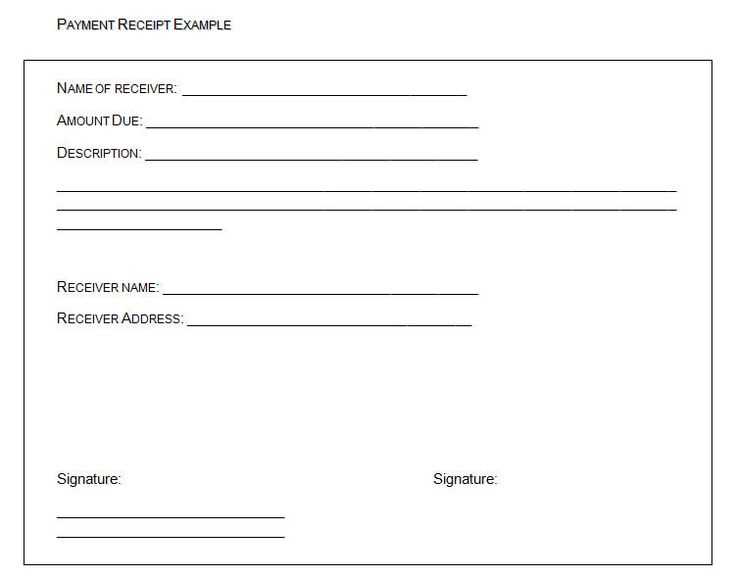

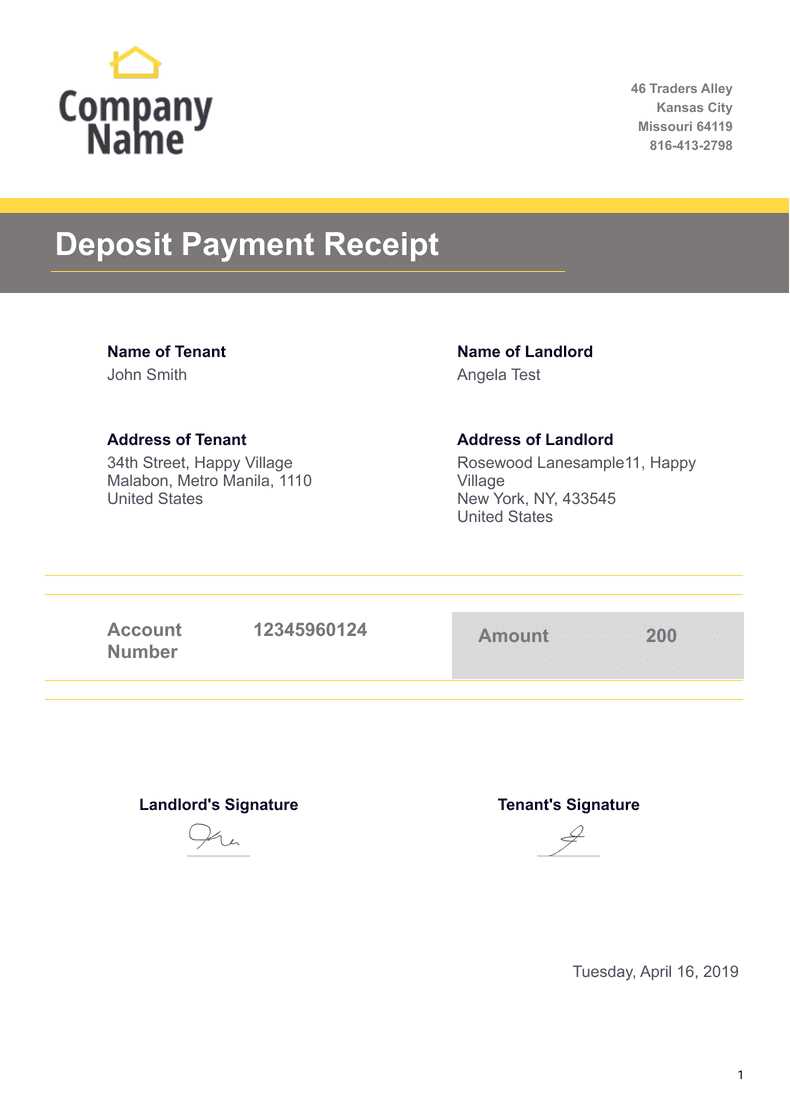

When you receive a deposit payment, it’s crucial to provide a clear and concise receipt that outlines the transaction details. A well-structured receipt not only serves as proof of payment but also ensures both parties understand the terms of the agreement. The following template can be customized to fit various situations, whether it’s a rental deposit, service fee, or advance payment.

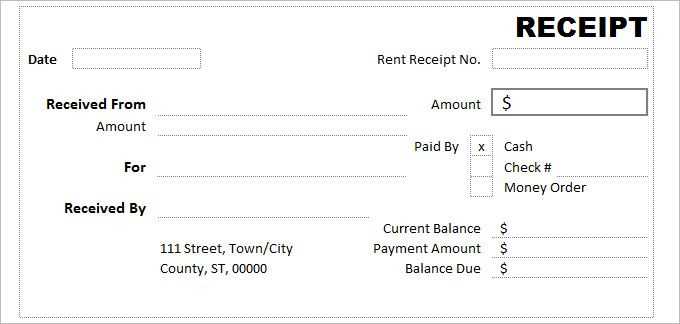

Start with the payer’s name and contact information, followed by the amount received. Be sure to specify the payment method, such as cash, check, or bank transfer. Include the date and a unique receipt number for easy reference. Then, describe the purpose of the deposit and the terms associated with it, such as refund conditions or deadlines.

Finish the receipt by providing your own details–business name, address, and contact info. This ensures transparency and makes it easier for the payer to reach out in case of any queries. Adding a section for signatures from both parties can further confirm the agreement.

Here are the corrected lines:

Make sure the date format is consistent across all sections. Use the “DD/MM/YYYY” format, especially in deposit receipts, as it eliminates confusion and aligns with international standards.

Adjust the wording in the deposit confirmation section. Replace “Receipt is sent” with “Deposit has been received.” This makes the statement clearer and more formal.

Payment Details

Be specific about the payment method. Instead of saying “Payment method: Bank Transfer”, indicate the exact method, such as “Payment method: Bank Transfer via IBAN” or “Payment method: Credit Card (Visa, MasterCard, etc.).” This ensures transparency.

Receipt Number

Ensure the receipt number is formatted uniformly. Use a unique number for each transaction, like “Receipt #123456.” This makes referencing easier and reduces errors in tracking deposits.

Double-check the amounts for any discrepancies in the deposit total. Ensure the currency is correctly noted and aligns with the payment details.

Finally, verify the recipient’s details–full name, company name, or organization name. Missing information can lead to confusion or processing delays later on.

Template for Deposit Payment Receipt

To create a clear and reliable deposit payment receipt, it’s important to include specific details that confirm the transaction. The following template includes all necessary elements for a simple, yet informative receipt.

Key Components of a Deposit Payment Receipt

- Receipt Number: Assign a unique identifier for easy tracking.

- Payment Date: Specify the date the deposit was received.

- Customer Information: Include the full name, address, and contact details of the individual or company making the deposit.

- Amount: Clearly state the total amount deposited.

- Payment Method: Indicate how the payment was made (e.g., cash, bank transfer, credit card).

- Description: Provide a brief description of what the deposit is for, such as reservation, rental, or service charge.

- Balance Due: If applicable, state the remaining balance that is due after the deposit.

- Company/Business Details: Include the name, address, and contact information of the business receiving the payment.

Example Template

- Receipt No: 12345

- Received From: John Doe

- Amount Paid: $500

- Payment Method: Credit Card

- Date of Payment: February 13, 2025

- For: Deposit for apartment rental

- Remaining Balance: $1500

- Business Name: XYZ Rentals

- Business Contact: [email protected]

Ensure that all fields are completed accurately to avoid confusion and maintain a record of the transaction for future reference.

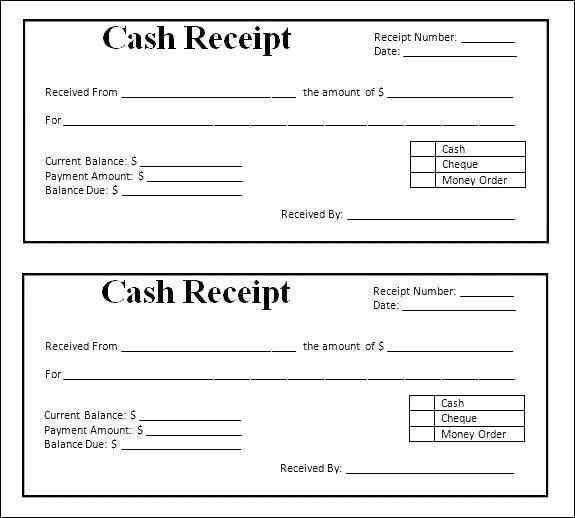

When designing a receipt template, ensure it accommodates all relevant details specific to the payment method used. Different payment methods may require additional or fewer fields, depending on the transaction type. Here’s how to format a receipt for common payment methods:

1. Cash Payments: For cash payments, the receipt should highlight the total amount paid, any change given, and the cashier’s name or ID. The transaction date and time are also necessary for clarity.

2. Credit/Debit Card Payments: For card payments, include the last four digits of the card number, the payment processor, and the transaction approval code. You should also list the payment method clearly as “Credit Card” or “Debit Card,” along with the transaction amount and date.

3. Bank Transfer: In the case of bank transfers, it’s important to include the reference number of the transaction, the bank’s name, and the date of payment. Specify whether the transfer was domestic or international to avoid confusion.

4. Mobile Payments (e.g., PayPal, Apple Pay): Mobile payments often require the inclusion of the mobile payment provider, transaction ID, and the payment method used (e.g., PayPal, Google Pay, Apple Pay). Clearly state the payment amount and the date.

5. Cheque Payments: When dealing with cheque payments, the cheque number, bank name, and transaction date should be listed. It’s helpful to mention the cheque’s validity status and whether the cheque is cleared or pending.

Formatting the receipt properly for each payment method ensures that all necessary details are captured and avoids any confusion for both parties. A clear, concise receipt that matches the payment method used will protect both the payer and the payee.

| Payment Method | Key Details | Required Information |

|---|---|---|

| Cash | Total paid, change given, cashier ID, transaction date | Amount paid, change amount, cashier name/ID |

| Credit/Debit Card | Card type, last 4 digits, transaction code, payment amount | Card number (last 4 digits), processor, transaction approval code |

| Bank Transfer | Reference number, bank name, transaction date | Reference number, bank details, payment date |

| Mobile Payments | Payment provider, transaction ID, payment method | Provider, transaction ID, payment amount, payment date |

| Cheque | Cheque number, bank name, validity status, payment date | Cheque number, bank name, payment status |

Clearly specify the payment date. This helps both the payer and the recipient track the transaction and confirm when the deposit was made.

Include the amount paid. Make sure to state the exact sum received to avoid any confusion. This figure should match the deposit total agreed upon beforehand.

Provide payment method details. Indicate whether the deposit was made via cash, credit card, bank transfer, or any other form of payment.

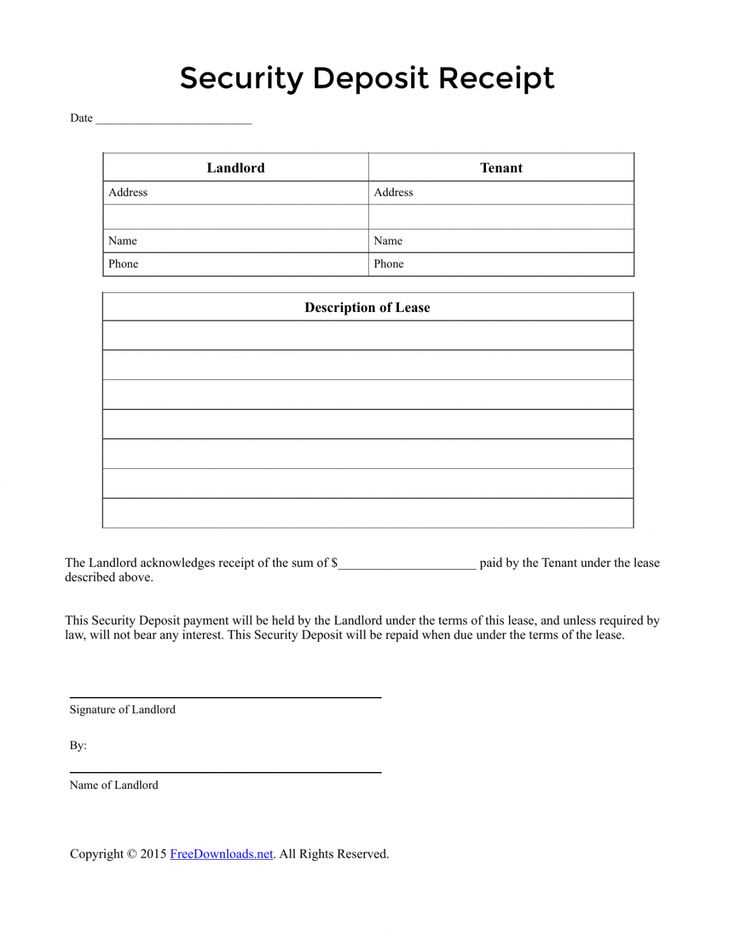

Identify both parties involved. The name of the payer and the recipient (business or individual) must be stated to establish who made and received the deposit.

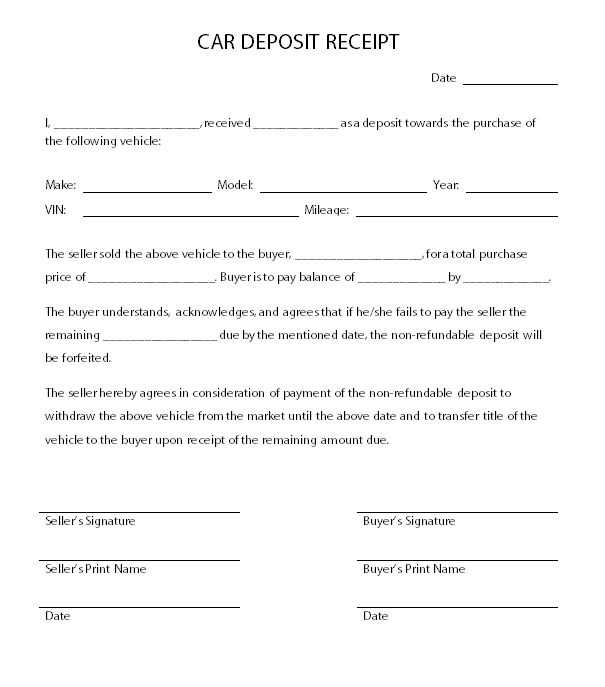

Reference any contract or agreement linked to the deposit. If the payment is part of a larger deal, referencing a contract or invoice number adds clarity and helps identify the purpose of the deposit.

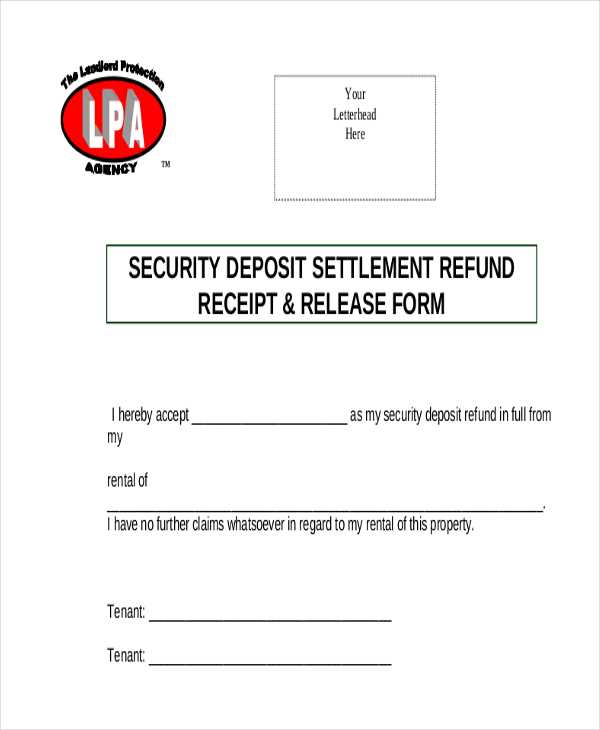

Detail any applicable terms or conditions. For example, if the deposit is refundable or non-refundable, or if it counts toward a larger payment, state these terms clearly.

Include a unique receipt number. This helps both parties track and reference the transaction, ensuring clear records.

Provide contact details for the recipient. It’s useful to include an email address, phone number, or other means of reaching the recipient in case there are any questions or concerns.

Ensure the deposit amount is clearly stated. Misleading or ambiguous figures can create confusion. Double-check that the total amount entered matches the intended deposit without any errors in numbers or wording.

Include the correct date and time of the transaction. Missing or incorrect timestamps can lead to misunderstandings or disputes regarding the deposit’s timing.

Accurately describe the purpose of the deposit. Avoid vague descriptions. Specify whether the deposit is for rent, services, or other reasons. A clear reference helps avoid future issues.

Provide both the payer’s and recipient’s full details. This includes names, addresses, and contact information. Missing or incomplete details can complicate tracking and verifying payments.

Don’t forget to include a receipt number or reference ID. This is key for tracking and future referencing. Each receipt should have a unique identifier to avoid confusion with other transactions.

Make sure the terms and conditions are visible and concise. Include any relevant refund or withdrawal policies. Ambiguous or hidden clauses can cause problems if the agreement is disputed.

Do not clutter the template with unnecessary information. Keep it simple and clear. Too much text can make the receipt harder to read and understand.

Check the formatting for consistency. Font size, spacing, and alignment should be uniform. Disorganized receipts might make it difficult for both parties to read or interpret the information correctly.

Lastly, ensure the template is legally compliant with local regulations. Inaccuracies or omissions could lead to legal complications if the template doesn’t meet specific requirements.

Deposit Payment Receipt Template

Ensure the receipt clearly mentions the deposit amount and the corresponding date of payment. Use straightforward language to avoid confusion about the transaction details. Make sure the purpose of the deposit is stated clearly, such as “Security deposit for rental agreement” or “Advance payment for service.”

Details to Include

The receipt should include the payer’s name, the payment amount, and any reference number or invoice number related to the deposit. A section confirming the method of payment, such as credit card, bank transfer, or cash, is also necessary.

Key Elements to Avoid

Don’t overload the receipt with unnecessary details that could clutter the page. Keep the focus on the deposit transaction itself. Avoid repeating the term “deposit” more than once, as it might create redundancy. Instead, refer to it using its context, like “payment for reservation” or “advance for goods or services.”