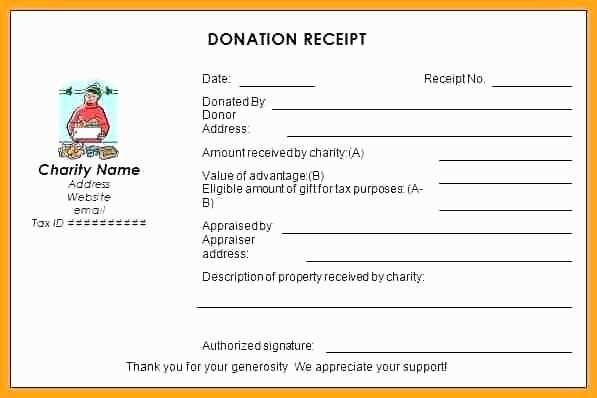

To create a solid donation receipt for a non-profit organization, include clear details like the donor’s name, donation date, and the amount. Ensure the receipt reflects your organization’s status as a tax-exempt entity. Make it simple yet informative to avoid confusion when donors need to claim their charitable contributions on taxes.

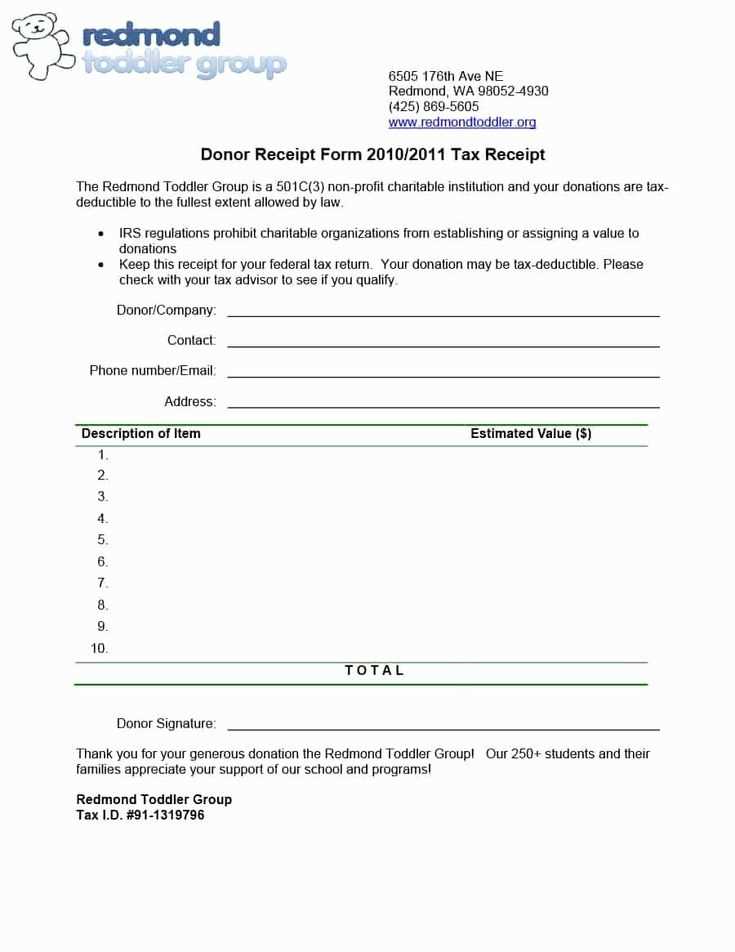

Always state whether the donation was monetary or in-kind, and if it was in the form of goods, provide an estimated value. Don’t forget to include your tax-exempt ID number, as this helps donors confirm the legitimacy of their gift.

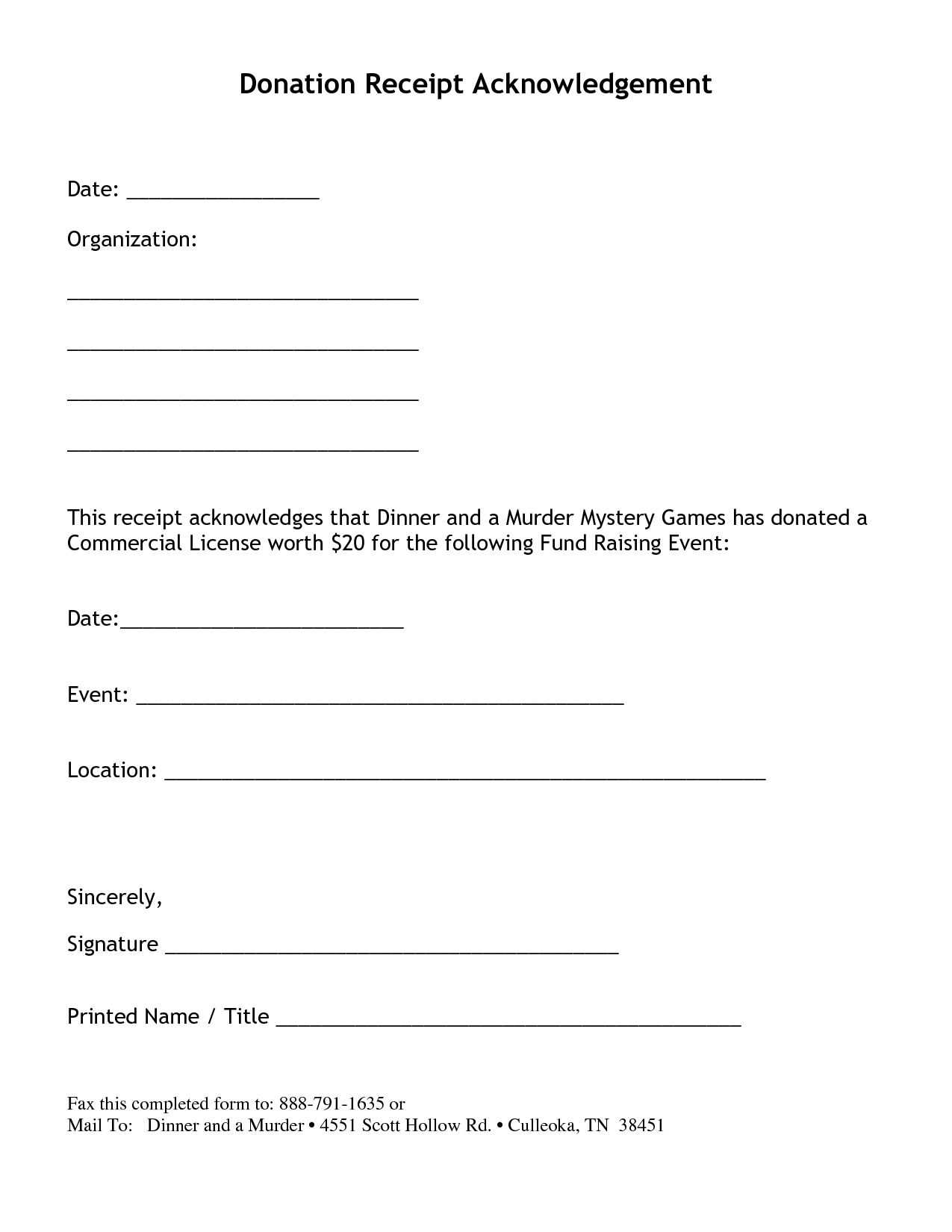

To make the receipt more useful, add a thank-you note to express appreciation for their contribution. This small gesture builds trust and encourages future donations. Lastly, a signature or official stamp confirms the authenticity of the document.

Non-Profit Donation Receipt Template Guide

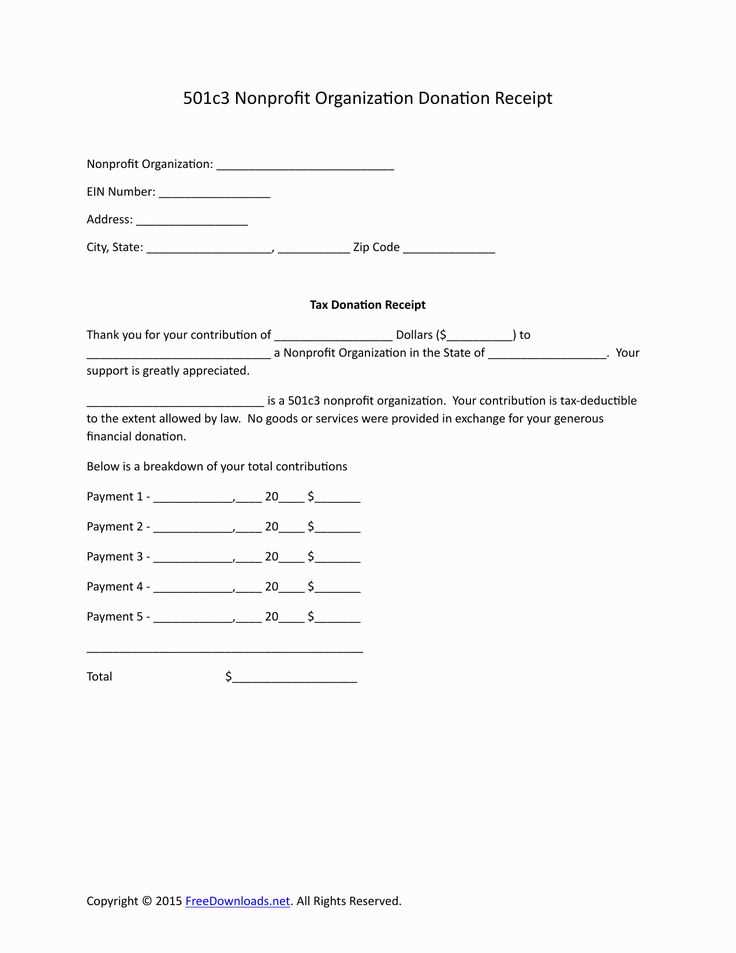

To create an effective donation receipt for a non-profit organization, include the following key details:

1. Donor Information

Ensure the donor’s full name, address, and contact information are clearly listed. This helps both the donor and your organization keep track of contributions for tax purposes.

2. Donation Details

Clearly state the date and amount of the donation, along with the donation type (e.g., monetary, in-kind). If the donation is in the form of goods or services, provide a detailed description and approximate value.

3. Tax Information

Specify that the donation is tax-deductible. Mention that no goods or services were provided in exchange for the donation, if applicable. Include the organization’s tax identification number (TIN) for verification purposes.

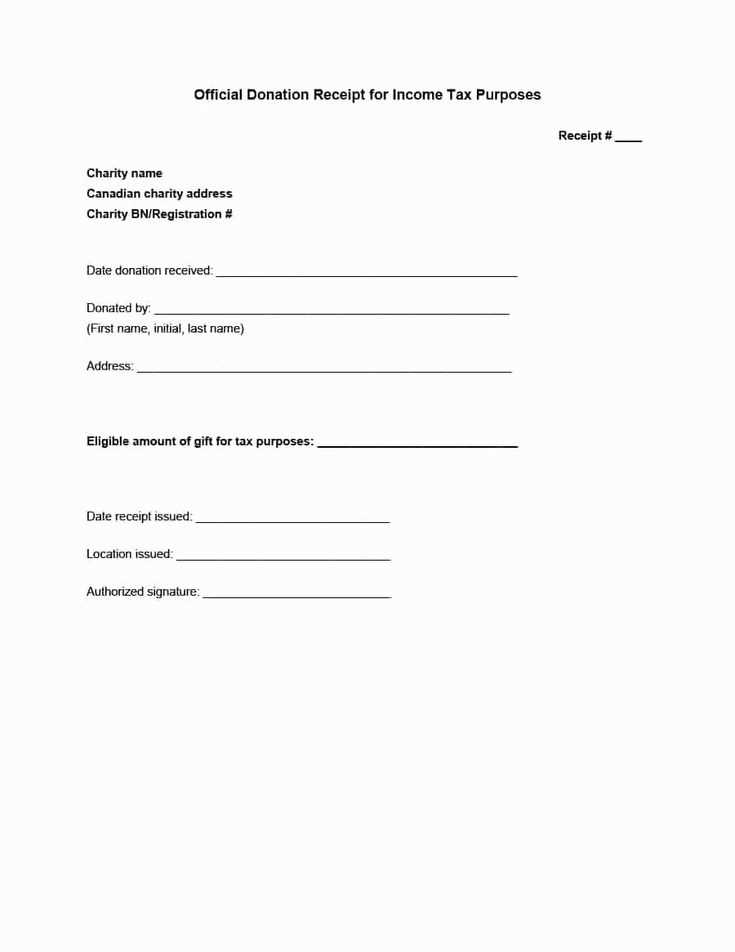

4. Receipt Format

Present the information in an easy-to-read layout. The table format is often the most effective method for clarity and organization.

| Donor Name | Donation Amount | Donation Date | Donation Type | Tax Information |

|---|---|---|---|---|

| [Donor’s Name] | [Donation Amount] | [Donation Date] | [Monetary/In-Kind] | [Tax Deductible Confirmation] |

Make sure the template is simple and professional, adhering to legal and tax requirements. Keep it consistent for all receipts issued.

Designing a Clear Donation Acknowledgment

Make sure the donor’s contribution is immediately acknowledged with clarity. A well-designed donation acknowledgment builds trust and strengthens relationships. Keep the message simple, professional, and focused on the donor’s impact.

1. Use a Clean, Readable Format

Ensure the acknowledgment is visually appealing and easy to read. Avoid cluttered text and excessive design elements. Use a clean layout with sufficient white space, and opt for a readable font and size to ensure the message is accessible.

2. Include Key Information

- Donor’s Name: Always include the full name of the donor, unless anonymity is requested.

- Donation Amount: Specify the amount donated, especially for monetary gifts. If applicable, include the number of items donated.

- Date of Donation: Clearly indicate the date when the donation was received.

- Tax Information: Provide details regarding the tax-deductible status of the donation, including necessary EIN (Employer Identification Number) for tax purposes.

3. Show Gratitude and Impact

Express sincere appreciation for the donor’s support. Be specific about how their donation will be used and the positive impact it will have on your organization or cause. This makes the acknowledgment feel personal and meaningful.

4. Maintain Professional Tone

Use a respectful and professional tone throughout the acknowledgment. The message should be warm and courteous, reflecting the importance of the donor’s contribution without sounding overly formal or detached.

Key Legal Requirements for Donation Receipts

Donation receipts must include specific details to comply with tax regulations. Include the organization’s legal name and tax identification number. Ensure the donor’s name and address are clearly stated.

Gift Description

Specify the amount of the donation, or if it’s a non-cash donation, provide a detailed description. Do not assign a value to non-cash gifts; the donor must determine its worth.

Statement of No Goods or Services

Clearly state whether the donor received any goods or services in exchange for the donation. If goods or services were provided, include a description and their estimated value.

For cash donations, the receipt should also mention if the donation exceeds $250, along with a statement affirming that no goods or services were provided in return. If goods or services were given, detail them along with their fair market value.

Structuring the Template for Easy Customization

Focus on simplicity and flexibility. Begin with clear placeholders for donor information, such as name, amount, and date. These fields should be clearly marked with labels, so users can quickly adapt them as needed.

Modular Design

Use modular sections for different parts of the receipt. This allows easy swapping of content without affecting the overall structure. For example, the donor’s message or additional notes can be placed in a separate block, which can be removed or edited without breaking the format.

Consistent Formatting

Maintain uniformity in fonts, spacing, and alignment throughout the template. This not only enhances readability but also makes adjustments straightforward. For instance, keep header styles consistent, and use consistent spacing around sections to avoid visual clutter when changes are made.

Ensure all data fields are easy to identify and update. Labeling them clearly helps users avoid confusion. Use simple HTML structures like tables or div blocks, so anyone can adjust the template without requiring complex coding skills.

Best Practices for Including Donor Information

Ensure that donor information is accurate and up-to-date. Double-check spelling and formatting of names, addresses, and donation amounts to avoid errors. Providing clear, consistent details helps build trust with donors.

Clear Acknowledgment of Donations

Make sure each donor’s contribution is clearly acknowledged. List the full donation amount and specify whether it was a one-time gift or recurring. Acknowledge any specific preferences or earmarks related to how the funds should be used.

Privacy and Confidentiality

Donor privacy must always be respected. Include a clear statement about how personal information is handled, stored, and protected. Allow donors to opt-out of public recognition or disclosures of their donation history if they prefer.

Digital vs. Paper Receipts: What to Choose

Choose digital receipts to reduce clutter, enhance organization, and help the environment. Paper receipts are often discarded and can contribute to unnecessary waste. Digital records, on the other hand, are easy to store, organize, and search through, offering convenience at your fingertips. If you regularly track expenses or need receipts for tax purposes, digital receipts make it easier to find and reference past transactions.

Advantages of Digital Receipts

Digital receipts provide immediate access and don’t require physical storage. You can quickly retrieve them from email or an app, reducing the risk of losing important receipts. Many systems also offer easy categorization, making it simpler to manage finances or keep records for auditing purposes. With security features like encryption, digital receipts also reduce the risk of fraud and tampering compared to paper alternatives.

Why Some Still Prefer Paper Receipts

Despite the convenience of digital receipts, paper ones have their place. Some people prefer physical records for their simplicity or the security of having a physical backup. Paper receipts are also useful in situations where internet access is unreliable or when specific stores don’t offer digital receipt options.

Ensuring Compliance with Tax Regulations

Verify your non-profit organization’s eligibility for tax-deductible donations. To do this, ensure that you are registered as a 501(c)(3) tax-exempt entity with the IRS (or equivalent for your country). If you’re unsure, consult with a tax advisor or legal professional to confirm your status.

Maintain Accurate Record-Keeping

Keep detailed records of all donations, including donor names, addresses, and amounts. This will help with tax filings and demonstrate that your organization is compliant with IRS regulations. Issue a formal donation receipt that includes these details and the organization’s tax-exempt status for donors to claim their tax deductions.

Provide Required Disclosures on Receipts

Include necessary information on your receipts, such as a statement that no goods or services were provided in exchange for the donation (if applicable). If any goods or services were provided, their fair market value should be disclosed to ensure donors know the amount eligible for a tax deduction.