Make your donation acknowledgment clear and professional by using a simple and effective template. This letter confirms receipt of a donation and expresses gratitude, which helps to maintain a positive relationship with donors. It’s important to specify the donation details, including the amount and date, to avoid confusion later on.

Ensure the letter includes a personalized thank you message. Tailor the note to reflect the donor’s generosity and impact. This shows appreciation and encourages continued support.

Additionally, include any relevant tax information, if applicable. Donors often require proof for their records, so it’s beneficial to mention the charitable status and tax-deductible nature of the donation. For greater transparency, be specific about how the donation will be used.

Receipt of Donation Letter Template

Start your donation acknowledgment letter by clearly stating the donor’s information and the donation details. This makes the letter both personal and professional.

- Donor’s Name: Ensure you use the correct and full name of the donor.

- Date of Donation: Clearly mention the date when the donation was received.

- Amount or Description of the Donation: State the value of the monetary donation or provide a description if it was an in-kind gift.

- Tax Deductibility Status: Inform the donor if their donation is tax-deductible and any applicable information related to that.

Be specific about how the donation will be used. This builds trust and shows transparency with your donors.

- Purpose of the Donation: Briefly describe how the donation will contribute to your cause.

- Impact of the Donation: Let the donor know how their contribution will make a difference.

Close the letter by thanking the donor for their generosity and support. Always make sure the closing is warm and personalized, leaving a lasting positive impression.

- Closing Remarks: End with a sincere thank you and invitation for future support.

- Signature: Include your name and position within the organization for authenticity.

How to Format a Donation Acknowledgment Letter

Begin by addressing the donor personally. Use their full name or preferred title to make the letter feel genuine. Start with a clear statement of gratitude for the donation, specifying the amount or item received. This shows the donor that their contribution is recognized and appreciated.

Include a brief description of how the donation will be used. Donors are more likely to feel valued when they understand the impact of their support. Specify the project or cause their donation will help, keeping it relevant and specific.

Follow up with a formal closing. Acknowledge their continued support, and offer an invitation to stay connected or involved with future activities. End with a warm expression of thanks, such as “With sincere gratitude” or “Thank you for your generous support.”

Don’t forget to include the organization’s contact information at the end for any questions or follow-up. Providing a phone number or email ensures they can reach out if needed.

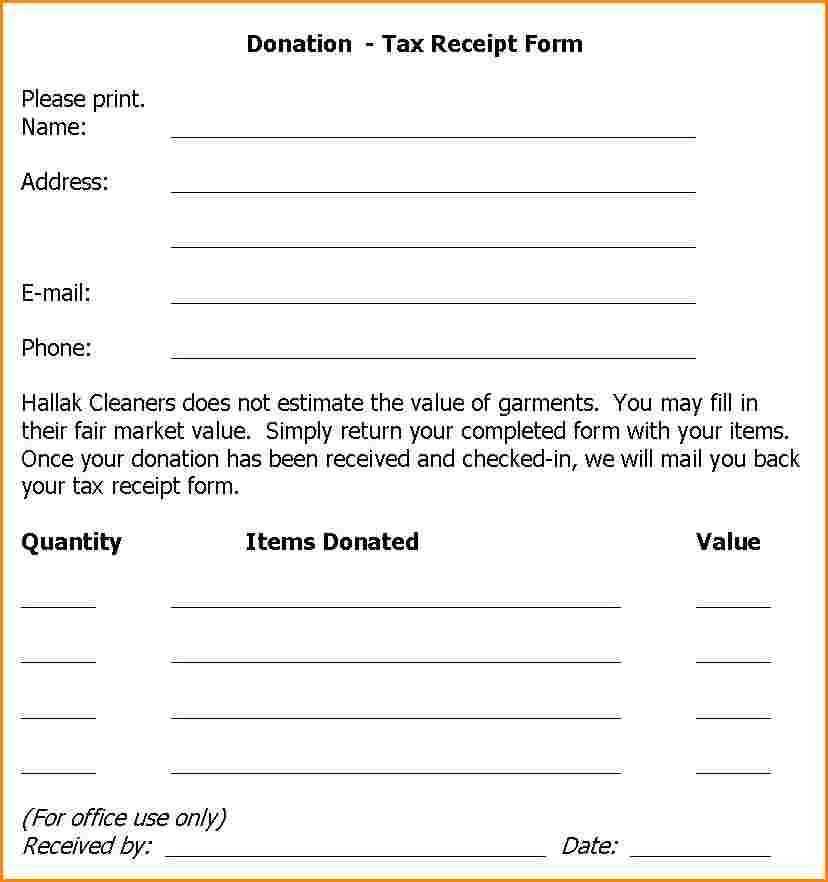

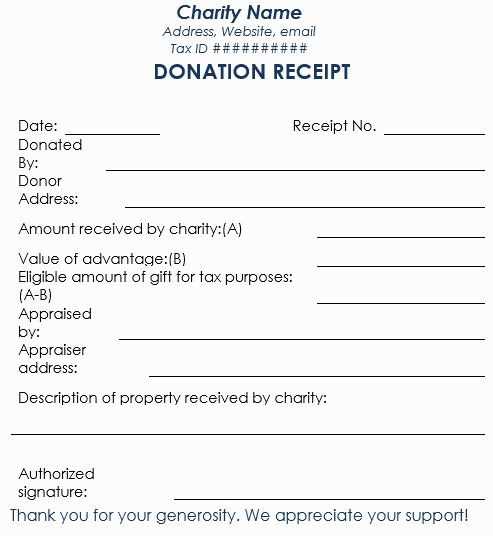

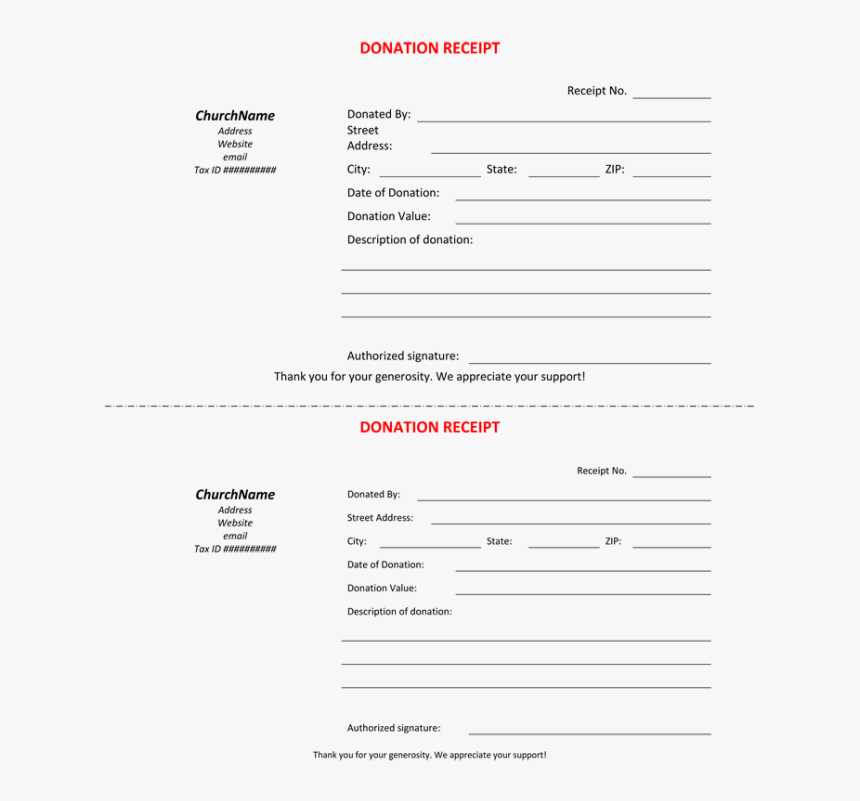

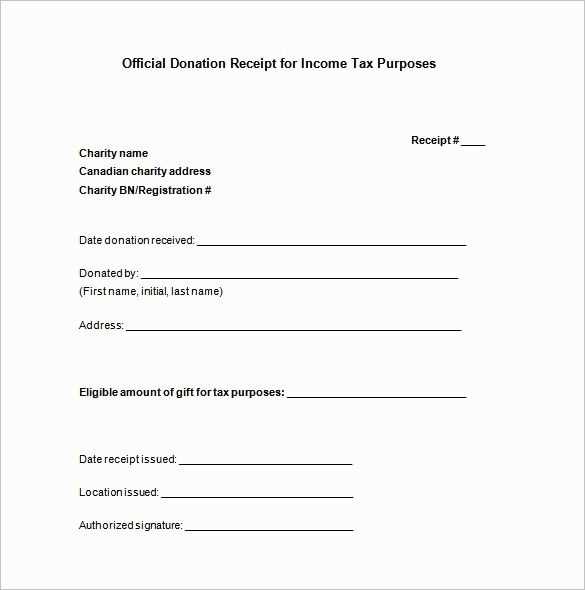

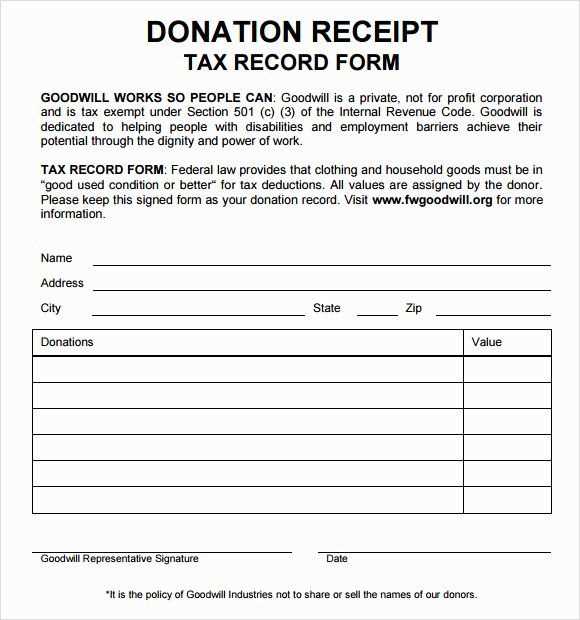

Key Information to Include in the Receipt

Include the donor’s full name, address, and contact details. This ensures proper record-keeping and allows for easy communication when needed.

Specify the donation amount or a clear description of the donated item. If a monetary donation was made, note the exact amount. For non-monetary gifts, provide a detailed description, including quantity and condition if applicable.

Clearly state the date the donation was received. This helps both the donor and your organization maintain an accurate timeline of donations for tax or other record-keeping purposes.

Tax Information and Deductibility

If the donation is tax-deductible, include a statement indicating the donor’s eligibility for a deduction. Specify whether any goods or services were exchanged for the donation and their value, as this affects the deductible amount.

Organization Details

Include the full name of the organization, its address, and the tax-exempt status, if applicable. This information assures the donor of the legitimacy of the transaction.

How to Customize the Donation Letter for Different Scenarios

Tailor your donation letter based on the donor’s relationship with your organization. For repeat donors, highlight their past contributions and how their support has made a difference. This personal touch reinforces their impact and encourages continued involvement.

For New Donors

When addressing new donors, introduce your organization and its mission clearly. Use a warm tone to make them feel welcomed and appreciated right from the start. Let them know how their first donation will be used and the difference it will make.

For Corporate Donations

Corporate donors require a more formal tone. Acknowledge their corporate social responsibility and explain how their support aligns with their business values. Include any recognition or benefits they may receive in return, such as public acknowledgment or tax benefits.

Always include a thank you statement that reflects the donor’s level of involvement. Acknowledge large contributions with a special mention or certificate of appreciation, while smaller donations can be appreciated with a heartfelt message that highlights the significance of their support.