If you’re looking to streamline your invoicing process, using a template can save you time and help ensure accuracy. A well-designed receipt template eliminates the guesswork and standardizes the way you document transactions. Whether you’re a small business owner, freelancer, or handling finances for an organization, creating or choosing the right template makes the whole process more efficient.

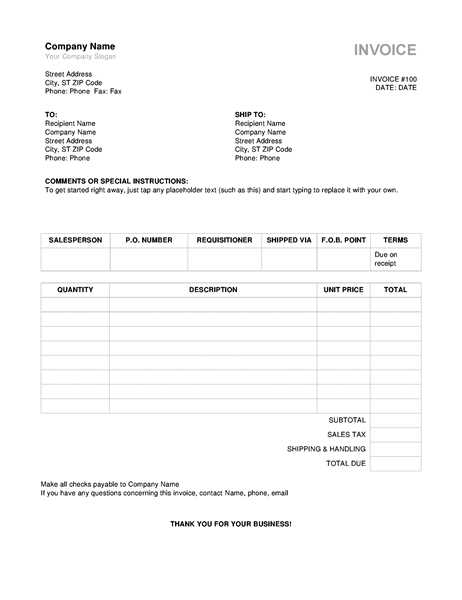

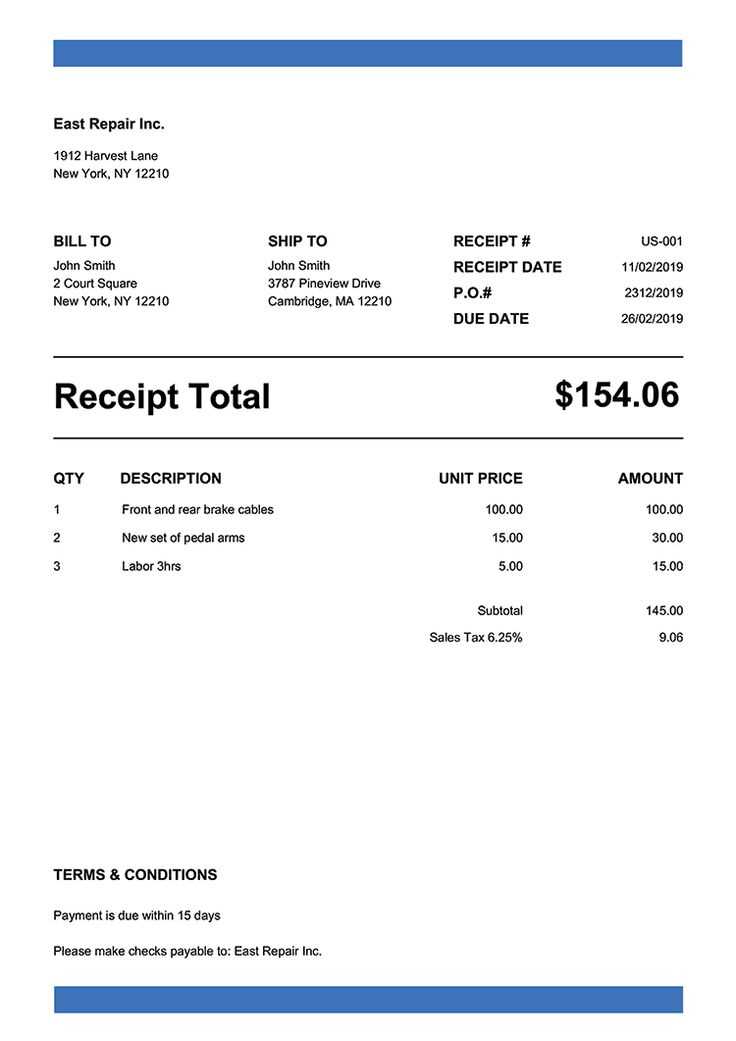

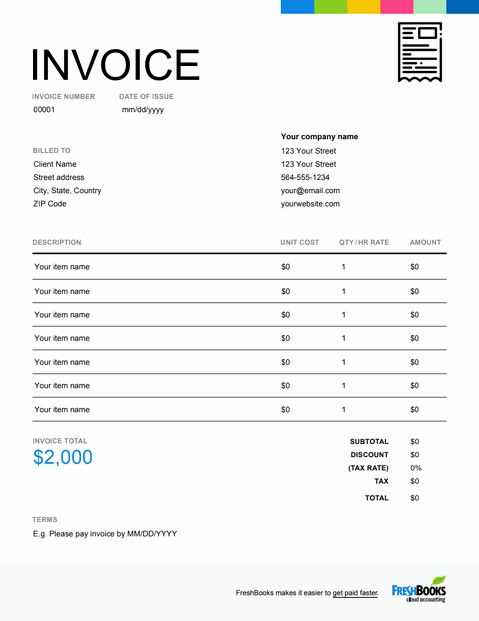

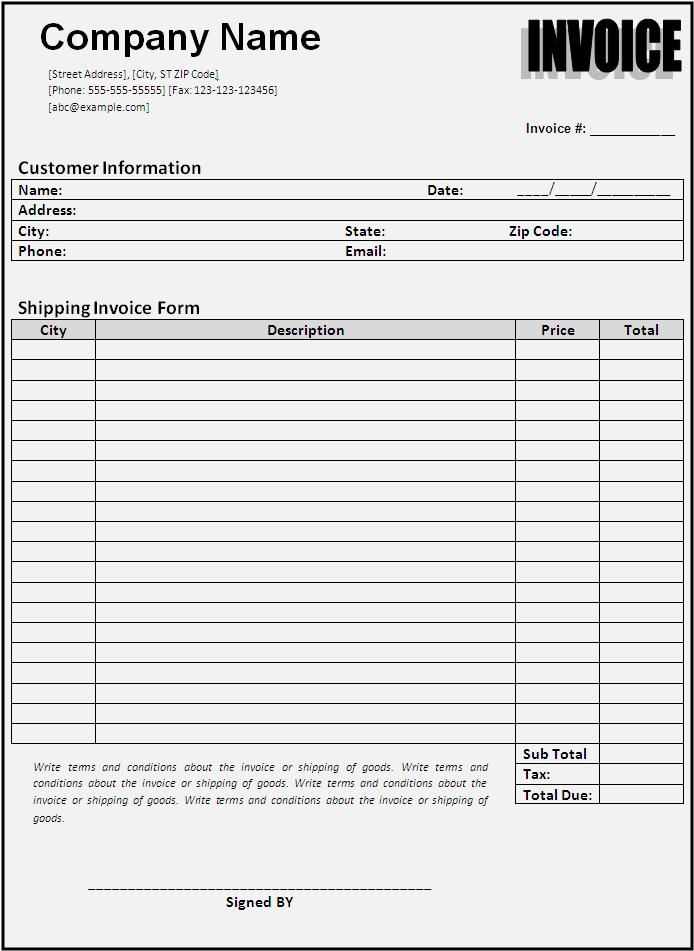

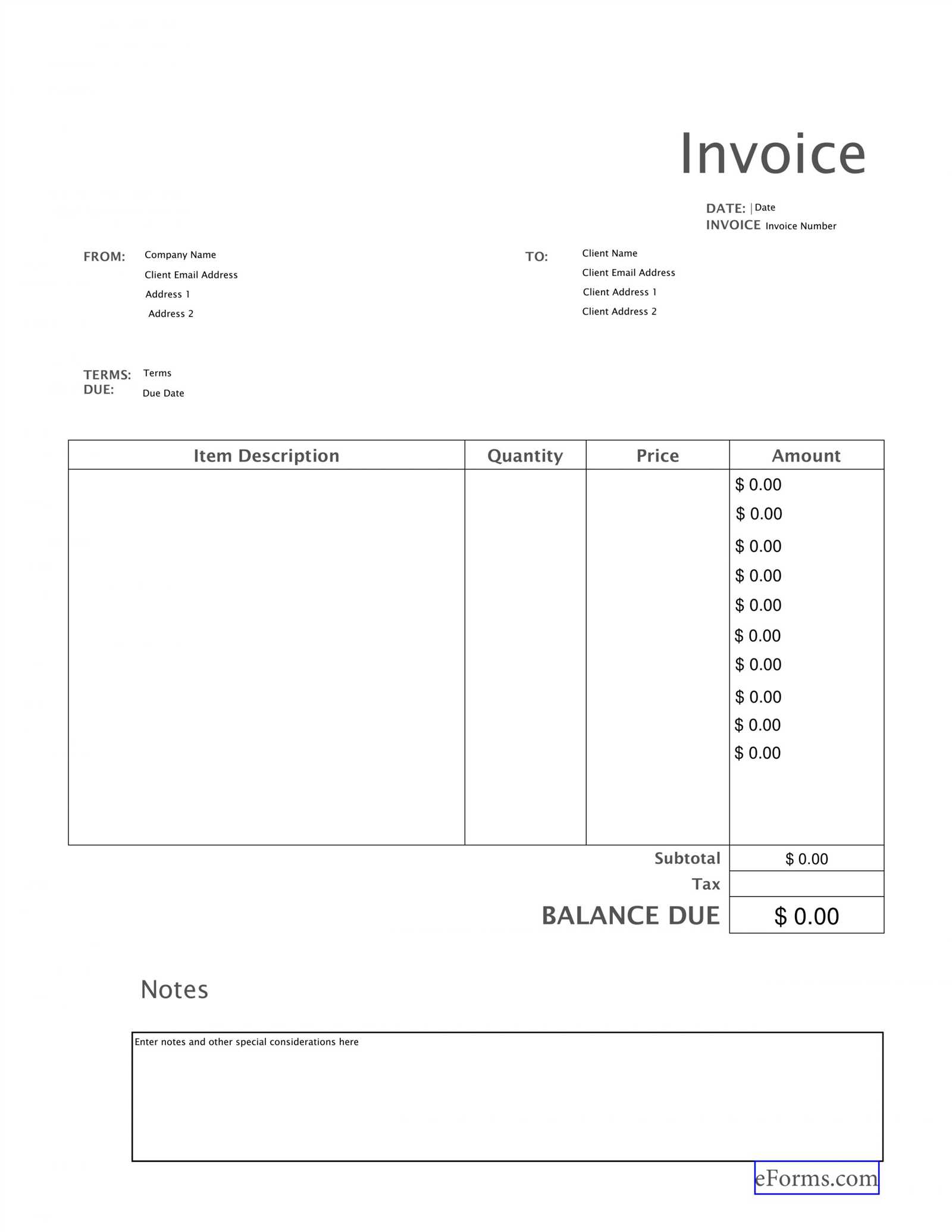

Choose a template that suits your needs. A simple receipt template should include basic details like your business name, contact information, itemized charges, and tax breakdown. Templates can be found in most word processing software, spreadsheet programs, or online tools like Google Docs and Microsoft Word. They are designed to meet various levels of complexity, from basic to more detailed, and can be tailored to fit your brand.

Consistency is key. Consistent use of a receipt template gives your business a professional look and ensures that you don’t overlook any crucial details. It’s especially important if you’re dealing with multiple transactions daily. Templates help you stay organized, track payments efficiently, and reduce errors in the long run.

Hey! How’s it going today?

Hey! What’s on your mind today?

Start by ensuring your receipt template reflects your brand’s identity and provides all necessary transaction details in a clear format.

Incorporate Branding Elements

- Logo: Position your company logo prominently for instant brand recognition.

- Business Details: Add your company name, contact number, address, and website for customer convenience.

- Colors: Use your brand colors for text, borders, or background to create a cohesive look.

Ensure Clear Transaction Information

- Itemized List: List each item purchased with a description, quantity, price, and applicable discounts or promotions.

- Payment Details: Specify the payment method (credit card, cash, etc.) and any transaction reference numbers.

- Taxes: Break down the tax applied and show the total amount clearly.

These customizations improve customer satisfaction and enhance your business’s professionalism in every transaction.

Ensure that the most important details are easily visible at the top of the receipt. This includes the business name, contact information, and transaction number. These elements help customers quickly identify the source and context of the receipt.

Organize the transaction items in a clear, consistent order. List each product or service with a description, quantity, unit price, and total cost. This format ensures customers understand exactly what they are paying for without confusion.

Use itemized sections for discounts, taxes, and shipping fees. Place these details separately from the main total to provide transparency. Show the breakdown of any additional charges, so customers know how their final amount was calculated.

Include a clear total at the bottom of the receipt, separate from the individual charges. The total should stand out, making it easy for customers to see the final amount due. If applicable, include a section for payment methods, such as credit card, cash, or any coupons used.

Incorporate a space for a return policy or customer service contact information. It reassures customers and offers easy access if they need assistance after the transaction. Always keep this section brief and to the point.

Focus on finding software that simplifies the invoicing process while offering flexibility and customization. Look for tools that provide templates suited for your specific needs, whether you’re a small business owner or part of a larger organization. Make sure the software integrates well with your accounting system to reduce manual entry and minimize errors.

Choose a platform with an intuitive user interface that doesn’t require steep learning curves. Speed is important, so select software that allows for quick receipt creation and easy updates. Pay attention to the number of payment methods and currencies it supports, especially if you’re working internationally.

Cloud-based options are often the most practical as they allow access from multiple devices and offer secure backup solutions. Additionally, opt for software that offers customer support and regular updates, ensuring it stays compatible with the latest standards and regulations.

Invoice Receipts Templates: Key Insights for Streamlining Your Process

When creating invoice receipts templates, focus on clarity and accuracy. Use a structured format that highlights key details, such as the transaction date, itemized list, total amount, and payment method. This ensures transparency and minimizes confusion for both parties involved.

Keep It Simple and Clear

Choose simple fonts and avoid unnecessary information. Include only essential fields like company name, contact details, client information, and a breakdown of charges. A clean, concise design helps avoid clutter and makes the document easy to read.

Incorporate Necessary Legal Information

Ensure your templates contain the legal requirements for your region. This may include tax information, registration numbers, and other mandatory disclosures. Being thorough with these elements can prevent legal issues and ensure compliance.

Incorporate adjustable fields so you can easily modify the template as needed. A flexible format saves time and effort, making the invoicing process quicker for repeated transactions.