Ready-to-Use Cash Receipt Format

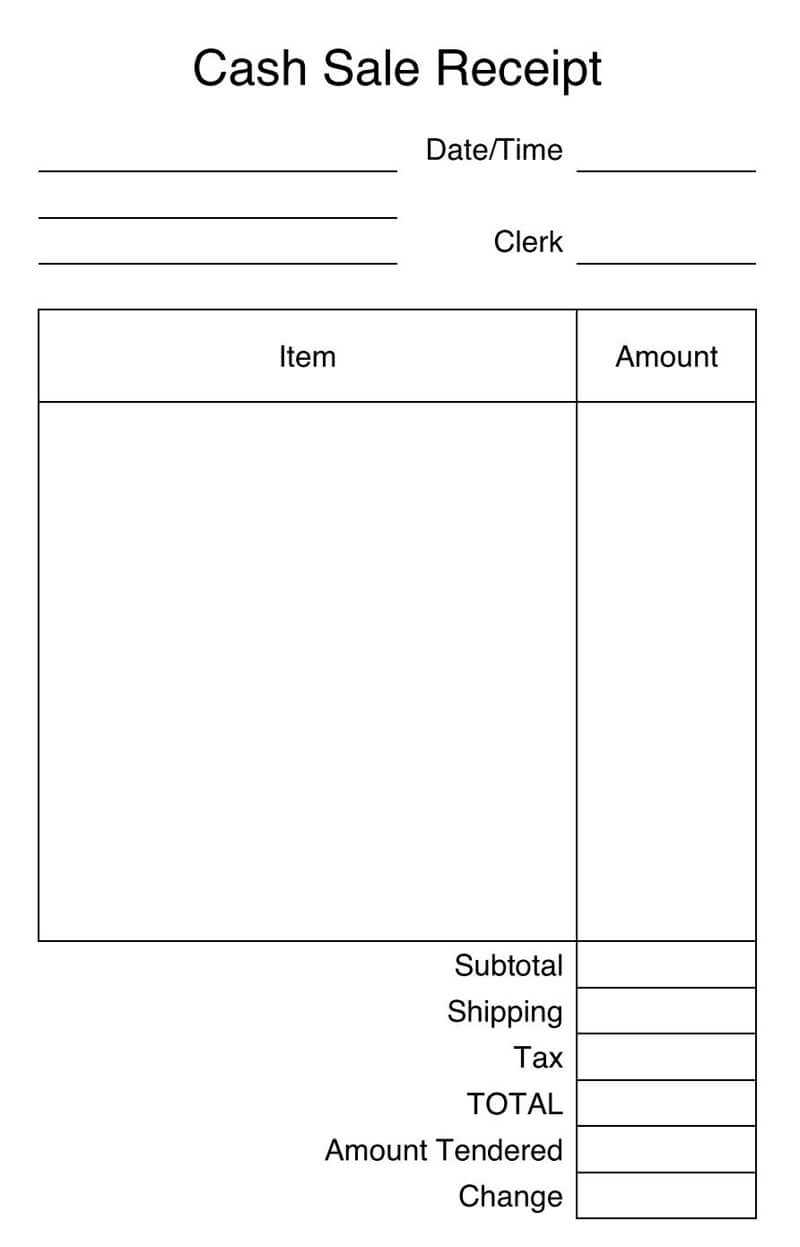

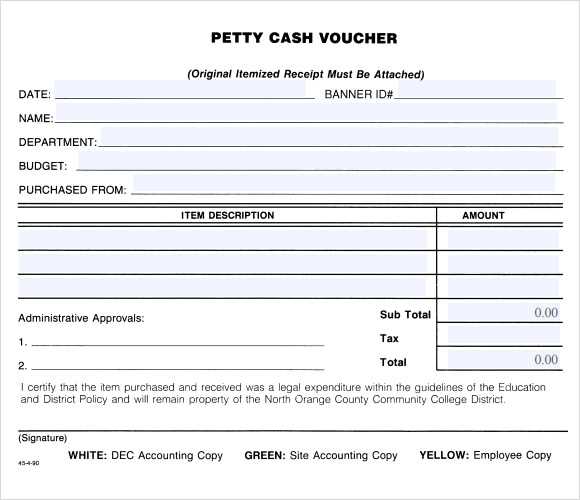

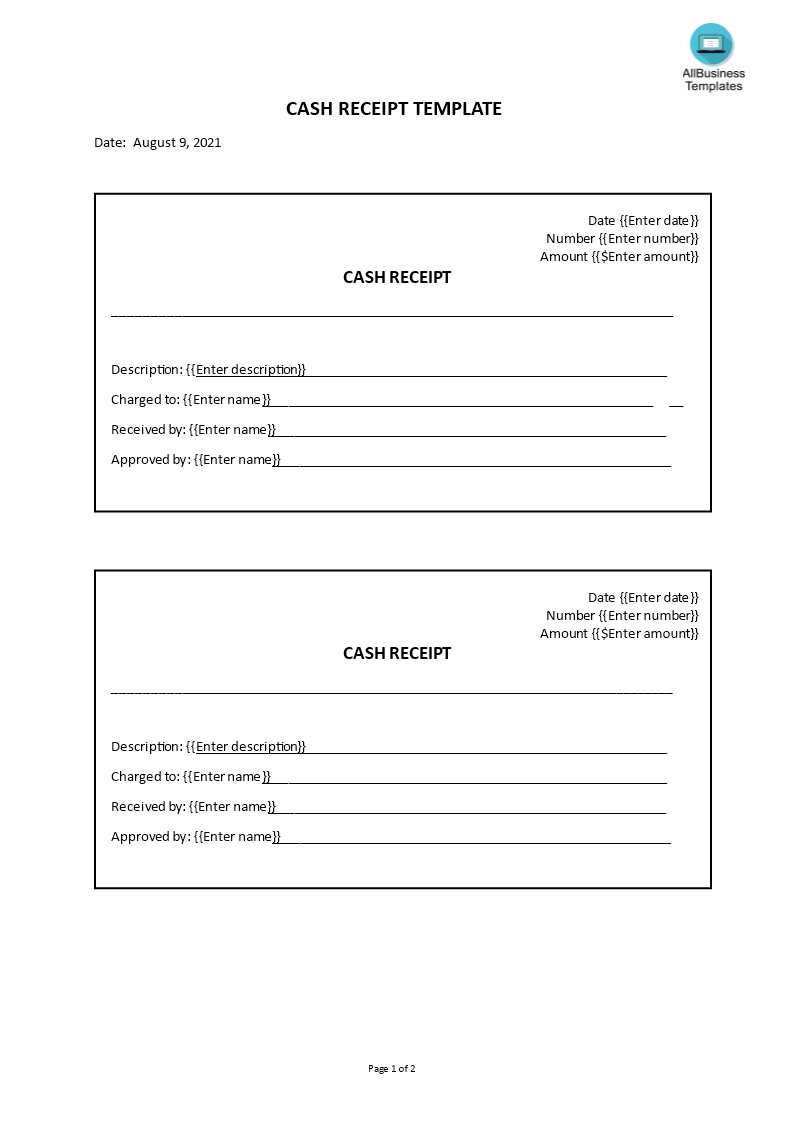

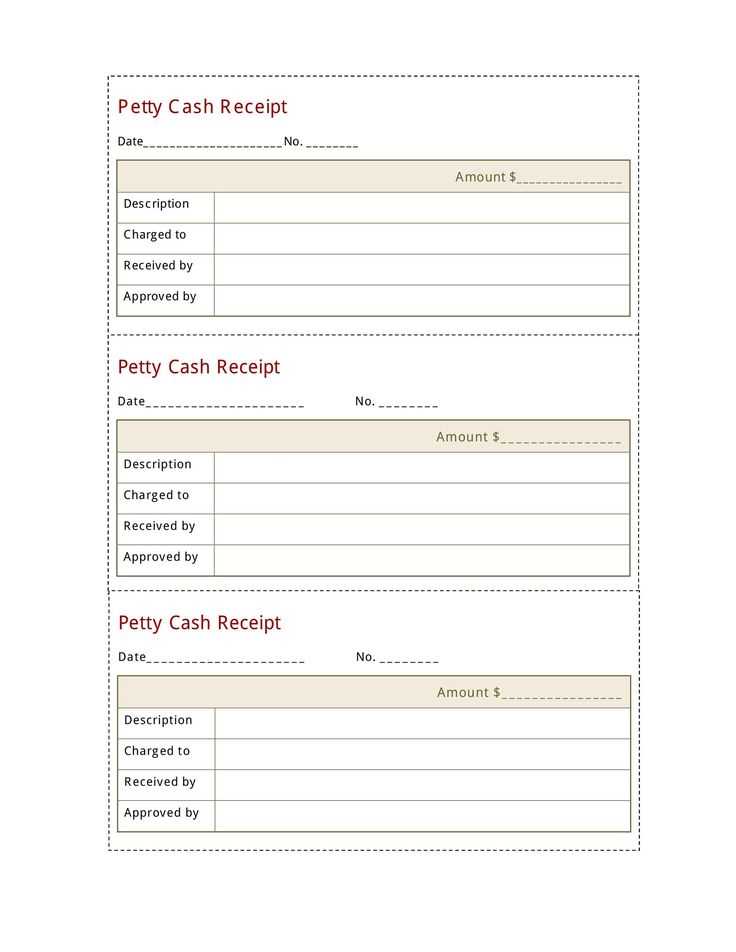

A basic cash receipt should include key details to confirm a payment. Here’s a simple structure:

- Receipt Number: Unique identifier for tracking.

- Date: When the payment was received.

- Payer’s Name: Full name of the person or business making the payment.

- Amount: The total received, written in numbers and words.

- Payment Method: Cash, bank transfer, or other.

- Description: What the payment was for.

- Received By: Name of the person or business receiving the payment.

- Signature: For verification.

Printable Cash Receipt Template

Use this format for a handwritten or digital receipt:

---------------------------------------- CASH RECEIPT ---------------------------------------- Receipt No: [Unique Number] Date: [DD/MM/YYYY] Received from: [Payer's Name] Amount: £[Amount] ([Amount in Words]) Payment Method: [Cash/Bank Transfer] For: [Payment Description] Received by: [Receiver's Name] Signature: _______________ Thank you for your payment. ----------------------------------------

When to Issue a Cash Receipt

Cash receipts confirm payments and help with record-keeping. Issue one whenever a customer pays in cash, especially for rent, services, or retail purchases. Businesses should keep a copy for accounting and tax purposes.

A well-structured receipt protects both parties and ensures clear financial records.

Simple Cash Receipt Template UK

What Details Should a UK Cash Receipt Contain?

How to Format a Basic Receipt for UK Use

Printable vs. Digital Receipt Templates: Pros and Cons

Legal Rules for Receipts in the UK

Best Free Receipt Templates for UK Businesses

How to Customize a Template for Your Needs

A UK cash receipt should include the date, receipt number, seller’s name and address, buyer’s name (if applicable), amount paid, payment method, description of goods or services, and a statement confirming payment. VAT-registered businesses must add their VAT number and a breakdown of VAT if applicable.

Format receipts with a clear title, such as “Cash Receipt,” followed by transaction details in a structured layout. Use bold or capitalized headers for sections like “Amount Paid” or “Payment Method” to enhance readability. Keep spacing consistent and ensure the total amount is easy to find.

Printable templates offer a professional look and can be stored physically, while digital receipts are convenient, reduce paper use, and allow for quick searches. Digital options are preferable for frequent transactions, but paper copies may be necessary for customers who request them.

UK law does not mandate receipts for cash payments unless the customer requests one. However, businesses must keep accurate records for tax purposes. If VAT applies, a proper invoice or VAT receipt is required.

Free receipt templates are available from HMRC, accounting software, and business websites. Look for templates with editable fields, automatic calculations, and printable formats to suit different needs.

Customizing a template involves adding a business logo, adjusting fonts, and including extra fields like customer contact details or refund policies. Editable PDF or spreadsheet formats provide the most flexibility.