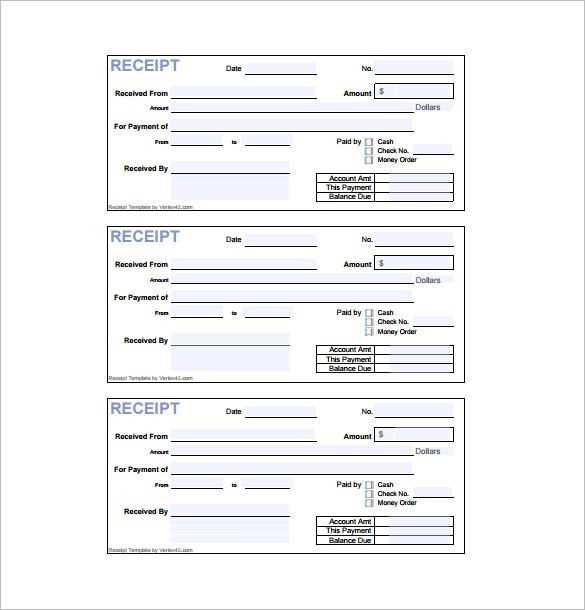

For individuals dealing with estate distribution in New York, the NYS Estate Distribution Receipt and Release Form is a critical document for finalizing the distribution of assets. This form ensures that heirs or beneficiaries formally acknowledge the receipt of their share, releasing the estate executor or administrator from further obligations. It serves as proof that the recipient has received the designated assets and is satisfied with the distribution.

The form typically includes sections for identifying the decedent’s estate, listing the distributed assets, and confirming that the recipient has no further claims against the estate. It also acts as a legal safeguard for the executor, ensuring that the estate administration can be closed without any disputes regarding the distribution. Beneficiaries should thoroughly review the form to ensure accuracy before signing, as it legally binds them to the distribution as stated.

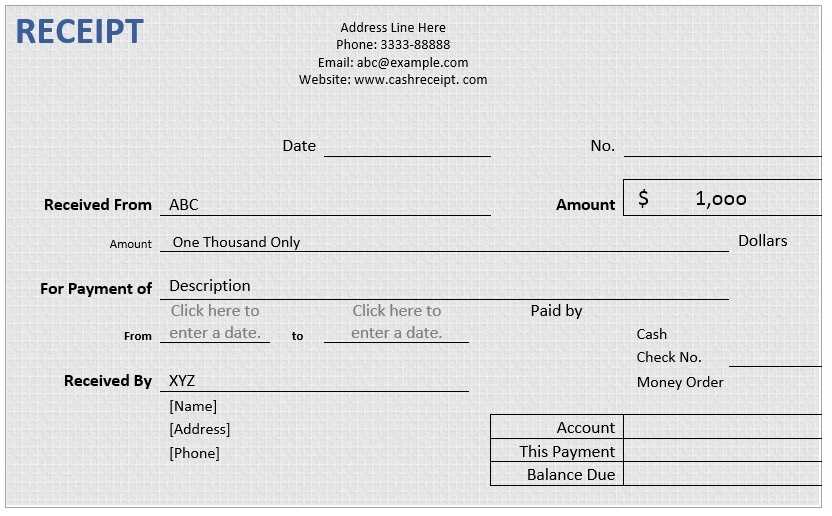

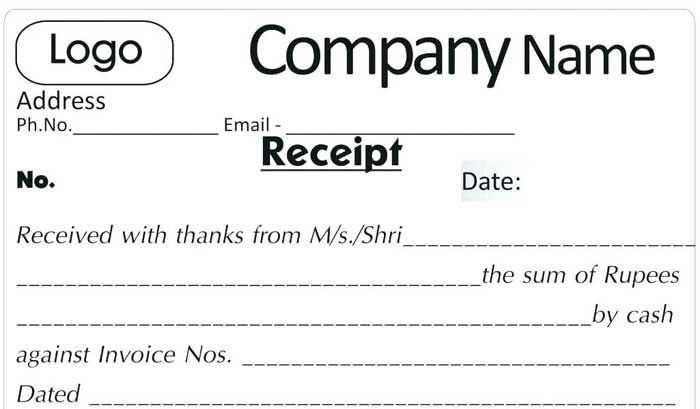

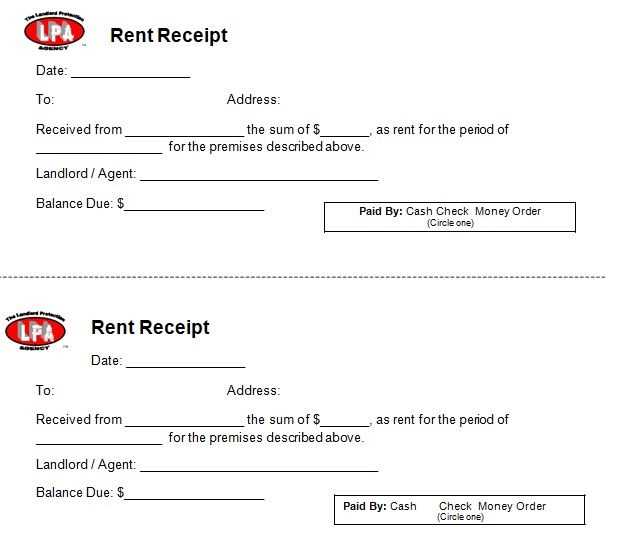

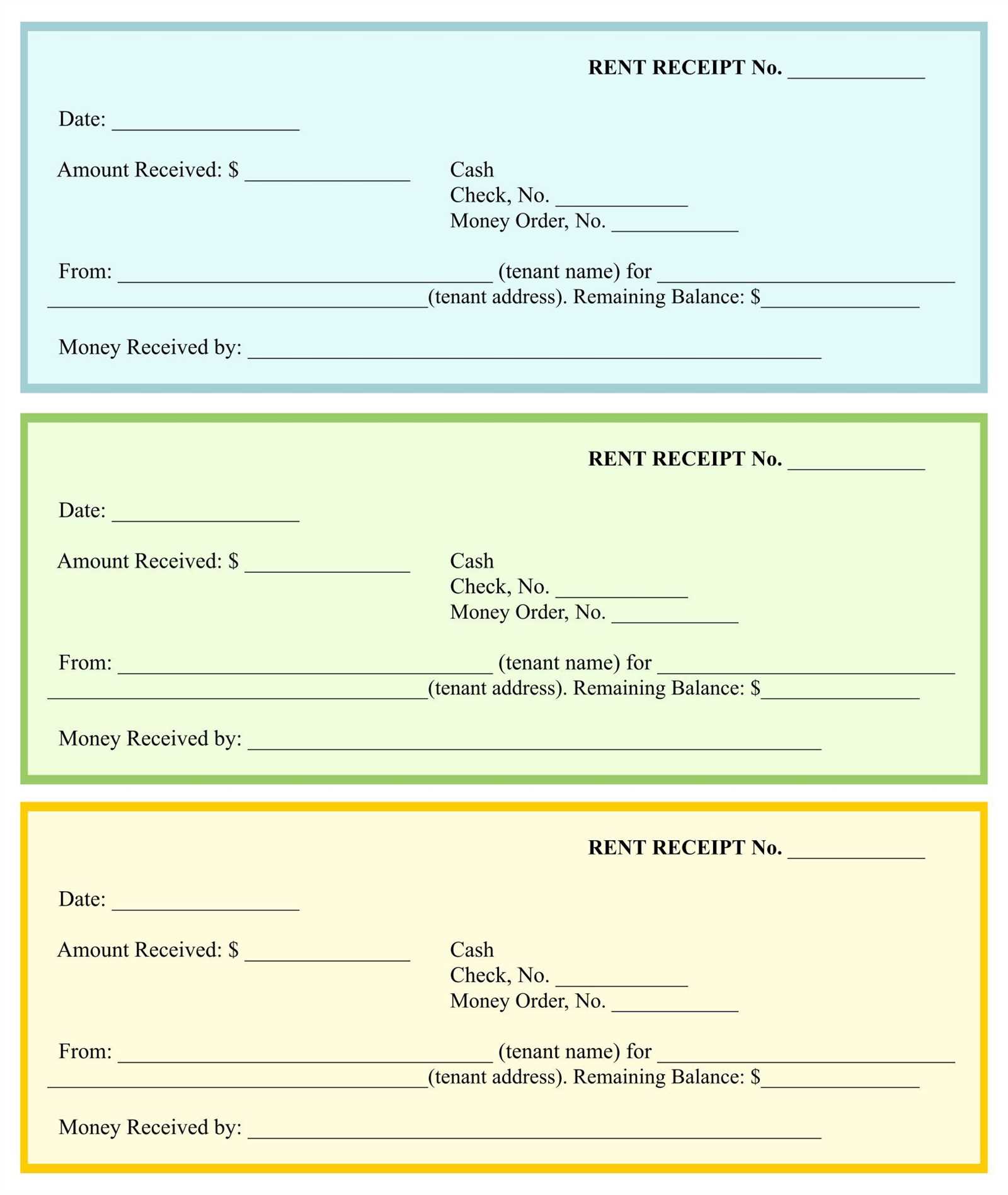

Using a template for this form can streamline the process, saving time while ensuring that all necessary legal information is included. A well-organized template will guide you through the required details, reducing the risk of errors and making the completion process much smoother. Always ensure the form is signed and notarized if required, to uphold its validity and avoid future complications.

Here is the revised version, where words are not repeated more than 2-3 times:

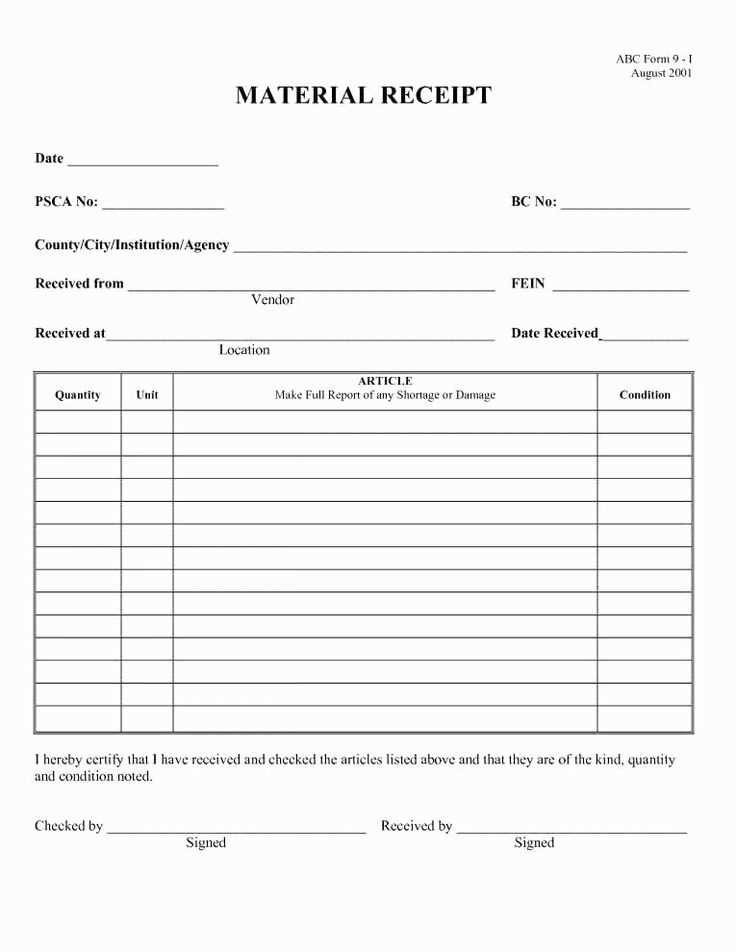

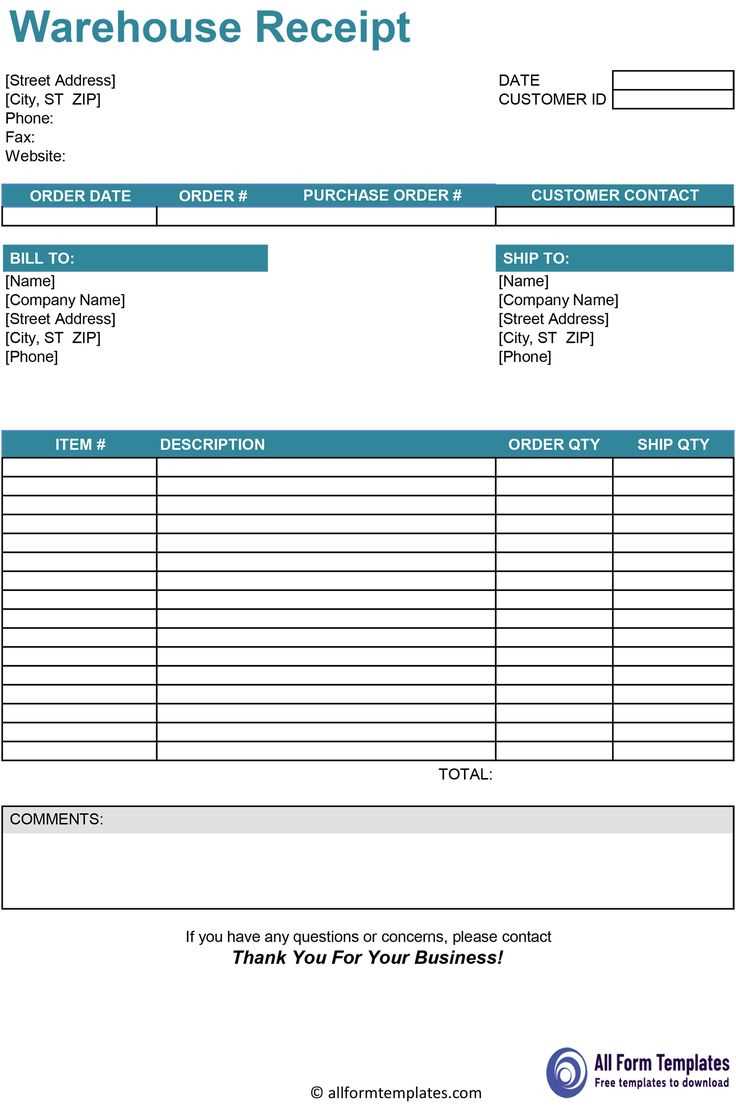

Ensure the estate distribution form includes clear sections for each beneficiary’s name, share, and specific distribution instructions. These sections should be labeled with relevant headings such as “Beneficiary Information” and “Distribution Details” for easy understanding.

Steps for Completing the Form

- Start by entering the decedent’s full name and estate reference number at the top of the document.

- List each beneficiary’s details under “Beneficiary Information”, including name, contact information, and the amount or item they are entitled to.

- For real property or physical assets, include a description and, if applicable, the legal parcel number or identifying features.

- Clearly define the date of distribution and any other terms that might be relevant for clarity, such as payment deadlines or conditions for transferring assets.

Final Steps

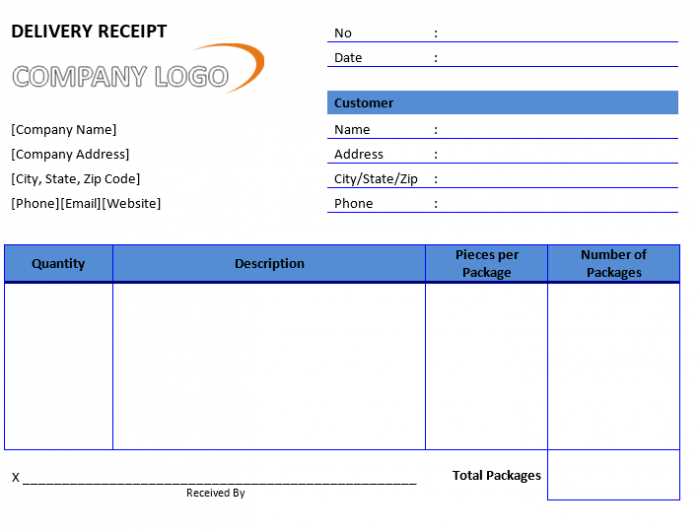

- Ensure both the estate representative and each beneficiary sign the document, acknowledging the distribution agreement.

- Consider having a witness sign, especially if required by state law for the form to be legally binding.

After completing the document, review it for accuracy before filing with the relevant authorities. It’s vital that all necessary details are included to avoid delays in processing the estate distribution.

- NYS Estate Distribution Receipt and Release Form Template

The NYS Estate Distribution Receipt and Release form is a crucial document for the proper distribution of assets following the settlement of an estate. It ensures that beneficiaries acknowledge receipt of their designated share and release the estate administrator or executor from further claims. This template provides a structured and legally binding way for beneficiaries to confirm the distribution of their inheritance, protecting both the estate and the recipients.

Key Elements of the Template

The form typically includes the following sections:

| Section | Description |

|---|---|

| Beneficiary Information | Name, address, and relationship to the decedent. |

| Estate Details | Information about the estate, including executor details and date of settlement. |

| Distribution Details | Clear description of the assets received, including values, property details, or specific items. |

| Release Clause | Statement where the beneficiary confirms receipt and agrees not to make further claims on the estate. |

| Signature Section | Signature lines for the beneficiary and a witness, as well as the date of signing. |

Why This Form Is Necessary

Using this form minimizes the risk of disputes after the estate is distributed. It provides both the estate executor and beneficiaries with a clear record that the distribution has been made, and that the beneficiary has no further claims. This document can be used in court or during audits to demonstrate that the estate was administered correctly.

Fill in the decedent’s full name, date of death, and the date the estate was officially closed. This information should be placed at the top of the form for clear identification. In the section for the distributing party, include the name of the executor or administrator, as well as their contact information.

Next, specify the beneficiaries. List each person who is receiving a share from the estate. Include full names, addresses, and the amount or specific assets they are entitled to receive. If the estate includes non-cash assets, provide a brief description of each item, such as real estate or personal property, alongside its estimated value.

Indicate the method of distribution for each beneficiary. Whether it’s cash, property, or a combination, outline how each share is being divided. In cases where the estate contains debts or liabilities, ensure these are accounted for and clearly outlined as deductions from the overall distribution. This helps avoid confusion and clarifies how much each beneficiary will ultimately receive.

Once all sections are complete, both the executor and the beneficiaries need to sign the form. The signatures confirm that all parties agree to the stated terms and that the distribution has been made in accordance with the will or state law.

After gathering the necessary signatures, submit the completed form to the relevant authorities or include it with any final estate filings required by New York State. This will formally conclude the estate distribution process.

Signing the Estate Distribution Receipt and Release Form has significant legal consequences. By signing this document, you acknowledge that you have received your share of the estate and agree to release the estate executor or administrator from further claims related to the distribution. This release is typically binding, meaning you waive your right to make any future legal claims regarding the estate distribution.

Binding Agreement

The form functions as a legal contract between you and the estate’s executor or administrator. Once signed, it confirms that you accept the distribution as final. If you later find discrepancies or feel you were shortchanged, the release prevents you from taking legal action to amend the distribution. This protects the estate from future disputes and ensures the executor is not held liable for further claims once the distribution process is completed.

Implications for Future Claims

Signing the receipt and release form can also limit your ability to contest the will or any aspect of the distribution later on. If you sign the release, you are generally prohibited from challenging the estate’s accounting or distribution process in court. This is a significant step, and you should only sign if you are certain that the estate has been properly administered and the distribution reflects the will’s intentions.

Before signing, consider consulting with an attorney to ensure you are fully aware of the consequences and that all aspects of the estate have been properly addressed. A well-drafted receipt and release form helps to prevent future legal complications, but it also means you forgo your right to pursue claims against the estate in the future.

Ensure all beneficiaries are listed correctly. Mistakes in names or missing beneficiaries can lead to delays or disputes. Double-check every detail to avoid confusion.

1. Missing Signatures

Both the estate representative and the beneficiaries must sign the form. An unsigned form can invalidate the distribution process, causing unnecessary delays. Ensure every required signature is present before submission.

2. Incorrect Distribution Amounts

Distribute assets according to the will or state laws. Avoid errors in dividing percentages or values, as they can lead to legal challenges. If uncertain, consult an attorney to verify accuracy.

3. Failing to Include the Date of Distribution

Always specify the exact date when the distribution occurs. Omitting this date may create confusion about the timeline and complicate future legal processes. Confirm the distribution date is clear and accurate.

4. Not Updating the Form for New Beneficiaries

If new heirs or beneficiaries emerge after the initial form completion, update the form immediately. Leaving out new beneficiaries could cause disputes or confusion down the road.

5. Overlooking Debts and Taxes

Before distributing assets, address any outstanding debts or taxes. If these obligations aren’t settled first, the estate may be held responsible for them, affecting the distribution process.

6. Not Seeking Professional Advice

If you’re unsure about the form or the distribution process, seek legal advice. A lawyer can guide you through the complexities and help avoid mistakes that could lead to complications later on.

Updated Estate Distribution Receipt and Release Template

To ensure clarity and precision in your estate distribution process, replace repetitive phrases in the receipt and release form while preserving the meaning of each section. This adjustment prevents ambiguity and guarantees that all involved parties understand their rights and obligations clearly. For instance, instead of repeatedly stating “I acknowledge receipt,” consider using variations like “I confirm receiving” or “The assets listed are acknowledged as received.” This method reduces redundancy and enhances the document’s overall flow.

In the section where beneficiaries confirm the distribution of their share, avoid restating “I release the estate from further claims” multiple times. Instead, try: “By signing this document, I waive any future claims regarding my share” or “I release the estate from any further obligations related to my portion.” This maintains the legal intent without overusing the same phrasing.

Furthermore, ensure the document reflects the specifics of the estate accurately. For example, when listing assets, clearly describe each item once, and refer to them concisely later on in the document. This approach streamlines the text, making it easier to read and understand.

In conclusion, a well-crafted distribution receipt and release form should balance clarity with brevity, ensuring all legal requirements are met while avoiding unnecessary repetition.