How to Generate a Motel 6 Receipt

A printable Motel 6 receipt helps with expense tracking and reimbursement. Use a structured template to ensure all required details are included.

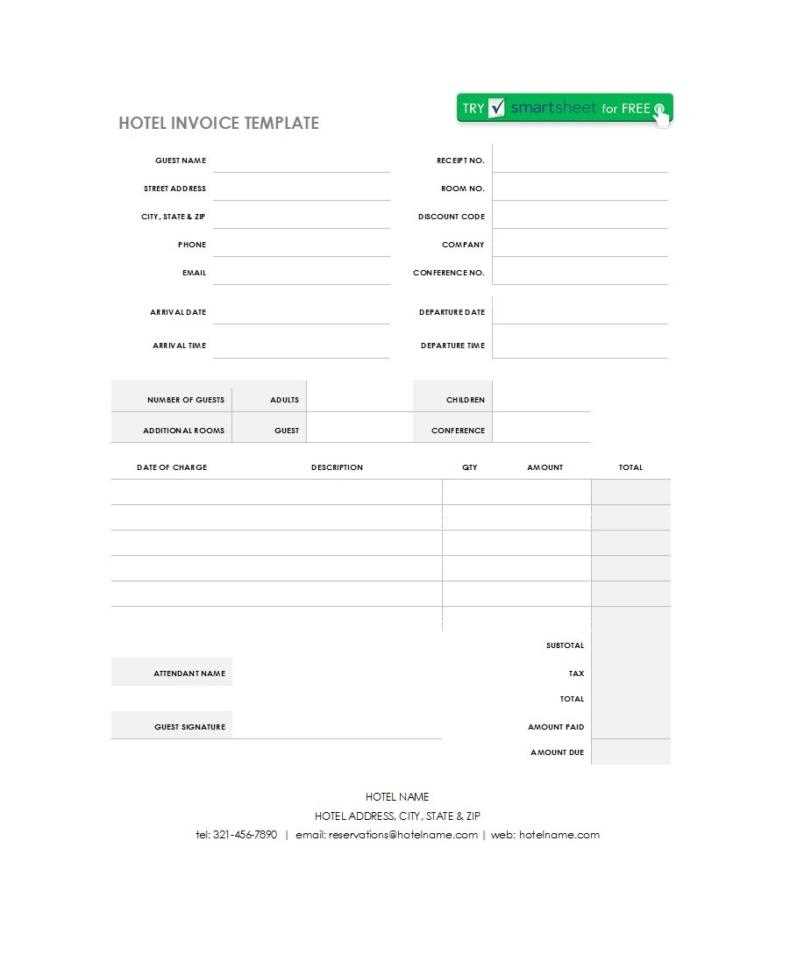

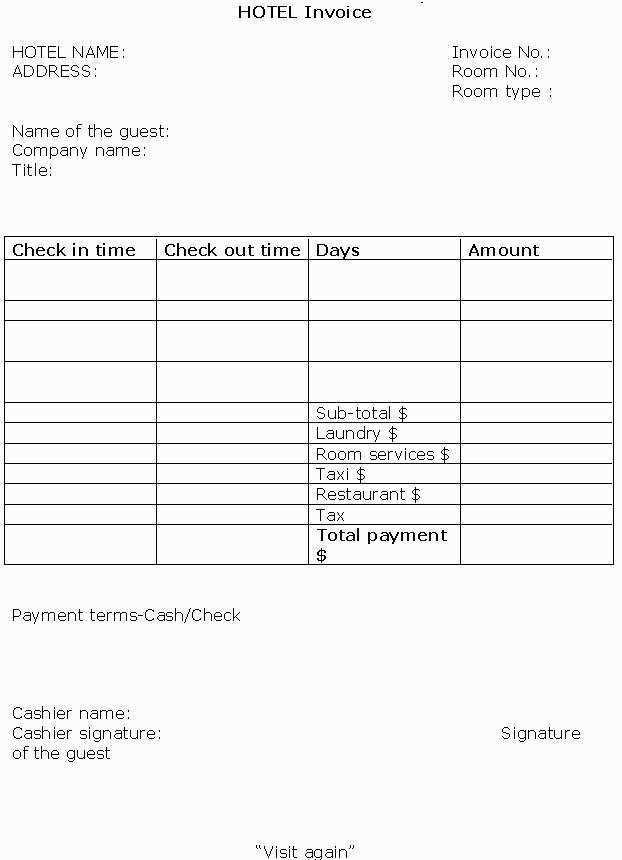

- Guest Information: Name, contact details, and identification number.

- Hotel Details: Motel 6 location, address, and phone number.

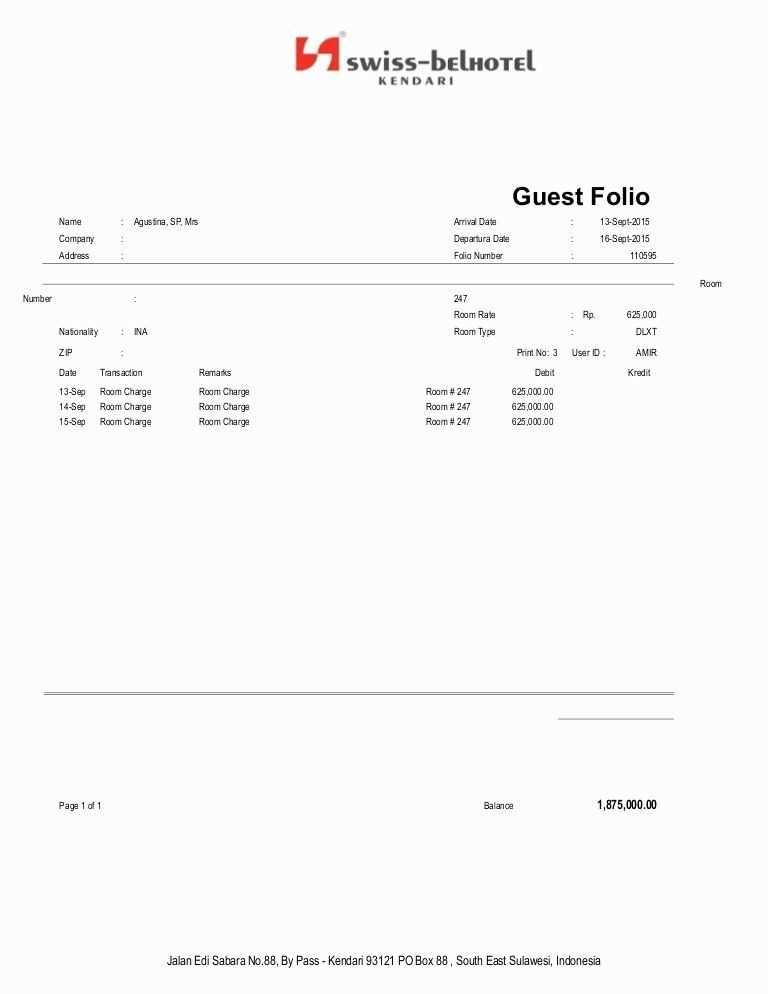

- Stay Information: Check-in and check-out dates, room number, and duration.

- Payment Summary: Room charges, taxes, discounts, and total amount paid.

- Payment Method: Credit card, cash, or other forms of payment.

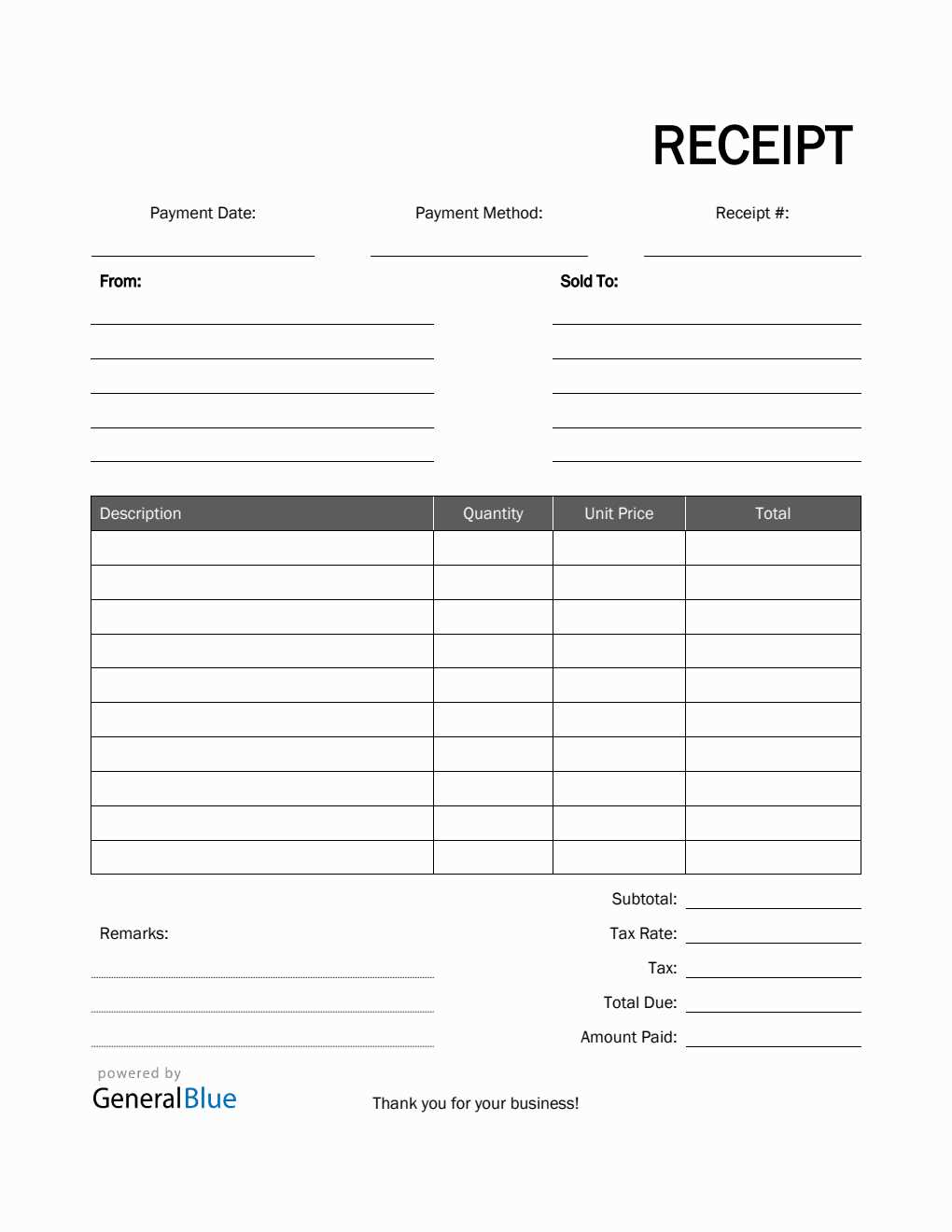

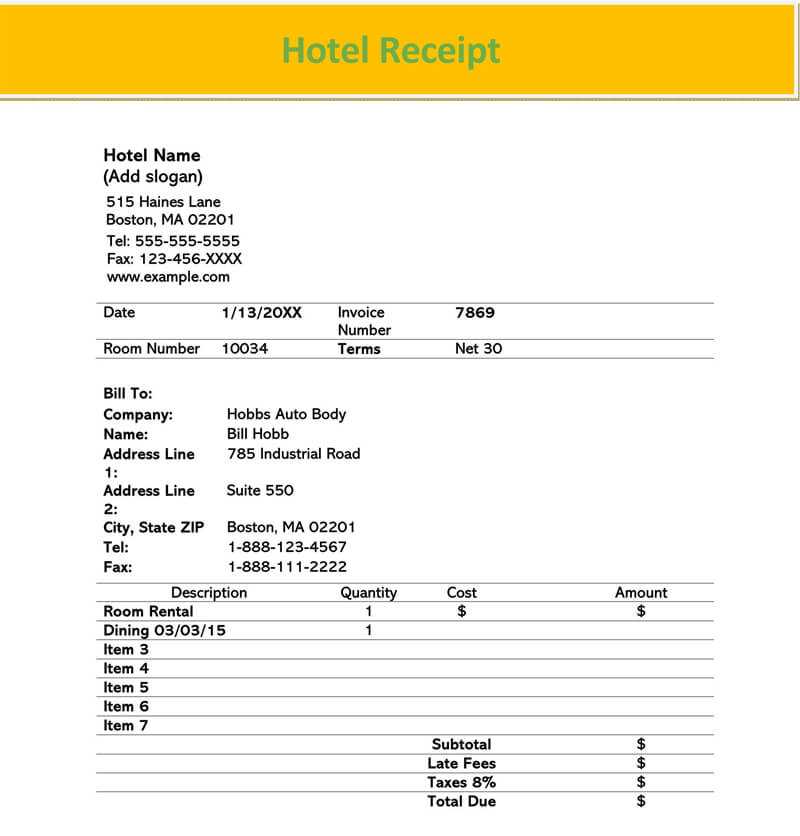

Printable Receipt Template

Use the following format for a printable Motel 6 receipt:

- Header: “Motel 6 Receipt” with the hotel’s logo and address.

- Guest Details: Name and contact information.

- Stay Information: Arrival and departure dates, room number.

- Billing Breakdown: Room rate per night, applicable taxes, total amount.

- Payment Method: Credit card, debit card, or cash.

- Receipt Number: Unique reference for verification.

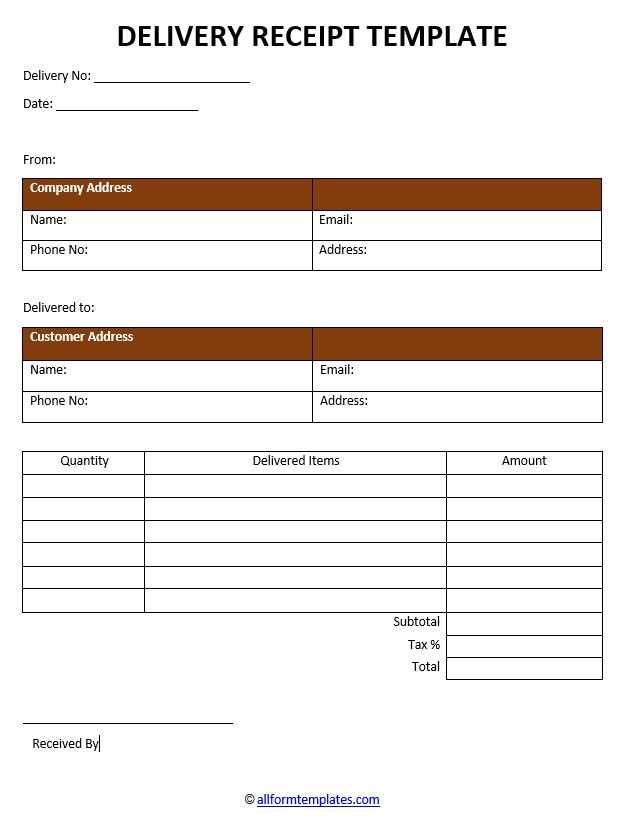

Ensure accuracy before printing or submitting the receipt. A well-structured template prevents errors and streamlines financial documentation.

Template Printable Motel 6 Receipt

Key Elements Included in a Motel 6 Template

How to Customize a Printable Receipt

Legal and Accounting Considerations for Using Templates

Best File Formats for Printable Receipts

Where to Find and Download a Receipt Template

Common Mistakes to Avoid When Using a Template

A well-structured Motel 6 receipt template includes the motel’s name, address, contact details, check-in and check-out dates, room number, guest name, payment method, and total amount charged. Ensure the receipt features an itemized breakdown of charges, including room rates, taxes, and any additional fees.

To customize a printable receipt, use a PDF editor, word processor, or spreadsheet software. Modify the motel details, adjust the date format, and include a unique invoice number for tracking. Ensure the font is clear and professional to maintain readability.

Legal compliance requires including accurate financial details for tax and record-keeping purposes. Ensure the receipt aligns with accounting standards by specifying payment confirmation and retaining copies for audits.

PDF is the preferred format for printable receipts due to its fixed layout and compatibility across devices. Word and Excel files offer easy customization but require conversion to PDF before printing. Avoid image-based formats, as they may reduce clarity when printed.

Download receipt templates from reputable sources offering editable formats. Verify the template includes all necessary fields before use.

Common mistakes include missing tax details, incorrect dates, and lack of signature fields. Always verify data accuracy before printing or issuing receipts.