Organizing your cash transactions becomes significantly easier with a well-structured template for receipts and payments. This tool streamlines tracking income and expenses, providing a clear overview of financial activities in real-time. You can quickly identify cash inflows and outflows, ensuring accurate record-keeping and smooth financial management.

By using a simple cash receipts and payments template, you’ll gain the ability to track daily financial movements without complexity. This allows you to focus on key aspects of your business or personal finances, leaving behind the hassle of complicated accounting processes. With just a few entries, your financial records become organized and actionable.

It’s easy to get started. Fill out the template with the necessary details, such as the date, transaction type, amount, and description. With each entry, your financial picture becomes clearer, helping you stay on top of your cash flow and make informed decisions about future expenditures or savings. This method also simplifies the process for audits, tax filings, and financial reviews.

Cash Receipts and Payments Template: A Practical Guide

Begin by establishing a clear format to track both incoming and outgoing cash flows. A simple, organized template allows for easier management and better control over finances. Here’s how to set up a useful template that covers both receipts and payments efficiently.

Structure Your Template

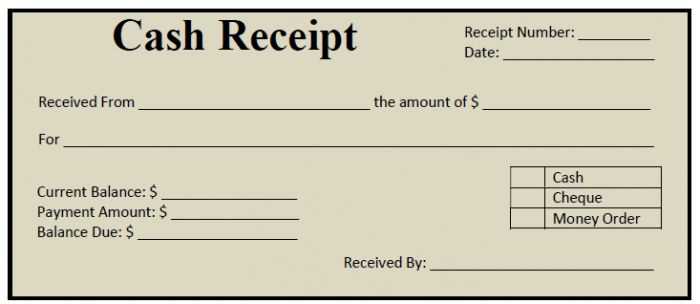

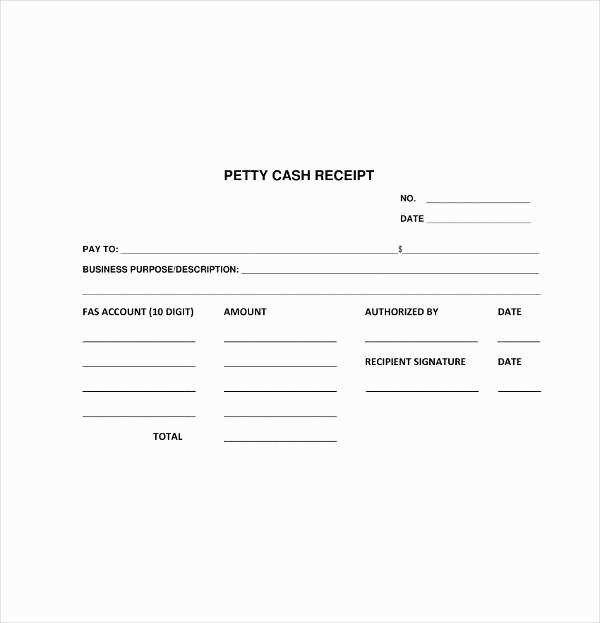

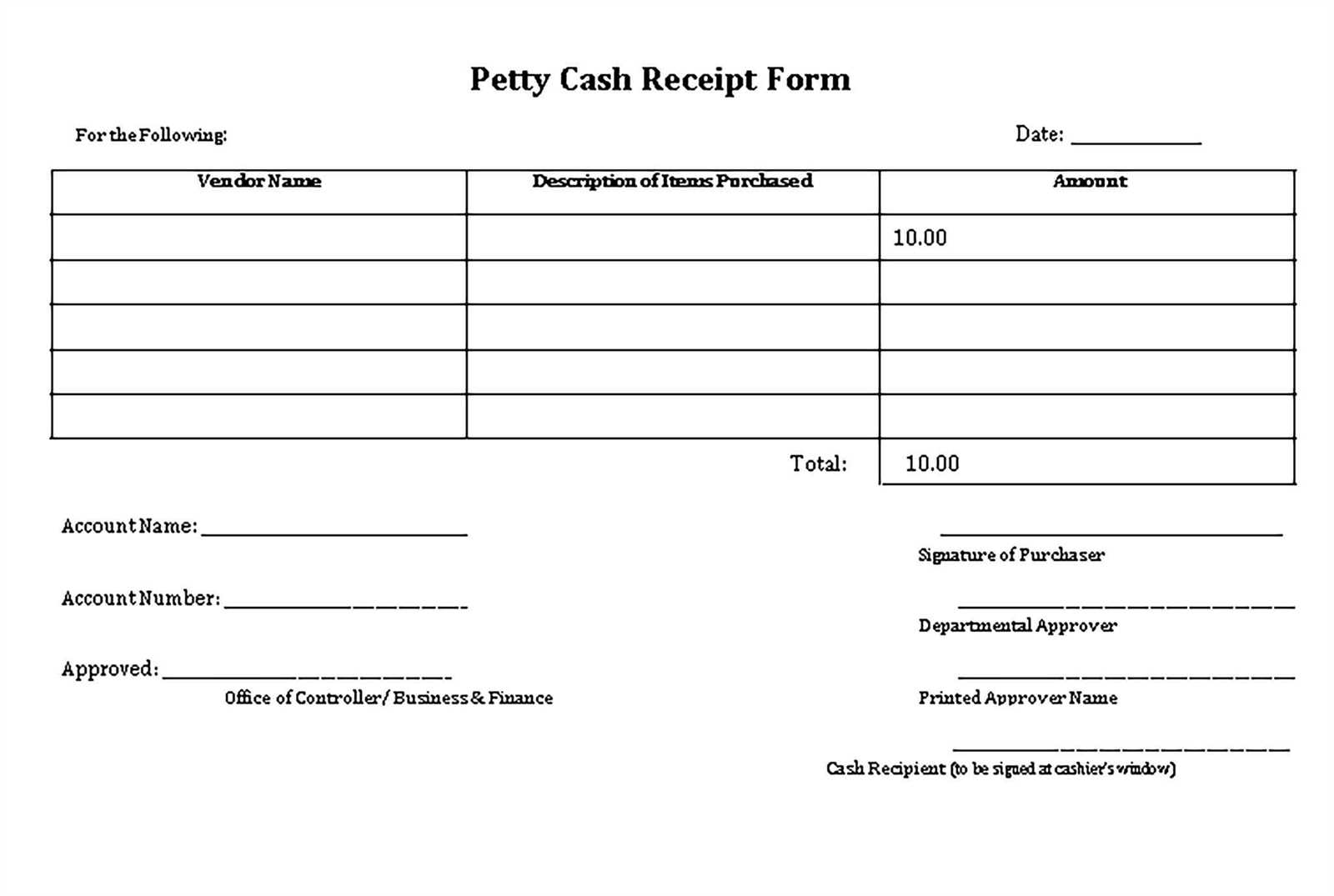

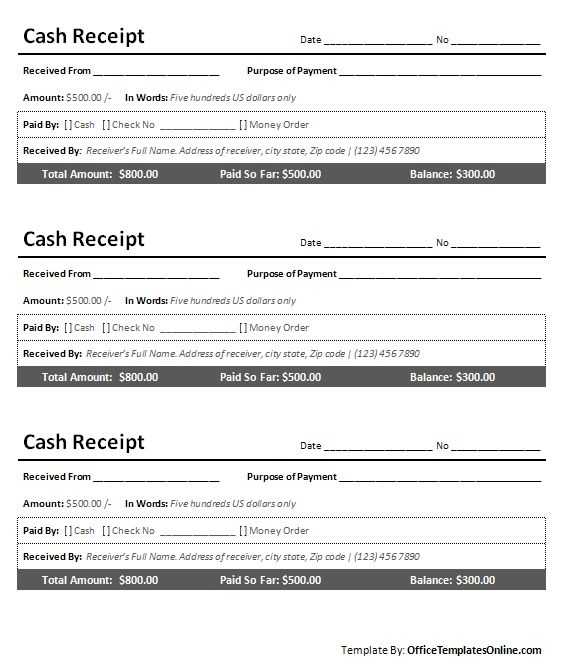

Your template should include the following key components:

- Date: Record the exact date of the transaction.

- Description: Provide a brief note about the transaction, such as the source of the cash receipt or the purpose of the payment.

- Amount: List the exact amount received or paid.

- Category: Classify the transaction (e.g., sales, loan, rent, supplies, wages, etc.).

- Payment Method: Specify how the cash was received or paid (e.g., cash, check, bank transfer, etc.).

- Balance: Track the remaining balance after each transaction to monitor your cash flow at all times.

Customizing the Template

Customize the template according to your needs. For instance, if you frequently handle payments in different currencies, include an additional column for the currency type. Similarly, if you deal with various departments or projects, consider adding specific columns for each one to track cash flow more precisely.

By maintaining such a template, you simplify financial tracking and ensure transparency, making it easier to spot discrepancies or opportunities for improvement in cash management.

Setting Up a Template for Tracking Cash Inflows

Begin by creating columns for each source of cash inflow. List the categories that reflect how money comes into the business–such as sales, loans, or other income. These categories will help you quickly identify which areas are contributing to the overall cash flow.

Add a column for the date of each transaction. This ensures you can track when cash is received, which is critical for managing your cash flow timing. Next, create a column for the amount of each payment, providing the actual cash inflow details for each entry.

Incorporate a payment method column. This will help track whether the payment was made via cash, credit, or bank transfer, giving you a clear view of the types of transactions happening. If relevant, you can also include a column for transaction reference numbers for easier tracking of each inflow.

For better organization, consider adding a column to categorize the source further. For example, sales could be broken down by product or service type. This extra level of detail gives you deeper insight into the performance of specific income streams.

Ensure that the template includes a total row at the bottom. This will automatically calculate the sum of all entries, making it easy to see your total cash inflows at any time. Make this row dynamic so that it updates as you add more entries.

Lastly, create space for notes in case you need to add context or explanations for specific transactions. This can be useful if a particular payment is out of the ordinary or requires follow-up.

Organizing Cash Outflows for Better Budget Management

Track fixed and variable expenses separately to get a clear view of your cash outflows. Fixed expenses, such as rent and utilities, remain constant, while variable costs, like groceries and entertainment, fluctuate. Categorizing these allows you to allocate funds more effectively and identify areas for adjustment.

Prioritize Key Payments

Ensure that priority expenses, such as loan repayments and tax obligations, are handled first. This minimizes the risk of late fees and penalties, which can quickly drain resources. Once these fixed payments are covered, you can distribute remaining funds across other categories based on necessity and urgency.

Implement Regular Expense Reviews

Conduct weekly or monthly reviews to monitor actual spending versus your budgeted amounts. This helps you stay on track and avoid surprises. If any outflows consistently exceed the budget, identify patterns and adjust accordingly. Tracking spending helps recognize unnecessary costs and provides an opportunity to make adjustments before they escalate.

Consider setting up automatic payments for routine bills to avoid late fees and reduce the mental load of managing multiple deadlines. You’ll also benefit from avoiding impulse spending when funds are automatically allocated to essential costs first.

Finally, set aside a portion of your budget for savings or unexpected costs. This acts as a buffer and ensures that cash flow remains stable during times of unforeseen expenses or changes in income.

Automating Your Template for Daily and Monthly Tracking

Use formulas and spreadsheet tools like Excel or Google Sheets to automate data entry for your cash receipts and payments template. Set up automatic date stamps for each transaction using functions such as =TODAY() for daily tracking or =EOMONTH(TODAY(), 0) for monthly summaries. This saves time and reduces the chance of manual errors.

Daily Tracking Automation

For daily tracking, link categories (such as income and expenses) to separate rows that automatically sum values. Use SUMIF functions to total specific categories, such as daily expenses or receipts. For example, =SUMIF(A2:A100, “Income”, B2:B100) will give you the total income based on your data range.

Another useful approach is setting a cell for daily balance calculation. Use a simple subtraction formula to track your daily net change: =SUM(Receipts)-SUM(Payments). This will automatically update each day without requiring manual recalculations.

Monthly Summary Automation

To automate monthly summaries, group data by month and apply SUMIFS to pull relevant transactions from each month. The formula =SUMIFS(B2:B100, A2:A100, “January”) allows you to track expenses or receipts specific to that month. Adjust the date range dynamically by referencing the month in a separate cell.

Using PivotTables can also streamline monthly reports. By categorizing data by date, you can easily summarize receipts and payments with just a few clicks. This method cuts down on time spent creating reports, ensuring you stay organized.