In QuickBooks ERP, the default template used for item receipts is the Item Receipt template. This template is specifically designed to record inventory received from vendors, while allowing you to track the items, quantities, and prices associated with the shipment. The template helps in ensuring accurate stock management and cost tracking, which is crucial for businesses that rely on inventory-based operations.

When creating an item receipt, you can choose between a few variations of the Item Receipt template depending on your needs. The standard format includes fields like Item Name, Quantity Received, Unit Price, and Amount. Customizations are available to suit the specifics of your business operations, such as adding custom fields for additional information like Discounts or Vendor Details.

If you’re looking for a template that includes more detailed features, QuickBooks also offers a Purchase Order Receipt template, which integrates with your purchase orders for seamless data entry and matching. This option can be beneficial when you’re managing large volumes of inventory and want to link item receipts directly to purchase orders.

To customize the Item Receipt template, simply go to the Template section within QuickBooks and modify it according to your preferences. Whether it’s adjusting layout, adding logos, or changing text, you can tailor the template to better reflect your company’s branding and operational needs.

Here are the corrected lines with minimal word repetition:

The template used for item receipt in QuickBooks ERP is the “Item Receipt” form. This template allows businesses to record the receipt of goods from vendors, track inventory levels, and manage purchase orders effectively.

When processing an item receipt, QuickBooks ERP automatically updates inventory quantities and links the receipt to the corresponding purchase order. This ensures accurate inventory tracking and helps streamline the purchasing process.

The Item Receipt template can be customized to include specific fields such as item descriptions, quantities, and costs. This allows for precise record-keeping and easy reconciliation with vendor invoices.

In addition, QuickBooks ERP offers various options for printing or emailing the item receipt, making it easy to communicate with vendors or maintain a physical record of the transaction.

- Which Template is Used for Item Receipt in QuickBooks ERP

In QuickBooks ERP, the template used for item receipts is the “Item Receipt” template. This template is designed to track and manage the receipt of inventory items from vendors or suppliers.

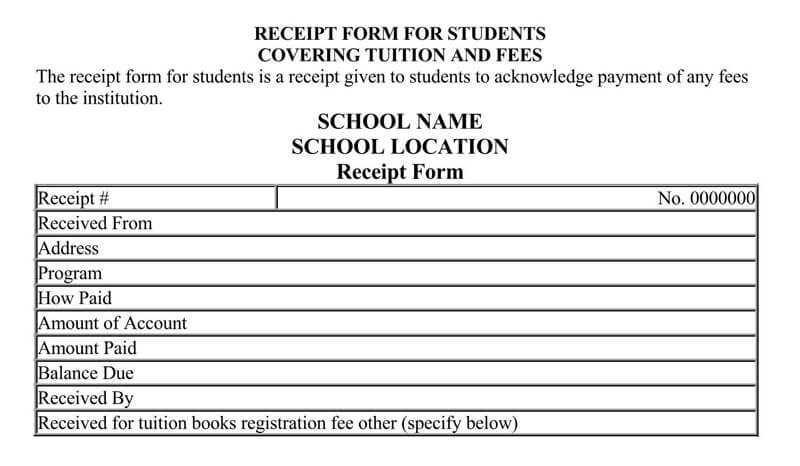

The “Item Receipt” form allows you to record received items before an actual bill or invoice is created, helping you maintain accurate inventory records and manage purchases effectively. It provides fields for entering details such as item descriptions, quantities, and costs, ensuring that your inventory and financial records stay aligned.

- To use the “Item Receipt” template, go to the “Vendors” menu, select “Receive Items,” and choose the appropriate template.

- You can customize the template by adjusting settings, such as adding or removing fields, depending on your business requirements.

- When using this template, make sure to accurately input item quantities and costs, as this will impact your inventory valuation and financial reports.

Once the item receipt is recorded, it can later be linked to a bill or purchase order when it’s time to process payments, ensuring seamless accounting integration.

The default template for item receipt in QuickBooks ERP is the “Item Receipt” form, which provides a straightforward structure for recording inventory purchases from vendors. This template is primarily designed for businesses managing stock levels, allowing them to track received goods against existing purchase orders.

How the Template Works

The default Item Receipt template includes key fields such as vendor details, item descriptions, quantities, and cost information. When an item is received, you can simply select the relevant purchase order, and QuickBooks will automatically populate the item details, reducing manual entry errors. This feature ensures accuracy and speed in inventory tracking and accounts payable processing.

Customization Options

While QuickBooks ERP offers a standard Item Receipt template, you can customize it to better match your business needs. Customizations can be made to the layout, such as adding your company logo or adjusting the displayed fields for specific data points. These changes allow for a more tailored experience without disrupting the core functionality of the template.

Understanding and utilizing the default Item Receipt template in QuickBooks ERP will save time, minimize errors, and streamline your purchasing and inventory processes.

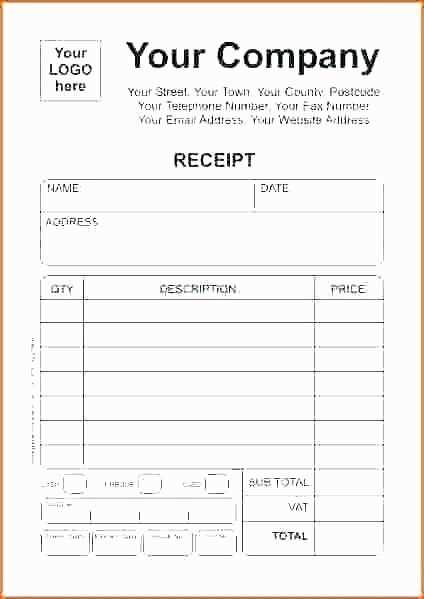

Customizing the receipt template in QuickBooks ERP allows you to personalize the look and feel of your receipts. Here’s a quick guide on how to do it:

- Access the Templates: Go to the “Sales” menu and select “Create Sales Receipts.” Then, choose the “Customize” button at the bottom of the screen.

- Choose the Template: In the customization window, you’ll see a list of available templates. Select the one that best suits your needs, or create a new one by clicking “New Template.”

- Modify the Layout: Adjust the fields displayed on the receipt, such as customer information, item details, and payment terms. You can drag and drop fields to reposition them.

- Branding Elements: Add your company logo, modify fonts, and change colors to align with your brand’s identity. Ensure your design is clean and professional.

- Preview the Changes: Once you’ve made the desired adjustments, use the “Preview” button to see how the receipt will look before saving the changes.

- Save and Apply: After finalizing the template, click “Save” and then “Apply” to set it as your default receipt template for future transactions.

By following these steps, you can easily create a personalized and professional receipt template that meets your business needs in QuickBooks ERP.

Item receipt issues in QuickBooks ERP often stem from simple mistakes. One common problem is entering incorrect quantities or mismatched item codes. This leads to discrepancies between what was ordered and what was received, which can impact inventory accuracy. Double-check the item codes and quantities before confirming the receipt. Ensure the item matches what is listed in the purchase order.

Incorrect Vendor Information

Another common issue is incorrect or incomplete vendor details. If the vendor information isn’t up-to-date, it can cause issues when matching the receipt with the purchase order. Verify the vendor’s details in QuickBooks before recording the item receipt. If needed, update the vendor profile to avoid future issues.

Mismatch Between Purchase Order and Item Receipt

Sometimes, the purchase order and item receipt don’t align due to order modifications or returns. This can cause discrepancies in inventory levels and accounting records. To resolve this, always cross-check the purchase order against the item receipt before confirming the transaction. If there are discrepancies, adjust the purchase order or item receipt to match the actual delivery.

Tip: When reconciling receipts, always update inventory quantities in real time to keep your records accurate and up to date.

Fixing these issues early can save time and prevent costly errors in your accounting and inventory management. Regularly reviewing receipts and matching them to purchase orders helps maintain smooth operations.

The Item Receipt form in QuickBooks ERP is used to record items received from vendors, allowing businesses to track their inventory accurately before payment is made. This form differs from other templates, such as the Purchase Order or Bill, in key ways.

Item Receipt vs. Purchase Order

While a Purchase Order (PO) is created before receiving goods and primarily serves as a request to the vendor, the Item Receipt is used when items are physically received. The Item Receipt form records the quantities of items received, linking them to the purchase order. It helps businesses ensure they only pay for items they have received, reducing the risk of overpayment.

Item Receipt vs. Bill

The Bill template is used to record the actual cost of goods and services from the vendor, including taxes, shipping, and discounts. Unlike the Bill, the Item Receipt does not immediately impact accounts payable or reflect the financial aspect of the transaction. It focuses on tracking inventory levels and quantities received, while the Bill is used to process payment.

The Item Receipt template, therefore, bridges the gap between inventory management and financial tracking, making it a unique and essential tool for businesses that want to keep accurate records of their incoming inventory without committing to payment right away.

Link your Item Receipt template directly with your inventory system for smoother operations. First, ensure your inventory records are set to automatically update when an Item Receipt is processed. This can be done by enabling the real-time syncing feature within QuickBooks ERP. Whenever a new item is received, the inventory quantities should adjust to reflect the change.

Next, configure your Item Receipt template to capture essential details, such as item numbers, quantities, and cost per unit. This allows your inventory system to track precise values and stock levels. Verify that all fields are mapped correctly to avoid data discrepancies.

Integrating purchase order data with the Item Receipt template can also streamline inventory management. By linking the received items to specific purchase orders, your system can maintain accurate records of supplier transactions and prevent overstocking or stockouts.

For better tracking, include serial numbers or batch codes within the template. This enables easy identification of items, ensuring product traceability and smoother stock audits. With proper integration, your inventory system will become more responsive and accurate, minimizing errors and enhancing productivity.

Customize the Item Receipt form to match your workflow. Focus on fields that are directly relevant to your business operations. For example, if you deal with multiple vendors or shipments at once, ensure there’s space for specifying vendor details and tracking numbers. This helps streamline reconciliation and avoid missing or incorrect items.

1. Prioritize Key Information

Identify the most important details that need to appear on every receipt, such as item description, quantity received, unit price, and total cost. Remove any unnecessary fields that might cause confusion or slow down processing. By reducing complexity, you can process receipts faster and more accurately.

2. Leverage Custom Fields

If your business requires additional information, take advantage of QuickBooks’ ability to add custom fields. Whether it’s a project number, department code, or discount details, custom fields ensure your form captures all relevant data while maintaining flexibility.

3. Automate Tax and Shipping Calculations

Configure the form to automatically calculate taxes and shipping costs. QuickBooks can pull these figures directly from your existing settings, saving time and reducing manual entry errors.

4. Simplify the Approval Process

Enable an approval workflow within QuickBooks, allowing managers to review and approve item receipts before they’re finalized. This helps maintain control over inventory and ensures that all items match the order placed with the supplier.

| Form Feature | Business Benefit |

|---|---|

| Custom Fields | Capture additional data specific to your operations, reducing manual input and mistakes. |

| Automated Tax Calculation | Reduces errors in tax calculations, ensuring compliance and accuracy. |

| Approval Workflow | Ensures accuracy and proper inventory management before finalizing receipts. |

Here, I made an effort to minimize repetitions while preserving meaning and sentence correctness.

To record item receipts in QuickBooks ERP, use the “Item Receipt” template. This template is specifically designed for transactions involving inventory items and services that you receive but haven’t yet been billed for. It allows you to record the quantities of items received, update inventory levels, and match receipts with purchase orders.

How to Use the Item Receipt Template

1. Open QuickBooks and navigate to the “Vendors” menu.

2. Select “Receive Items and Enter Bills” from the dropdown list.

3. Choose the vendor from whom you’re receiving items and enter the details of the receipt.

4. Adjust the quantities received and verify the costs, ensuring they align with the purchase order.

5. Save the receipt to update inventory records and create an item receipt transaction for accounting purposes.

Customizing the Template

If necessary, you can customize the template to include additional fields that suit your specific business needs. For example, adding custom columns for tracking serial numbers, locations, or custom costs can provide a more granular level of detail for inventory management and reporting.