Creating a donation receipt in QuickBooks is simple and can help keep track of charitable contributions. Use the template designed for this purpose to ensure all necessary details are included.

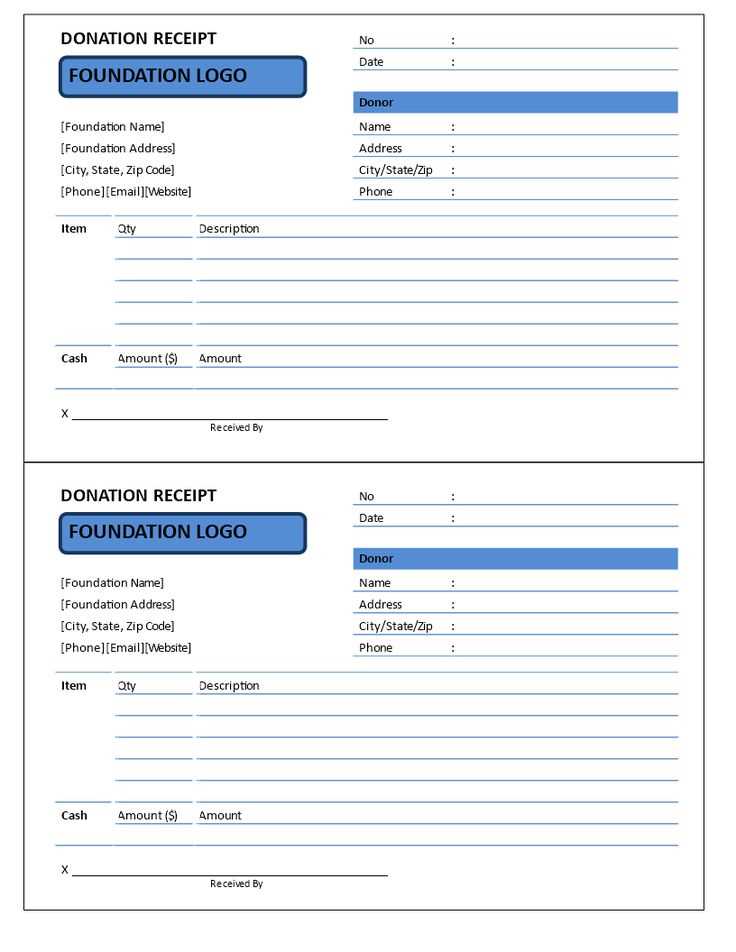

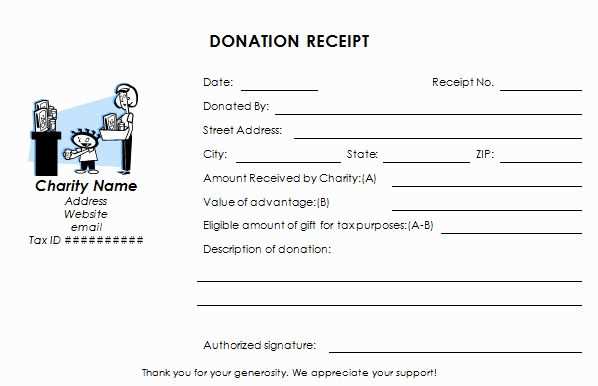

The template should have key fields: donor’s name, donation amount, date of donation, and the nonprofit organization’s information. Make sure to add any special notes about the donation, such as whether it was a cash or in-kind donation.

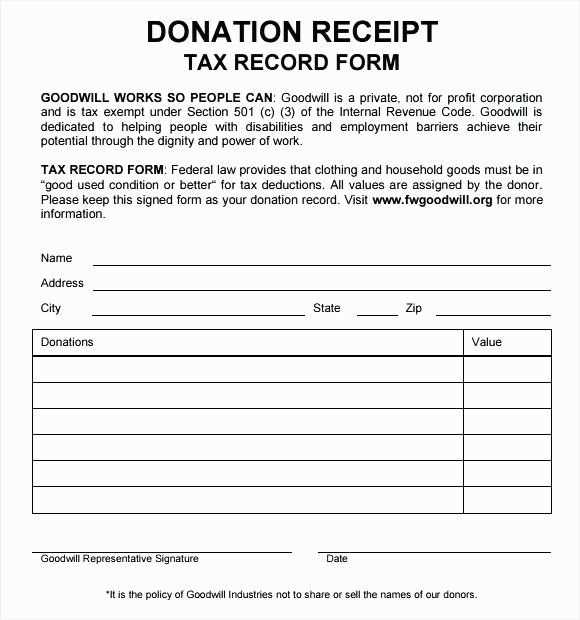

If the donation is in-kind, include a brief description of the items, along with their estimated value. This helps ensure the donor receives accurate information for tax purposes. Remember to keep this information organized in QuickBooks for easy access when needed.

Using a well-structured template ensures compliance with IRS guidelines and makes the receipt process faster and more reliable. It also simplifies record-keeping for both the donor and the organization.

Here’s a version with corrected repetitions:

Ensure you include key details such as the donor’s name, donation date, and the amount donated. Clearly state if the donation is monetary or in-kind. This will help the recipient organization comply with tax laws and provide an accurate record for both parties.

If the donation is in kind, list the items or services donated along with their fair market value. For cash donations, specify the exact amount given. Also, make sure to include your organization’s name, address, and tax identification number.

Do not forget to add a statement confirming no goods or services were provided in exchange for the donation, if applicable. This will ensure the donor can claim the full tax benefit. Finally, ensure the receipt is signed by a representative of the organization for added authenticity.

QuickBooks Donation Receipt Template

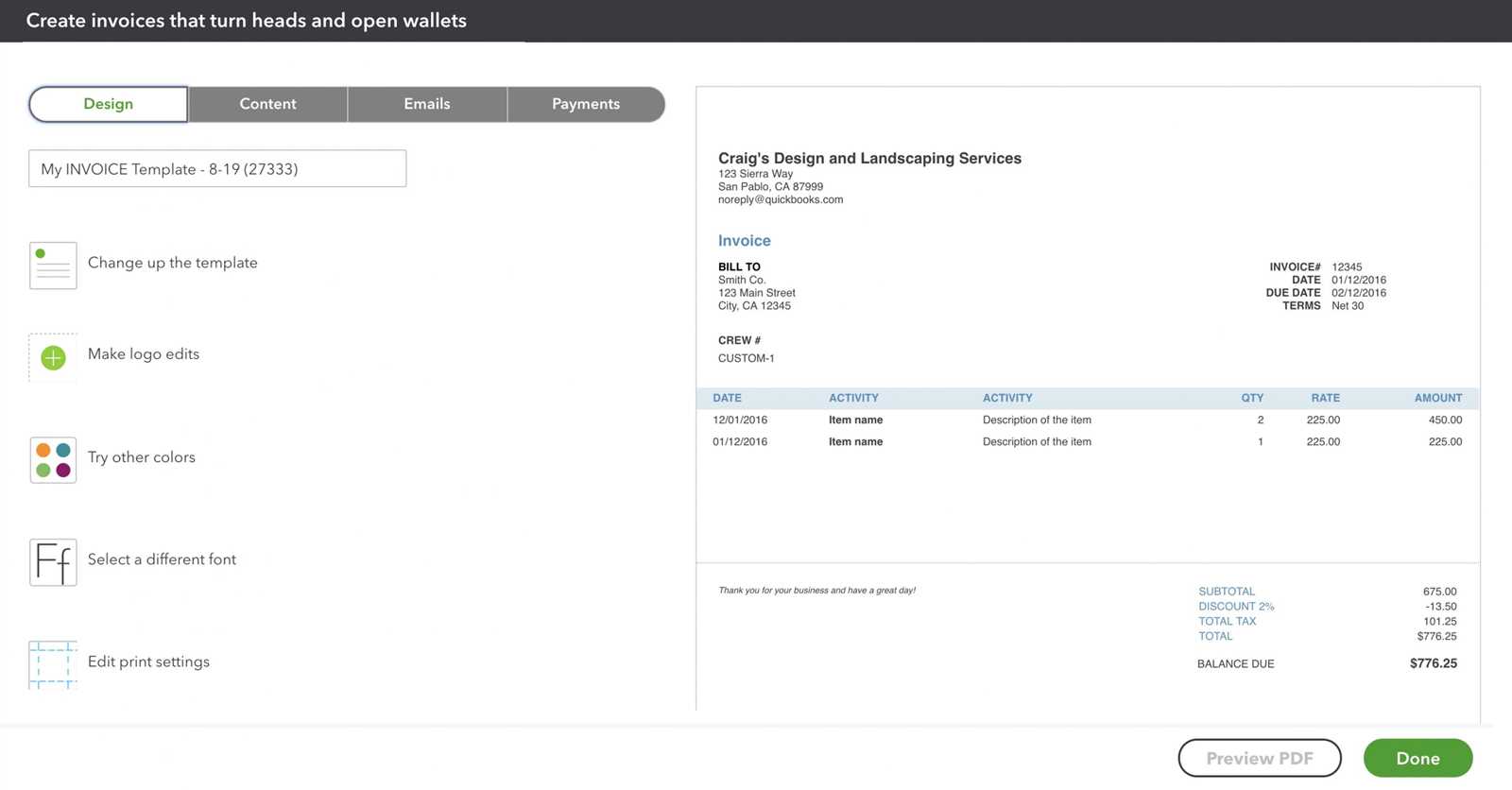

To create a custom donation receipt in QuickBooks, begin by opening your QuickBooks account and selecting “Sales” from the left menu. Click on “Create Invoice” and select “Donation” as the type of transaction. From here, you can personalize the receipt by adding donor information, donation amount, and the specific purpose of the donation. QuickBooks allows you to customize fields such as the donor’s name, donation date, and tax-deductible amount, which are crucial for transparency and tax purposes.

Key Details to Include in a Donation Acknowledgment

When drafting a donation acknowledgment, ensure the receipt includes the following details:

- Donor’s Name and Address: This is essential for record-keeping and tax purposes.

- Donation Amount: The exact amount of the donation should be clearly stated.

- Date of Donation: Helps the donor track their contributions in a specific year.

- Statement of No Goods or Services Received: This confirms that the donation is tax-deductible.

- Charity’s Information: Include your organization’s name, address, and tax ID number.

How to Automate Acknowledgments for Donations in QuickBooks

To streamline the acknowledgment process, set up automated email receipts in QuickBooks. You can configure QuickBooks to automatically send a receipt every time a donation is recorded. Go to the “Settings” menu, select “Sales” and then “Sales Form Content.” Turn on the “Auto-send email” option for donations. This will ensure that each donor receives a prompt and accurate receipt without manual intervention, saving you time and minimizing errors.