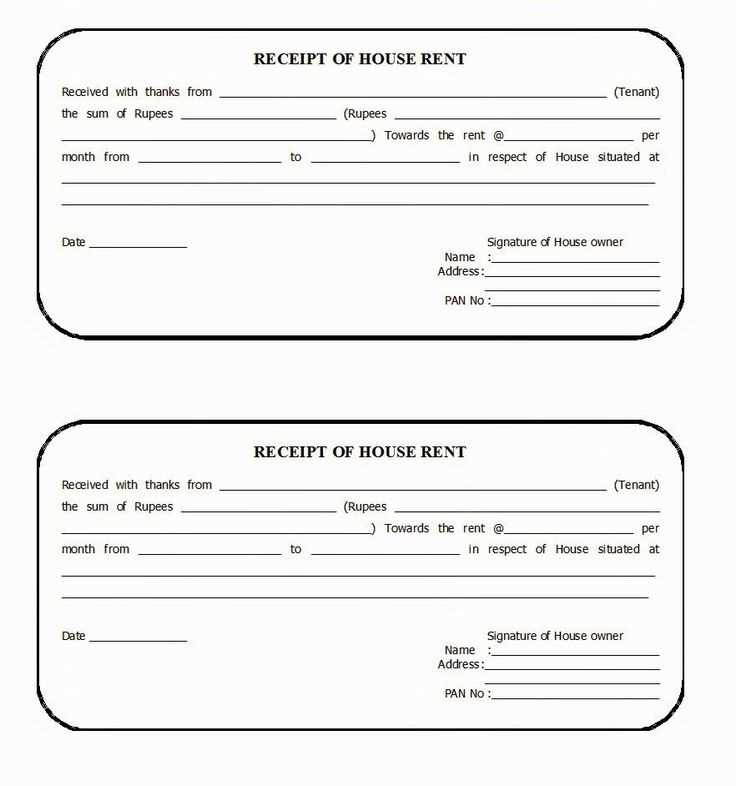

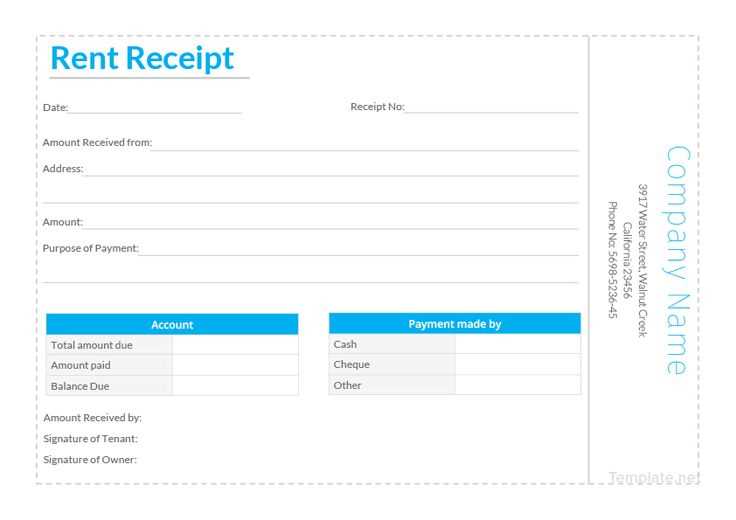

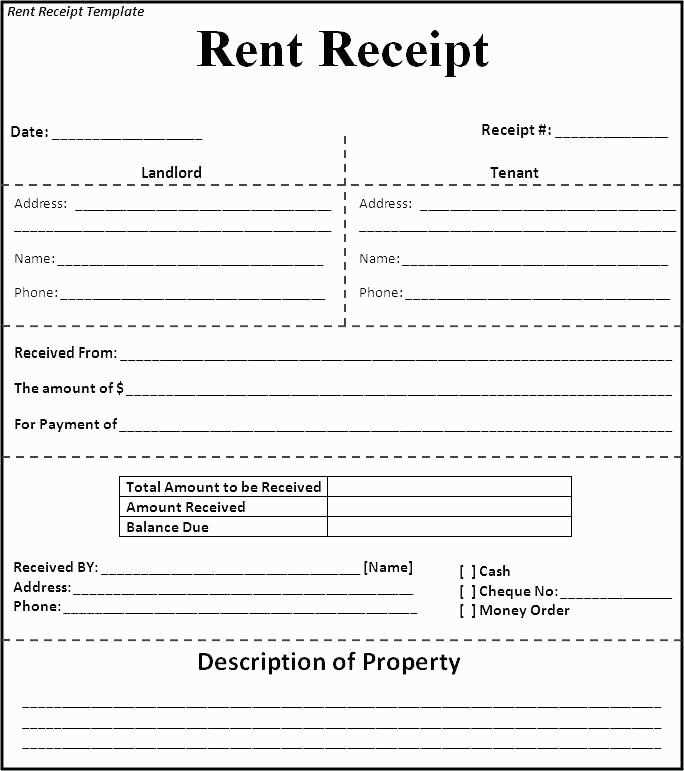

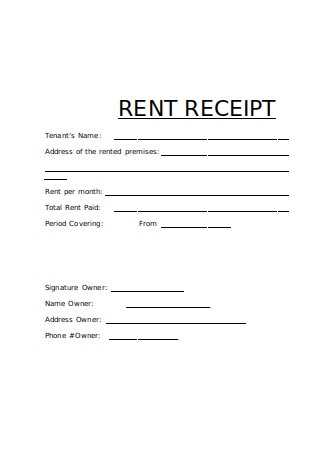

Use a straightforward and clear receipt template to document holiday rental transactions. A well-structured receipt ensures both you and your guest have a record of the payment and terms agreed upon. Include details such as rental dates, total amount, and payment method for clarity.

The template should contain key sections like property address, guest’s name, rental period, and the breakdown of costs. If applicable, list any additional charges such as cleaning fees or deposits. Clearly note the amount paid, along with the payment method used, to avoid confusion later.

Customize the template with your logo and contact information for a professional touch. This makes it easier for guests to reach out in case of questions, and it reinforces your brand. Don’t forget to include the rental agreement reference number, which links the receipt to the original booking.

A receipt helps maintain transparency and reduces disputes over payments. It also provides a paper trail for both parties, which is useful for record-keeping or future reference. Keep it simple but detailed enough to cover all aspects of the transaction.

How to Include Rental Dates and Property Details

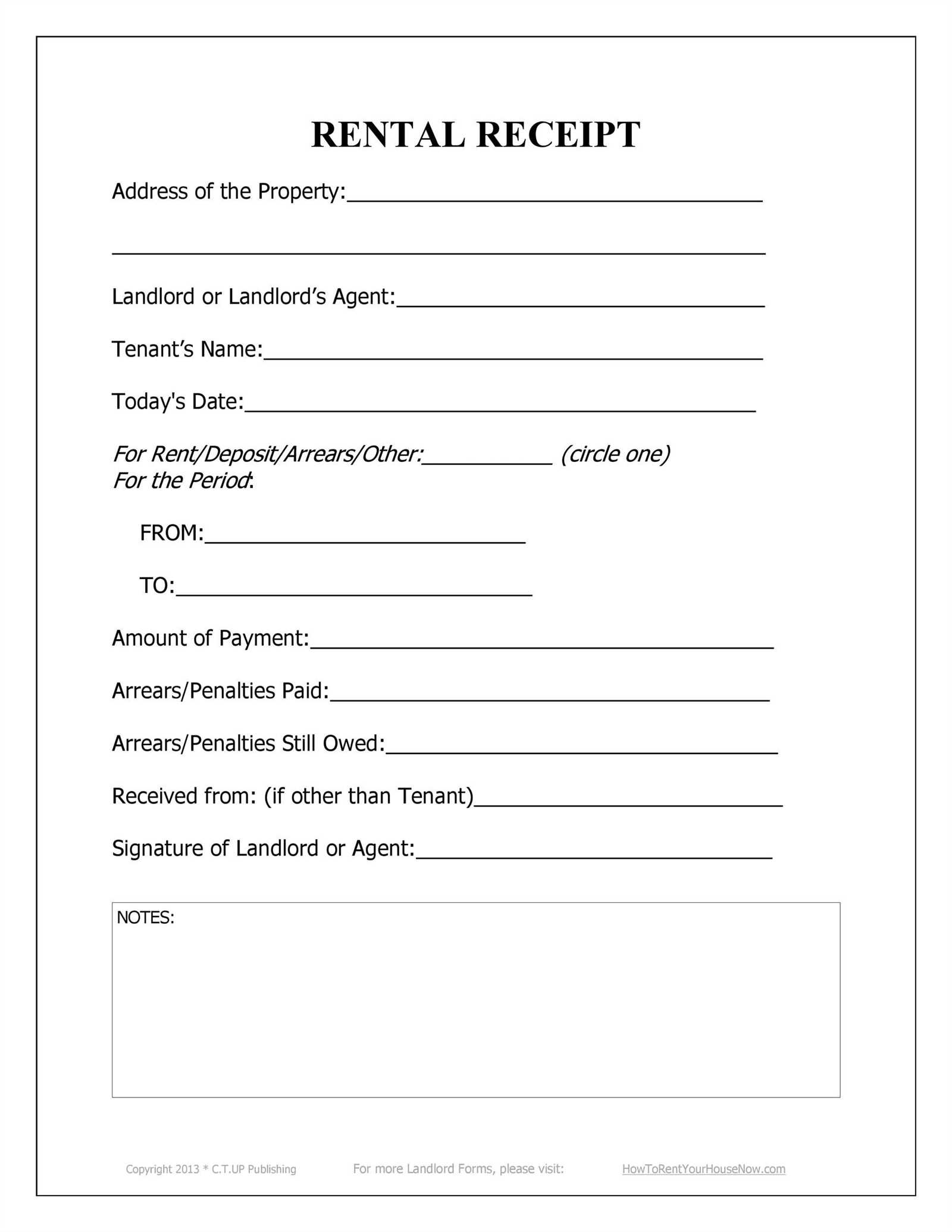

Clearly state the rental period and property information on your receipt to avoid confusion and ensure transparency. Start by listing the start and end dates of the rental period. This ensures both parties know the exact duration of the stay.

Rental Dates

- Specify the check-in and check-out dates. For example, “Check-in: May 15, 2025, Check-out: May 22, 2025.”

- Ensure the dates are clearly visible and correctly formatted to avoid any misunderstandings.

- Include the time of check-in and check-out if necessary, especially if it impacts pricing or availability.

Property Details

- Provide a brief description of the property. Mention the number of bedrooms, bathrooms, or any special features (e.g., “2-bedroom apartment with a sea view”).

- List the full address of the property. Include the street name, city, state, and postal code.

- If applicable, include a reference number for the booking or any unique identifier that helps track the reservation.

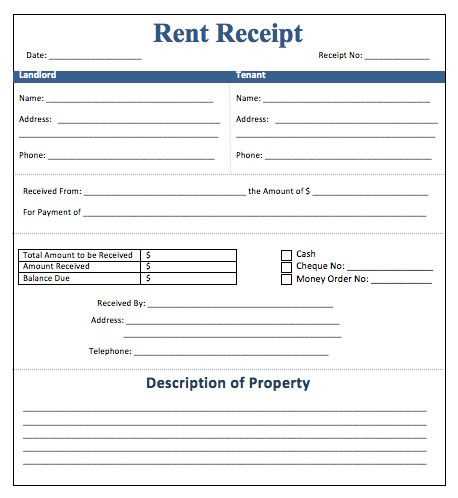

Essential Payment Information to Include

Ensure you list the total rental amount, specifying the nightly rate, cleaning fee, and any applicable taxes. Clearly break down all components of the payment so the guest knows exactly what they are paying for.

Deposit and Payment Terms

Specify if a deposit is required, the amount, and the due date. Include the payment method options and any additional instructions regarding cancellations or payment deadlines. This reduces confusion and sets clear expectations for both parties.

Refund and Cancellation Policy

Detail how refunds are processed, including the amount a guest may receive depending on the cancellation date. Clarify whether the deposit is refundable and under what circumstances, helping guests understand the financial responsibilities involved.

Legal Requirements for a Holiday Rental Receipt

A holiday rental receipt must include specific information to meet legal standards. It should clearly state the rental amount, the period of stay, and any taxes or fees that apply. Ensure the receipt includes the full name and address of the property owner, as well as the guest’s name and the rental property details. This provides clarity and protects both parties in case of disputes.

Mandatory Information

The receipt should list the rental rate for the stay, any additional charges like cleaning fees, and applicable taxes. Specify the payment method used and the date of the transaction. These details are often required by local authorities for tax reporting purposes, making it critical for the landlord to keep accurate records.

Tax Compliance

Depending on the location, some jurisdictions may require landlords to charge specific taxes, such as occupancy or tourism taxes. Ensure these taxes are clearly noted on the receipt, as failure to do so could lead to compliance issues. Keep updated with local regulations to ensure the receipt meets all legal obligations.