions, quantities, prices, and any relevant taxes, such as VAT. These fields should be easy to customise based on the type of transaction you’re processing.

Consider Your Business Type

If you’re in retail, opt for a template that is straightforward and focuses on itemised lists, prices, and tax breakdowns. Service-based businesses may need more flexibility for adding notes or specific service descriptions. Look for a template that aligns with the needs of your particular industry, ensuring it can handle the specific details your transactions require.

Look for Compliance with UK Tax Regulations

Ensure the receipt template complies with UK tax laws. For VAT-registered businesses, the template must include a VAT breakdown, showing the total amount of VAT charged. The template should also be able to generate a unique receipt number for each transaction. This is important for keeping accurate records and staying compliant with HMRC’s requirements.

Check for templates that allow for easy digital and physical copies, as some businesses may need to email receipts or print them on-site. The template should fit your business’s operation style and provide you with the flexibility you need.

Customising Your Receipt Template for Different Transactions

Tailor your receipt template to suit the specific details of each transaction. This ensures clarity and prevents confusion for both you and your customers.

1. Sales Transactions

For standard sales, include basic information like the date, item description, quantity, price, and total. Add fields for tax rates and total tax paid if applicable. Here’s what to consider:

- Itemized list of products/services sold

- Price per item, quantity, and subtotal

- Tax breakdown (if VAT applies)

- Total amount (including tax)

- Payment method (cash, card, etc.)

2. Refunds and Exchanges

Refund and exchange receipts need to clearly show the original transaction and the adjustments made. Include:

- Original receipt number or reference

- Reason for refund or exchange

- Amount refunded or exchanged

- Adjusted total (if applicable)

- Any restocking fees (if applicable)

By customising these sections, you ensure transparency and accuracy for both the customer and your accounting records.

Legal Requirements for Receipts in the UK: What You Need to Include

In the UK, receipts must contain certain details to be legally valid. Here’s what you must include:

1. Date and Time of Transaction

A receipt should clearly show the date and time of the transaction. This is crucial for record-keeping and may be required for returns or exchanges.

2. Business Details

The name, address, and contact information of the business issuing the receipt must be included. This provides transparency and ensures that customers can reach the business if needed.

3. Description of Goods or Services

A clear description of the goods or services purchased should be listed, along with their quantity and price. For businesses that sell multiple items, each item should be listed separately with its price.

4. Total Amount Paid

The total amount paid, including taxes, must be indicated on the receipt. If VAT is applicable, the amount of VAT should be shown separately.

5. Payment Method

The receipt should specify the payment method used, whether it’s cash, credit card, or other payment types. This helps confirm how the transaction was completed.

Keeping these details in mind will ensure your receipts are compliant with UK legal requirements.