If you need a quick and simple solution for creating rent receipts in Ontario, using an Excel template is one of the best options. With an Excel template, you can easily customize the details and ensure accurate documentation for both landlords and tenants. The process is straightforward, allowing you to focus on maintaining proper records.

Start by inputting the necessary information such as the tenant’s name, rental period, and the amount paid. Make sure to include the rental property address and any relevant details such as payment method and late fees, if applicable. A good template will also allow you to track receipts over time, creating a clear history of payments.

Additionally, Excel’s built-in features, such as date formats and formulas, can help automate calculations and ensure consistency across all receipts. Whether you’re a landlord managing multiple units or a tenant needing proof of payment, this tool can streamline the process and avoid errors.

Here’s an option with minimized word repetition:

To create a streamlined rent receipt in Excel for Ontario, avoid overcomplicating the format. Begin with the basic details: tenant name, address, rental period, payment amount, and date. Use Excel’s table feature to organize this information clearly. Below is a suggested layout.

Suggested Layout

| Field | Details |

|---|---|

| Tenant Name | [Tenant’s Name] |

| Rental Property Address | [Property Address] |

| Payment Date | [Date] |

| Amount Paid | [Amount in CAD] |

| Rental Period | [Start Date – End Date] |

| Landlord Name | [Landlord’s Name] |

Ensure the font is legible and consistent throughout the sheet. Excel provides options for customizing the table design, so use them to highlight important fields without overwhelming the viewer.

How’s it going today? Anything in particular you want to work on or talk about?

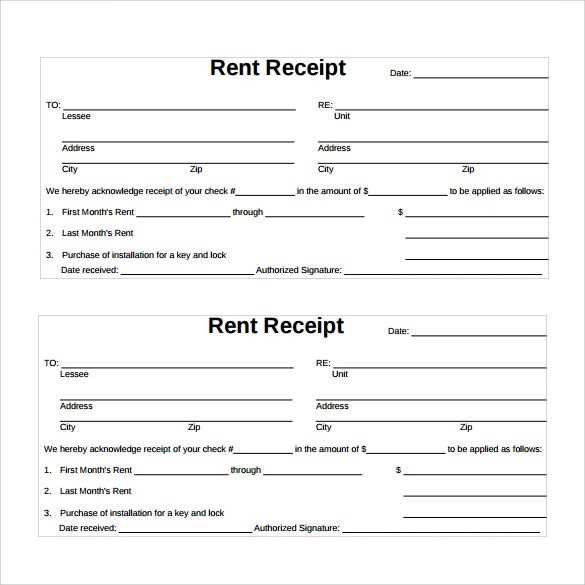

Open Excel and start with a blank sheet. In the first row, label the columns for key information such as “Tenant Name,” “Rental Address,” “Payment Date,” “Amount Paid,” and “Payment Method.” Adjust column widths for clarity.

Under “Tenant Name,” enter the full name of the renter. In the “Rental Address” column, list the address of the property. This ensures that the receipt is tied to a specific location, which is important for both tenant and landlord records.

Enter the “Payment Date” in the next column. Use a date format (e.g., MM/DD/YYYY) for consistency. In the “Amount Paid” column, input the exact rent payment amount. Double-check this number, especially if it includes partial payments or adjustments.

For the “Payment Method,” specify how the rent was paid, whether by cash, cheque, bank transfer, or another method. If using cheque or bank transfer, include the reference number for tracking.

In a separate cell, calculate the balance due (if any) by subtracting the payment amount from the total rent due. This will show if the rent is paid in full or if there is a remaining balance.

Next, include a receipt number for tracking purposes. This is helpful in case the tenant needs to reference the receipt in the future or for bookkeeping.

For the footer, add a brief statement indicating that the payment has been received and that the receipt serves as proof of payment. You can also include your contact information or rental business name if applicable.

Finally, save the sheet as a template so you can easily reuse it for future payments. This saves time and ensures consistency in your rent receipts.

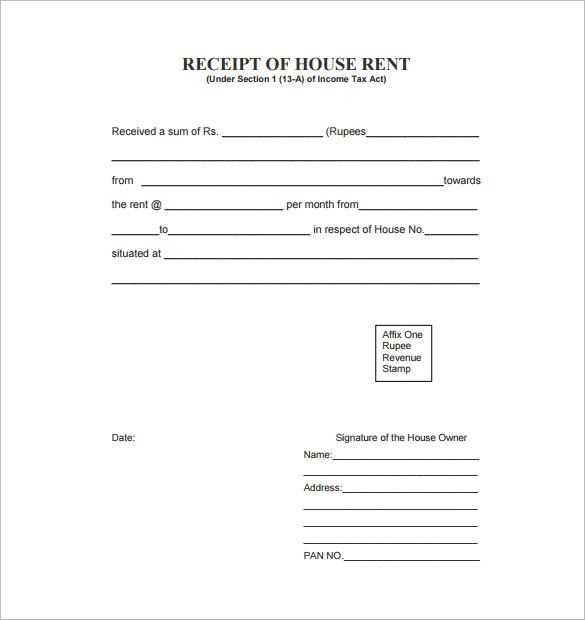

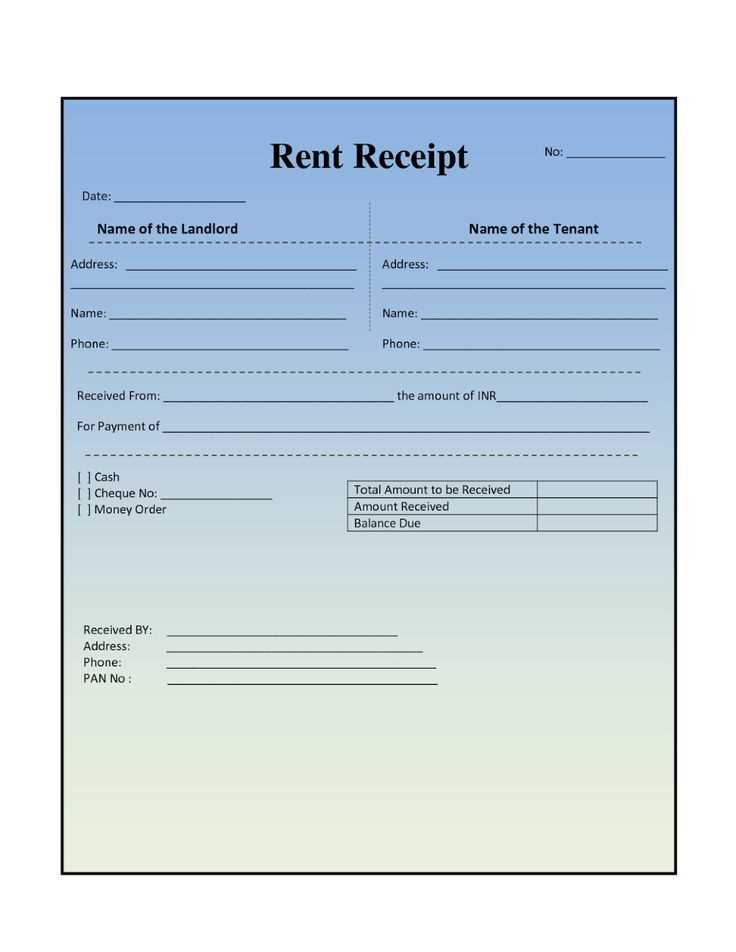

A rent receipt must contain several key pieces of information to be clear and legally valid. These include the tenant’s and landlord’s names, the amount paid, the rental period, and the payment method.

Tenant and Landlord Details

Start by including the tenant’s full name and address, along with the landlord’s contact details. This ensures that both parties are clearly identified in the transaction.

Amount Paid and Rental Period

Clearly specify the rent amount paid and the corresponding rental period. Mention if the payment covers partial months or any additional fees like utilities or parking. This helps prevent misunderstandings.

Also, include the date the payment was made and the payment method used (e.g., cheque, bank transfer, or cash). If possible, note the transaction or reference number for extra clarity.

Finally, a brief description of the rented property, such as the address or unit number, ensures there’s no confusion about the specific rental being referred to in the receipt.

Many users overlook simple details, leading to errors when filling out templates. To avoid these pitfalls, pay close attention to the following aspects:

1. Forgetting to Customize Fields

One of the most common mistakes is using templates without adjusting the placeholder fields. Always replace default text with specific details like rental amount, dates, and tenant information. Generic placeholders can cause confusion or legal issues.

2. Incorrect Formatting

Another mistake is overlooking the proper formatting. Ensure that currency, dates, and other numbers follow the required style. For instance, ensure rent amounts are listed with two decimal places and dates are written in the correct format.

3. Not Saving Properly

Many users forget to save their modified template in a secure, accessible location. After making changes, save the document immediately to avoid losing important data.

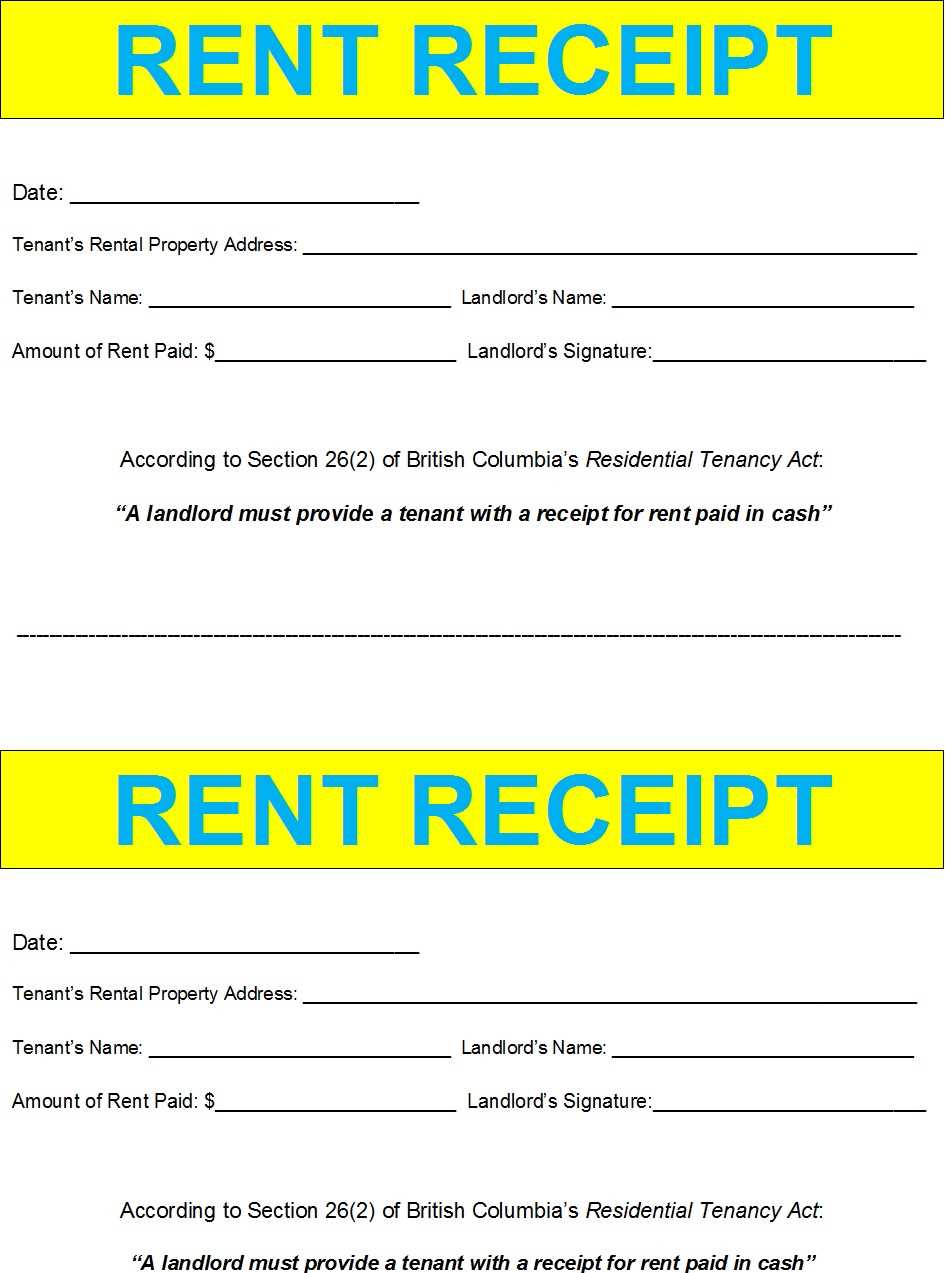

4. Ignoring Local Legal Requirements

Templates may not always reflect up-to-date local rental regulations. Verify that the template you use complies with Ontario’s rental laws and includes all necessary clauses specific to your area.

5. Leaving Out Key Information

Ensure all relevant sections are filled, including both landlord and tenant information, payment due dates, and the length of the rental period. Missing details can lead to disputes or confusion down the road.

6. Relying Too Much on Templates

Using templates is helpful, but it’s important to double-check the document for accuracy and completeness. Templates can’t cover every scenario, so make sure it reflects the specific needs of each rental agreement.

For Ontario rent receipt templates in Excel, make sure to include key details: tenant’s name, address, rental amount, payment date, and period covered by the payment. This will ensure clarity and compliance. A simple table layout works best for ease of use. The first column should be for the payment date, the second for the rent amount, and a third for the period it covers (e.g., “January 1 – January 31”). Always ensure that both parties sign and date the receipt for verification purposes.

Include Key Payment Information

In addition to the basic rent amount, include any other applicable fees or credits (e.g., parking, utilities). Use a clear, separate row for each fee or credit. Keep the format consistent for all receipts to avoid confusion.

Formatting Tips for Clarity

Use bold headers for the key sections such as “Rent Amount,” “Payment Date,” and “Period.” Avoid cluttering the receipt with excessive information. Ensure there’s enough space between each row for readability. Save the template for future use or quick edits in the future.