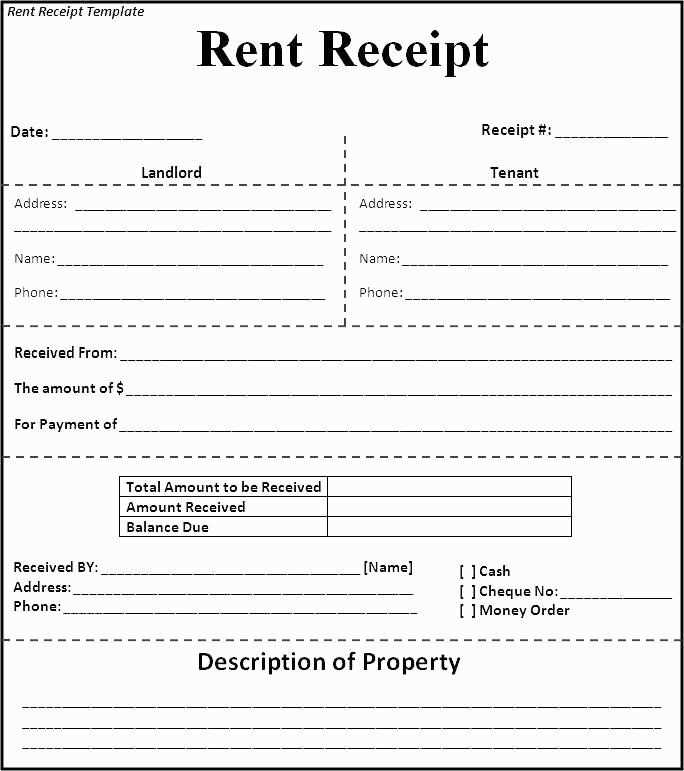

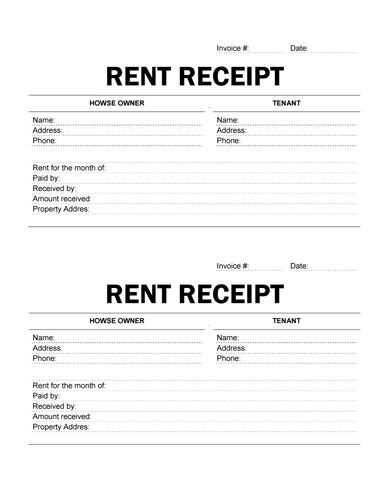

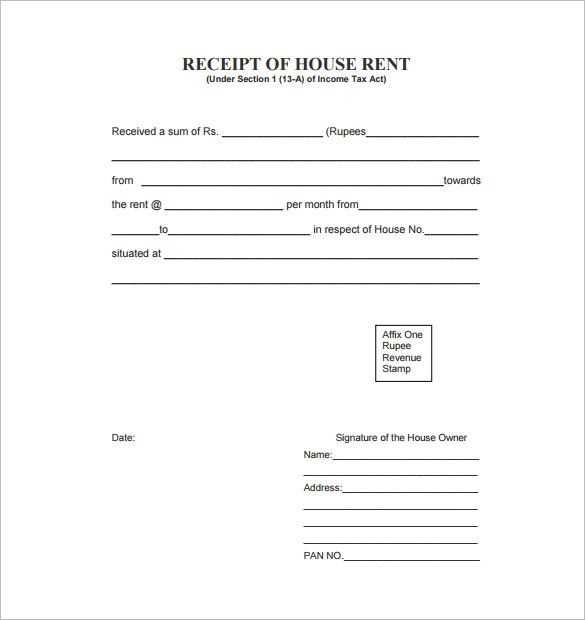

A rent receipt template in Ontario must include specific details to be legally valid. The receipt should clearly list the tenant’s name, address of the rental property, payment amount, and the payment date. Ensure the landlord’s information, including full name and address, is also included. This guarantees both parties have clear documentation of the transaction.

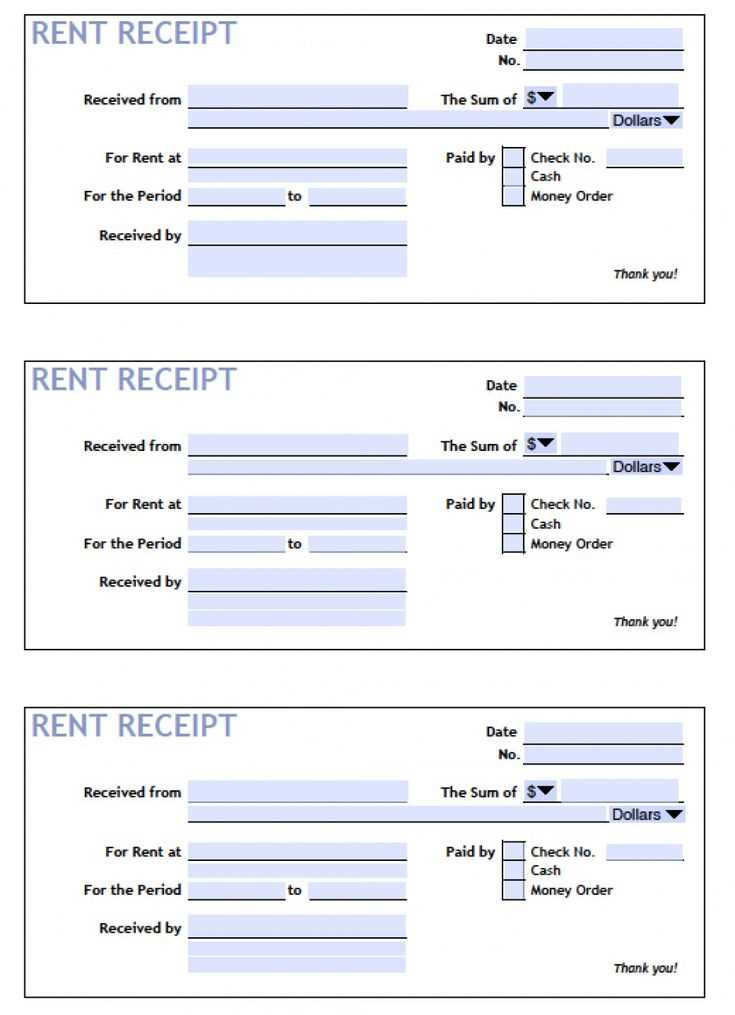

The receipt should also specify the rental period covered by the payment. For monthly rentals, note the exact start and end dates for clarity. If the payment includes any additional charges such as utilities or late fees, be sure to mention those separately. This will help avoid any confusion regarding the rent amount.

While the rent receipt is not mandatory in Ontario, having one can protect both tenants and landlords in case of disputes. Providing a clear, written record of payment helps ensure transparency and accountability. Additionally, keeping these receipts for tax purposes or future reference is highly recommended.

Here are the revised lines with minimized repetition of words:

To create a clear and concise rent receipt template in Ontario, ensure each field contains the necessary details without redundancy. Focus on the tenant’s name, rental amount, payment method, and date of payment. Avoid excessive repetition of terms like “payment” or “tenant” by using alternatives where applicable.

Tenant and Landlord Details

Clearly state the names and contact information of both parties. Ensure accuracy by only including the essential details, such as the full name and address of both the tenant and landlord. Avoid unnecessary repetitions of contact information throughout the template.

Payment Information

Specify the rental amount, payment method, and payment date clearly. For example, “Paid by cheque on [date] for the rental period [date range].” This wording avoids repeating “paid” or “payment” while providing all the necessary financial details.

- Rent Receipt Template for Ontario

For landlords in Ontario, issuing a clear and accurate rent receipt is a simple but necessary part of managing rental properties. A rent receipt should include specific details to ensure both parties have a record of the payment. Below is a sample template for creating a rent receipt, which can be customized based on your needs.

Key Information to Include

Every rent receipt must contain essential elements to avoid disputes and ensure transparency. These include:

- Landlord’s Name and Contact Details: Full name and phone number or email address for communication.

- Tenant’s Name: The full name of the tenant who made the payment.

- Rental Property Address: Complete address of the rental property.

- Amount Paid: The total amount of rent paid for the specific period.

- Payment Date: The exact date the payment was made.

- Payment Method: Whether the payment was made in cash, cheque, or via bank transfer.

- Receipt Number: A unique identifier for each receipt for future reference.

- Period Covered: The specific month or time frame that the payment covers.

- Landlord’s Signature: Signature of the landlord to confirm receipt.

Sample Rent Receipt Template

Here is a simple example you can use:

--------------------------------------------------- RENT RECEIPT Landlord’s Name: [Full Name] Contact Information: [Phone Number / Email] Tenant’s Name: [Tenant Full Name] Rental Property Address: [Complete Address] Amount Paid: $[Amount] Payment Date: [Date] Payment Method: [Cash/Cheque/Bank Transfer] Receipt Number: [Unique Number] Period Covered: [Month/Year] Landlord's Signature: ___________________________ ---------------------------------------------------

Make sure all information is filled out clearly and accurately. It’s advisable to keep copies of all receipts for your records and provide tenants with a duplicate for their personal use. This will help maintain a professional and organized rental process.

To create a simple receipt in Ontario, ensure it includes these key components: the date, the full name of the tenant or customer, a clear description of the rented property or service, the amount paid, and the method of payment. Make sure to label the receipt as “RECEIPT” at the top for clarity.

Include Legal Requirements

Ontario law requires that all rental receipts contain the name of the landlord or property manager, along with their address or business information. This helps ensure the document can be used as proof in case of disputes. Include any relevant rental period, such as “Paid for rent from [start date] to [end date].” This establishes a clear timeline for the payment.

Keep the Format Simple and Clear

The format should be straightforward. Use a table or bullet points for the payment breakdown, especially if multiple payments are involved. This makes it easy for both parties to track amounts paid and remaining balances. Double-check for any typos or errors that could confuse the details on the receipt.

In Ontario, landlords must provide tenants with a rental receipt upon request, especially when rent is paid in cash or by money order. This receipt serves as proof of payment and must include specific details. Here are the key requirements:

- The receipt must include the landlord’s name and address.

- The tenant’s name should be clearly stated.

- The rental period (start and end dates) must be specified.

- The amount of rent paid should be listed, along with the payment method.

- The date the rent payment was made must be included.

- If a partial payment was made, this must also be indicated with the remaining balance.

It’s important to note that these receipts are not optional. Under the Residential Tenancies Act, landlords are required to provide documentation for rent payments. Failure to do so can lead to disputes or complications in tenant-landlord relations.

Providing these receipts regularly helps maintain transparency and builds trust between parties. Additionally, it can prevent any future disagreements or confusion regarding rent payments.

Incorrectly issuing receipts can lead to confusion, legal complications, or even audits. To avoid common errors, follow these key guidelines:

1. Missing Details

- Always include the date of transaction, the full names and addresses of both parties, and a clear description of the service or product provided.

- Include the exact amount paid, the method of payment (e.g., cash, credit card), and the applicable taxes or discounts.

2. Not Using Sequential Numbering

- Failure to assign a unique, sequential number to each receipt can lead to a disorganized record-keeping system. This numbering helps both you and the customer track the receipt easily and maintain accurate accounting.

3. No Signature or Authorized Stamp

- If required by law or company policy, ensure that the receipt is signed or stamped by an authorized representative. This adds authenticity and avoids disputes about the receipt’s legitimacy.

4. Inaccurate Tax Information

- Ensure the receipt reflects the correct tax rate, including any applicable provincial or federal tax. Mistakes here can lead to issues during tax filing or potential penalties.

5. Failure to Provide a Copy

- Always provide a copy of the receipt to the customer. Whether digital or paper, they should have a record of the transaction for their own reference, especially for returns or disputes.

Ensure that your rent receipt clearly includes all relevant details for both parties. A simple template can be structured as follows:

| Detail | Information |

|---|---|

| Landlord’s Name | Insert full name |

| Tenant’s Name | Insert full name |

| Property Address | Insert complete address |

| Rental Period | Start date – End date |

| Amount Paid | Insert total amount |

| Payment Method | Insert method (e.g., cash, cheque, bank transfer) |

| Receipt Date | Insert date of receipt |

| Landlord’s Signature | Provide space for signature |

Use this template to ensure transparency and avoid misunderstandings regarding rental payments. Always provide both a copy to the tenant and retain one for your own records.