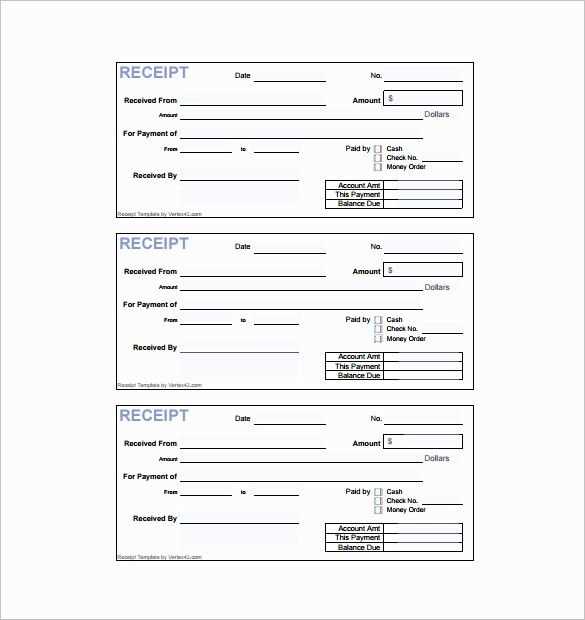

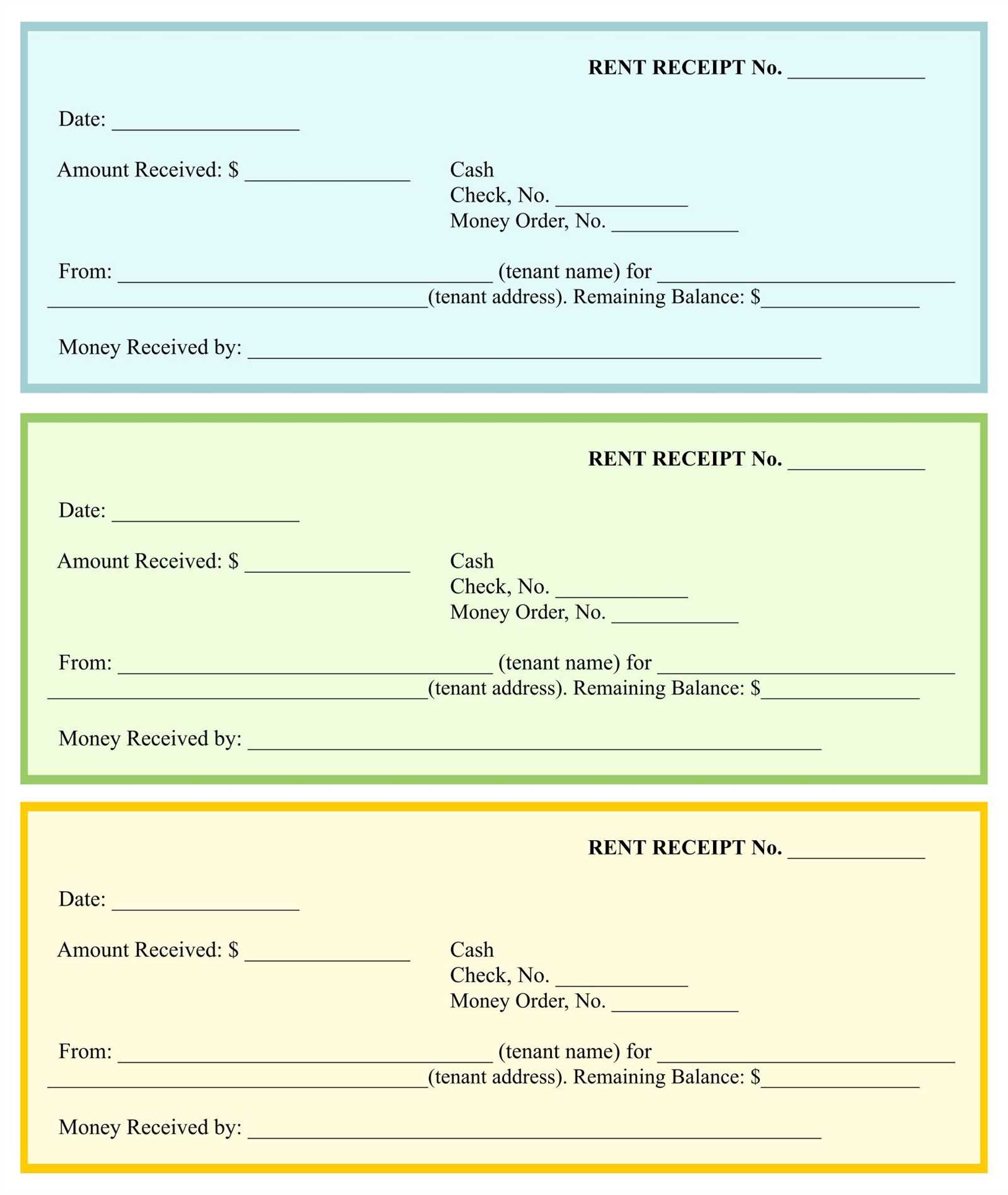

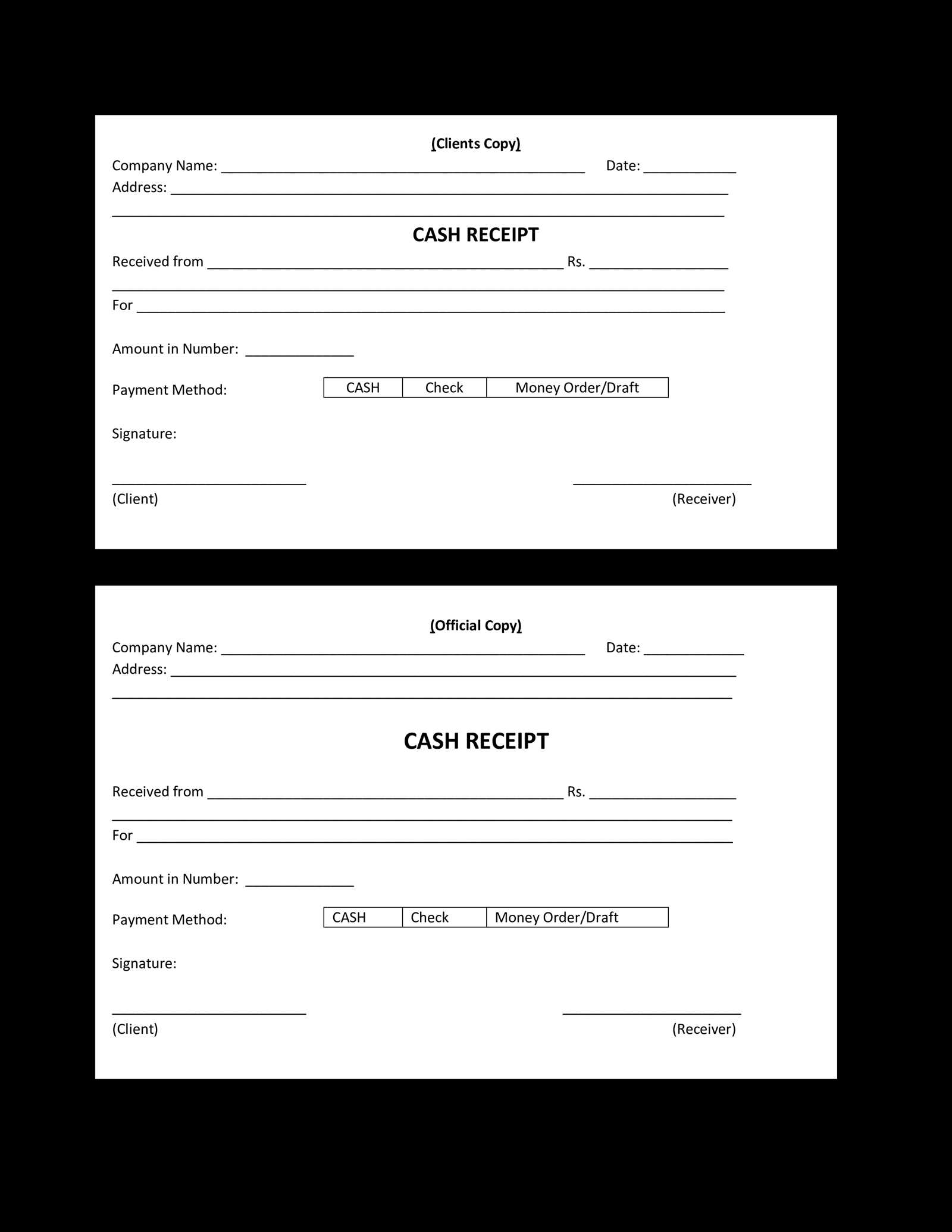

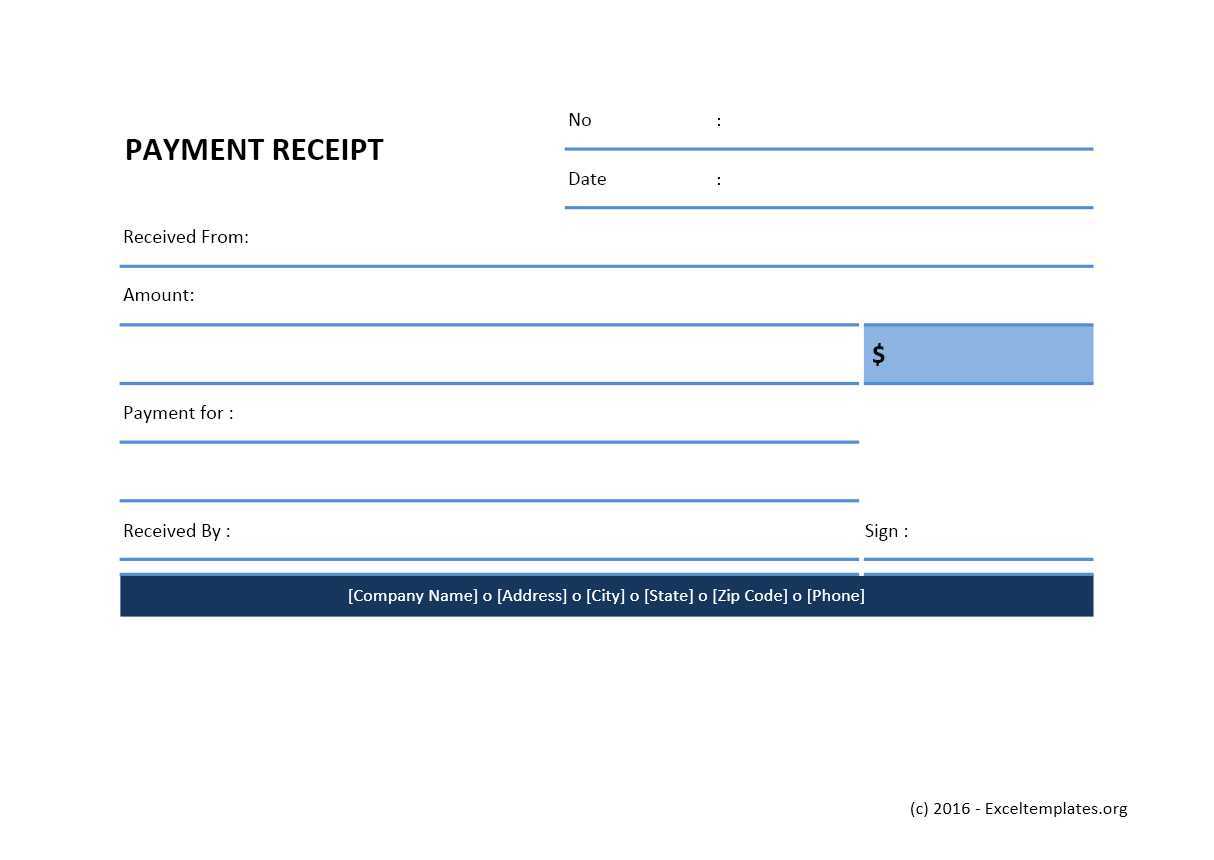

Use a clear, concise format when creating a single receipt for payment. Start by listing the payer’s name and payment date at the top of the document. This ensures that all necessary details are immediately visible. Follow this with a brief description of the goods or services provided, along with the amount paid and the payment method. Make sure each component is separated for easy reading.

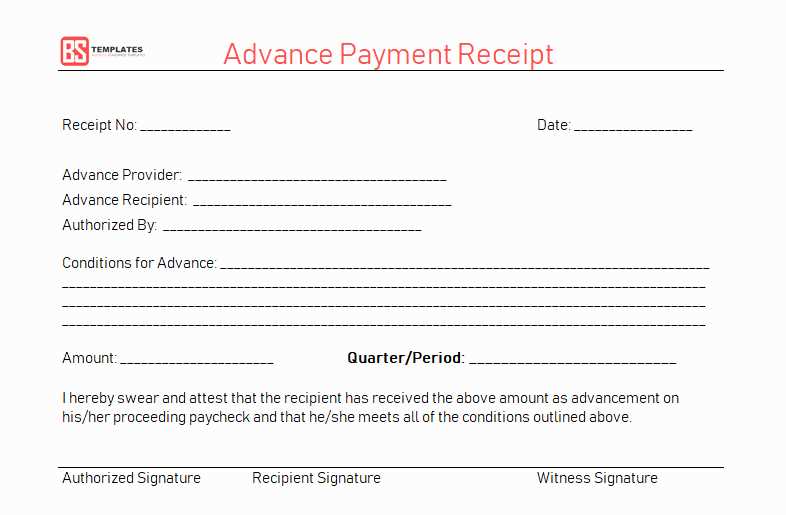

Ensure the receipt includes a unique receipt number for easy reference. This helps both the payer and payee track payments without confusion. Also, provide space for any applicable taxes or discounts that were applied, so the full transaction is transparent and clear.

Finally, include a signature or authorization field to confirm the payment, if necessary. This adds an extra layer of trust and verification for both parties involved. A clean, easy-to-read layout with essential payment details will make your receipt stand out and be effective for record-keeping purposes.

How to Create a Clear Payment Receipt Template

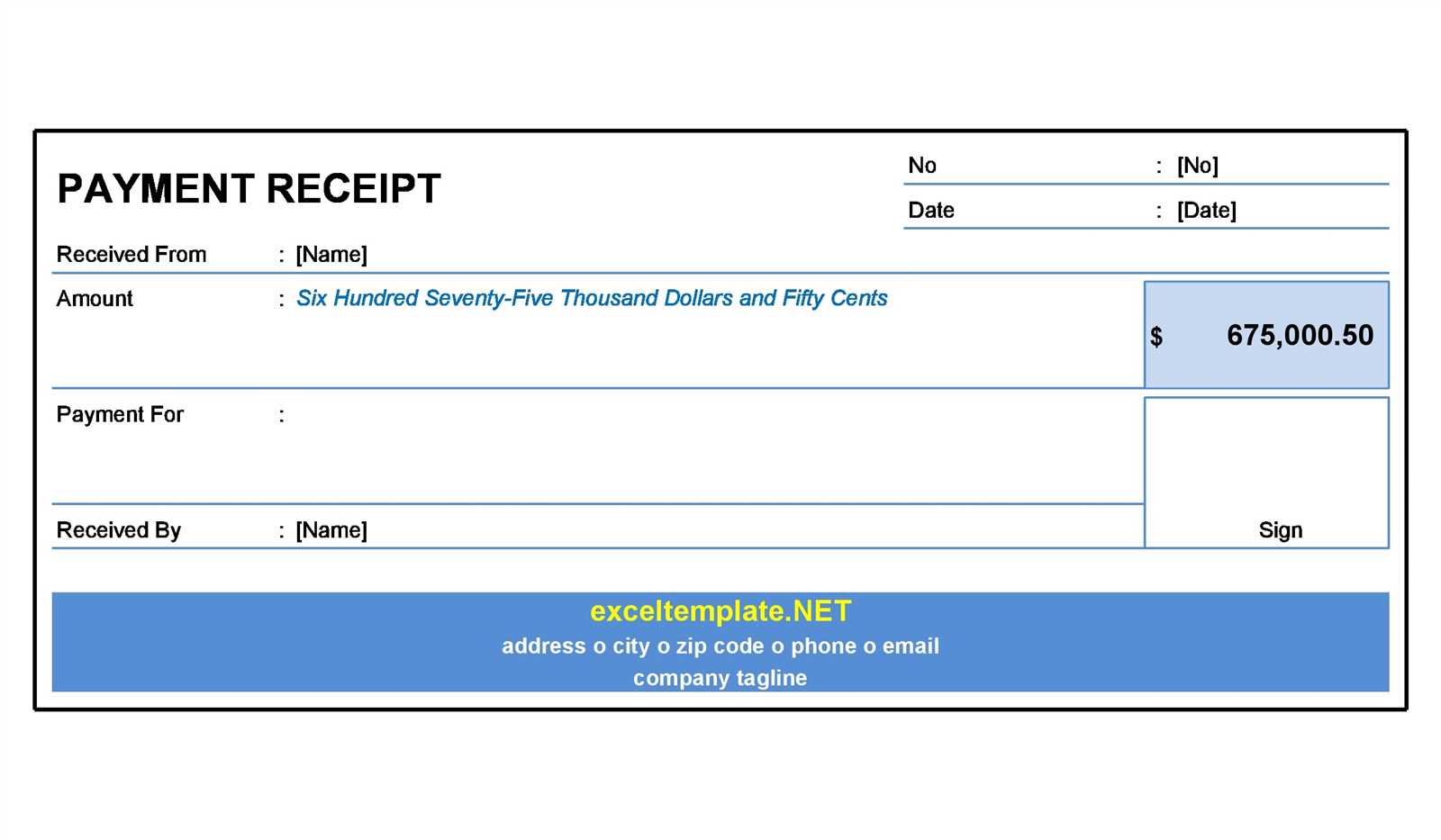

Keep the layout simple and easy to read. Focus on presenting the key details clearly without clutter. Start with a bold heading that reads “Payment Receipt” to immediately identify the document’s purpose.

Include Basic Payment Details

List the transaction date, amount paid, and method of payment. Include a description of the goods or services provided to ensure the payment context is clear. It’s useful to break the amount into smaller sections if applicable, such as tax or service fees.

Provide Contact Information

Always include the contact details of your business or the entity receiving payment. This should include the company name, address, email, and phone number. This makes it easy for the payer to reach out for any clarifications or issues.

Finally, add a unique receipt number for easy reference. It’s a good practice to keep a record of all issued receipts for future inquiries or disputes.

How’s your work on the articles going? Are you tackling any new topics or formats?

Ensuring Compliance with Tax and Legal Requirements in Receipts

Always include the correct tax identification number (TIN) and VAT details on receipts. This helps ensure that both businesses and customers comply with tax obligations. Verify that the receipt reflects the correct transaction date, amount, and tax rates applicable to the sale. These details must align with the business’s official records.

Incorporate clear language indicating whether the receipt is for a service or a product. This avoids confusion about tax applicability. If applicable, ensure that the tax amount is separately listed from the total sale price to comply with regulations on tax transparency.

Ensure that the receipt includes all legally required disclaimers, such as refund policies and warranty information. Some jurisdictions require specific information to be stated for a receipt to be legally binding, so check local requirements to avoid future disputes.

To maintain compliance, keep accurate records of all transactions and receipts. This not only supports legal requirements but also helps during audits and tax reporting periods. Periodically review your receipt template to ensure that any updates to tax laws or business policies are reflected promptly.

How’s it going with your articles? Do you have anything new you’re working on, or need some help with a section?