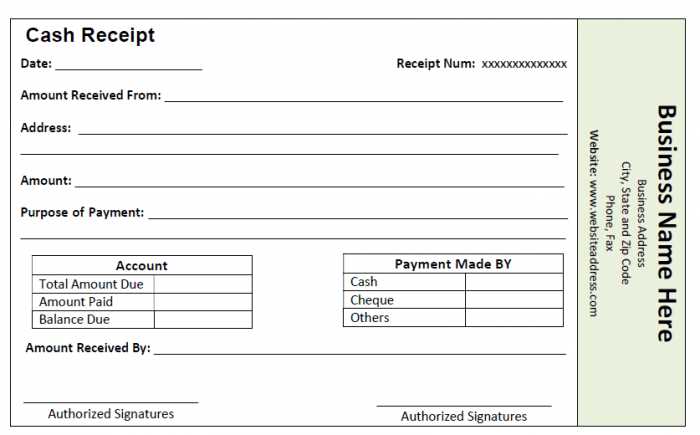

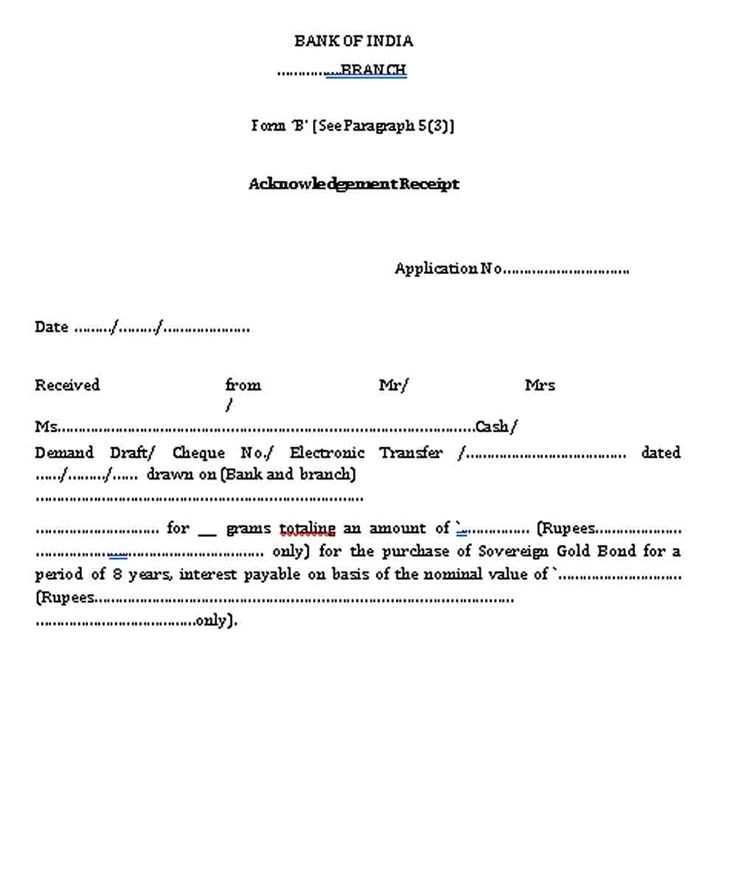

Use a clear and concise format to ensure smooth transactions and proper record-keeping. A well-designed receipt template should include fields for the payer’s name, the amount received, the date, the purpose of the transaction, and a signature section. This layout keeps the documentation transparent and organized.

Include specific details in the receipt to avoid confusion later. The payer’s contact information and any references to a prior agreement or invoice should be clearly stated. Make sure to include the method of payment, whether it’s cash, cheque, or digital transfer, along with the relevant transaction ID or cheque number.

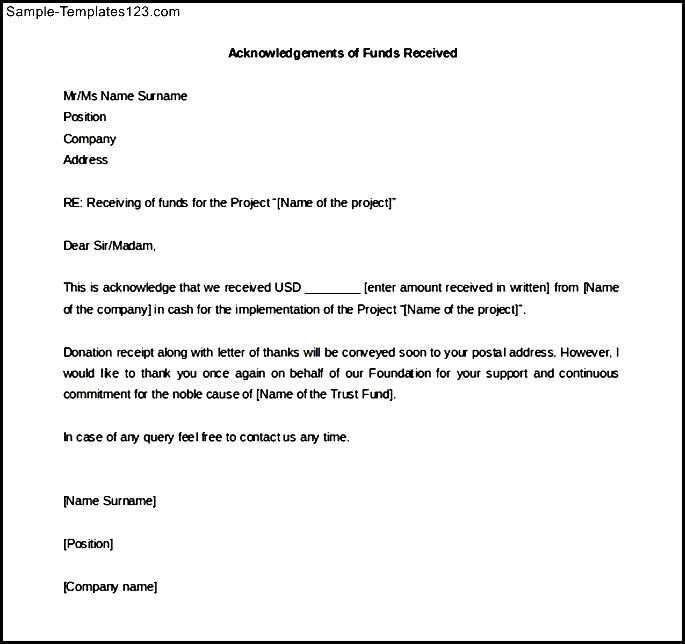

Consider leaving space for additional notes at the bottom of the template. This area can be useful for adding reminders or further explanations if necessary. A well-structured receipt makes it easier for both parties to track and verify financial exchanges at any time.

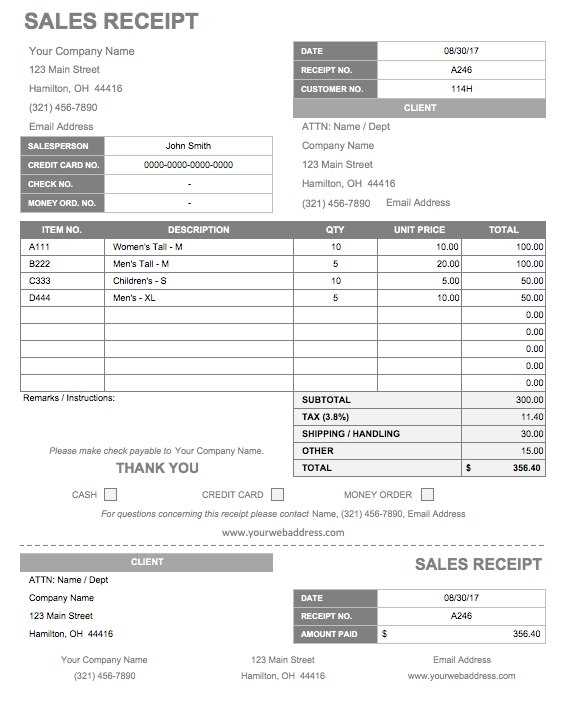

Key Elements to Include in a Receipt Template

Begin with a clear title indicating the document is a receipt. This should be easily noticeable at the top of the template.

Transaction Details

Include the transaction date and time to specify when the payment was made. Clearly list the amount received, including the currency. It’s also helpful to indicate the method of payment (e.g., credit card, cash, bank transfer).

Buyer and Seller Information

Provide the full name or business name of both the buyer and the seller. Include contact details, such as phone number or email address, for future reference or inquiries.

Lastly, make sure to add a unique receipt number for easy reference. This helps track the transaction and allows for proper documentation if needed later.

How to Customize a Receipt Template for Different Transaction Types

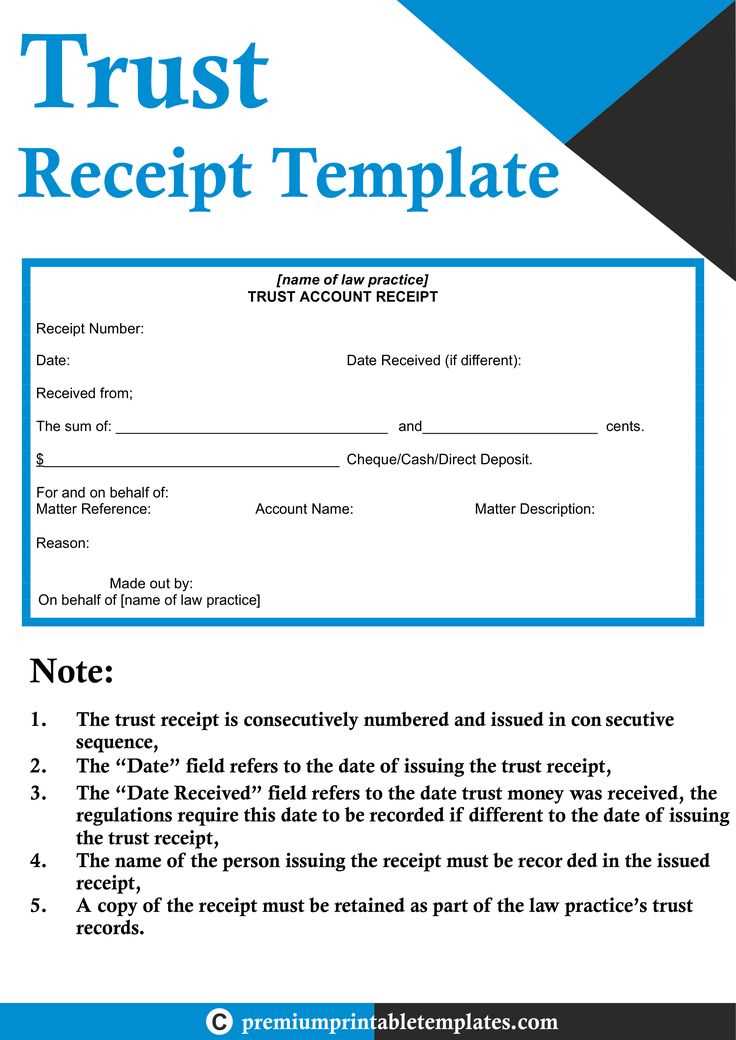

Tailor your receipt template by adjusting the layout and information based on the transaction type. For a cash transaction, focus on capturing the total amount, payment method, and any change given. Ensure the amount is clearly visible, and include a line item that specifies the cash received.

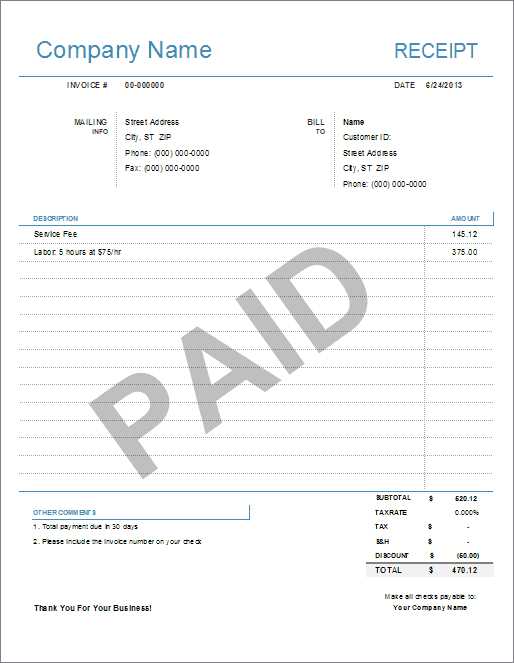

For credit card payments, include a transaction ID, authorization code, and the last four digits of the card number for verification. It’s important to also display the payment gateway or processor used, which helps streamline accounting and customer support inquiries.

When handling refunds or returns, emphasize the refund amount, original transaction reference, and reason for the return. Add a section for notes or special conditions related to the transaction, like restocking fees or expiration dates on returned items.

For online or digital payments, include the method (PayPal, Stripe, etc.), a payment confirmation number, and the transaction date. If applicable, include an order number and shipping details. This ensures transparency for both parties in digital transactions.

Each transaction type requires specific details, so customizing fields accordingly avoids confusion and ensures accurate record-keeping. Adjust the layout to highlight critical information for each scenario without overcrowding the template with irrelevant sections.

Ensuring Legal and Tax Compliance in Your Receipt Template

Ensure that your receipt template includes accurate and necessary details to comply with tax regulations. Start by including the legal entity’s full name, address, and tax identification number. This information is required to confirm your business’s identity and its legal obligations.

Key Tax Information

Include the breakdown of taxes such as sales tax or VAT. Make sure the tax rate is correct according to the local tax laws and that the tax amount is clearly separated from the total amount. This helps with transparency and ensures that the tax authority can easily verify the receipt details.

Recording Payment Details

Ensure that the receipt clearly shows the payment method–whether cash, card, or bank transfer. This helps with record-keeping and simplifies any future audits or tax filings. Also, specify the date and time of the transaction to avoid confusion in case of discrepancies.