To create a valid tax receipt for the Canada Revenue Agency (CRA), follow the template outlined below. This will help ensure your document meets CRA’s requirements and is accepted for tax purposes.

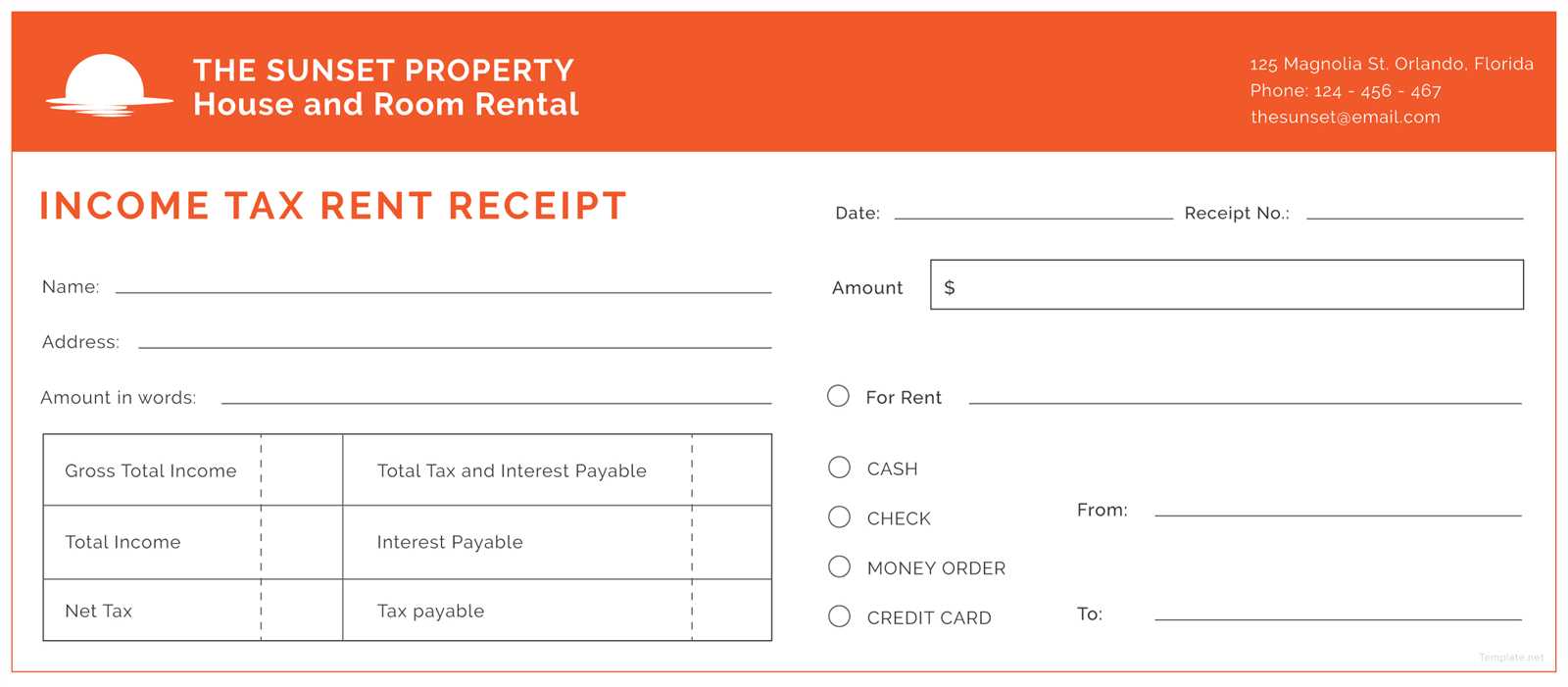

Start with your business name and address. Clearly display the official name of your organization, along with the full mailing address. Include the province or territory, postal code, and contact information like phone number and email address. The receipt must be easily traceable back to the organization.

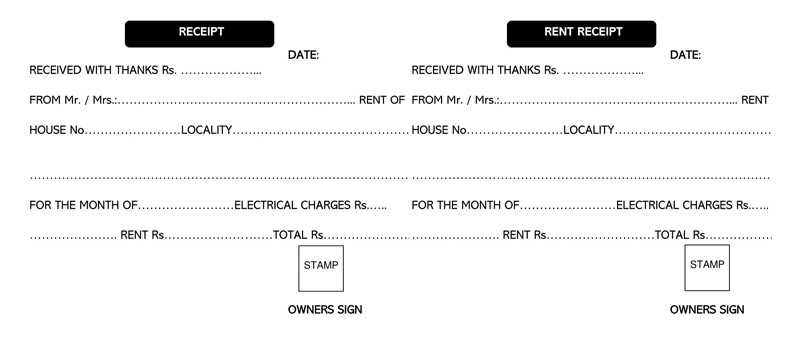

Include the date of donation. The date is important for tax deductions, so ensure it’s accurate and clearly visible on the receipt. This helps verify when the transaction occurred and aligns with tax filing periods.

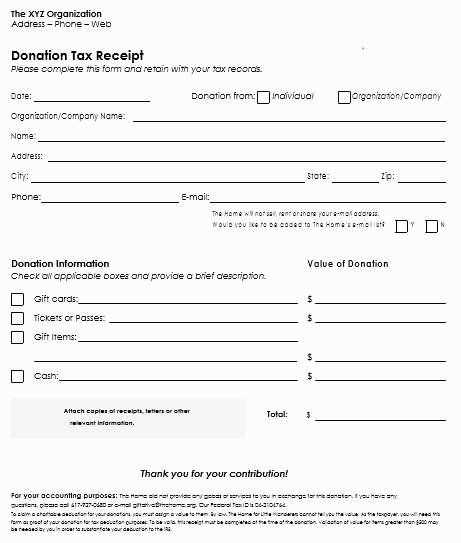

List the donor’s details. Full name, address, and the amount donated are required. For cash donations, a breakdown of the amount and the method of payment (e.g., cheque, credit card) should be noted.

Provide a description of the donation. This is essential for non-cash donations. Specify the nature of the donation, including the quantity and condition of the item(s). If it’s a monetary gift, note the exact amount.

Include the official CRA number. Your charity or organization’s CRA registration number must be included on the receipt to confirm your status as a recognized charity. Without this, the receipt may not be accepted for tax deduction purposes.

Don’t forget the signature line. A signed and authorized representative of the organization must sign the receipt. This provides legal verification of the transaction and helps prevent disputes.

Here’s a detailed HTML plan for the article titled “Tax receipt template CRA” with three focused and practical subheadings:htmlEditTax Receipt Template CRA

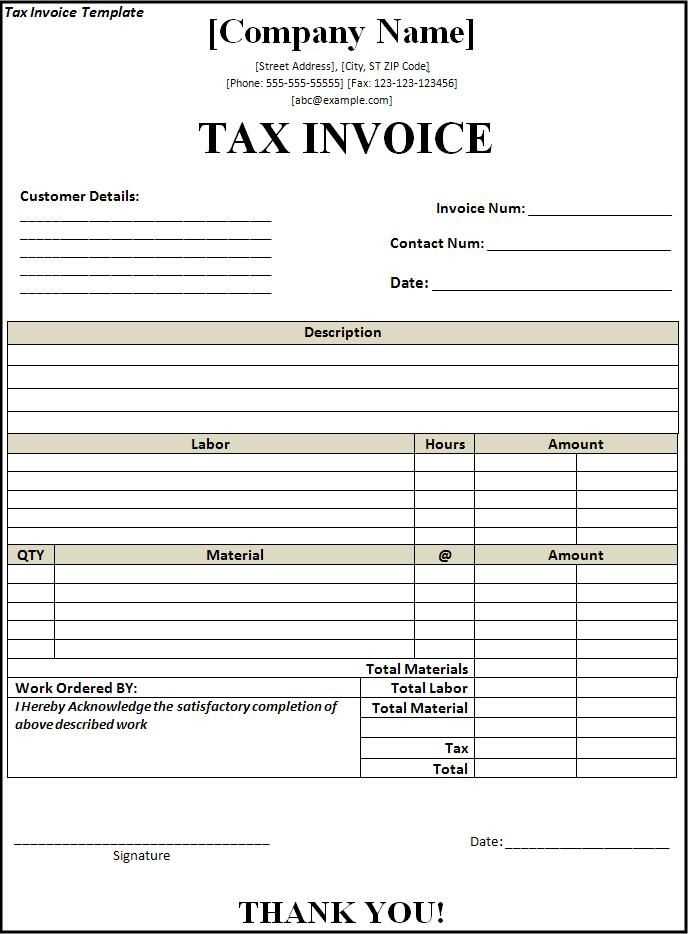

The tax receipt template for CRA should include specific fields that align with the Canada Revenue Agency’s (CRA) standards. Below is a clear HTML structure with three sections dedicated to different aspects of the receipt.

1. Overview of Required Fields in a CRA Tax Receipt

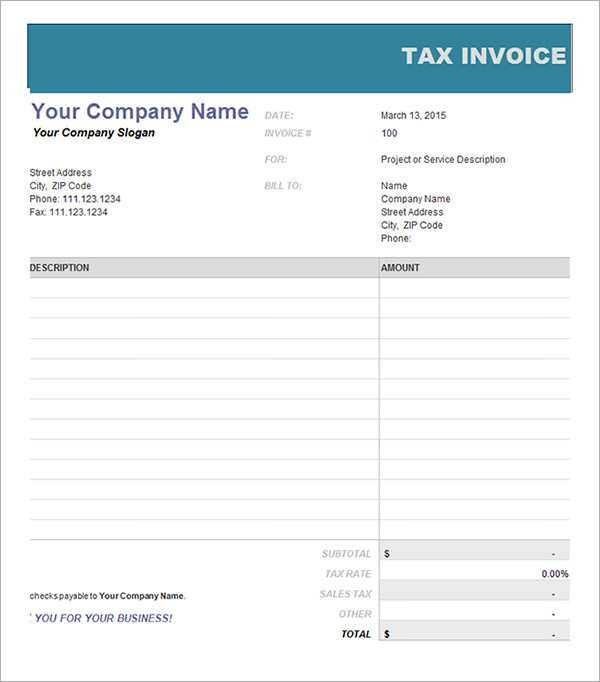

Ensure the receipt includes the following mandatory details: the recipient’s name, address, and the organization issuing the receipt. Include the CRA registration number, the total amount donated, and the date of donation. These details are critical to meet CRA compliance for tax purposes.

2. Structuring the Donation Amount and Breakdown

Clearly display the donation amount and the breakdown for any items or services included in the donation. For cash donations, list the exact amount given, and for goods or property, describe each item with its fair market value. This breakdown must be accurate to avoid discrepancies in tax reporting.

3. Including a Signature Section and Receipt Number

Add a space for the authorized signature from the issuing organization and a unique receipt number for record-keeping. This section validates the receipt, ensuring it’s traceable in the organization’s accounting system and in case of any audits or verification requests from CRA.

How to Create a Valid Tax Receipt for CRA Purposes

To create a valid tax receipt for the Canada Revenue Agency (CRA), include the following details:

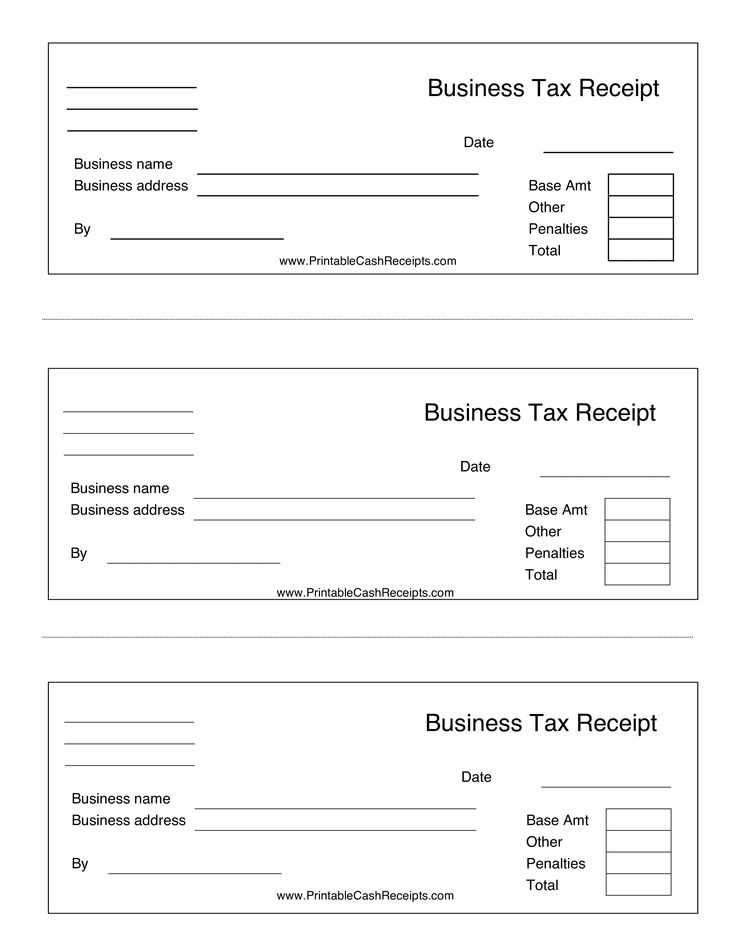

1. Contact Information

Ensure the receipt displays the name, address, and contact details of the organization issuing the receipt. This should be clearly visible to verify the source of the donation or transaction.

2. Amount and Description

List the exact amount of the donation or payment made. If applicable, provide a brief description of the goods or services received in exchange for the donation. This is necessary for distinguishing charitable donations from other types of payments.

3. Official Registration Number

If the receipt is for a charitable donation, include the charity’s CRA registration number. This confirms that the organization is recognized by the CRA for tax receipt purposes.

4. Date of Issuance

The receipt must clearly show the date it was issued. This helps the recipient claim the correct tax year deduction.

5. Signature of an Authorized Person

Include the signature of an authorized person from the organization. This confirms the receipt is legitimate and authorized for tax purposes.

6. Receipt Number

Assign a unique receipt number to help both the issuer and the recipient track and reference the transaction.

7. For Charitable Donations

If it’s a charitable donation receipt, specify that the receipt is for a charitable donation, and ensure the receipt includes a statement explaining that no goods or services were provided in exchange for the donation. If goods or services were provided, the fair market value of those items must be deducted from the amount claimed on the receipt.

By including these key details, you can ensure your tax receipt meets CRA requirements and helps the recipient properly claim their tax benefits.

Common Mistakes to Avoid When Issuing Tax Receipts

Ensure that all necessary details are included. A tax receipt must contain the full name of the recipient, the amount donated, the date of the transaction, and the organization’s name and address. Omitting any of these details can invalidate the receipt.

Do not forget to include your official charity registration number. If you fail to mention it, the receipt might be considered incomplete by the tax authorities, and the donor may be unable to claim their tax deduction.

- Incorrect or missing dates: Always make sure the receipt includes the exact date of the donation. A common mistake is either using the wrong date or omitting it altogether, which can cause issues during tax filing.

- Not providing a receipt for smaller donations: Even small contributions should have receipts. Donors may still need these for tax purposes.

- Incorrect donation amount: Double-check the figures. Ensure the amount on the receipt matches the amount donated. A mismatch can cause confusion and delays in processing tax claims.

Check that the receipt clearly states whether the donation was monetary or non-monetary. This distinction is important for both the donor and tax authorities.

Do not fail to issue a receipt when one is requested. A donor can claim tax benefits only if they receive a valid receipt. Always confirm that a receipt is provided promptly after the donation.

- Failure to include the correct organizational details: Make sure your organization’s full legal name, address, and charity registration number are properly displayed on the receipt.

- Incorrect description of the donation: Accurately describe what was given, especially for non-cash donations. Failing to do so can make the receipt invalid.

Lastly, avoid issuing receipts for donations that do not meet the necessary criteria for tax deductions. For instance, personal gifts or donations from ineligible entities should not receive a tax receipt.

How to Submit Tax Receipts to the CRA for Non-Profit Organizations

To submit tax receipts to the Canada Revenue Agency (CRA) for non-profit organizations, follow these key steps:

1. Ensure the Receipts Meet CRA Requirements

Each receipt must include specific information: the name of the non-profit, the recipient’s name, the amount donated, the date of the donation, and a valid receipt number. The organization’s official registration number must also be displayed, which can be obtained from the CRA if your organization is registered as a non-profit.

2. Submit Receipts Electronically or by Mail

If you’re submitting tax receipts electronically, ensure they are part of your online filing system or included in a detailed spreadsheet format. If mailing hard copies, organize them in a clearly labeled package and send to the CRA address specified for non-profit tax receipts. Be sure to keep copies of all submitted documents for your records.