A well-structured debt collection payment receipt is necessary for both creditors and debtors to maintain clear financial records. It should include key details such as the debtor’s name, payment amount, date, method of payment, and an acknowledgment statement. Without these elements, misunderstandings can arise, leading to disputes or compliance issues.

Every receipt should specify whether the payment is partial or full and reference the corresponding invoice or debt account. This prevents confusion and ensures proper documentation of outstanding balances. If applicable, including late fee adjustments or interest calculations adds transparency to the transaction.

For legal protection, always include the creditor’s contact details and a unique receipt number. If payments are handled through an agency, their official stamp or signature adds credibility. A clear disclaimer stating that receipt of payment does not cancel any remaining debt can also be useful.

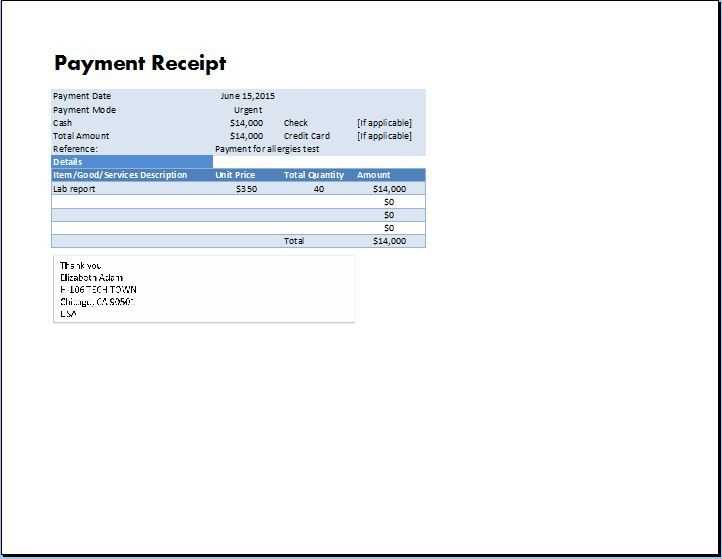

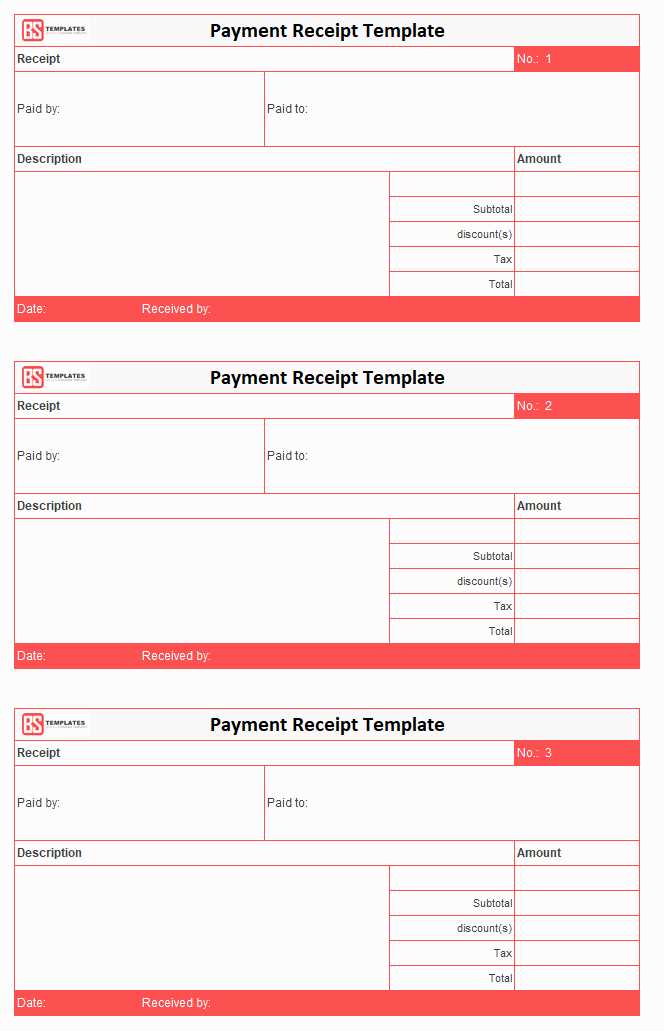

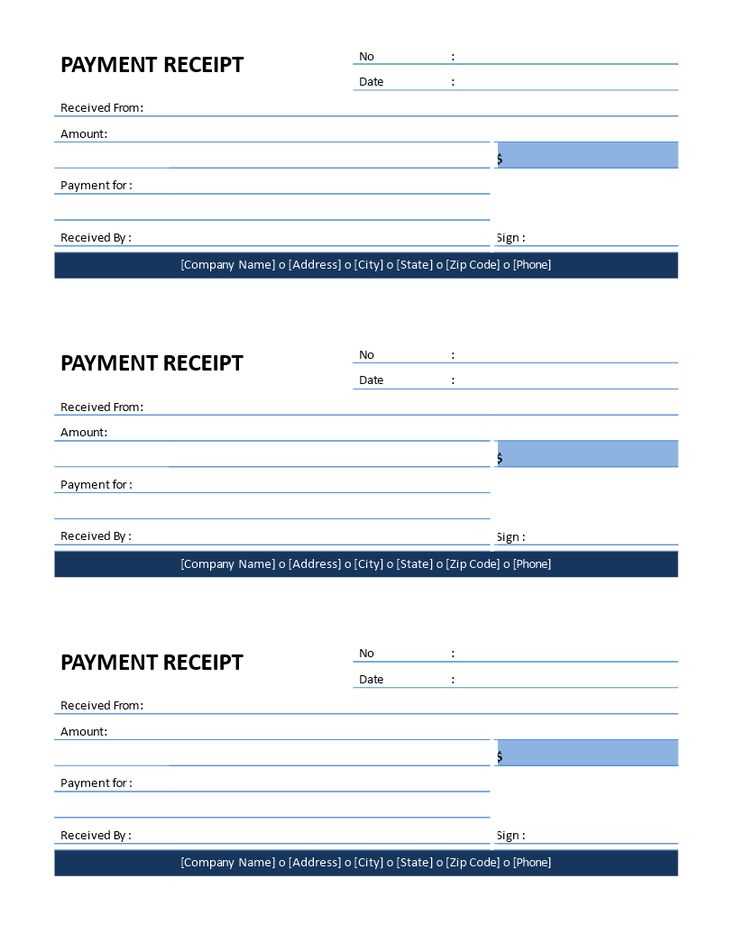

Using a standardized template saves time and keeps records consistent. Whether issued digitally or on paper, a structured format ensures accuracy and simplifies bookkeeping. Below, you’ll find a practical template to streamline your debt collection process.

Here’s an optimized version without unnecessary repetition, while keeping the meaning intact:

To create a debt collection payment receipt template, focus on clarity and precision. The main elements to include are the payer’s and recipient’s names, the payment amount, the date of the transaction, and a description of the debt being paid off. A concise structure ensures all critical information is clear and easy to reference later.

Key Sections of a Payment Receipt

| Field | Description |

|---|---|

| Payer’s Name | Full name of the person making the payment. |

| Recipient’s Name | Full name of the entity or person receiving the payment. |

| Payment Amount | The total amount of money paid. |

| Date of Payment | The exact date the payment was made. |

| Description | A brief note describing the debt being settled. |

Additional Considerations

If the payment is partial, note the remaining balance. Ensure the payment method (e.g., cash, check, or electronic transfer) is specified. For easier record-keeping, consider including a unique receipt number to reference future transactions.

- Debt Collection Payment Receipt Template

A Debt Collection Payment Receipt should clearly document the details of the transaction for both the creditor and the debtor. This template should include the following key sections:

- Debtor Information: Full name, address, and contact details.

- Creditor Information: Name, business name (if applicable), and contact details.

- Payment Details: Amount paid, payment method, and date of payment.

- Outstanding Balance: The remaining balance (if any) after the payment has been applied.

- Payment Reference: A unique reference number or invoice number tied to the payment.

- Signature Section: Spaces for both the creditor’s and debtor’s signatures for acknowledgment.

This template ensures that both parties have a formal record of the payment, protecting their interests in case of disputes. Be sure to customize the template based on the specific terms agreed upon between the debtor and creditor. Keep all receipts in a secure place for future reference or potential legal action.

Include these key details to ensure your debt collection receipt is complete and clear:

- Receipt Number: Assign a unique number to each receipt for tracking and referencing.

- Debtor’s Information: Clearly list the debtor’s name, address, and contact details.

- Creditor’s Information: Include the creditor’s name, address, and contact details as well.

- Amount Paid: Specify the exact amount received, including the currency and any additional fees if applicable.

- Date of Payment: Mention the exact date when the payment was made.

- Payment Method: Identify how the payment was made (e.g., cash, check, bank transfer, etc.).

- Outstanding Balance: Clearly show the remaining balance after the payment.

- Payment Description: Provide a brief explanation of the payment (e.g., part of debt, full settlement, etc.).

- Transaction Reference: Include any transaction or reference number associated with the payment.

- Signature: Include space for both the creditor and debtor to sign, confirming the payment receipt.

By including these details, the receipt serves as both proof of payment and a reference for both parties in case of future disputes.

To ensure a debt collection payment receipt is legally compliant, include key elements that validate the transaction. Start with a unique receipt number for tracking purposes. Clearly state the date of the payment. Include the full names and addresses of both the creditor and debtor, confirming their identities. Specify the payment amount, currency, and any applicable fees. Itemize the breakdown if the payment covers multiple services or debts.

Key Payment Details

Make sure to include the method of payment, whether cash, check, or bank transfer, along with relevant transaction details like bank account numbers or check numbers. If applicable, provide the balance remaining after the payment is made. This gives clarity on what was paid and what is still owed.

Signatures and Legal Clauses

Conclude with the signature of the person authorized to accept the payment, either the creditor or their representative. If required by local regulations, add a clause confirming the transaction’s compliance with applicable laws. This helps establish the document’s validity in legal matters.

Organize receipts by category to make retrieval easier. Create folders for each category, such as “Medical,” “Utilities,” or “Business Expenses.” Use clear labels to quickly identify what each folder contains. This system minimizes time spent searching for receipts and helps track spending.

Go digital whenever possible. Scan or take clear photos of physical receipts. Store them in cloud storage services like Google Drive or Dropbox for easy access and long-term preservation. Digital receipts are searchable and take up no physical space, reducing clutter.

Maintain consistent naming conventions for your files. For example, name each receipt with the date and the vendor’s name, like “2025-02-05_ABC_Store.” This practice prevents confusion and simplifies searches when you need to locate a specific receipt.

Keep backup copies of important receipts, especially those needed for tax filings or warranty claims. Store copies on an external hard drive or another cloud platform to avoid losing them in case of technical issues with your primary storage system.

Regularly review and clean up your receipts. Set a schedule to go through your stored receipts, archiving older documents and discarding anything unnecessary. This keeps your collection manageable and prevents clutter from building up over time.

Ensure all relevant details are included. Omitting key information, such as the amount paid, date of payment, or the recipient’s name, can lead to confusion or disputes later. Always double-check that the receipt reflects all the necessary transaction details clearly and accurately.

Not Using a Unique Identifier

Each receipt should have a unique identification number. Skipping this step makes it difficult to track transactions and can cause issues during audits or when reviewing records. This number helps both parties refer to a specific transaction without ambiguity.

Incorrect Payment Methods

Verify that the payment method listed matches what was actually used. If the customer paid by credit card but the receipt lists cash, it may create problems down the line. Always record the payment method correctly to avoid misunderstandings.

Missing the signature or verification stamp can make a receipt invalid. If required by law or company policy, ensure the receipt is signed by the issuer or stamped with a company seal to confirm authenticity. This helps establish trust and accountability in the transaction.

Printable vs. Digital: Choosing the Right Receipt Format

Printable receipts are tangible and offer a physical record that can be stored or handed directly to clients. They are ideal when you need a hard copy for tax purposes, audits, or physical documentation for legal reasons. Printed receipts often give a sense of security and permanence, especially in face-to-face transactions.

Printable Receipts

Printed receipts are reliable for businesses dealing with customers who prefer a physical record. They are easy to archive, and many clients trust paper receipts for their simplicity and accessibility in case of disputes. However, printing costs can add up over time, especially for businesses with high transaction volumes.

Digital Receipts

Digital receipts are becoming a preferred option for many, as they can be sent via email or text message immediately after payment. They are easy to store and organize electronically, reducing the need for physical storage. Digital formats also allow for quick access and sharing, which is convenient for both businesses and clients. However, some customers may have concerns about email delivery issues or data privacy, making them hesitant to switch completely from paper records.

Choosing the right format depends on your business needs and the preferences of your customers. If you cater to a tech-savvy audience or operate online, digital receipts may be the more efficient option. For businesses that interact directly with customers in person or in regulated industries, printed receipts might offer more confidence and practicality.

Tailor your debt collection receipt template by incorporating your company’s logo, contact details, and specific payment terms. Start with adding your business name and logo at the top, ensuring it’s easy to recognize. Next, include the payment method(s) you accept, such as bank transfers, checks, or online payments. This helps the customer quickly understand how to settle their debt.

Adjust the language of the template to match your business tone. If your company has a formal tone, use professional and courteous language. For a more casual approach, ensure the wording is clear and direct without sounding harsh. Make sure the template includes all necessary fields, like the debtor’s name, invoice number, date of payment, and the amount settled.

Consider adding a section that specifies any late fees or interest rates if applicable. If your business charges for overdue payments, list those charges clearly on the receipt. Customize the template further by adding space for a reference number or transaction ID, which can help track payments more efficiently.

Review the template regularly to ensure it aligns with your business policies and stays up-to-date with legal requirements. Customizing your receipt helps maintain professionalism while ensuring the payment process is as smooth and clear as possible for both you and the debtor.

Begin by including a clear header to specify the document’s purpose: “Debt Collection Payment Receipt.” This will help both parties quickly identify the nature of the transaction.

- Date of payment: List the exact date the payment was received to avoid confusion. This serves as an official record for both parties.

- Amount paid: Clearly mention the payment amount received. Be precise to prevent discrepancies.

- Method of payment: Note how the payment was made (e.g., cash, bank transfer, credit card). This ensures transparency and helps in tracking payments.

- Debtor’s information: Include the name and contact details of the debtor to maintain a direct link to the payment record.

- Outstanding balance: Indicate any remaining balance if the full debt was not cleared. This keeps both parties informed about the remaining amount.

- Reference or invoice number: Attach any reference numbers to maintain consistency in future correspondence and records.

After including these essential details, ensure the document is signed by the authorized person or the collector to validate the receipt. Make sure both parties keep a copy for their records.