Use the “Payment Due Upon Receipt” template to clearly communicate payment expectations with your clients. This template is straightforward and removes ambiguity, ensuring that payment is made immediately upon receipt of the invoice.

Set a professional tone by specifying the payment terms, such as the due date, payment methods, and any penalties for late payments. By doing this, you reduce the chance of delayed payments and keep your cash flow steady.

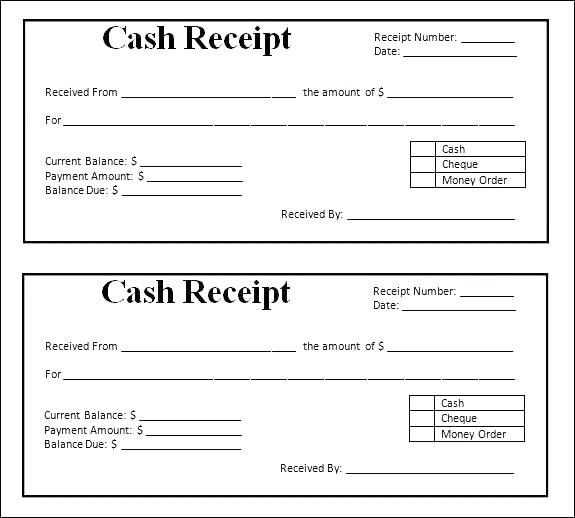

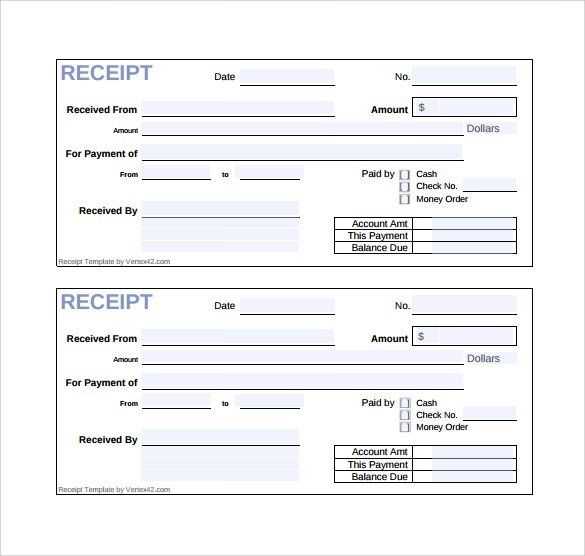

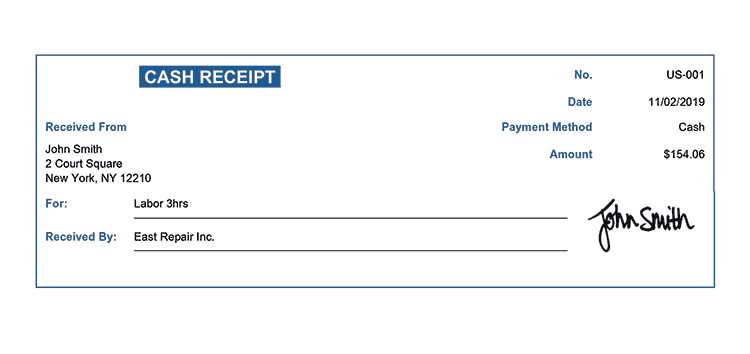

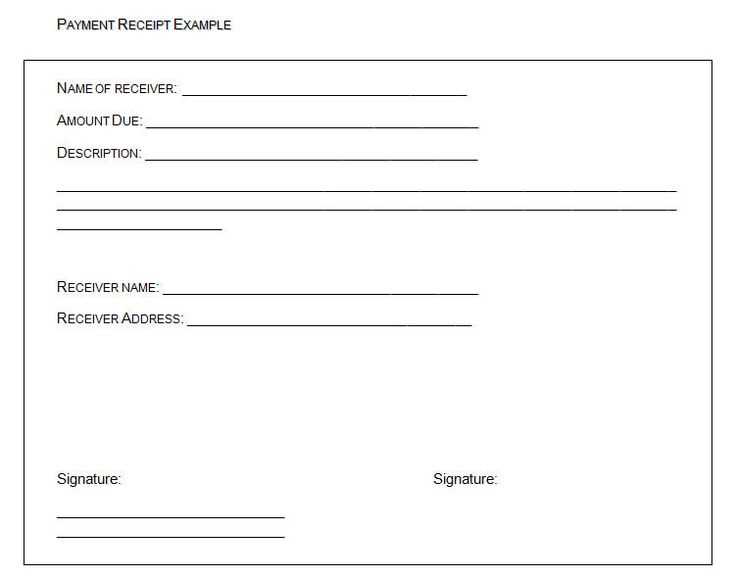

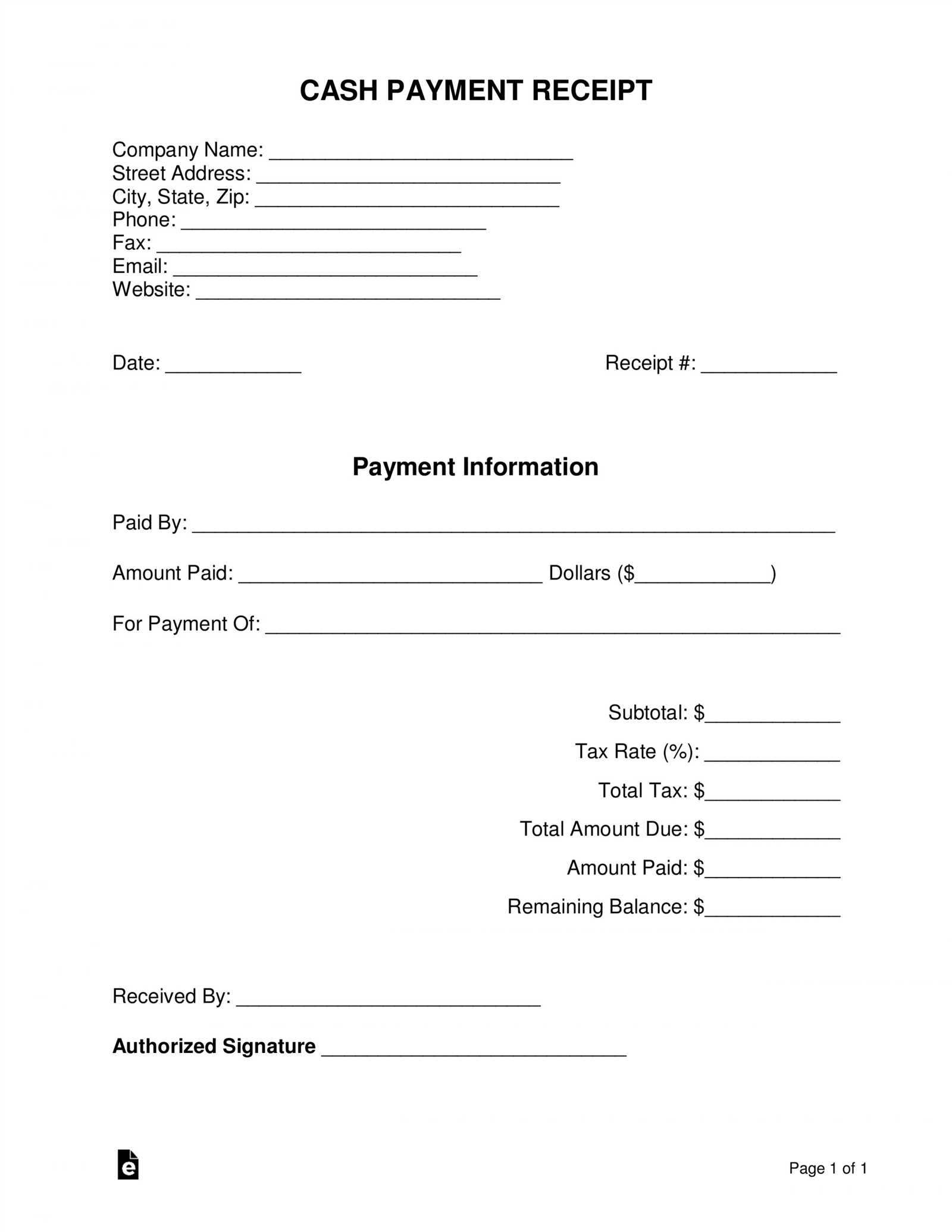

Always make sure to include your business details, invoice number, and a breakdown of the services provided. This will give your client all the information they need to process the payment quickly without confusion.

If you’re using Qbo or similar software, it’s easy to generate and send these invoices with just a few clicks. Ensure that the invoice is clear, with no room for misinterpretation about payment terms. Once the client receives it, payment is due right away, and the process will be smoother for both parties.

Qbo Payment Due Upon Receipt Template: A Practical Guide

The “Payment Due Upon Receipt” template in Qbo simplifies invoice management by making it clear that payment is expected immediately after the invoice is issued. Follow these steps to create and use this template effectively:

How to Create a Payment Due Upon Receipt Invoice in Qbo

1. Go to the “Sales” section and select “Invoices”.

2. Click on “Create Invoice” to start a new one.

3. Fill in the necessary details, including customer information, items, and amounts.

4. Set the “Due Date” as the current date. This ensures that payment is due immediately upon receipt of the invoice.

5. In the terms section, select “Due Upon Receipt” from the drop-down menu.

6. Save and send the invoice to your customer. It’s important that the terms are clearly stated to avoid confusion.

Best Practices for Using the Payment Due Upon Receipt Template

- Clear Communication: Always communicate your payment terms in advance, so clients know what to expect.

- Follow Up Promptly: If payment isn’t received within the expected timeframe, send a friendly reminder email or follow up with a call.

- Keep It Simple: Ensure that your invoice is straightforward and includes all relevant details like services/products, amounts, and payment instructions.

- Use Reminders: Set automatic reminders in Qbo to ensure you stay on top of outstanding payments.

This template helps maintain a professional and efficient billing process, ensuring quick payment turnaround. By following these steps and tips, you’ll create a seamless invoicing experience for both you and your customers.

How to Customize the Payment Due Upon Receipt Template in QBO

Open QuickBooks Online (QBO) and go to the “Settings” menu by clicking the gear icon in the top right corner.

Under the “Your Company” section, click on “Custom Form Styles.” This is where all your templates are stored.

Select the “Edit” option next to the “Payment Due Upon Receipt” template to modify it.

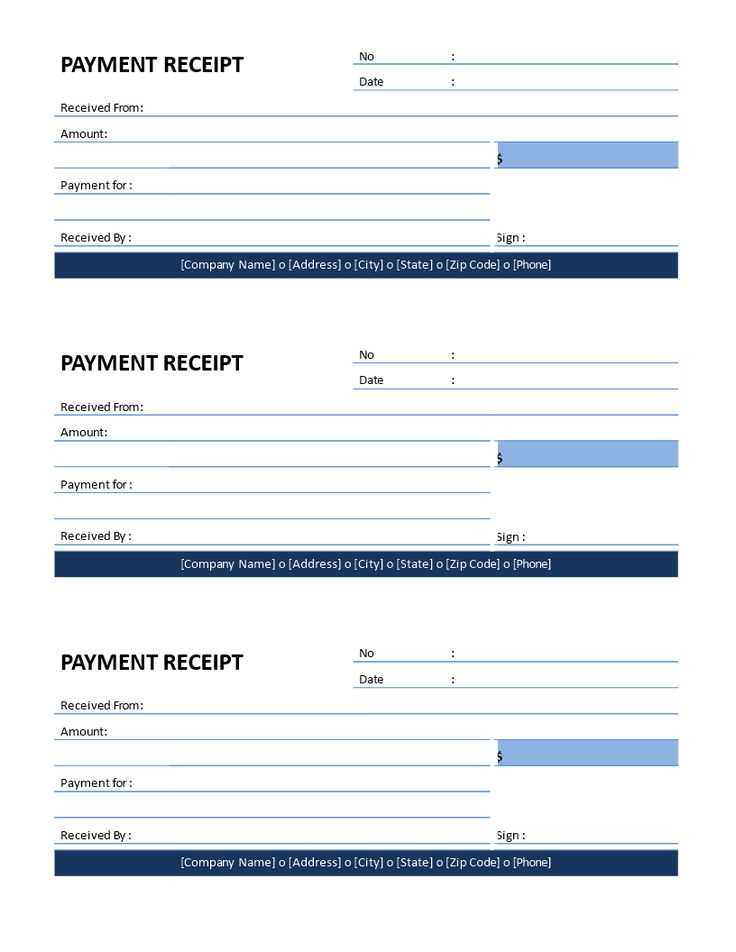

Use the “Design” tab to change the layout, color scheme, and font style. You can also add your logo to the template by clicking “Manage” under the “Logo” section.

If you need to adjust the content, go to the “Content” tab. Here, you can edit the text fields, including invoice terms, and add or remove any sections. Use the “Preview” button to check your changes before finalizing them.

Once you’re satisfied with the changes, click “Done” to save the template. You can now use this customized template for future invoices and payments due upon receipt.

Key Considerations for Setting Payment Terms and Due Dates

Set clear payment terms based on your cash flow needs. Define whether you expect payment immediately, within a certain number of days, or after services are rendered. If your business has tight cash flow, a “due upon receipt” policy helps ensure prompt payments. However, offering flexible terms like “net 15” or “net 30” can encourage business relationships without straining clients.

Understand your client’s payment habits. Before finalizing terms, consider your client’s past payment patterns. Some businesses prefer longer terms, while others might struggle with immediate payments. Adjust terms to align with your client’s capacity while still protecting your business interests.

Consider industry standards. Research what’s common in your industry. Setting unrealistic terms can deter potential clients, so staying within typical ranges helps maintain competitiveness without sacrificing your financial stability.

Include late fees for overdue payments. If you set a due date, make sure to include a clause for late payment penalties. This can encourage clients to pay on time while also protecting your business from prolonged cash flow issues. Specify the fee clearly in your terms.

Offer discounts for early payments. Offering small discounts for early payments can motivate clients to settle invoices faster. This can help with cash flow and build goodwill with your customers.

Handling Late Payments: Best Practices for Follow-Up Using QBO Templates

Send a reminder as soon as a payment becomes overdue. Using QuickBooks Online (QBO) templates, you can quickly generate a friendly reminder letter, ensuring it’s professional and clear. Keep your tone polite but firm, reinforcing the expectation of timely payment.

Set up automated reminders in QBO to prevent delays. By customizing reminder emails, you can ensure customers receive a gentle nudge before their payment is due. This proactive approach reduces the chance of payment lag.

If the payment is delayed, follow up within a week of the due date. Utilize QBO’s customizable templates to send a second, slightly firmer reminder. Focus on the fact that the payment was missed and reiterate the payment terms without being confrontational.

If the account remains unpaid after the second reminder, send a third communication with a more assertive tone. At this point, you can also include details about late fees, ensuring it’s clear that further action may be taken if payment is not received.

For customers who continue to delay payment, offer options like payment plans or negotiated terms. A personalized follow-up email using QBO templates can show flexibility while also setting clear expectations regarding the agreed payment structure.

Always keep communication professional. Using QBO templates for every step of the follow-up process streamlines your efforts, helping maintain a professional image while addressing late payments promptly and clearly.