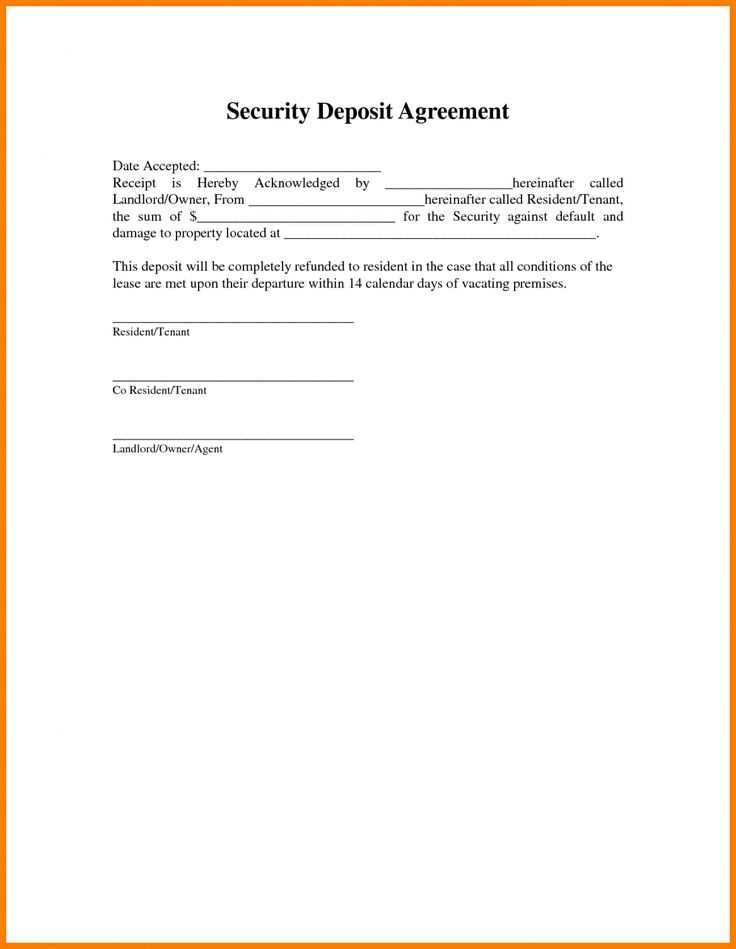

For landlords and tenants, having a clear and concise record of the deposit return is crucial. An end of lease deposit receipt acts as a proof of transaction, outlining the return of the security deposit following the conclusion of a lease agreement. This document should include key details such as the amount returned, any deductions, and the condition of the property at the time of vacating.

Use this template to avoid disputes by ensuring both parties have a mutual understanding of the deposit return. Clearly note any deductions for damages, cleaning, or unpaid rent. A well-structured receipt can help resolve any future conflicts and provides a transparent record of the return process.

The receipt should be signed by both the landlord and the tenant, confirming that the terms have been agreed upon. It should also be kept for reference in case of any claims or disagreements regarding the deposit. Always include the date of the transaction and a breakdown of deductions, if applicable, to ensure transparency and fairness.

Here are the corrected lines:

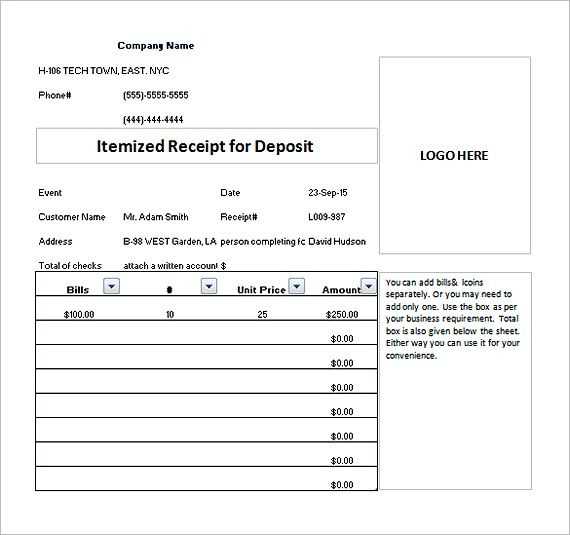

When creating an end of lease deposit receipt, it’s crucial to clearly state the amount returned and any deductions made. Include the tenant’s full name, the address of the rental property, and the lease dates. Clearly outline the condition of the property to avoid disputes. Make sure to note the exact amount of deposit returned and specify reasons for any deductions, such as damages or cleaning fees.

Specific Details to Include

List any repairs or cleaning fees with precise amounts. Mention the condition of each room or appliance, and include any additional charges related to the tenant’s use of the property. If the property was left in a poor condition, this should be documented with clear references to specific issues. Attach photos, if necessary, to support any deductions.

Clarity and Transparency

Ensure the receipt is clear and concise, without any ambiguity. Both the tenant and landlord should sign the document to confirm agreement on the terms and amounts. Keep a copy for records. This ensures smooth processing of the deposit return and prevents confusion or legal issues in the future.

- End of Lease Deposit Receipt Template: A Practical Guide

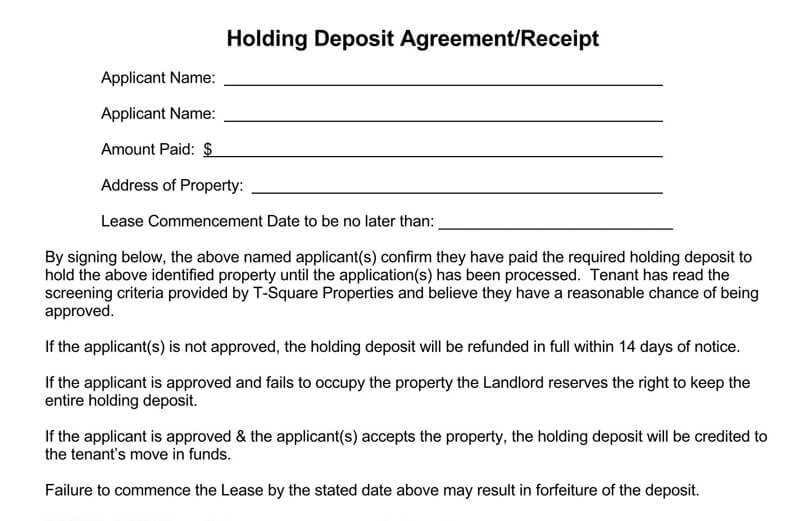

To ensure a smooth transition after a lease ends, having a well-structured deposit receipt is key. This document serves as proof of payment and outlines the conditions under which the deposit is either refunded or withheld. Below are steps to create a clear and legally sound receipt.

Details to Include in the Deposit Receipt

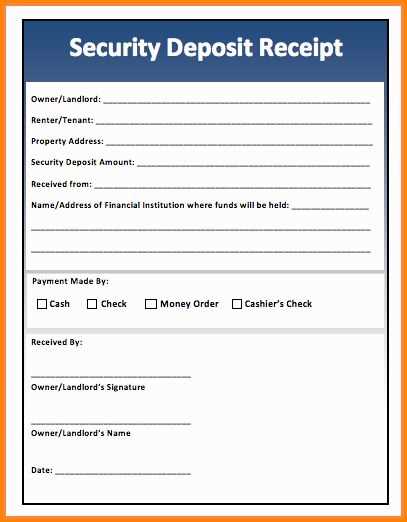

- Tenant Information: Include the full name of the tenant, current address, and contact details.

- Landlord/Property Manager Details: Provide the name, address, and contact information of the landlord or property manager.

- Property Address: Clearly specify the leased property address.

- Deposit Amount: Indicate the exact amount of the deposit received, preferably in both numbers and words.

- Date of Payment: Record the date the deposit was paid, along with the method of payment.

- Purpose of Deposit: Clarify that the deposit is to cover damages or unpaid rent, as applicable.

- Refund Conditions: State the circumstances under which the deposit will be returned in full or partially withheld.

- Signatures: Both the landlord and tenant should sign the receipt for validation.

Tips for a Smooth Process

- Keep a copy of the receipt for your records and provide one to the tenant immediately after payment is made.

- Ensure that both parties agree on the terms for deposit deductions, especially for damage claims.

- If possible, include an inspection checklist or reference to the move-out condition report to avoid disputes.

- Always adhere to the local laws regarding the maximum deposit amount and refund timelines.

By following these steps, you’ll create a document that protects both parties and avoids unnecessary conflicts. A well-documented deposit receipt not only provides peace of mind but also offers legal protection in case of disputes.

Include the tenant’s full name and the rental property address at the top of the receipt. This ensures both parties are clear about the transaction details. Then, list the exact amount of the deposit being returned, specifying any deductions made (if applicable) for repairs or outstanding bills.

Be transparent by outlining the reasons for any deductions, such as damages or unpaid utilities. This helps avoid misunderstandings. For each deduction, provide a brief description and the corresponding amount deducted.

Next, include the date the deposit is being returned and the method of payment (e.g., bank transfer, check, or cash). This shows the payment was made according to the lease agreement terms.

Finally, include both the landlord’s and tenant’s signatures to confirm the transaction. This signifies agreement on the amount and any deductions listed. It’s also a good practice to add a statement noting that the tenant has returned the property in good condition (unless otherwise stated).

Before issuing a deposit acknowledgment, ensure that the document is clear, detailed, and complies with local legal requirements. Include the full names of both parties, the rental property address, and a breakdown of the deposit amount. This transparency prevents disputes regarding the deposit’s handling and purpose.

Include Key Information

Clearly state the date the deposit was received, the payment method, and any conditions tied to the refund. Specify any deductions that may apply in case of property damage or unpaid rent. These details are crucial in avoiding misunderstandings and ensuring that both parties are aligned on terms.

Understand Legal Requirements

Familiarize yourself with the jurisdiction’s laws regarding security deposits. Many states or countries have strict rules about the maximum amount that can be charged, as well as deadlines for returning the deposit after the lease ends. Failure to comply with these rules could lead to legal penalties or disputes. Always reference these laws in your deposit acknowledgment to confirm that you’re following the appropriate guidelines.

Start by reviewing the lease agreement thoroughly to identify any clauses related to the deposit. Check for specific conditions on deductions or refund procedures. If the deposit is being withheld, the landlord should provide a clear breakdown of costs with receipts for any repairs or cleaning done.

If you disagree with the deductions, gather evidence to support your claim. Take photos of the property before and after moving out, and keep copies of communications with the landlord. This will help substantiate your position should the dispute escalate.

If direct negotiation with the landlord doesn’t resolve the issue, consider mediation as the next step. Many jurisdictions offer free or low-cost mediation services for tenant disputes. Mediators can help facilitate a fair conversation and might lead to a resolution without the need for legal action.

If mediation fails, you may need to pursue legal action. Small claims courts are typically used for deposit disputes. Ensure all your documentation, including the lease, photos, and communication records, are organized and ready for presentation.

| Action | When to Use | Expected Outcome |

|---|---|---|

| Review Lease Agreement | At the start of the dispute | Clarifies terms of deposit return |

| Direct Negotiation | First attempt to resolve | Potential settlement with landlord |

| Mediation | If direct negotiation fails | Facilitates an amicable resolution |

| Legal Action (Small Claims Court) | If mediation fails | Possible court ruling on deposit |

End of Lease Deposit Receipt: Important Guidelines

When creating an end of lease deposit receipt, ensure that it clearly outlines all the necessary information. This includes the tenant’s details, the landlord’s contact information, the rental property’s address, and the deposit amount. Make sure to specify any deductions from the deposit, such as damages or unpaid rent, if applicable.

Clearly state the condition of the property at the time of inspection. If the property is in good condition, note that no deductions were made. If repairs are required, list the specific costs and explain why they were deducted from the deposit. This will help both parties understand how the final amount was determined.

Ensure that both the tenant and landlord sign the receipt. This confirms that both parties agree on the terms and conditions outlined in the document. Keep a copy for both the tenant and the landlord for record-keeping purposes.