If you’re looking for a quick and easy way to create payroll checks and receipts, an Excel template is a practical solution. It allows you to customize your payroll process and avoid the need for expensive software or third-party services. Whether you’re running a small business or need a simple way to manage employee payments, an Excel template can streamline the entire process with minimal effort.

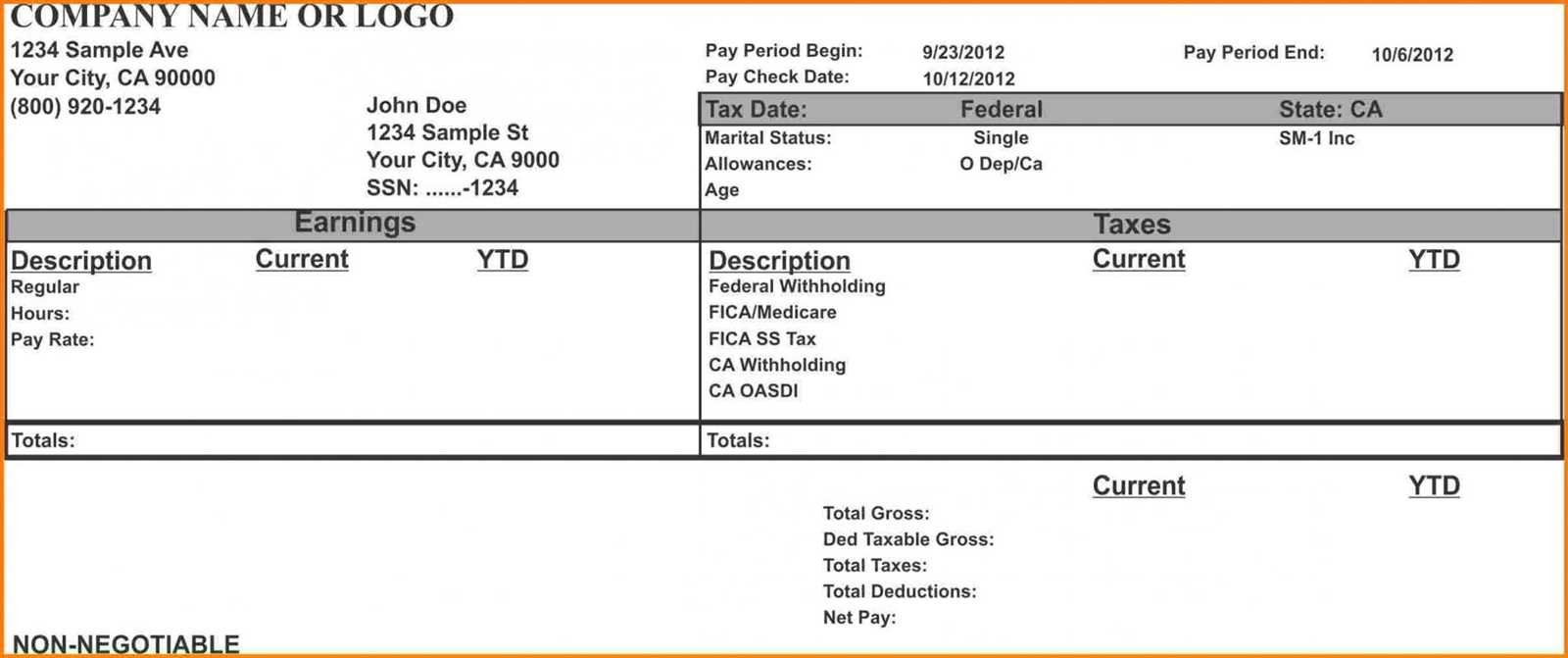

Using a payroll check template ensures accuracy by automating calculations for taxes, deductions, and net pay. Most templates offer clear sections for employee details, payment breakdowns, and tax computations, making it easy to track and issue payments. Simply input the necessary data, and the template will do the rest. It also allows for fast adjustments whenever changes occur in tax rates or payment schedules.

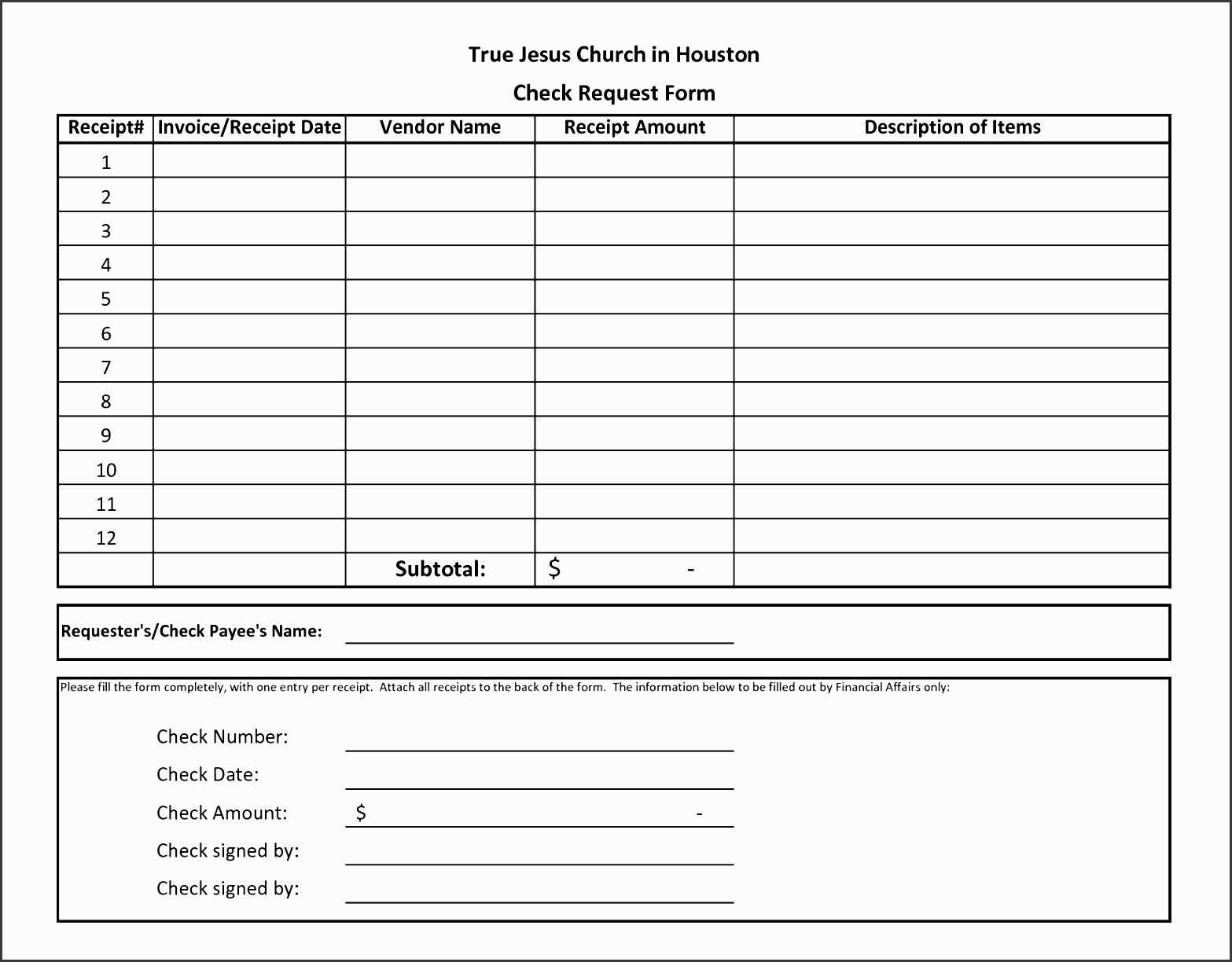

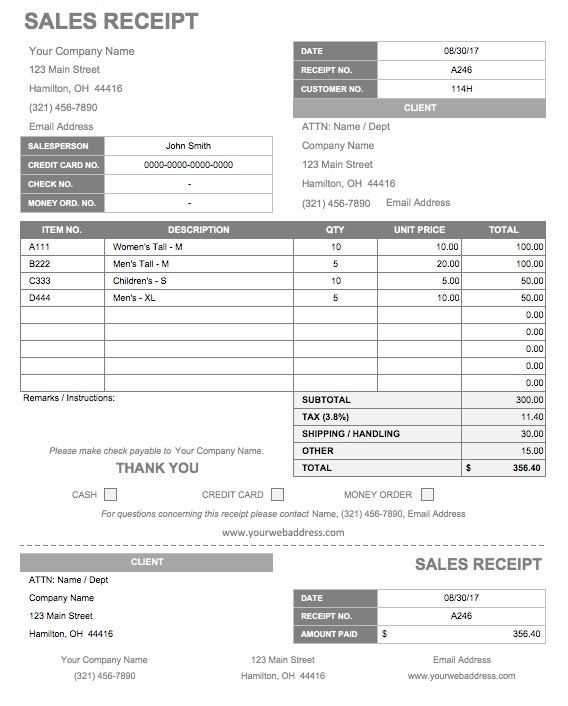

The receipt template works alongside the payroll check, providing employees with a clear record of their payment history. It’s simple to generate a receipt after each payroll cycle, ensuring transparency and clarity for your employees. With a free, customizable template, you’ll save time and keep your payroll management both organized and up to date.

Download a free Excel payroll check and receipt template today, and start handling payroll with confidence and ease. Customizable, flexible, and efficient–this tool will help you maintain smooth operations without extra costs or complex systems.

Here’s the corrected version, with minimal repetition:

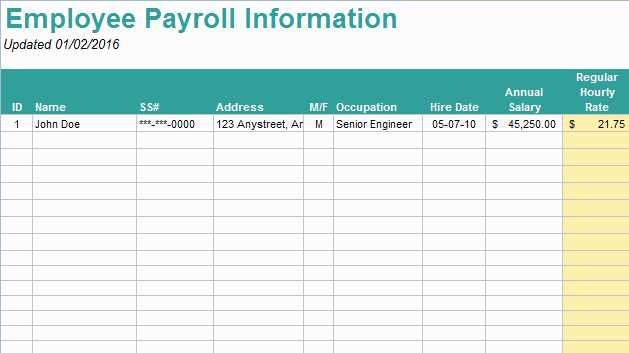

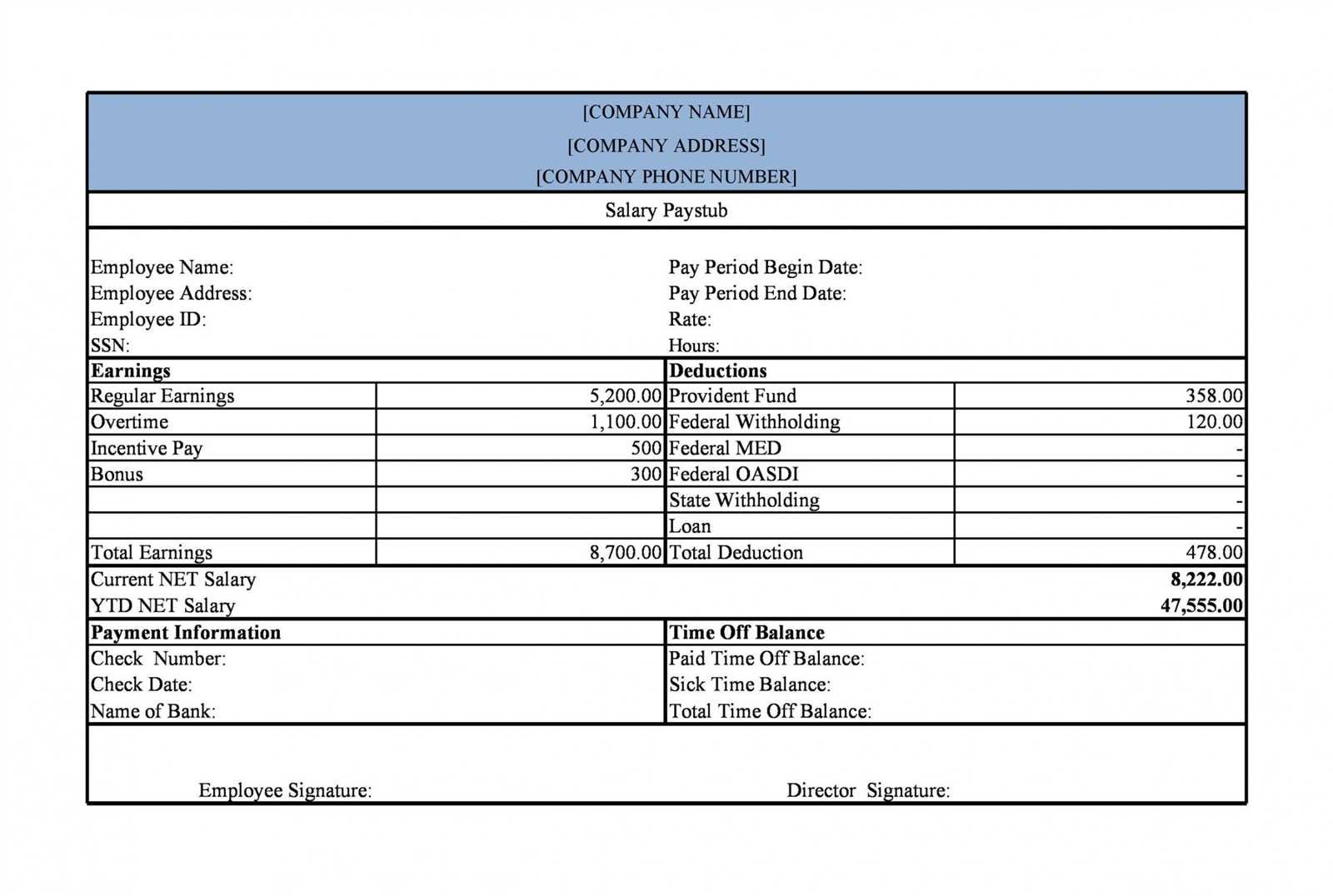

If you’re creating a payroll check template in Excel, ensure that your layout is clean and straightforward. Start by including the employee’s name, job title, and pay period at the top. This gives an immediate overview of the information. Below that, list the hours worked, the hourly rate, and the gross pay calculation. Be clear and concise with these numbers. Include any deductions such as taxes, insurance, and retirement contributions. This transparency helps avoid confusion later. Finally, calculate the net pay and clearly show the final amount that will be paid to the employee.

Formatting tips: Use bold for section headers and borders for clarity. A clean layout ensures that the payroll process runs smoothly and the check is easy to read. Ensure that formulas for calculations are correct and automatic, so errors are minimized. If you plan to issue the template regularly, save it as a reusable model.

Consider offering a receipt alongside the payroll check. The receipt can list detailed breakdowns of earnings, deductions, and net pay for each pay period. This makes it easier for employees to keep track of their payments and simplifies accounting records.

Remember, consistency in your payroll check template will save time, reduce mistakes, and build trust with employees.

- Free Payroll Check and Receipt Template in Excel

Download a free payroll check and receipt template for Excel to streamline your payroll process. This template allows you to create checks and receipts easily, ensuring accuracy and saving time. Whether you’re paying employees or issuing reimbursements, this tool will help you keep records clear and organized.

- Customizable Fields: The template includes customizable sections for employee names, pay periods, gross wages, deductions, and net pay. Adjust these fields based on your company’s payroll structure.

- Simple Formulas: Built-in formulas automatically calculate deductions, taxes, and net pay. This removes the risk of manual errors and ensures calculations are always up-to-date.

- Receipt Generation: You can easily generate a receipt for any payroll check issued. This helps keep both employer and employee informed of payment details.

- Printable Format: Once you fill out the details, the template is ready for printing. Issue a paper check or generate a PDF copy for digital records.

- Tracking and Reporting: The template tracks all payments made, providing a quick overview of expenses and helping with year-end tax reporting.

With this Excel template, managing payroll becomes much simpler. Save time and reduce mistakes, whether you’re running a small business or handling multiple payments. Download it now and start organizing your payroll with ease.

To download a payroll check template in Excel, start by searching for a reliable template provider online. You can find free downloadable payroll check templates from websites such as Microsoft Office Templates, Vertex42, or Template.net. Choose one that suits your company’s needs and fits your local tax requirements. Most templates come pre-designed with placeholders for employee details, paycheck amount, and tax deductions.

Step 1: Download the Template

After selecting a template, click on the download button. Save the file to a location on your computer where you can easily find it. Once downloaded, open the Excel file using Microsoft Excel or another compatible spreadsheet software.

Step 2: Customize the Template

After opening the template, you can begin customizing it. Start by replacing any default information with your own company’s details, such as the company name, address, and payment period. Update the employee’s name, ID number, salary details, and other relevant payroll information. If necessary, adjust any formulas for taxes or deductions based on your location or business needs.

Ensure that the template includes all necessary deductions like federal and state taxes, benefits, or retirement contributions. Excel allows you to modify formulas or add new fields if required. You can also adjust the layout, font size, and color scheme for better readability or to match your company’s branding.

Once you’ve filled out all the necessary details, save the document. It’s a good idea to keep a master version of the template, which can be reused for each payroll cycle with minor adjustments. After finalizing the customization, you’re ready to print the check or save it as a PDF for electronic distribution.

Begin by downloading a payroll receipt template for Excel. Several free options are available online, and many come preformatted to suit common payroll needs. Choose one that matches your requirements.

Next, open the template in Excel. Review the sections that need to be filled in: typically, these will include employee details, pay period, and earnings. Start with inputting the employee’s name, job title, and employee ID, if applicable.

In the “Earnings” section, enter the total salary or wages earned during the pay period. If the employee is paid hourly, make sure to calculate the total hours worked and multiply by the hourly rate to get the gross earnings.

If deductions such as taxes or insurance apply, input these amounts in the appropriate fields. These deductions will subtract from the gross pay to calculate the net pay. Some templates automatically compute this, but double-check to ensure the formulas are correct.

After entering the earnings and deductions, the template should calculate the net pay. Verify this number against your payroll calculations to confirm accuracy.

In the final section, add any additional information, such as the payment method (e.g., check, direct deposit) and any additional notes (e.g., overtime or bonuses). This ensures that both the employer and employee have a clear record of the transaction.

Once all fields are complete, save the document as a new file. You can then print or email the receipt to the employee for their records.

Make sure to regularly update the template if there are changes in employee details or pay structures. This will save time in the future and maintain accuracy.

One of the most common mistakes when using payroll templates in Excel is neglecting to update tax rates. Payroll calculations often rely on tax rates that change annually. Ensure you check and update these rates before processing each payroll cycle. Failure to do so can result in incorrect deductions and penalties.

Ignoring Employee Specifics

Another mistake is using a generic template without customizing it for each employee. Payroll templates should account for various factors like hourly wages, overtime, bonuses, and deductions specific to each worker. Ensure you input accurate data for each employee to avoid errors in compensation.

Overlooking Data Validation

Not setting up proper data validation is another issue. Excel allows you to create drop-down lists and validation rules to minimize human error. Without these checks, you risk entering incorrect data such as wrong dates, negative numbers in hours worked, or incorrect rates, which can all lead to inaccuracies in your payroll.

Also, remember to double-check your formulas. A misplaced cell reference or incorrect function can throw off your entire payroll calculation. Always test your template with sample data to confirm that all formulas are working as intended before finalizing any payroll reports.

How to Create a Payroll Check and Receipt Template in Excel

To set up a payroll check and receipt template in Excel, focus on organizing key elements like employee information, pay details, and tax deductions. Begin with creating columns for employee name, address, and job title. Add sections for pay periods, hourly rate, total hours worked, and gross pay.

Payroll Check Template Layout

Design the template to display detailed pay breakdowns, including deductions, net pay, and payment date. The following table shows a simple example:

| Employee Name | Job Title | Pay Period | Gross Pay | Tax Deductions | Net Pay |

|---|---|---|---|---|---|

| John Doe | Manager | 01/01/2025 – 01/31/2025 | $4,500 | $900 | $3,600 |

| Jane Smith | Accountant | 01/01/2025 – 01/31/2025 | $3,000 | $600 | $2,400 |

Receipt Template Layout

For a payroll receipt, make sure to include receipt number, employee details, and payment method. It’s useful to highlight the total amount paid and the breakdown for transparency.

| Receipt Number | Employee Name | Date | Amount Paid | Payment Method |

|---|---|---|---|---|

| 00123 | John Doe | 02/01/2025 | $3,600 | Direct Deposit |

| 00124 | Jane Smith | 02/01/2025 | $2,400 | Check |

Remember to adjust tax deductions and rates based on your region. This basic template can be customized to meet the specific needs of your business or organization.