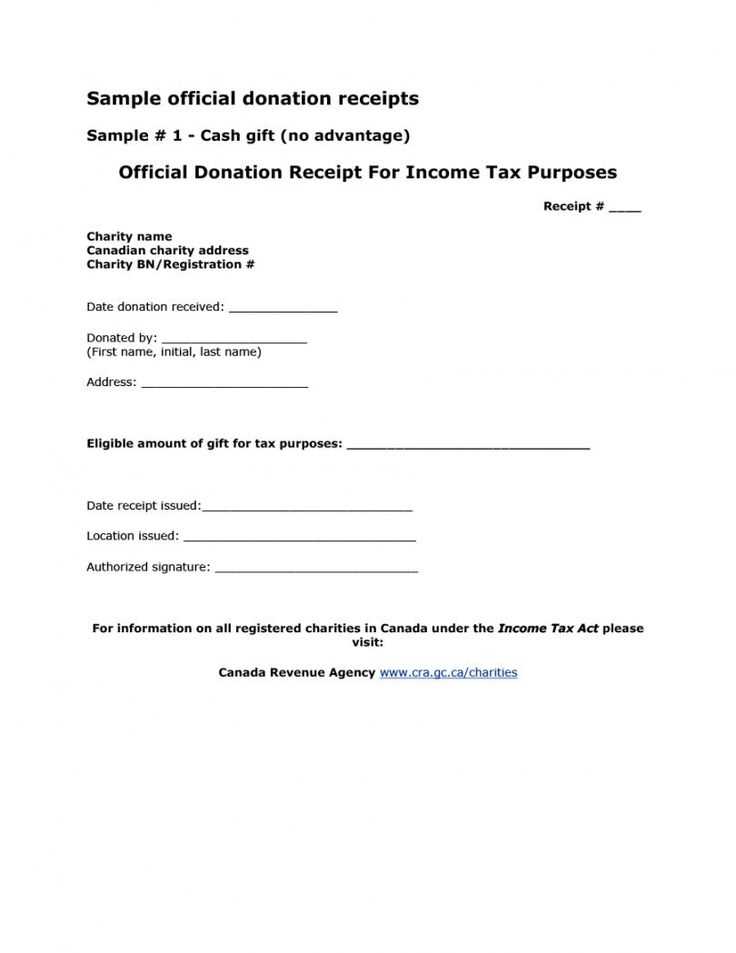

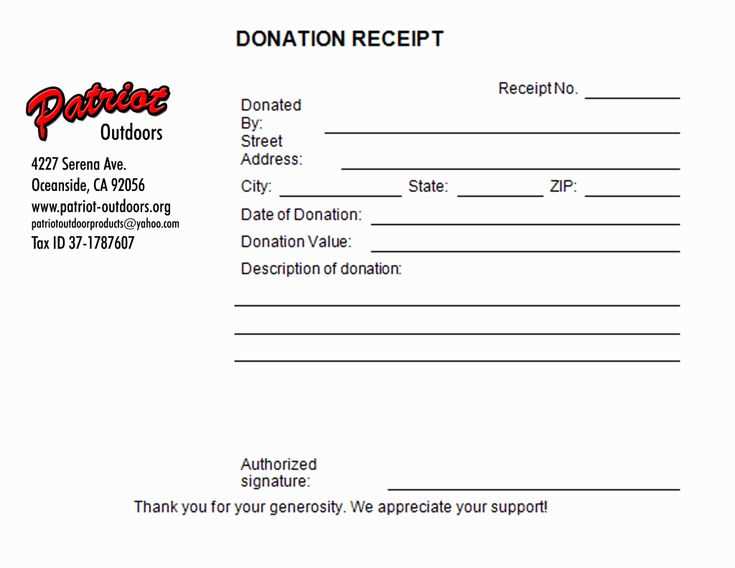

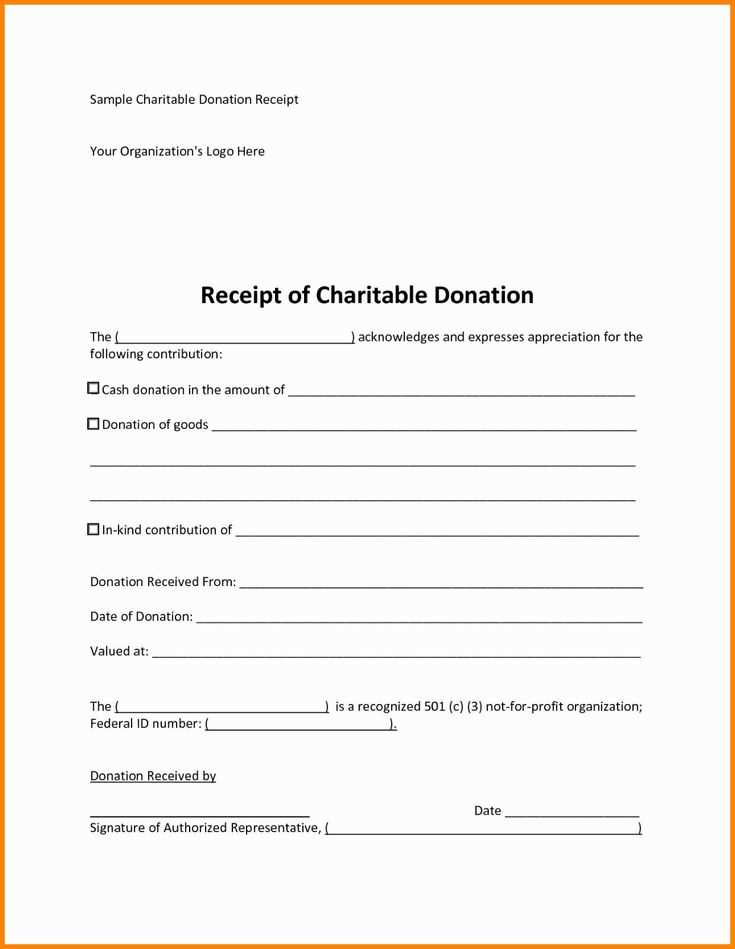

When preparing a charitable donation receipt, accuracy is key. A clear, concise document ensures that both the donor and the organization have proper records for tax purposes. Begin by including the donor’s full name, the donation date, and the specific amount or description of items donated.

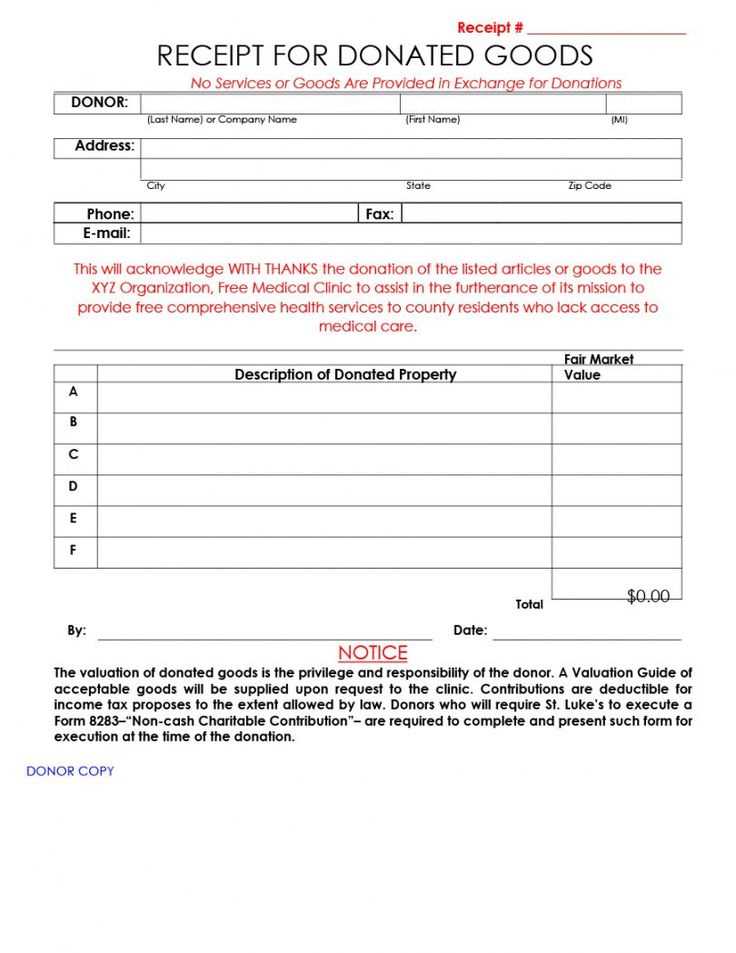

Next, ensure that the receipt clearly states whether the donation is monetary or in-kind. If it is a gift of goods, provide a detailed description, including the condition of the items. This helps prevent any confusion during tax filing. Also, make sure to indicate that no goods or services were provided in exchange for the donation, which is crucial for tax deductions.

Finally, always include the charity’s name, address, and a statement confirming its status as a registered nonprofit. This makes the receipt legitimate and verifies that it meets IRS requirements. With these simple steps, you can create a donation receipt that is both professional and tax-compliant.

Here is the revised version:

Make sure to include the donation amount and the date on the charitable donation receipt. This ensures clarity for both the donor and the organization, serving as a reliable record for tax purposes. Be sure to specify that no goods or services were provided in exchange for the donation if that’s the case. If something was given, clearly state the fair market value of the items or services.

Key Elements

Each receipt should have the name of the charity, its address, and tax-exempt number. Always include the donor’s name and address as well, so there’s no confusion when it comes to acknowledgment. Double-check that the charity’s mission and contact details are correct on the document.

Donor Information

If possible, request the donor’s contact information to ensure all receipts are properly addressed. This can help with follow-up communications and ensure transparency in future donations. Don’t forget to thank the donor for their generosity–it makes the receipt more personal and appreciated.

- Charitable Donation Receipt Template

Clearly identify the donor and the organization. Include the donor’s full name and address, along with the charity’s name, address, and tax identification number. The date of the donation must be included for accurate record-keeping.

Specify the exact amount of the monetary donation or a description of the donated goods. If applicable, include the estimated value of the items donated. If the donor received anything in return, such as a gift or service, list its fair market value, adjusting the donation amount accordingly.

For tax purposes, clarify whether any goods or services were provided in exchange for the donation. If none, make a note stating this explicitly. Ensure the receipt is signed by an authorized representative from the charity, confirming the details and complying with tax regulations.

Ensure the document contains all required details to meet legal standards. These include the donor’s name, address, and a description of the donation. Specify whether the donation was cash or property, and include the value of the contribution if applicable.

- Include the name of the organization receiving the donation, along with their tax identification number.

- State the date the donation was made and issue the receipt immediately after the donation is processed.

- Clearly mention if the donation was a gift or if any goods or services were received in return. If goods or services were provided, include a description and fair market value.

- Ensure the receipt is signed by a representative of the organization to validate its authenticity.

Use clear language to avoid ambiguity in the document. A straightforward and concise format will hold up better in case of an audit or if the donor needs the receipt for tax purposes.

Lastly, make sure the document complies with any local or national tax laws that apply to charitable contributions. Consider consulting a legal professional to confirm that your receipt template aligns with current regulations in your jurisdiction.

Include the donor’s name and address at the top of the receipt. This ensures both you and the donor can reference the gift for tax purposes.

Clearly state the date of the donation. This helps track when the contribution was made, which is important for accounting and tax deductions.

Describe the donated item or the cash value. If the donation is in the form of goods, provide a detailed list, including any specific items or categories. For cash donations, note the total amount donated.

If applicable, mention if the donor received any goods or services in return. The IRS requires that the value of these goods or services be deducted from the total donation amount for tax reporting purposes.

Provide your organization’s name and tax identification number. This is crucial for the donor to claim their tax deduction, especially if the charity is a registered nonprofit.

Always include a thank-you message. A personal note expressing gratitude can go a long way in strengthening relationships with your supporters.

| Detail | Explanation |

|---|---|

| Donor’s Name and Address | Used for tax purposes and tracking donations. |

| Date of Donation | Helps both parties track the transaction for tax deductions. |

| Donation Description | List specific items or the cash amount donated. |

| Goods or Services Provided | If any, include their value to determine the deductible amount. |

| Organization’s Name and Tax ID | Required for tax purposes, particularly for registered charities. |

| Thank You Message | Personal acknowledgment of the donation. |

Use a clean and easy-to-read font like Arial or Times New Roman. Keep the font size between 10 and 12 points to ensure readability without overwhelming the recipient.

Align text to the left for a polished look. Use bold for section headers and key details, such as donation amounts and dates, but avoid excessive bolding that could make the document appear cluttered.

Include proper margins (1 inch on all sides) for a balanced layout. This simple step can make the receipt look organized and professional.

Ensure the donation receipt is divided into distinct sections, such as donor information, donation details, and a thank-you note. This organization improves clarity and helps with quick reference.

Provide space between sections and use bullet points or numbered lists for easy readability. A clean, structured format enhances the document’s professionalism and flow.

Use the official organization logo and contact details at the top for branding consistency. Make sure these elements are high-quality and aligned properly.

Always include a footer with relevant legal or tax-related disclaimers, if applicable, to demonstrate transparency and compliance.

Ensure your charitable donation receipt is clear and concise. List the name of the donor and their contact information at the top. Include the date of donation and the amount or description of the item donated. For monetary donations, specify whether the donation was cash, check, or other types of payment. If a donation is non-monetary, describe the items given and estimate their value.

Clearly state that no goods or services were provided in exchange for the donation if applicable. This helps the donor with tax deductions. If goods or services were provided, include their value and specify the amount of the donation that is tax-deductible.

Use simple and accurate language to ensure the receipt serves its purpose for both the donor and the charity. Include the organization’s name, tax ID number, and contact information to meet legal requirements and facilitate any inquiries.

Finally, ensure the receipt is signed by an authorized individual from your organization to validate the donation. This signature adds authenticity and finalizes the process, ensuring everything is above board.