Use a donation receipt template to make the process of acknowledging financial contributions simple and professional. These receipts are key for record-keeping and can be essential for tax purposes. A well-designed template helps both the donor and the recipient by providing clear, accurate information.

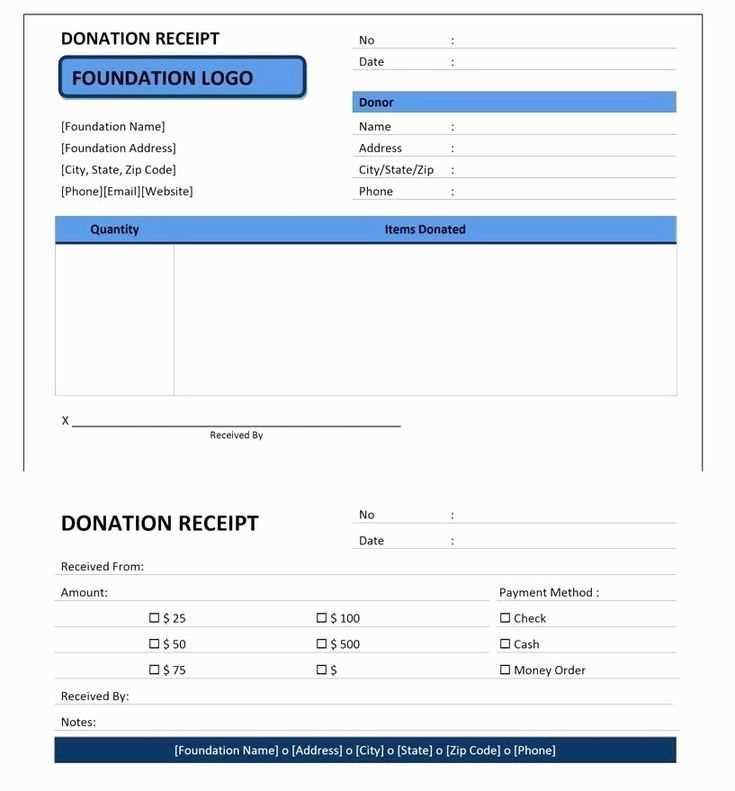

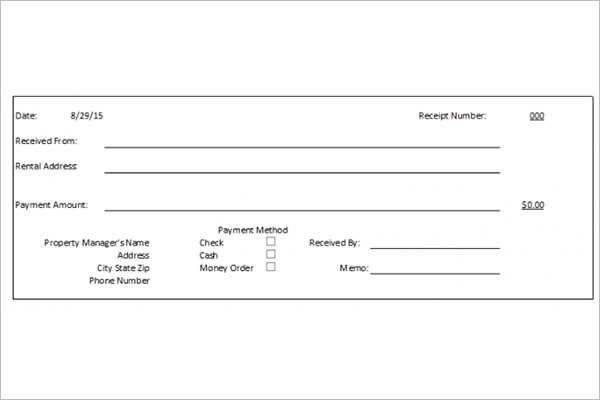

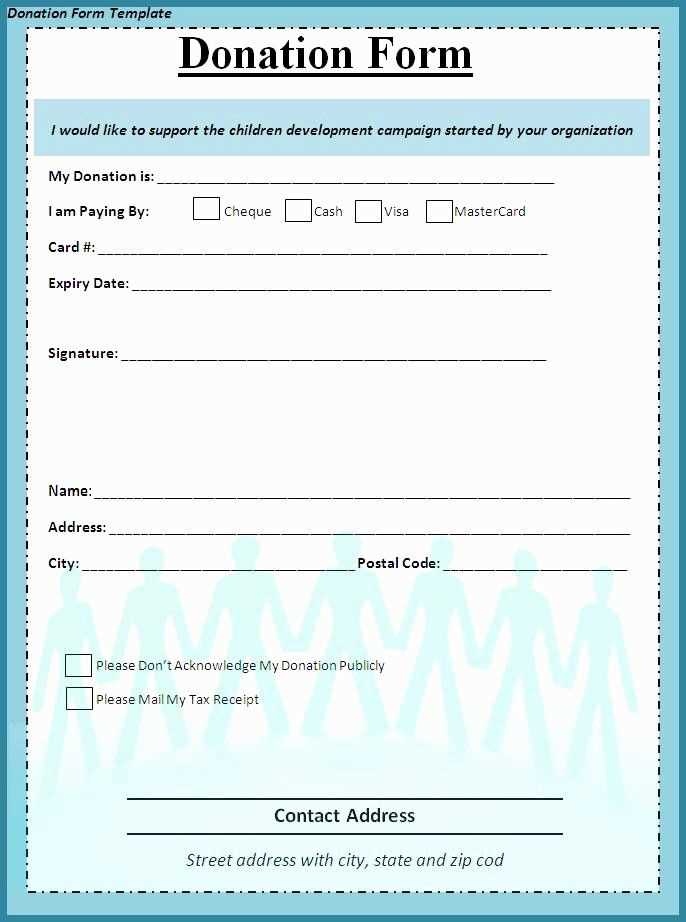

Start by including the donor’s details such as their full name, address, and contact information. It’s also necessary to specify the amount donated, the date of the contribution, and the method of payment. Make sure to clearly state whether the donation was in cash or via other means like cheque or bank transfer.

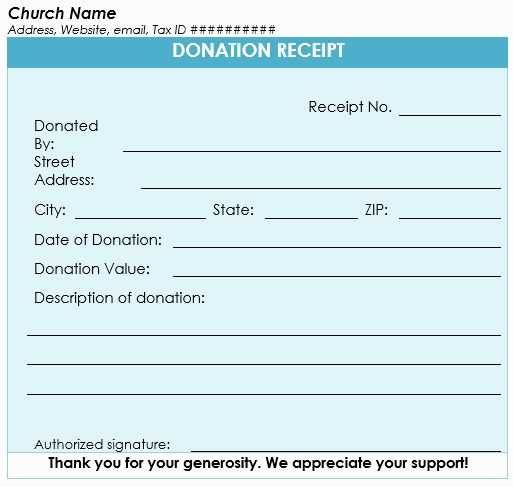

Acknowledge the donor’s generosity with a brief, personal message. This creates a more meaningful interaction. Additionally, don’t forget to include your organization’s name, address, and tax-exempt status if applicable. This helps provide legitimacy and ensures that the receipt meets legal requirements.

To make things easier for future donations, consider setting up a customizable template you can reuse. This can save time and ensure consistency in your receipts. Customizing it according to your organization’s needs makes it a valuable tool for both accounting and relationship-building with donors.

Here are corrected lines with reduced word repetition:

When creating a donation money receipt, focus on clarity and conciseness. Replace redundant phrases to improve readability and professionalism. Here’s how you can refine the structure:

Revised Example:

- Before: “The donor has given a donation of $50, and this donation is confirmed for the charitable cause.”

- After: “The donor has contributed $50 to the charitable cause.”

The revised line removes unnecessary repetition, keeping the message direct and to the point. Here’s another example:

Second Example:

- Before: “This receipt confirms that the donor has donated the amount of $100, which will be used for the intended purpose.”

- After: “This receipt confirms a $100 donation, designated for the intended purpose.”

By removing excess wording, you maintain a professional tone while ensuring the content is easily understood. Aim to keep each line clear and precise, avoiding overuse of similar words like “donation” and “amount.” This helps convey the information effectively without sounding repetitive.

- Donation Receipt Template Guide

Begin with a clear statement of the donor’s name, the date of the donation, and the amount given. Include a line specifying whether the donation was monetary or in-kind. For in-kind donations, provide a description of the items donated, ensuring all necessary details are included for tax purposes. It’s helpful to use simple and straightforward language.

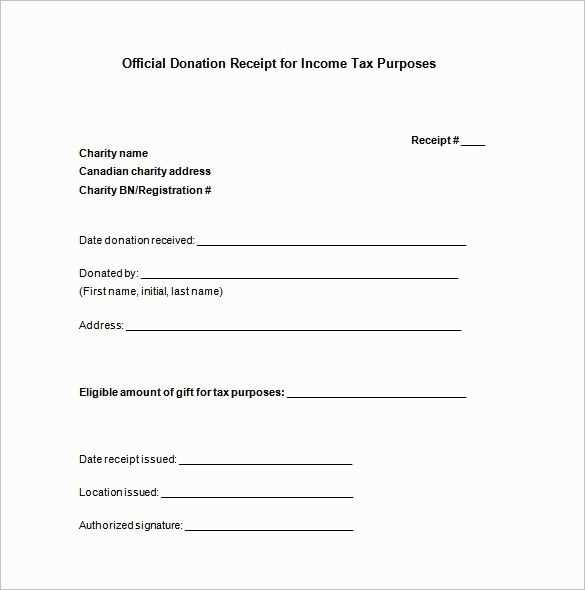

In the next section, outline the organization’s name, address, and tax identification number (TIN). This assures the donor that the receipt is legitimate and provides all the necessary information for tax deductions. Be specific about your organization’s status (e.g., 501(c)(3) if applicable in the United States) so donors can easily verify the eligibility for deductions.

Detail any benefits the donor may have received in exchange for the donation, such as event tickets or merchandise. If the donation exceeded a certain threshold, mention whether the donor received any goods or services in return, and if so, estimate the fair market value of those items. This step is necessary for compliance with IRS regulations or similar tax authorities.

Conclude with a thank you statement. Gratitude should be expressed clearly, acknowledging the donor’s support and the impact it will have on the cause. Make sure to sign the receipt with an authorized person’s name, position, and contact details for any follow-up inquiries.

Lastly, ensure that the receipt is easy to read and professionally formatted, offering space for all relevant details without overwhelming the donor with unnecessary information. This template can be customized depending on the type and scale of the donation, but these core elements should remain consistent.

To tailor a donation receipt template, begin by incorporating key details: donor’s name, donation amount, and date. Include your organization’s name and address for transparency. If applicable, add tax-exempt status information to ensure the donor can claim tax deductions. It’s also a good idea to include a thank-you message, acknowledging the donor’s support.

Key Elements to Include

| Element | Description |

|---|---|

| Donor’s Information | Name, address, and contact details for future communication. |

| Donation Details | Amount donated and whether it was a one-time or recurring contribution. |

| Tax Information | If eligible, include tax-deductible status, EIN number, and donation type. |

| Thank-You Message | Personalize the receipt with a brief acknowledgment of the donor’s generosity. |

Personalizing Your Template

Modify the layout to match your organization’s branding. Adjust colors, fonts, and logo placement to create a professional and visually appealing design. If you’re using an automated tool or software, many platforms offer pre-designed templates with easy customization options.

Donation receipts must clearly outline the date, amount donated, and the organization’s details. Include a statement confirming whether the donation was in cash, goods, or services. If the donation exceeds a certain threshold, typically set by local tax authorities, organizations must issue a detailed receipt. For tax-exempt organizations, the receipt must also specify the organization’s tax-exempt status and include their tax ID number.

Ensure the receipt includes the donor’s full name and address, as it is required for tax purposes. If the donation is non-cash, provide a description of the item(s) donated, along with their estimated value, if possible. Non-cash donations might also require an appraisal or additional paperwork to verify their worth. Make sure to follow the local regulations regarding the acknowledgment of these donations, as different regions have specific rules.

If the donor receives goods or services in exchange for the donation, the receipt must indicate the fair market value of these items and deduct that from the donation amount. This will prevent the donor from overstating the amount of their charitable contribution on their tax return.

Ensure each receipt includes the donor’s full name, donation amount, date, and a statement confirming whether goods or services were exchanged. This keeps records clear and meets tax requirements.

Use a consistent format for all receipts. A standardized layout simplifies tracking, minimizes errors, and ensures compliance with legal standards.

Store digital copies securely. Cloud-based storage with encryption protects data and prevents loss, while access controls limit visibility to authorized personnel.

Automate receipt generation for efficiency. Donor management software can instantly issue receipts, reducing manual workload and maintaining accuracy.

Send receipts promptly. Donors appreciate quick confirmation, and timely delivery builds trust while reinforcing transparency.

Review records periodically. Regular audits help identify discrepancies, improve accuracy, and maintain compliance with regulations.

Donation Money Receipt Template

To create a clear and professional donation receipt, include the date, name of the donor, amount donated, and purpose of the donation. Ensure the template has a unique identifier, such as a receipt number, for easy tracking. Mention the nonprofit organization’s name and contact details for verification purposes. Include a statement clarifying the tax-deductible nature of the donation, if applicable. Lastly, leave space for any additional notes or special instructions.

Example Template:

- Receipt Number: 12345

- Donor Name: John Doe

- Donation Amount: $100.00

- Date of Donation: February 14, 2025

- Purpose: General Fund

- Nonprofit Organization: XYZ Charity

- Tax Deductible: Yes

- Additional Notes: Thank you for your generous support!

Keep the format simple and easy to understand, ensuring all necessary details are visible. Avoid adding unnecessary sections or filler content that could confuse the reader. By following this structure, both the donor and the organization will have a clear record for future reference.