Creating a reliable and clear sales receipt template is key for maintaining organized records in any transaction. A receipt should list all relevant details of the sale in a straightforward manner, ensuring both the seller and the buyer are on the same page.

Include transaction date, item description, quantity, price per unit, and total amount as the core elements. Be sure to add the payment method and tax information if applicable. This way, the document serves as a clear reference for both parties.

Formatting the receipt correctly ensures that all crucial information is easy to find. Use bold for headings, and provide a breakdown of the costs for transparency. A simple, clean layout avoids confusion and keeps the focus on the important details.

Here are the corrected lines with minimized repetitions:

Streamline your sales receipt template by removing redundant phrases. For example, instead of repeating “item” in every line, simply list it once and use clear bullet points or separators. This makes the receipt more concise and readable.

Instead of repeating the word “total” for each section, group the amounts and specify only the final total at the bottom of the receipt. This helps focus attention on the most important information.

Keep the language simple and direct. For instance, “Payment received” can replace “Amount paid is received,” cutting down unnecessary repetition.

Also, avoid using the same phrase to describe similar actions. Instead of saying “receipt for purchase” multiple times, use “confirmation” or “purchase details” to keep the content varied and to the point.

- Template of Sales Receipt

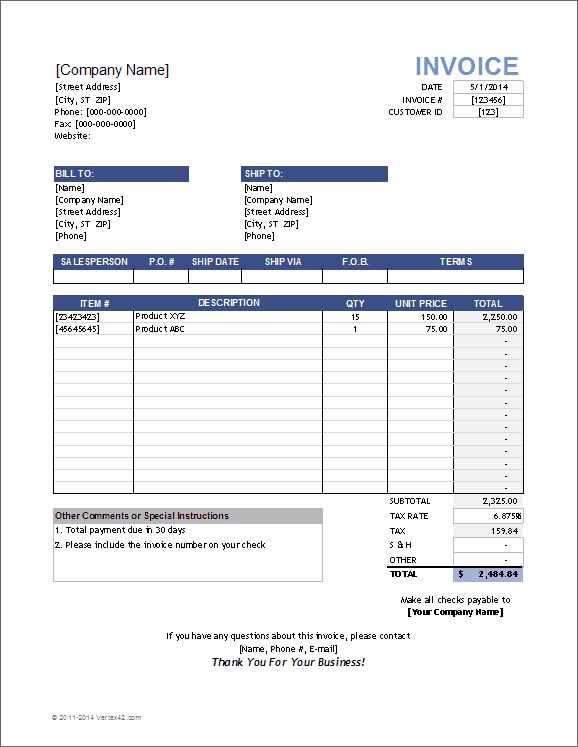

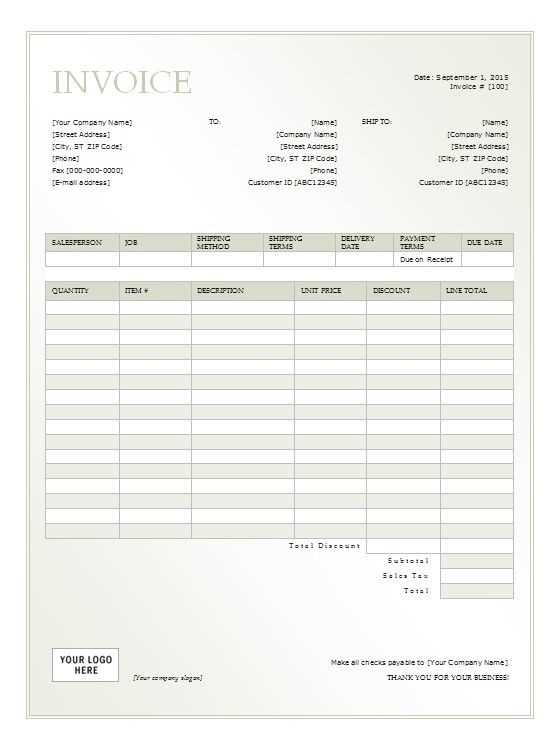

Design a simple, clear template for your sales receipt that includes key information: the seller’s details, buyer’s information, product or service description, price, and total amount. Make sure to have space for transaction date and payment method. Clear section separation and legible font make the receipt easy to read and understand.

Ensure that your template has sections for product/service names, quantities, unit prices, and any applicable taxes. This makes it straightforward for both parties to verify the details. For clarity, provide both the total before tax and after tax. An optional field for discounts can also be added if applicable.

Don’t forget to include terms of sale, return policies, or warranty information if relevant. These can be added at the bottom of the receipt in a smaller, but still readable, font. Ensure all fields are aligned and consistent in format for a professional look.

Using a template that is easy to edit and update, like a word processor or Excel, helps maintain consistency across multiple transactions. If you are using digital tools, consider adding an auto-generated receipt number for tracking purposes.

Include the following components for a complete and accurate sales document:

1. Business Information

List the full name, address, and contact details of your company. This establishes your identity and allows for quick communication if needed.

2. Buyer Information

Include the buyer’s name, address, and contact details. This helps track transactions and ensures proper delivery.

3. Sales Date

Specify the exact date of the sale to avoid any confusion regarding payment terms or delivery schedules.

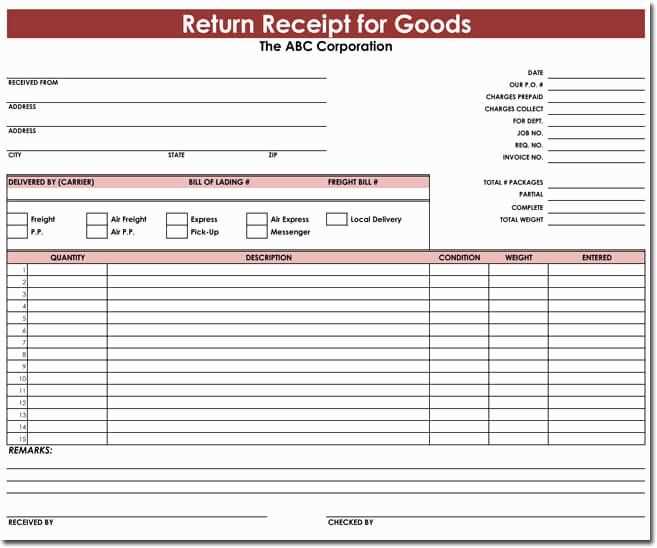

4. Description of Goods/Services

Provide a detailed list of the items sold or services rendered. Include product names, quantities, and unit prices for transparency.

5. Price and Total Amount

State the total amount for the transaction, including taxes, discounts, and any additional charges. This ensures both parties agree on the final cost.

6. Payment Terms

Clarify the payment method (e.g., cash, credit card, bank transfer) and due dates for any outstanding balance.

7. Invoice Number

Assign a unique invoice number for each sales document. This helps with record keeping and reference in case of disputes.

8. Terms and Conditions

Include any applicable warranties, return policies, and shipping conditions to avoid misunderstandings.

9. Signature

Ensure both the seller and buyer sign the document to confirm the transaction has been completed. Electronic signatures may also be used.

Table Example

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $10 | $20 |

| Service B | 1 | $50 | $50 |

| Total | $70 | ||

For retail businesses, a receipt should clearly highlight product details, prices, and any taxes. Include a separate line for discounts or promotions, and consider adding a loyalty program number if applicable. This makes it easy for customers to track their purchases and rewards.

For service-based businesses, focus on service descriptions, duration, and applicable rates. Provide space for hourly rates or package details, and add any applicable taxes or fees. This ensures clarity in what services were provided and how they are billed.

Restaurants or cafes should include the order details, including food items, drinks, and their individual prices. A section for tips or gratuity can be helpful. Customizing for a restaurant might also include a space for order number or server name for easy identification.

For freelance workers or consultants, receipts must focus on service hours, project milestones, or tasks completed. Include detailed descriptions and rates per hour or flat fees, along with a breakdown of any taxes or discounts.

In wholesale or B2B transactions, provide a clear breakdown of bulk items or large orders. Include product codes or SKU numbers for easy inventory tracking and add any additional shipping or handling fees. Businesses in these fields often need detailed documentation for returns and warranty claims.

By tailoring receipt templates to the specific nature of your business, you create a more professional image and make it easier for both you and your customers to manage transactions and track financials.

Ensure that your sales receipts comply with local tax and business laws. Each document should include accurate details on transactions to avoid future disputes.

Key Legal Requirements

- Include both buyer’s and seller’s full names and contact details.

- Clearly state the date and time of the transaction.

- Detail the product or service purchased, including quantity and price.

- Provide a unique transaction reference number for traceability.

- Specify the applicable taxes (e.g., VAT) and the final amount paid.

Consumer Protection Laws

Sales receipts must reflect terms of sale clearly, including any warranties or return policies. Misleading statements or omissions can lead to legal issues under consumer protection laws.

Data Protection Compliance

- Ensure personal data is handled in accordance with data protection laws, such as GDPR for European customers.

- Limit the collection of sensitive information unless absolutely necessary for the transaction.

Retention and Accessibility

- Keep copies of receipts for the required period, as stipulated by local tax authorities.

- Make sure receipts are easily accessible for customers in case of returns or audits.

Use the tag to create an ordered list for displaying specific information. The

- element organizes items in a numbered sequence, which is ideal for step-by-step processes or ranked lists. Inside the

- for each item you want to list. This approach adds clarity to receipts, making them easy to read and follow.

To avoid confusion, ensure that the numbers reflect the exact order of the transaction steps or items purchased. Keep each list concise and to the point. Avoid unnecessary sub-listing, which may complicate the structure.

Remember to close the

- tag properly to maintain correct formatting and list structure in your document.

- tag, use